FRACTURE AND DE-FINANCIALIZATION

Introduction

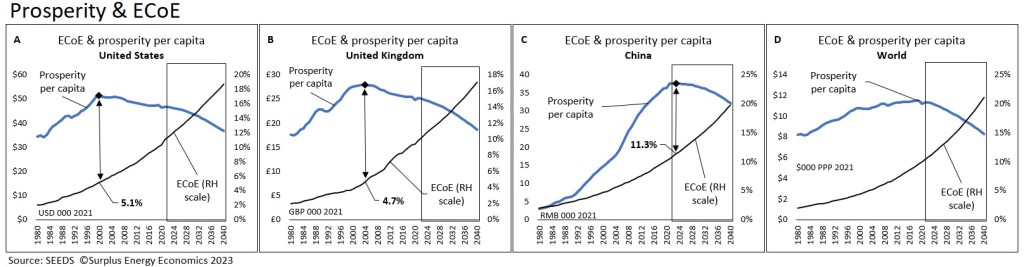

In this fourth instalment of The Surplus Energy Economy, we turn to perhaps the most complex part of the equation, which is the financial system. The connections between energy and material prosperity, though largely disregarded and dismissed by orthodox economics, are nevertheless comparatively straightforward, at least in principle.

The nearest approach to the straightforward in finance is the concept of money as claim. Once we recognize that money has no intrinsic worth – but commands value only as a ‘claim’ on the output of the material economy – two things become apparent.

The first is that the financial system consists of an aggregate ‘body of claims’ on the material economy of products and services. The second is that the viability and sustainability of the system depends on the extent to which these claims can be honoured ‘for value’ by the real economy. To be a little more specific, the system is viable as long as participants believe that these claims can be honoured.

The situation now is that financial viability depending upon accuracy of proxy has been strained to breaking-point. As we have seen, prior growth in economic prosperity has gone into reverse. At the same time, though, the financial system, as a ‘body of claims’, has carried on expanding, in part because of the fallacious assumption that the material can be driven by the monetary.

As we shall see, there are reasons to suppose that the ‘real’ economy of goods and services is now at least 40% smaller than the ‘financial’ economy of money and credit.

A simple analogy might be useful here. When people arrive at a function, they hand over their hats and coats in return for paper checks, which act as claims. During the function, the managers of the venue print a large number of additional checks. The checks alone will not, of course, keep the attendees warm and dry on their journeys home, for which only physical hats and coats will suffice.

Only at the end of the function does it become apparent that there aren’t enough hats and coats to honour every check. Neither is it clear which checks are or are not valid. The only way to stave off this denouement is to keep the function – or the party – going for as long as possible.

This is loosely analogous to the current situation, where financial ‘claims’ far exceed the capabilities of the underlying material economy to honour them. Modest disequilibria of this kind can be mediated by inflation which, in our analogy, varies the rate of exchange between checks and coats. But the current extent of disequilibrium could only be mediated by runaway inflation.

Moreover, each person believes that every single check equates to an entitlement to a complete coat or hat. They are not going to be happy when they discover that this is not the case. The term for what ensues is value destruction, which is destined to happen in a way that is likely to be chaotic.

The unfolding squeeze

As well as noting that prior growth in material economic prosperity has gone into reverse, we have also observed that the real costs of energy-intensive necessities are on a strongly rising trajectory.

The resulting process is known here as affordability compression. It has two effects. One of these is a relentless decline in the ability to afford discretionary (non-essential) products and services. The other is that it makes it increasingly difficult for households to ‘keep up the payments’ on everything from secured and unsecured credit to subscriptions and staged-payment purchases.

This process helps us to gauge where the effects of the aforementioned process of ‘value (claims) destruction’ are likeliest to be experienced. As well as undermining sectors which depend on discretionary consumption, affordability compression poses a direct threat to the flows which inform the viability of the financial system. The world is awash with debt and quasi-debt obligations, much of which exist outside the regulated banking system, and some of which cannot even be quantified in their entirety. Many enterprises have been built on a business model which financializes, into capital value, forward income streams whose future reliability has, hitherto, been taken for granted.

