SEEDS, STAGFLATION AND CRASH RISK

For anyone involved in economic interpretation, these are hectic times. They’re frustrating times, too, for those of us who understand that the economy is an energy system, but have to watch from the sidelines as huge mistakes are made on the false premise that economics is ‘the study of money’, and that energy is ‘just another input’.

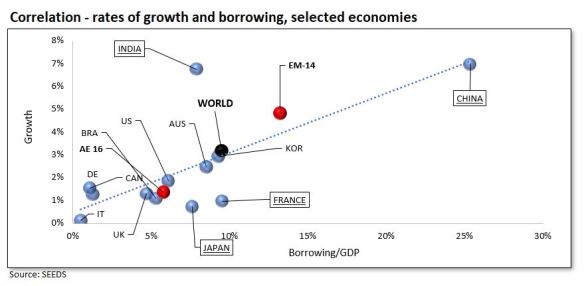

Latest developments with the SEEDS model add to this frustration, because it’s becoming clear that energy-based interpretation can identify definite trends in the relationships between energy use, economic output, ECoE (the energy cost of energy), prosperity and climate-harming emissions. Cutting to the chase on this, the efficiency with which we convert energy into economic value is improving, but only very slowly, whilst the countervailing, adverse trend in ECoEs (which determine the relationship between output and prosperity) is developing more rapidly.

Where observing our decision-makers and their advisers is concerned, we’re in much the same position as the soldiers who “would follow their commanding officer anywhere, but only out of a sense of morbid curiosity”. Essentially, policy-makers who’ve long been following the false cartography of ‘conventional’ economics have now encountered a huge hazard that simply isn’t depicted on their maps.

Having used SEEDS to scope out the general shape of the economy during and (hopefully) after the Wuhan coronavirus pandemic, there seem to be two questions of highest immediate priority. The first is whether the crisis will usher in an era of recessionary deflation or monetarily-triggered inflation, and the second concerns the likelihood of a near-term ‘GFC II’ sequel to the global financial crisis (GFC) of 2008.

On the latter, it’s becoming ever harder to see any way in which a crash (which has been long in the making anyway) can be averted. Indeed, it could be upon us within months. The ‘inflation or deflation?’ question is more complicated, because it needs to be seen within drastic structural changes now taking place in the economy.

Let’s start with how governments have responded to the economic effects of the pandemic. The ‘standard model’ has involved a two-pronged response, because the crisis has posed two classes of threat to the system. The first is an interruption to the incomes of people and businesses idled by lockdowns, and the second is that households could be rendered homeless, and otherwise-viable enterprises put out of business, by a temporary inability to keep up with payment of interest and rent.

Accordingly, governments have responded with policies which are termed here support and deferral. ‘Support’ has meant replacing incomes, albeit in part, by running enormous fiscal deficits, which, in the jargon, means injecting fiscal stimulus on an unprecedented scale. ‘Deferral’ has been carried out by providing payment ‘holidays’ for borrowers and tenants.

Neither of these responses is remotely sustainable for more than a few months, but there’s a difference between them in terms of timescales. Whereas support has to be (and has been) provided now, deferral pushes problems forward to that point in the near future at which lenders and landlords can no longer survive the effects of the payment ‘holidays’ granted to household and business borrowers and tenants.

The most pressing risk now is that the need to exit ‘deferral’ will arrive before the provision of ‘support’ has ceased to be necessary. We can think of this as a vector pointing towards the near future.

In the United States, for example, unemployment payments are being reduced, and payment ‘holidays’ are being terminated, precisely because of the vector which these converging policy responses create. Simply put, government cannot afford to continue income support indefinitely, whilst payment ‘holidays’ are already posing grave risks to the survival of counterparties (lenders and landlords) – and this triangulation is just as much of a problem in other countries as it is in America.

Unfortunately, the gobbledegook of ‘conventional’ economics acts to disguise how serious our economic plight really is. For example, British GDP was reported to have deteriorated by ‘only’ (in the circumstances) 20% in April, because an underlying deterioration (of close to 50%) was offset by the injection of £48bn borrowed by the government. Whilst a further £55bn borrowed in May took the total increase in government debt to £103bn, the Bank of England, in parallel, created a very similar (and by no means coincidentally so) £100bn of new money with which to purchase pre-existing government debt.

In other words – and across much of the world, not just in Britain – central banks are monetising the stimulus being injected into the economy by governments. All other things being equal, too much of this would pose a threat to the credibility and the purchasing power of fiat currencies. It’s not quite that simple, of course – and all other things aren’t equal – but it would be folly to dismiss this very real potential hazard.

The effects of these processes on the ‘real’ economy of goods and services are instructive. Where household essentials are concerned, demand has been sustained (by income support), but supply has been reduced by lockdowns. What this has meant is that the prices of household essentials have started moving up, at rates that would appear to have annualised equivalents of roughly 8%. This, incidentally, has been happening even though energy prices have slumped. What’s driving inflation in the ‘essentials’ category is the divergence between supply (impacted by lockdowns) and demand (supported by governments).

Where discretionary (non-essential) purchases are concerned, an opposite trend has set in. Consumers’ incomes, though supported by governments, are nevertheless lower than they were before the crisis, meaning that demand for discretionaries has fallen. This has been compounded by consumer caution, caused in part by fear and uncertainty, but also by impaired incomes, rising debts and diminished savings. Similar trends are visible amongst businesses which, much like consumers, are continuing to spend on things that they must have, but are slashing their expenditures (including their investment) on anything discretionary or, to put it colloquially, ‘optional’.

These trends are going to have profound consequences, not just for the economy, but for businesses in the favoured and unfavoured sectors, a theme to which we might return at a later time, because it also feeds into the broader issue of what “de-growth” is going to mean for business.

