THE ANATOMY OF THE NEXT CRASH

Surprising though it might seem, barely two weeks have elapsed since those of us who anticipate GFC II – the sequel to the 2008 global financial crisis (GFC I) – were in a very, very small minority.

Consensus opinion, backed to the hilt by conventional economics, said that no such event was going to happen. Rather, we had entered the sunny uplands of “synchronised growth”, and debt had ceased to be anything much to worry about.

Of course, events, in Italy and elsewhere, haven’t yet proved us right, or the consensus wrong. We remain in a minority, though one that seems to be becoming larger. But events should embolden us, and on two fronts, not one.

First, recent developments strengthen the case for GFC II, not because of their seriousness alone, but because – as will be explained here – they conform to a logical pattern that points towards a coming crisis.

Second, we’re being reminded of quite how far conventional economics is out of touch with reality. This, of course, will be proved decisively if – or when – GFC II does happen.

This, when you consider its implications, is really quite remarkable. Government, business and finance all place heavy reliance on a school of thought which decrees that the workings of the economy are entirely financial – so, if events prove this approach to have been wrong, the ramifications will be enormous.

Those of us who understand that, far from being a matter of money, the economy is an energy system, have a lot of work in front of us.

This seems like a good point at which to publish the promised brief summary of why GFC II is likely.

ECoE starts to bite

Here is one big difference which makes the two contesting views of the economy incompatible. For anyone who believes in money-based interpretation, there are few (if any) logical barriers to perpetual growth in prosperity.

From an energy perspective, however, there is every reason to doubt the feasibility of indefinite expansion on a finite planet.

To be quite clear about this, what is contended here is not that we will “run out of” either petroleum or of energy more broadly. Rather, the argument is that we are running out of cheap energy.

“Cheap”, in this context, does not refer to sums of money invested in the supply of energy. Rather, it refers to the quantity of energy consumed whenever energy is accessed.

The definition used here is the energy cost of energy, or ECoE. Throughout much of our industrial history, the trend in ECoE has been downwards. This trend, beneficial for growing prosperity, was driven by geographical reach, economies of scale and technology.

In recent times, however, both reach and scale have plateaued, and technology has become a mitigator of ECoE increase rather than an accelerator of ECoE decrease. The driver now is depletion.

According to SEEDS, the global trend ECoE was 1.7% in 1980, and 2.6% in 1990. The difference between the two numbers was modest, and neither was a material (or, to most observers, even a noticeable) head-wind to growth.

Because the operative trend is exponential, however, ECoE was close to 4% by 2000, and had now become large enough to start driving a wedge between economic expectation and economic outcome.

The dynamic of sequential crises, part one – GFC I

By about 2000, then, underlying growth in prosperity was weakening, something not helped by the form of globalisation being promoted. Fading growth wasn’t something that conventional economics could explain, let alone accept.

What was apparent, however, was that the ability of Westerners to go on increasing their consumption was flagging, not least because of the outsourcing of skilled, well-paid jobs to the emerging market economies (EMs).

The solution to this seemed simple – give consumers easier and cheaper access to credit.

Two expedients combined to further this aim. The first was to drive down the real (ex-inflation) cost of borrowing. The second was to increase the availability of debt through “deregulation” of the financial sector. Both accorded with the prevailing ideology of laissez-faire economics, with its emphasis on diminishing the role (including the regulatory role) of the state.

Obviously enough, this strategy drove global debt upwards. Expressed in PPP dollars at constant 2017 values, world debt increased by 43%, from $121 trillion in 2000 to $174tn in 2007. Nobody in any position of influence seemed unduly concerned about this, because GDP had increased by a seemingly-impressive 53% over the same period.

Hardly anyone seemed to notice that each $1 of this growth had been accompanied by $2.08 of net new debt. Accordingly, the clear inference – that a big chunk of this “growth” was nothing more substantial than the simple spending of borrowed money – passed largely unnoticed.

The second, less obvious consequence of deregulation was the diffusion of risk, and the separation of risk from return. Various innovative practices enabled the creation of high-return, high-risk instruments which could be sliced in such a way that high risk was divested and high return retained. Surprisingly few observers noticed quite how dangerous this practice was likely to prove.

Risk-aversion revisited

The first – and, with hindsight, unmistakeable – portent of GFC I happened during the “credit crunch” of 2007. Banks, suddenly aware of elevated risk, couldn’t know which counterparties were safe, and which were not.

This was an instance of risk-aversion. What resulted was an interruption in the continuity of credit supply. This took down the small number of banks which had been reckless enough to finance their lending using short-term credit from wholesale markets. These aside, the system seemingly recovered from risk-aversion, though astute observers must by now have realised that the “credit crunch” might well be a precursor to something more systemic.

This 2007 chapter is highly relevant now, because we have entered a new phase of risk-aversion. Even before recent events in Italy, some of us had discerned the rise of risk-aversion, most obviously in the travails of a string of EM currencies. The probability is that this isn’t simply a function of a strengthening dollar, but reflects the withdrawal of capital from countries now seen as risky.

This time – and with a significance that will become obvious shortly – it is the creditworthiness of countries and their currencies which are being questioned, not just that of banks

This is why, here, we had started discussing GFC II, and commenting on its imminence, well before anything kicked off in the Euro Area (EA).

These events have not, then, changed our expectations. Rather, they have conformed to a pattern in which an outbreak of risk-aversion precedes a full-blown crisis.

The dynamic of sequential crises, part two – GFC II

So far, the dynamic of GFC II is conforming to the pattern of GFC I, with an episode of risk-aversion happening first. If the pattern continues, we will get through this chapter and breathe a collective sigh of relief – just in time for GFC II to catch us unawares.