Within a material economy, the effects of affordability compression cannot long be ignored. As its reality gains recognition, asset values will fall sharply, albeit more severely in some sectors and asset classes than in others. This process is likely to occur along lines that are already quite predictable. But the real danger lies less in market slumps than in a degradation of the network of inter-connected liabilities that constitute the financial system.

These problems are unlikely to be manageable, meaning that we should anticipate disorderly – and, quite possibly, chaotic – contraction in the financial system. Decision-makers seem to be woefully under-informed about these risks, even though various events, such as the recent LDI problem in the British pensions sector, should have provided clear warning.

For the most part, policy-makers, and perhaps market participants too, continue to believe in an economic orthodoxy which states that the economy can never cease to grow and is not, therefore, subject to material constraints. They also seem to believe, again fallaciously, that the authorities can overcome any and every problem using monetary tools. There is, as yet, little or no appreciation that the banking system cannot lend material resources into existence, and that central bankers cannot conjure low-cost energy out of the ether.

A few simple statistics serve to illustrate this point. Between 2002 and 2021, each dollar of reported growth in GDP was accompanied by $3.10 in incremental debt and an estimated increase of $4.75 in broader obligations. Over that same period, SEEDS calculates that fully 70% of reported “growth” was the cosmetic effect of pouring ever more liquidity into the economy, and counting the transactional use of that money as economic “activity”.

In short, the financial system has parted company with the underlying economy, and the notion that the latter can “grow” sufficiently to re-validate the former belongs in the realm of myth and fable. As will be explained here, we can reasonably conclude that each dollar-equivalent of supposed value in the global financial system is now backed by less than $0.60 in material worth.

Financialization of the economy has been an integral part of the confection created on the basis of absurdly ill-informed expectations for the economic future. Whilst the process of de-globalization is starting to gain some recognition, there is almost no appreciation of the likelihood and consequences of de-financialization.

To explain why these things are happening, we need first to revisit some basics.

Of money and matter

There are, essentially, two ways in which we can seek to understand the working of the economy. One of these is the orthodox approach, which states that the economy can be explained entirely in terms of money. If this were true, it would mean that there need never be any end to economic expansion, because the behaviour of the economy is determined, not by material resources, but by money, a human artefact wholly under our control. This would make feasible the paradox of ‘infinite economic growth on a finite planet’.

The alternative explanation, preferred here, is that the economy is a physical system for the supply of material products and services. Since none of these products and services can be made available without the use of energy, we can conclude that prosperity is a function of the supply, value and cost of energy. Instead of the limitless, immaterial potential of the economy defined as money, the surplus energy approach recognizes the existence of physical constraints to expansion. Though energy is ‘the master resource’, these limits also apply to non-energy resources, and to the finite tolerance of the environment.

Energy-based analysis draws a clear distinction between the material and the financial. The critical concept here is that of ‘two economies’. Effective interpretation of the economy requires an understanding of the difference between a ‘real’ or material economy of products and services and a ‘financial’, representational or proxy economy of money and credit. This conforms to the principle of money as claim, which recognises that “money, having no intrinsic worth, commands value only as a ‘claim’ on the output of the material or ‘real’ economy determined by energy”.

This in turn makes it perfectly possible for us to create ‘excess claims’, meaning a body of monetary claims which exceeds the delivery capability of the underlying economy. That is precisely where we are now. The financial system will be forced to renege on excess claims that the underlying economy cannot honour.

This situation arises from the operation of a fallacious precept, which is that financial expansion can drive growth in the physical economy.

This fallacy can best be explained in terms of what has actually been happening over an extended period. By the 1990s, adverse changes in the energy dynamic had created a phenomenon known as “secular stagnation”, meaning a non-cyclical decrease in economic growth. It was assumed, quite wrongly, that this material deceleration could be overcome using monetary tools.

