THE WHY AND HOW OF DE-DOLLARIZATION

As America’s public debt spirals ever further out of control – and with the expanding BRICS+ group working on a common trading currency and a rival settlement system – the question of de-dollarizing the global financial system is becoming a hot topic.

We need to look at this issue, not in terms of reserve currencies, but of flows of trade and investment. The dollar isn’t going to be ‘overthrown’ or ‘replaced’ so much as circumvented.

The patterns that emerge from this circumvention are going to have profound – and adverse – implications, not just for the US, but for the broader Western world as well.

Introduction

Though de-dollarization is going to happen, it’s not likely to involve a switchover to a basket of currencies or IMF SDRs, still less the adoption of another currency, such as the euro or the renminbi, to take over from USD. The dollar now accounts for 59% of global currency reserves, and this, whilst down from 66% in 2015, and 72% in 2001, continues to dwarf nearest rival the EUR (20%), let alone the RMB (less than 3%).

But reserve currency status isn’t the point at issue. What really matters is the currency denomination of flows of trade and investment around the world. Trade flows are likely to exit the dollar system in a piecemeal manner, starting with oil and moving on to other important commodities, and investment can be expected to follow trends in international trade.

Hitherto, the conduct of these flows in USD has conferred an enormous exorbitant privilege on the United States, and critics allege that the US abuses this privilege, not just when it indulges in enormous public borrowing to prop up its otherwise-faltering economy, but also when it “weaponizes” the dollar through the use of USD-based settlement systems to enforce sanctions on countries such as Russia and Iran.

Geopolitics aside, the critical issue is the flip-side of “exorbitant privilege”. This is the cost imposed, through the market dollar under-valuation of their output, on other countries in general, and EM economies in particular.

As we shall see, it can be calculated that the rest of the world gets only $0.54 for each dollar-equivalent of economic value that their countries produce. Put the other way around, we can calculate that the market dollar is over-valued by about 85% in relation to underlying value in the world outside the United States.

What we should expect to see is a rolling shift towards bilateral and multilateral trade and investment in currencies other than the dollar. Beginning with oil, this can be expected to move on to natural gas, chemicals, minerals and agricultural commodities. A point is likely to be reached at which most of the ‘hard’ trade (and associated investment) in energy, raw materials and commodities shifts over to non-USD transactions outside the ‘dollar fence’. ‘Softer’ trades may follow, but at some remove from commodities.

The dynamic here is straightforward. In a global economy now inflecting from growth into contraction, national economies can get by without dollar-denominated Hollywood blockbusters and the latest gizmos from Silicon Valley, but they must have energy, chemicals, minerals and food.

Ironically, most of the raw materials needed for transition to renewable energy are likely to end up on ‘the other side’ of the de-dollarized ‘fence’, a trend which fits within some broader implications that we’ll consider later in this discussion.

The basis of the dollar system

Back in 1945, it made perfect sense to base new global trade and investment arrangements on the dollar. America accounted for 50% of global GDP, and was the world’s biggest creditor nation. There was no rival – not even the USSR – to America’s geopolitical and economic supremacy.

The Bretton Woods system, established in 1944, was the foundation-stone of the post-war economic and financial architecture. Other currencies moved around a dollar which itself was tied to gold. The major transnational institutions – which now include the BIS and the FSB as well as the IMF and the World Bank – are dollar-denominated agencies, meaning that their activities and reporting are undertaken in dollars.

But a great deal has changed since 1945. Depending on how we measure it, the US share of global GDP has fallen to either 25% or, more realistically, 15%, and America is now the world’s biggest debtor nation.

The Bretton Woods system was broken in 1971, when Richard Nixon suspended the gold convertibility of the dollar.

This meant that the dollar gained primacy in a wholly fiat system which, in theory, sets no limits on how much currency any individual jurisdiction can issue. In practice, America has direct access to a global credit system to which all other countries’ access is mediated by the markets.

America may or may not be gaming this system to political advantage through sanctions, but the US certainly abuses its primacy when it undertakes reckless public borrowing. The latest trillion-dollar increment to US government debt was added in the final fourteen weeks of 2023.

No other country – not even China – can get away with anything remotely like this. A case in point was the attempt of the British government, in September 2022, to borrow £220bn (about $330bn) to finance £60bn of household energy support plus £161bn of tax cuts to be spread over five years.