This time, though, the fundamental dynamic is different, which means that the shape of GFC II will be different as well.

The explanation for this lies in how we responded to GFC I.

Put simply, during GFC I the authorities woke up to the obvious fact that the world had too much debt. Whenever debt becomes excessive – for a household, a business or a whole economy – the primary problem isn’t whether the debt can be repaid. At the macroeconomic level, at least, repayment can usually be deferred.

The big and immediate problem is servicing the debt – and this, by 2008, had become something that the world’s borrowers simply couldn’t afford to do. The logical solution seemed to be to slash interest rates.

This involved two processes, not one. The first, which was to take policy rates down to somewhere near zero, would never have been enough on its own. This was why massive QE programmes were launched, buying bond prices upwards in order to force yields sharply lower.

Defenders of QE argued that this didn’t amount to “printing” or otherwise creating new money, that it wasn’t monetisation of debt, and that it wouldn’t spark a sharp rise in inflation.

None of these assurances was, or is, cast-iron. QE isn’t the creation of money so long as it is reversed in good time. QE may not in principle be debt monetisation, but it certainly has become that in Japan, where QE money has been used by the BoJ to buy up nearly half of all JGBs in issue. It would be no huge surprise if the ECB, too, adopted monetisation as the least-bad way out of the looming debt crisis. And QE need not spark inflation, if by that term is meant rises in retail prices – but QE most assuredly has created huge inflation in the prices of assets.

A new adventurism

Be that as it may, what we have seen since GFC I has been “monetary adventurism”, which is distinct from the “credit adventurism” practised before 2008. The credit variety hasn’t gone away – indeed, it has worsened, with each dollar of “growth” since 2008 coming at a cost of $3.39 in new debt, compared with a ratio of 2.08:1 before GFC I – but monetary adventurism has leveraged its consequences.

The numbers are that, between 2008 and 2017, GDP increased by $28.8tn, but debt expanded by $98tn. Nor is this all. The destruction of returns on capital has created what the WEF has called “a global pension timebomb”, blowing a hole estimated by SEEDS at close to $100tn in worldwide pension provision adequacy. QE has poured something of the order of $28tn into the system. In the background, meanwhile, ECoE has continued to tighten its grip, rising from 5.3% in 2007 to 8.0% now.

To cut to the chase, most of the recorded “growth” in world GDP since 2008 has been cosmetic, amounting to nothing more substantial than the simple spending of borrowed money. As we have seen, this is corroborated by the concentration of “growth” towards the lower end of the value-added spectrum.

Bring the increase in ECoE into the equation as well and what we are looking at is a 10% ($7.6tn) increase in world prosperity trying to support a 54% ($98tn) expansion in total debt. Moreover, the 10% increase in aggregate prosperity has barely matched the rate of growth in population numbers. People have not been getting more prosperous, then, but they have been getting ever further into debt.

What on earth could go wrong with that?

Not like GFC I – the nature of GFC II risk

Thus far, with an episode of risk-aversion in the EM economies compounded by debt worries in Europe, events are following the pattern of GFC I.

But there are at least three reasons why we should not assume that GFC II will continue to look a lot like GFC I.

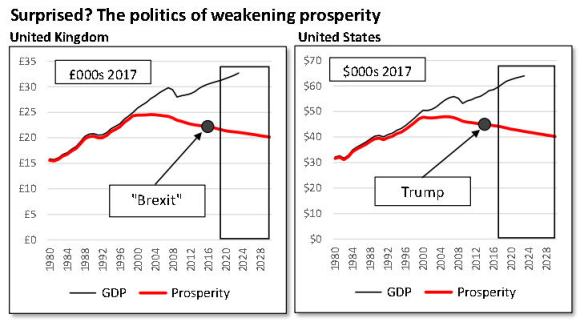

First, prosperity per person has been declining across almost all of the Western economies. The worst affected countries include France (a fall of 5.4% since 2007), Australia (-6.0%), the United States (-6.3%), Britain (-7.9%) and – of course – Italy, where prosperity has declined by 8.4%.

It is no coincidence at all that major political reverses for the establishment have happened in four of these five countries. Deterioration in prosperity seems certain to have informed the “Brexit” vote, the election of Mr Trump, the defeat of all established parties in the first round of presidential voting in France, and the triumph of Lega and M5S in Italy.

The relevance of this going forward, though, is something termed here “acquiescence risk”. This broadly means that populations undergoing hardship are likely to oppose any kind of rescue plan, especially if it is assumed by voters to involve rescues for an elite, and “austerity” for everyone else.

The second big difference between conditions now and those prevailing in 2008 is that recklessness has no longer been confined almost entirely to the developed economies of the West. This broader compass is hinted at by risk-aversion in the EMs. On the SEEDS risk matrix, China is now rated as riskier than any economy other than Ireland.

Third, and most important of all, a phase of “credit adventurism” which put banks at risk in 2008 has become a wave of “monetary adventurism” which puts fiat currencies themselves at risk.

What we should anticipate, then, is that GFC II will be truly global, not exempting EMs, and that, this time, currencies, and therefore national economies, will share a wave of risk previously (in 2008) borne largely by banks alone.

Precedent can help us anticipate why GFC II will happen – but will prove a poor guide to its shape and extent.

= = = = =

Since brevity was promised here, it is to be hoped that the foregoing provides a succinct summary of why GFC II is likely.

There seem certain to be plenty of opportunities for going into this in greater detail.

= = = = =