These efforts began with rapid credit expansion, which led directly to the global financial crisis (GFC) of 2008-09. Thereafter, “credit adventurism” was compounded with “monetary adventurism”, in the form of supposedly “temporary” gimmicks including QE, ZIRP and NIRP.

These initiatives haven’t stemmed the deterioration in material economic expansion, of course, but they have had two extremely negative consequences. First, they have burdened the financial system with vast claims which cannot possibly be honoured in full.

Second, they have abrogated the principles of market capitalism, a system which requires (a) that investors must earn a positive real return on their capital, and (b) that markets should be allowed to price value and risk without undue interference.

It might be thought that repudiation of the principles of market capitalism has a broader significance. In previous generations, the public had a choice between collectivism, on the one hand, and market capitalism, on the other. The public appeal of the collectivist ideal has never recovered from the collapse of the Soviet Union, and capitalism has now been undermined by the abandonment of its central principles. There is no simple answer to the question “what economic system do we have now?”

Be that as it may, our immediate concern, in this instalment of The Surplus Energy Economy, is with the financial situation. The conclusion set out here is that, whilst the material economy might be capable of gradual and managed decline, the financial system cannot escape severe and disorderly contraction.

Questions of equilibrium

The concept of ‘two economies’ sets the context for our interpretation of financial conditions. If the financial system exists as “a body of claims on the material economy”, then its viability depends on the claim-honouring capability of the real economy. Likewise, since prices are financial notations attached to material products and services, then systemic inflation or deflation are functions of changes in the relationship between the material economy and its financial corollary.

The best ‘point of entry’ to this complex situation is the matter of economic equilibrium. Effective functioning of the ‘two economies’ dynamic requires a close relationship between the financial and the material. Put another way, the material economy must be capable of honouring the claims placed upon it by the financial economy.

Small divergences between the two are manageable, and are arbitraged by changes in the level of pricing, because prices are the point of intersection between the material and the monetary. But the emergence of severe disequilibrium means that the financial system has created a large body of claims that cannot be honoured ‘for value’.

Claims that cannot be honoured must, by definition, be repudiated. This can happen in one, or both, of two ways. The first of these is inflationary, whereby a person who is owed $1,000 is repaid in money which has lost a sizeable proportion of its purchasing power or claim value – he or she receives $1,000, but this has the purchasing power of only, say, $500 at the time that the commitment was created. This is known as ‘soft default’. The alternative is ‘hard default’, where the borrower repudiates the obligation on the basis of ‘can’t pay, won’t pay’.

The current situation is illustrated in Fig. 12, in which the ‘financial economy’ is represented by reported GDP, and the ‘real economy’ by prosperity as calculated by the SEEDS economic model. These, to be clear, are measures of flow rather than stock – but the viability of the stock of assets and liabilities depends upon the validity of forward expectations for flow.

As is shown in Fig. 12A, global debt has grown far more rapidly than GDP over an extended period, during which more than $3 of net new debt has been taken on for each $1 of reported “growth”.

As we have seen, much of the supposed “growth” of the past quarter-century has been the cosmetic effect of credit expansion. SEEDS calculates prosperity by (a) stripping out this ‘credit effect’, and (b) deducting trend ECoE – the Energy Cost of Energy – from the resulting underlying or ‘clean’ economic output.

The result, shown in Fig. 12B, is severe disequilibrium between the financial economy (represented by GDP) and the real economy (represented by prosperity). As of the end of 2021, the real economy was 40% smaller than its financial proxy. This gap will continue to widen, unless and until we cease the process of artificially inflating GDP using liability expansion.

Fig. 12

The remaining charts in Fig. 12 calibrate obligation downside by applying this 40% flow indicator to the stock aggregates of debt (Fig. 12C) and broader ‘financial assets’ (Fig. 12D). The latter, as assets of the financial sector, are the liabilities of the government, household and non-financial corporate sectors of the economy.

