WHY SUBSIDY HAS BECOME INESCAPABLE

What happens when energy prices are at once too high for consumers to afford, but too low for suppliers to earn a return on capital?

That’s the situation now with petroleum, but it’s likely to apply across the gamut of energy supply as economic trends unfold. On the one hand, prosperity has turned down, undermining what consumers can afford to spend on energy. On the other, the real cost of energy – the trend energy cost of energy (ECoE) – continues to rise.

In any other industry, these conditions would point to contraction – the amount sold would fall. But the supply of energy isn’t ‘any other industry’, any more than it’s ‘just another input’. Energy is the basis of all economic activity – if the supply of energy ceases, economic activity grinds to a halt. (If you take a moment to think through what would happen if all energy supply to an economy were cut off, you’ll see why this is).

Without continuity of energy, literally everything stops. But that’s exactly what would happen if the energy industries were left to the mercies of rising supply costs and dwindling customer resources.

This leads us to a finding which is as stark as it is (at first sight) surprising – we’re going to have to subsidise the supply of energy.

Critical pre-conditions

Apart from the complete inability of the economy to function without energy, two other, critical considerations point emphatically in this direction.

The first is the vast leverage contained in the energy equation. The value of a unit of energy is hugely greater than the price which consumers pay (or ever could pay) to buy it. There is an overriding collective interest in continuing the supply of energy, even if this cannot be done at levels of purchaser prices which make commercial sense for suppliers.

The second is that we already live in an age of subsidy. Ever since we decided, in 2008, to save reckless borrowers and reckless lenders from the devastating consequences of their folly, we’ve turned subsidy from anomaly into normality.

The subsidy in question isn’t a hand-out from taxpayers. Rather, supplying money at negative real cost subsidizes borrowers, subsidizes lenders and supports asset prices at levels which bear no resemblance to what ‘reality’ would be under normal, cost-positive monetary conditions.

In the future, the authorities are going to have to do for energy suppliers what they already do for borrowers and lenders – use ‘cheap money’ to sustain an activity which is vital, but which market forces alone cannot support.

How they’ll do this is something considered later in this discussion.

If, by the way, you think that the concept of subsidizing energy supply threatens the viability of fiat currencies, you’re right. The only defence for the idea of providing monetary policy support for the supply of energy is that the alternative of not doing so is even worse.

Starting from basics

To understand what follows, you need to know that the economy is an energy system (and not a financial one), with money acting simply as a claim on output made possible only by the availability of energy. This observation isn’t exactly rocket-science, because it is surely obvious that money has no intrinsic worth, but commands value only in terms of the things for which it can exchanged.

To be slightly more specific, all economic output (other than the supply of energy itself) is the product of surplus energy – whenever energy is accessed, some energy is always consumed in the access process, and surplus energy is what remains after the energy cost of energy (ECoE) has been deducted from the total (or ‘gross’) amount that is accessed.

From this perspective, the distinguishing feature of the world economy over the last two decades has been the relentless rise in ECoE. This process necessarily undermines prosperity, because it erodes the available quantity of surplus energy. We’re already seeing this happen – Western prosperity growth has gone into reverse, and growth in emerging market (EM) economies is petering out. Global average prosperity has already turned down.

From this simple insight, much else follows – for instance, our recent, current and impending financial problems are caused by a collision between (a) a financial system wholly predicated on perpetual growth in prosperity, and (b) an energy dynamic that has already started putting prosperity growth into reverse. Likewise, political changes are likely to result from the failure of incumbent governments to understand the worsening circumstances of the governed.

Essential premises – leverage and subsidy

Before we start, there are two additional things that you need to appreciate.

The first is that the energy-economics equation is hugely leveraged. This means that the value of energy to the economy is vastly greater than the prices paid (or even conceivably paid) for it by immediate consumers. Having (say) fuel to put in his or her car is a tiny fraction of the value that a person derives from energy – it supplies literally all economic goods and services that he or she uses.

The second is that, ever since the 2008 global financial crisis (GFC I) we have been living in a post-market economy.

In practice, this means that subsidies have become a permanent feature of the economic landscape.

These issues are of fundamental importance, so much so that a brief explanation is necessary.

First, leverage. The energy content of a barrel of crude oil is 5,722,000 BTU, which converts to 1,677kwh, or 1,677,022 watt-hours. BTUs and watt-hours are ‘measures of work’ applicable to any source or use of energy. Human labour equates to about 75 watts per hour, so a barrel of crude equates to 22,360 hours of labour. At the (pretty low) rate of $10 per hour, this labour would cost an employer $223,603. Yet crude oil changes hands for just $65 which, undeniably, is a bargain. If the price of oil soared to $1,000/b, it would wreck the economy – but it would still be an extremely low price, when measured against an equivalent amount of human effort.