The markets stopped this plan, by selling GBP down to crisis levels, and driving the yields on gilts (British government bonds) sharply upwards. Some might argue that that particular fiscal gambit deserved to be stopped, but the point is that dollar-denominated markets pass verdicts on government policies.

America isn’t exempt from market pressure, but its public borrowing is direct-from-source, and the Fed has far more rate-determining influence than any other central bank.

Matters of cost

The way the dollar-denominated system works can be illustrated by reference to oil. Any country wishing to import oil must first earn or buy the dollars needed to settle this trade, and the oil exporting recipients must, for want of alternatives, put their receipts into a world financial system denominated in dollars. The US not only has privileged access to the global credit system but could even, in extremis, simply create (“print”) the dollars needed for imports, whether of oil or of anything else.

Is there a cost, to this dollar-denominated system, for countries in the WOUSA (the World outside the United States)? It’s arguable, not just that there is such a cost, but that this cost is exorbitant.

In considering the cost of dollar privilege, we need to draw a clear distinction between finance and economics. Whilst financial transactions between currencies necessarily take place at market rates, there’s an alternative (and more meaningful) convention when it comes to making international comparisons and calculating global economic aggregates.

This is PPP conversion into international dollars.

PPP means “purchasing power parity”. If, for instance, the same product or service sells for £10 in Britain and $15 in America, the PPP GBP exchange rate for that particular item is $1.50. The greater meaningfulness of PPP conversion is reflected in its use for the calculation and forecasting of global GDP. If it’s confirmed (by the IMF) that the world economy grew by 2.5% last year, that will be a PPP-based measurement.

In Western countries, PPP rates are seldom very far from market ones, but very different circumstances apply in much of the EM world. In 2022, Russian GDP (of 153tn roubles) translated to $4.8tn in PPP dollars, but only $2.2tn at market rates. Similarly, Chinese dollar GDP in 2022 was $29.9tn (bigger than the American economy) in PPP terms, but only $17.9tn in market dollars.

If, for purposes of comparison with the US, we converted the defence budgets of China and Russia into market dollars, we’d be understating how much those countries are really spending on pay and procurement undertaken in local currencies, because we’d be using a misleading basis of currency comparison.

For our purposes, the point about drawing a clear distinction between finance and economics when using these different FX conventions is that what the FX markets think about a currency isn’t economic ‘fact’.

PPP gives us a much more meaningful measure of the comparative size of economies, and therefore provides important information about different countries’ roles in the global economy.

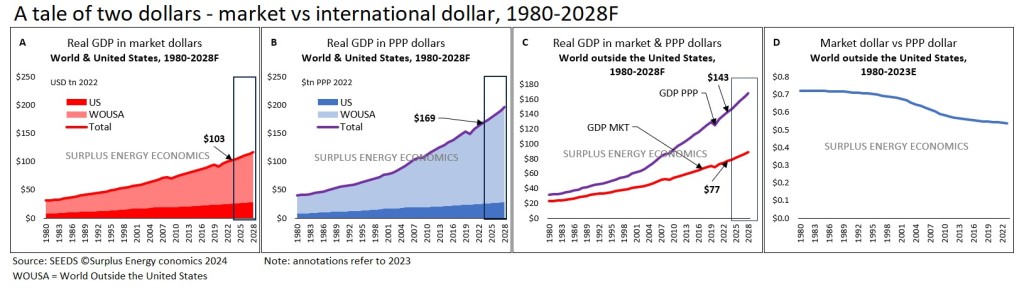

This is illustrated in Fig.1.

Taking provisional data for 2023 in market dollars, global GDP was $103tn, or $77tn in the WOUSA economy. But WOUSA GDP in international (PPP) dollars was far higher than this, at $143tn PPP.

What’s important here is the international purchasing power of countries other than the US. They produce local-equivalent GDP of $143tn, but would get only $77tn for it in the theoretical event of selling it all on forex markets.

In other words, every PPP dollar-equivalent of WOUSA GDP is priced at only $0.54 in market dollars.

These countries aren’t, of course, going to “sell” their GDP on dollar-denominated markets, but conversion into dollars at market rates exerts a major influence on their economic standing, particularly when it comes to borrowing and investment. This also has a bearing on bilateral and multilateral trade and investment flows between countries.

The application of PPP enables us to calculate the rate of exchange between the market dollar and its international counterpart. The market dollar has been weakening on this basis (Fig. 1D), but the exorbitant privilege of the USD remains substantial.

Fig. 1