The process of equilibrium analysis isn’t designed to anticipate downside in the financial system in any detailed way, and we can deem it probable that the outcome will be worse than this portrayal, not least because of liability inter-connection, and sheer panic. Rather, what is illustrated here is a broad measure of exposure to the destruction or repudiation of commitments. If it transpires that ‘the future isn’t what it used to be’, then expectations, incorporated into values, will be recalibrated accordingly.

As mentioned earlier, if the disequilibrium between ‘claim’ and ‘substance’ was small, it could be reconciled by comparatively modest inflation. But downside of 40% means that, absent hyperinflation, a cascade of hard defaults has become inescapable.

Of pricing and inflation

Before we move on to an assessment of exposure, it’s worth pausing to consider the concept of inflation. A broad definition of inflation is that it measures changes in the general level of prices – but what is meant by ‘price’?

Orthodox economics ascribes pricing to the inter-action of ‘supply and demand’, but both of these are stated entirely financially, meaning that no allowance is made for the material. The role of the material is clearly of huge importance, something which is demonstrated, for example, every time a drought or other untoward event reduces the production of grain. In this situation, the price of grain rises, not because of choices made by suppliers or consumers, but because the material parameters of supply have changed.

From the ‘two economies’ perspective, which does acknowledge the material, a very different definition of price emerges – essentially, prices are the financial notations attached to physical products and services. Two parameters are thus involved in the price equation – one of these is transactional activity, and the other is material availability.

A lack of clarity on the issues of pricing and inflation is implicit in any system of notation which concentrates entirely on the financial, and disregards the material. Thus, the headline definition of inflation as changes in retail or consumer prices disregards changes in asset prices. This has enabled advocates of QE to ignore the “everything bubble” in asset prices and assert that QE ‘isn’t inflationary’.

The reality, of course, is that QE is inflationary, but this inflation occurs at the point at which newly-created money is injected into the system. If, back in 2008-09, QE money had been handed to anglers, the prices of fishing paraphernalia would have soared. In the event, the money wasn’t given to fishermen, but to investors, so it was the prices of assets, rather than of rods, reels and lures, which took off.

By convention, asset price changes are ignored in the computation of inflation. Accordingly, QE could be regarded as non-inflationary so long as its effects were confined to the prices of assets. This changed in 2021, when pandemic responses involved directing QE to households. This, needless to say, resulted in the spread of inflation from assets, where it is disregarded, into consumer products and services, where it makes headlines.

Statisticians do not apply consumer price inflation when calculating ‘real’ economic growth, but use the broad-basis GDP deflator instead. This measure, though, has serious shortcomings of its own. In short, we cannot measure inflation effectively if we confine ourselves to measuring the financial against the financial, whilst disregarding the material.

The SEEDS concept of RRCI – the Realised Rate of Comprehensive Inflation – is designed to overcome these shortcomings, and is compared with the conventional measure of systemic inflation in Fig. 13. As you can see, historic inflation has been understated in relation to the RRCI measure, of which a corollary has been that capital has been priced even more negatively than headline data implies.

Fig. 13

Looking ahead, it seems likely that global systemic inflation will retreat from a 2022 provisional estimate of 9.3%, but is likely to remain between 5% and 6%. This projection suggests that the matrix of factors governing pricing will include (a) continuing rises in the costs of necessities, (b) falls in the prices of discretionaries, (c) asset price corrections, and (d) interest rates that remain negative in relation to RRCI.

How much exposure?

Global financial liabilities need to be understood at several different levels. One of these is conventional debt, and another comprises those broad commitments which are known as ‘financial assets’ but which, as mentioned earlier, are the liabilities of the government, household and PNFC (private non-financial corporate) sectors of the economy. Both debt and broader liabilities can be subdivided into public- and private-sector commitments.

Let’s start putting some numbers on the magnitude of global financial exposure. This is complicated, and Fig. 14 is intended to set out the broad structure of financial liabilities – at constant values – by comparing the end-of-2021 situation with the equivalent position on the eve of the global financial crisis (GFC) in 2007.