The economy, then, could be crippled by energy prices that would still be ultra-cheap in purely energy-content terms. More to the point, this could happen at prices that were still too low to ensure profitability in the business of energy supply.

The comparison between petroleum and its labour equivalent is meant to be solely illustrative – the relevant point is that the economy is gigantically leveraged to the ‘work value’ contained in all exogenous energy sources.

Second, the end of the market economy. The market economy works on a system of impersonal rewards and penalties. If you make shrewd investments, you’re likely to make a profit – but, if you act recklessly (or simply have a run of bad lack), you stand to lose everything. Failure, as penalised impersonally by market forces, is the flip-side of reward, itself (in theory) equally impersonal. Logically, market forces don’t allow you to have reward without the risk of failure. Using debt to leverage your position acts to increase both the scope for profit and the potential for loss.

The 2008 crisis was a culminating failure of reckless financial behaviour, by individuals, businesses, banks, regulators and policymakers. Left simply to the workings of the market, the penalties would have been on a scale commensurate with the preceding folly. Individuals and businesses which had taken on too much debt would have been bankrupted, as would those who had lent recklessly to them. If market forces had been allowed to work through to their logical conclusions, 2008 would have seen massive failures, bankruptcies and defaults – spreading out from those who ‘deserved’ to be wiped out to take in ‘bystanders’ with varying degrees of ‘innocence’ – whilst asset prices would have collapsed, and much of the banking system, as the primary supplier of credit, would have been destroyed.

Some economic purists have argued that this is exactly what should have happened, and that we will in due course pay a huge price for the ‘moral hazard’ of rescuing the reckless from the consequences of their actions.

They might well be right.

Be that as it may, though, the point is that market forces were not allowed to work out to their logical conclusions. As well as simply rescuing the banks, the authorities set out on the wholesale rescue of anyone who had taken on too much debt. This was done primarily by slashing interest rates to levels that are negative in real terms (lower than inflation). Though described at the time as “temporary” and “emergency” in nature, these interventions are, for all practical purposes, permanent.

There’s irony in the observation that, though idealists of ‘the Left’ have dreamed since time immemorial of overthrowing the ‘capitalist’ system, the market economy has not been destroyed by its foes, but abandoned by its friends.

The Age of Subsidy

Critically for our purposes, what began in 2008 and continues to this day is wholesale subsidy. ZIRP has provided emergency and continuing sustenance for everyone who had borrowed recklessly in the years preceding the crash. It has also multiplied the incentive to borrow. Negative real interest rates are nothing more nor less than a hand-out to distressed borrowers, not only sparing them from debt service commitments that they could no longer afford, but inflating the market value of their investments, too.

Though less obvious than its beneficiaries, this subsidy has turned huge numbers into victims. Savers, including those putting resources aside for pensions, have been only the most visible of these victims. We cannot know who might have prospered had badly-run, over-extended businesses gone to the wall rather than continuing, in subsidised, “zombie” form, to occupy market space that might more productively have gone to new entrants. We do know that the young are victims of deliberate housing cost inflation.

There’s nothing new about subsidies, of course, and governments have often subsidised activities, either because these are seen to be of national importance, or because they have pandered to the influential interests on whom the subsidies have been bestowed.

Purists of the free market persuasion have long castigated subsidies as distortions of economic behaviour and they are, theoretically at least, quite right to think this.

The point, though, is that, since 2008, the entire economy has been made dependent on the subsidy of money priced at negative real levels.

Anyone who is ‘paid to borrow’ is, of necessity, in receipt of subsidy.

That we live in ‘the age of subsidy’ has a huge bearing on the outlook for energy. With this noted, let’s return to the role of energy in prosperity.

Prosperity in decline – turning-points and differentials

As we’ve noted, once the Energy Cost of (accessing) Energy – ECoE – passes a certain point, the remaining energy surplus becomes insufficient to grow prosperity, or even to sustain it. This point has now been reached or passed in almost all Western economies, so prosperity in those countries has turned down. Efforts to use financial adventurism to counter this effect have done no more than mask (since they cannot change) the processes that are undercutting prosperity, but have, in the process, created huge and compounding financial risks.

In the emerging market (EM) economies, prosperity continues to improve, but no longer at rates sufficient to offset Western decline. Global prosperity per person has now turned downwards from an extremely protracted plateau, meaning that the world has now started getting poorer. Amongst many other things, this means that a financial system predicated on the false assumption of infinite growth is heading for some form of invalidation. It also poses political and social challenges to which existing systems are incapable of adaption.

How, though, does the energy-prosperity equation work – and what can this tell us about the outlook for energy itself?