With the cost of essentials rising whilst the prices of discretionaries are falling, broad inflation has remained at or close to zero, but these are early days in a fast-changing situation. Whilst the statisticians are still-playing catch-up, the ordinary person probably already knows that the cost of essentials is rising, whilst his or her reduced spending on discretionaries might serve to disguise the countervailing falls in their prices.

Where the slightly longer-term is concerned, one school of thought contends that prolonged recession will induce deflation, whilst another states that monetary intervention is likely, on the contrary, to trigger rising inflation.

Those who are dovish on the issue point out that the extensive use of newly-created QE money back in 2008-09 did not promote inflation, though that argument is weakened if we include asset prices, and not just consumer purchases, in our definition of inflation.

The essence of the dovish case is that money injected into asset markets can be ‘sanitised’, such that it doesn’t ‘leak’ into the broader economy. There is some justification for this view, because asset aggregates are purely notional values – whilst the investor can sell his stock portfolio, or the homeowner his house, the entirety of these asset classes can never be monetised, because the only potential buyers of, say, a nation’s housing stock are the same people to whom that stock already belongs. When ‘valuations’ are placed on the entirety of an asset class, what’s really happening is that marginal transaction prices are being applied to produce an aggregate valuation, even though the asset class could never be sold in its entirety.

In practical terms, this limits the ability of investors to ‘pull their money out’, because they can only do this by finding other investors willing to buy. It also leverages intervention, such that, for instance, the value of an asset class may be increased by a large amount (or a fall of that magnitude prevented) by a comparatively small intervention at the margin, especially where the psychology of intervention has deterred potential sellers.

Where inflationary consequences are concerned, though, these are matters of degree. Back in the GFC, the four main Western central banks (the Fed, the ECB, the BoJ and the BoE) increased their assets by $3.2tn between July 2007 ($3.55tn) and December 2008 ($6.73tn). In the space of just four months between February and June this year, these central banks spent $5.6tn, a larger sum even when allowance is made for the changing values of money.

To be clear, asset purchases thus far have not been enough to shake confidence in currencies. Neither $230bn of purchases by the Bank of England, $590bn spent by the Bank of Japan, or even the $1.85 tn injected by the European Central Bank, is a large enough sum to put currency credibility at risk. The Fed, meanwhile, having spent $2.94tn between February and May, pulled its horns in slightly during June, reducing net purchases thus far to $2.89tn.

To draw comfort from these numbers, though, would be to reckon without a number of other significant factors. One of these is that economic activity is falling much more rapidly now than it did back in the GFC, even though the extent of this fall is being disguised by the effects of fiscal stimulus. Whilst reported global GDP might decrease by about 11% this year, SEEDS calculations suggest that the slump in underlying or ‘clean’ economic output (C-GDP) is likely to be around 17%, and could be worse than that.

Secondly, and more significantly, there is a clear danger that the monetisation of borrowing may come to be seen as a ‘new normal’ (though, of course, a new abnormal would describe it better). If the running of fiscal deficits, which are then monetised, ceases to be regarded as a temporary and emergency measure, and comes instead to be seen as standard practice, a very hefty knock will have been dealt to faith in currencies.

The third (and still worse) risk is something that we might term ‘the Ides of Autumn’. If governments have to keep on running deficits, and are still doing this at a point where deferral ‘holidays’ force them to bail out lenders and landlords, then we could enter wholly uncharted territory. Additionally, the Fed has taken upon itself the task of propping up asset markets, in theory just in the US but, in practice, around the world.

To put this in context, we need to think ahead to some future point, quite possibly in September or October, when things could well start to go horribly wrong. Governments and central banks, still supporting incomes through stimulus programmes, now have a choice to make. Do they stand back and watch lenders and landlords fail, accept a wave of massive defaults on household and business debt, and allow a crash in the prices of (for example) stocks and property?

The strong probability has to be that they would not sit back and just let these things happen. If to this is added the likelihood of permanent (or, at least, very long-lasting) falls in productive capacity, we have the ingredients for monetary intervention on a scale quite without precedent. To be sure, the Fed has pulled back from intervention in recent weeks, but we can by no means assume a continuation of such insouciance in a situation where banks are on the brink of failure, Wall Street is tumbling, property prices are slumping and borrowers are on the edge of mass default.

There are, then, very good reasons for drawing at least two inferences from the current situation. The first is that, in a reversal of what happened in 2008-09, a financial crash might very well follow (rather than precede) an economic slump. The second is that, faced with the frightening alternatives, central banks might decide that massive monetisation is ‘the lesser of two [very nasty] evils’.

To return to where we started, energy-driven interpretation reveals that the financial system, and policy more broadly, has been building a monster for at least twenty years. It is indeed ludicrous that people and businesses have been paid to borrow, by negative real rates, and by the narrative that the Fed and others will never let anyone pay the price of recklessness. As ECoEs have risen, and prosperity growth has ceased and then started to go into reverse, policymakers have persuaded themselves that ‘growth in perpetuity’ can be sustained by ever-greater credit and monetary activism, and by an implicit declaration that the whole system is ‘too big to fail’. That trying to fix the ‘real’ economy with monetary gimmickry is akin to ‘trying to cure an ailing house-plant with a spanner’ seems never to have occurred to them. We may be very close to learning the price of ignorance and hubris.

PLEASE NOTE

11th March 2020

As you’ll have seen, there’s been a big jump in the number of comments posted here.

This has happened because I’ve just found out that the system which notifies me of comments awaiting approval has stopped working, seemingly a couple of weeks or so ago.

Please accept my apologies for this (and my grateful thanks go to the person who worked out what was causing this glitsch).

Until this is sorted, I’m going to do the approvals process manually, looking regularly at the list rather than waiting to be notified. I hope this won’t be much slower than the normal process.