Please note that, because international obligations need to be met through market transactions, the data set out in Fig. 14 is stated in dollars converted from other currencies at market rates, rather than on the PPP (purchasing power parity) convention generally preferred in Surplus Energy Economics.

Both charts are calibrated at constant 2021 values, enabling direct comparisons to be made between the scale of liabilities at both dates. The biggest change by far has been the sharp increase in broad financial liabilities, which are estimated to have increased by 90% in real terms between 2007 and 2021, rising from $294tn to $555tn between those years.

With GDP shown for reference, Fig. 14 divides liabilities into government debt, private debt and the aggregate of estimated financial assets. Private debt is further subdivided into sums owed to banks and other lenders.

Fig. 14

Conventional debt data is available from the Bank for International Settlements. BIS data shows that, at the end of 2021, governments owed $84tn (93% of GDP) whilst, within private sector debt totalling $153tn (166% of GDP), $95tn (98% of GDP) was owed to commercial banks.

The real issue, though, isn’t debt, but broader financial exposure. These “financial assets” are reported by the Financial Stability Board.

Financial assets fall into four broad categories. Three of these – central banks, public financial institutions and commercial banks – are self-explanatory, though it’s noteworthy that the total exposure of commercial banks (estimated here at $208tn) far exceeds the conventional debt owed to them by households and PNFCs ($95tn). The fourth is NBFIs, meaning ‘non-bank financial intermediaries’.

We need to be clear that these broad liabilities are very largely unregulated. The FSB is not a regulatory authority, but works to improve transparency and encourage best practice. Individual jurisdictions are under no obligation to supply data to the FSB. As a result, available data is neither complete nor particularly timely, with information relating to the end of 2021 only published on the 22nd December 2022.

In general, commercial banks are regulated where they act as ‘deposit-taking institutions’, meaning that the aim is to protect the public as customers of the banks. This is not the same thing as macro-prudential regulation, whose effectiveness is circumscribed by the exclusion of institutions which do not accept deposits from customers. The effect of tightening regulation on retail banks can be to drive more business towards unregulated players. There is, then, a huge gap in the ability of the authorities to maintain, or even to monitor, macroeconomic stability.

This lack of regulation is particularly important when we look at NBFIs. This sector is commonly referred to as the “shadow banking system”. NBFI exposure is enormous, and can be estimated at about $275tn as of the end of 2021. This exceeds the combined total of global government and private debt ($237tn).

The NBFI sector has various components, which include pension funds, insurance corporations, financial auxiliaries and OFIs (other financial intermediaries). This latter category includes money market funds, hedge funds and REITs.

In an article published in 2021, Ann Pettifor provided a succinct description of the shadow banking system. She traces the rise of the sector to the privatisation of pension funds, which happened in 30 countries between 1981 and 2014, and which, she says, “generated vast cash pools for institutional investors”.

Shadow banking participants “exchange the savings they hold for collateral”, generally in the form of bonds, usually government bonds. Instead of charging interest, they enter into repurchase (repo) agreements whereby the borrower undertakes to buy back the bonds at a higher price.

She points out that securities “are swapped for cash over alarmingly short periods”, and that “operators in the system have the legal right to re-use a security to leverage additional borrowing. This is akin to raising money by re-mortgaging the same property several times over. Like the banks, they are effectively creating money (or shadow money, if you like), but they are doing so without any obligation to comply with the old rules and regulations that commercial banks have to follow”.

Implications

This is a good point at which to pull together some of our observations about the relationship between the economy and the financial system.

First, we have observed how the process of liability expansion has created cosmetic “growth” in GDP, which is mistakenly assumed to be a meaningful measure of economic output. Second, a large proportion of the stock of credit exists outside the envelope of banking regulation and macroprudential oversight. We can note that credit expansion, promoted by keeping the cost of capital at levels below the rate of inflation, has created a hugely over-inflated “everything bubble” in asset prices – and that all bubbles eventually burst. It’s worth remembering that the bursting of a bubble doesn’t, of itself, destroy value – rather, it reveals the value that has been destroyed during the preceding period of malinvestment.