According to SEEDS (the Surplus Energy Economics Data System), global prosperity stopped growing when trend ECoE hit 5.4%. It might, at first sight, seem surprising that subsequent deterioration has been very gradual, even though ECoE has carried on rising relentlessly, now standing at 8.0%. This apparent contradiction is really all about the changing geographical mix involved – until recently, deterioration in Western prosperity had been offset by progress in EM countries, because the ECoE/growth thresholds differ between these two types of system.

Essentially, EM economies seem to be capable of continuing to grow their prosperity at levels of ECoE a lot higher than those which kill prosperity growth in Western countries.

The following charts illustrate the comparison, and show prosperity per capita (at constant 2018 values) on the vertical axis, and trend ECoE on the horizontal axis. For comparison with America, the China chart shows prosperity in dollars, converted at market exchange rates (in red) and on the more meaningful PPP basis of conversion (blue). For reference, ECoE at 6% is shown as a vertical line on both charts.

As you can see, American prosperity had already turned down well before ECoE reached 6%. Chinese prosperity has carried on growing even though ECoE is now well above the 6% level.

How can China carry on getting more prosperous at levels of ECoE at which prosperity has already turned down, not just in America but in almost every other advanced economy?

There seem to be two main reasons for the different relationships between prosperity and ECoE in advanced and EM economies.

First, prosperity isn’t exactly the same thing in a Western or an EM economy – put colloquially, how prosperous you feel depends on where you live, and where you started from.

In America, SEEDS shows that prosperity per person peaked in 2005 at $48,660 per person (at 2018 values), and had fallen to $44,830 (-7.9%) by 2018. Over the same period, prosperity per person in China rose by an impressive 84% – but was still only $9,670 per person last year. Even that number is based on PPP conversion to dollars – converted into dollars at market exchange rates, prosperity per person in China last year was just $5,130.

Both numbers are drastically lower than the equivalent number for the United States. Not surprisingly, Chinese people feel (and are) more prosperous than they used to be, even at levels of prosperity that would amount to extreme impoverishment in America. Before anyone says that “America is a more expensive place to live”, conversion at PPP rates is supposed to take account of cost differentials – and, even in PPP terms, the average Chinese citizen is 78% poorer than his or her American equivalent.

The second critical differential lies in relationships between countries. Historically, trade relationships favoured Western over EM economies, though this has been changing, perhaps helping to explain the gradual narrowing in personal prosperity between developed and emerging countries.

Moreover, there are often quirks in the relationships between countries, even where they belong to the same broad ‘advanced’ or ‘emerging’ economic grouping. Germany is an example of this, having benefited enormously from a currency system which has been detrimental to other (indeed, almost every other) Euro Area country. For some time, Ireland, too, was a beneficiary of EA membership, though those benefits have eroded since the period of “Celtic Tiger” financial excess.

The conclusion, then, is that there’s no ‘one size fits all’ answer to the question of ‘where does ECoE kill growth?’, just as prosperity means different things in different types of economy.

It should also be noted that China’s ability to keep on growing prosperity at quite high levels of ECoE is not necessarily a good guide to the future. As things stand, China’s economy, driven as it by extraordinary levels of borrowing, is looking ever more like a Ponzi scheme facing a denouement.

The situation so far

Given how much ground we’ve covered, let’s take stock briefly of where we are.

We’ve observed, first, that the rise in trend ECoEs is in the process of undermining prosperity. Much of this has already happened – prosperity in most Western economies has now been deteriorating for at least a decade, whilst continued progress in EM economies is no longer enough to keep the global average stable. As ECoEs continue to rise, what happens next is that EM prosperity itself turns down, a process which will accelerate the rate at which global prosperity declines. SEEDS already identifies one major EM economy (other than China) where strong growth in prosperity will soon go into reverse.

Second, a world financial system predicated entirely on perpetual ‘growth’ in prosperity has become dangerously over-extended. Again, this observation isn’t something new. The inauguration, more than ten years ago, of mass subsidy for borrowers and lenders surely tells us that we’ve entered a new ‘era of abnormality’, in which subsidy is normal, and where historic principles (such as positive returns on capital) no longer apply.

If you stir energy leverage into this equation, an inescapable conclusion emerges. It is that we’re going to have to extend our current acceptance of ‘financial adventurism’ to the point where energy supply, just like borrowers and lenders, becomes supported by monetary subsidy.

The only way in which this might not happen would be if we could somehow escape from the implications of rising ECoE. Some believe that renewables will enable us to do this – after all, just as trend ECoEs for oil, gas and coal keep rising, those of wind and solar continue to move downwards.

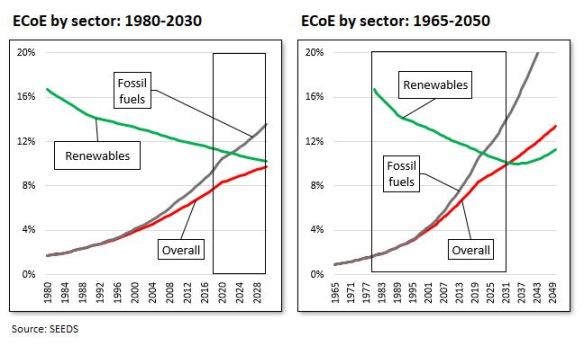

This situation is summarised in the first of the following charts, which shows broad ECoE trends over the period (1980-2030) covered by SEEDS. As recently as 2000, the aggregate trend ECoE of renewables (shown in green) was above 13%, compared with only 4.1% for fossil fuels (shown in grey). Renewables are already helping to blunt the rise in ECoE, such that the overall number (in red) is lower than that of fossil fuels alone. We’re now pretty close to the point where the ECoE of renewables will be below that of fossil fuels.

On this basis, it’s become ‘consensus wisdom’ to assume that renewables will, like the 7th Cavalry, ‘ride to the rescue in the final reel’. Unfortunately, this comforting assumption rests on three fallacies.

The first is “the fallacy of extrapolation”, which is a natural human tendency to assume that what happens in the future will be an indefinite continuation of the recent past. (One of my mentors in my early years in the City called this “the fallacy of the mathematical dachshund”). The reality is much likelier to be that technical progress in renewables (including batteries) will slow when it starts to collide with the limits imposed by physics.

The second fallacy is that projections for cost reduction ignore the derivative nature of renewables. Building, say, a solar panel, a wind turbine or an electrical distribution system requires inputs currently only available courtesy of the use of fossil fuels. In this specialised sense, solar and wind are not so much ‘primary renewables’ as ‘secondary applications of primary fossil input’.

We may reach the point where these technologies become ‘truly renewable’, in that their inputs (such as minerals and plastics) can be supplied without help from oil, gas or coal.

But we are certainly, at present, nowhere near such a breakthrough. Until and unless this point is reached, the danger exists that that the ECoE of renewables may start to rise, pushed back upwards by the rising ECoE of the fossil fuel sources on which so many of their inputs rely. This is illustrated in the second chart, which looks at what might happen beyond the current time parameters of SEEDS. In this projection, progress in reducing the ECoEs of renewables goes into reverse because of the continued rise in fossil-derived inputs.

The third problem is that, even if renewables were able to stabilise ECoE at, say, 8% or so, that would not be anywhere near low enough.

Global prosperity stopped growing before ECoE hit 6%. British prosperity has been in decline ever since ECoE reached 3.6%, and an ECoE of 5.5% has been enough to push Western prosperity growth into reverse.

As recently as the 1960s, in what we might call a “golden age” of prosperity growth – when economies were expanding rapidly, and world use of cheap petroleum was rising at rates of up to 8% annually – ECoE was well below 2%.

In other words, even if renewables can stabilise ECoE at 8% – and that’s a truly gigantic ‘if’ – it won’t be low enough to enable prosperity to stabilise, let alone start to grow again.

Energy and subsidy – between Scylla and Charybdis

The idea that we might need to subsidise energy ‘for the greater economic good’ is a radical one, but is not without precedent. Though the development of renewables has been accelerated in various countries by subsidies provided either by taxpayers or by consumers, the important precedent here doesn’t come from the solar or wind sectors, but from the production of oil from shales.

There can be no doubt that shale liquids, primarily from the United States, have transformed petroleum markets – without this production, it’s certain that supplies would have been lower, and prices could well have been a lot higher. Yet the supply of shale has owed little or nothing to the untrammelled working of the market. Rather, shale has received enormous subsidy.

Repeated studies have shown that shale liquids production isn’t ‘profitable’, because cash flow generated from the sale of production has never been sufficient to cover the industry’s capital costs, let alone to provide a return on capital as well. The economics of shale are too big a subject to be examined here, but the critical point is the rapidity with which production declines once a well is put on stream. This means that any company wanting to expand (or even to maintain) its level of production needs to keep drilling new wells – this is the “drilling treadmill” which, critically, has always needed more investment than cash flow from operations can supply.

Yet shale investment has continued, despite its record of generating negative free cash flow. It’s easy to attribute this to the support provided by gullible investors, but the broader picture is that shale producers, like ‘cash burners’ in other sectors, have been kept afloat by a tide of ultra-cheap capital made available by the negative real cost of capital.

In all probability, this is the pattern likely to be followed by the energy industries more generally, as profitability is crushed between the Scylla of rising costs and the Charybdis of straitened consumer circumstances.

In short, we’re probably going to have to ‘create’ the money to keep energy supplies flowing. If the argument becomes one in which energy is described as ‘too important to be left to the market’, energy will join a growing cast of characters – including borrowers, lenders and ‘zombie’ companies – kept in existence by the subsidy of cheap money.