As we have seen, the underlying dynamic of the material economy is imposing affordability compression, which is the combined effect of the erosion of prosperity and rises in the real costs of necessities.

We can trace two logical consequences of affordability compression. One of these is a decline in sectors supplying non-essential products and services to consumers. It’s reasonable inference that, as well as driving down stock prices in discretionary sectors, this will result in business failures and defaults on debt, compounded by the effects of job losses.

The second consequence will be a degradation in the flow of income streams from households to the corporate and financial sectors. This sets the scene for a second set of stock price slumps, bankruptcies, defaults and redundancies.

What these indicators suggest is rapid, largely uncontrolled and disorderly contraction in the financial system, understood as an inter-connected and overlapping network of liabilities. The system holds together only if participants have confidence in the honouring of commitments ‘for value’.

The erosion of this confidence is likely to create a domino effect, which starts at the outer perimeter of unregulated lending and then moves inwards towards the regulated banking sector, with defaults compounded by the undermining of collateral values.

It is likely to be assumed that, as in 2008-09, governments and central banks will be able to intervene to shore up the system, but it is in fact unlikely that this will be possible. Aggregate non-government financial liabilities are nearly twice as large now, in real terms, as they were back in 2007 on the eve of the GFC.

With global GDP (in market-converted dollars) standing at $97tn, it is hard to see how the authorities can bail out any sizeable proportion of an estimated $480tn in non-government liabilities without engaging in the creation of liquidity on a scale that would be certain to trigger runaway inflation. The problem is compounded by the observation that the GDP denominator, at $97tn, is itself a dramatic overstatement of underlying material prosperity, a number which SEEDS puts at only $58tn.

Surplus Energy Economics has never predicted that the economy somehow ‘must’ collapse, noting that the rate of decline in prosperity is comparatively modest, and could be manageable. Recognition of the energy dynamic of prosperity erosion does not compel anyone to join the ranks of the collapse-niks.

But the financial complex, rather than the economy itself, is where real and extreme systemic risk does exist. We might be able, to put it colloquially, to ‘get by with less’, but we cannot ‘meet our commitments with less’. Much of this is a result of ignorance (about the real workings of the economy), intentional denial and limitations in oversight.

With the idea of economic contraction deemed to be (quite literally) unthinkable, it has suited us to assume, quite wrongly, that we can energise the material economy with monetary innovations. As well as failing, this has burdened us with financial commitments that we cannot even fully quantify, let alone honour or manage. An admittedly speculative possibility is that decision-makers might, in desperation, opt for the ‘soft default’ of runaway inflation rather than the ‘hard default’ of reneging on interconnected commitments that cannot be honoured.

As we have seen, the convention of disregarding asset prices within the calibration of inflation has enabled us to operate the system on the basis that ‘QE doesn’t cause inflation’. The situation changed when, during the pandemic crisis, QE was no longer confined to investors, but was extended to consumers as well.

At this point, inflation extended from asset prices to CPI, prompting action – rate rises and QT – from central bankers. The patterns of central bank action are illustrated in Fig. 15, in which policy rates are compared with CPI inflation to calculate illustrative real (ex-inflation) interest rates, and trends in central bank assets are summarised in Fig. 15D. The surge in inflation caused real rates to plunge to extraordinarily negative levels before a combination of rate rises and retreating inflation caused a correction back towards zero.

Thus far, the central banks, led by the Federal Reserve, have shown considerable resolve in their determination to use rate increases, and QT, to tame inflation. It is likely now, though, that CPI and similar calculations of inflation will fall, less because of monetary tightening than in response to economic deterioration.

If, as is to be expected on the basis of energy-based prosperity analysis, this economic deterioration causes asset prices to fall, and drives headline inflation downwards, the ensuing hardship might create calls for monetary easing at an intensity that central bankers may be unable to resist.

Knowing that the excess claims embedded in the financial economy must, by definition, be eliminated in one of only two ways, we cannot rule out a process of inflationary ‘soft default’.

Fig. 15