THE ANATOMY OF THE NEXT CRASH

Surprising though it might seem, barely two weeks have elapsed since those of us who anticipate GFC II – the sequel to the 2008 global financial crisis (GFC I) – were in a very, very small minority.

Consensus opinion, backed to the hilt by conventional economics, said that no such event was going to happen. Rather, we had entered the sunny uplands of “synchronised growth”, and debt had ceased to be anything much to worry about.

Of course, events, in Italy and elsewhere, haven’t yet proved us right, or the consensus wrong. We remain in a minority, though one that seems to be becoming larger. But events should embolden us, and on two fronts, not one.

First, recent developments strengthen the case for GFC II, not because of their seriousness alone, but because – as will be explained here – they conform to a logical pattern that points towards a coming crisis.

Second, we’re being reminded of quite how far conventional economics is out of touch with reality. This, of course, will be proved decisively if – or when – GFC II does happen.

This, when you consider its implications, is really quite remarkable. Government, business and finance all place heavy reliance on a school of thought which decrees that the workings of the economy are entirely financial – so, if events prove this approach to have been wrong, the ramifications will be enormous.

Those of us who understand that, far from being a matter of money, the economy is an energy system, have a lot of work in front of us.

This seems like a good point at which to publish the promised brief summary of why GFC II is likely.

ECoE starts to bite

Here is one big difference which makes the two contesting views of the economy incompatible. For anyone who believes in money-based interpretation, there are few (if any) logical barriers to perpetual growth in prosperity.

From an energy perspective, however, there is every reason to doubt the feasibility of indefinite expansion on a finite planet.

To be quite clear about this, what is contended here is not that we will “run out of” either petroleum or of energy more broadly. Rather, the argument is that we are running out of cheap energy.

“Cheap”, in this context, does not refer to sums of money invested in the supply of energy. Rather, it refers to the quantity of energy consumed whenever energy is accessed.

The definition used here is the energy cost of energy, or ECoE. Throughout much of our industrial history, the trend in ECoE has been downwards. This trend, beneficial for growing prosperity, was driven by geographical reach, economies of scale and technology.

In recent times, however, both reach and scale have plateaued, and technology has become a mitigator of ECoE increase rather than an accelerator of ECoE decrease. The driver now is depletion.

According to SEEDS, the global trend ECoE was 1.7% in 1980, and 2.6% in 1990. The difference between the two numbers was modest, and neither was a material (or, to most observers, even a noticeable) head-wind to growth.

Because the operative trend is exponential, however, ECoE was close to 4% by 2000, and had now become large enough to start driving a wedge between economic expectation and economic outcome.

The dynamic of sequential crises, part one – GFC I

By about 2000, then, underlying growth in prosperity was weakening, something not helped by the form of globalisation being promoted. Fading growth wasn’t something that conventional economics could explain, let alone accept.

What was apparent, however, was that the ability of Westerners to go on increasing their consumption was flagging, not least because of the outsourcing of skilled, well-paid jobs to the emerging market economies (EMs).

The solution to this seemed simple – give consumers easier and cheaper access to credit.

Two expedients combined to further this aim. The first was to drive down the real (ex-inflation) cost of borrowing. The second was to increase the availability of debt through “deregulation” of the financial sector. Both accorded with the prevailing ideology of laissez-faire economics, with its emphasis on diminishing the role (including the regulatory role) of the state.

Obviously enough, this strategy drove global debt upwards. Expressed in PPP dollars at constant 2017 values, world debt increased by 43%, from $121 trillion in 2000 to $174tn in 2007. Nobody in any position of influence seemed unduly concerned about this, because GDP had increased by a seemingly-impressive 53% over the same period.

Hardly anyone seemed to notice that each $1 of this growth had been accompanied by $2.08 of net new debt. Accordingly, the clear inference – that a big chunk of this “growth” was nothing more substantial than the simple spending of borrowed money – passed largely unnoticed.

The second, less obvious consequence of deregulation was the diffusion of risk, and the separation of risk from return. Various innovative practices enabled the creation of high-return, high-risk instruments which could be sliced in such a way that high risk was divested and high return retained. Surprisingly few observers noticed quite how dangerous this practice was likely to prove.

Risk-aversion revisited

The first – and, with hindsight, unmistakeable – portent of GFC I happened during the “credit crunch” of 2007. Banks, suddenly aware of elevated risk, couldn’t know which counterparties were safe, and which were not.

This was an instance of risk-aversion. What resulted was an interruption in the continuity of credit supply. This took down the small number of banks which had been reckless enough to finance their lending using short-term credit from wholesale markets. These aside, the system seemingly recovered from risk-aversion, though astute observers must by now have realised that the “credit crunch” might well be a precursor to something more systemic.

This 2007 chapter is highly relevant now, because we have entered a new phase of risk-aversion. Even before recent events in Italy, some of us had discerned the rise of risk-aversion, most obviously in the travails of a string of EM currencies. The probability is that this isn’t simply a function of a strengthening dollar, but reflects the withdrawal of capital from countries now seen as risky.

This time – and with a significance that will become obvious shortly – it is the creditworthiness of countries and their currencies which are being questioned, not just that of banks

This is why, here, we had started discussing GFC II, and commenting on its imminence, well before anything kicked off in the Euro Area (EA).

These events have not, then, changed our expectations. Rather, they have conformed to a pattern in which an outbreak of risk-aversion precedes a full-blown crisis.

The dynamic of sequential crises, part two – GFC II

So far, the dynamic of GFC II is conforming to the pattern of GFC I, with an episode of risk-aversion happening first. If the pattern continues, we will get through this chapter and breathe a collective sigh of relief – just in time for GFC II to catch us unawares.

This time, though, the fundamental dynamic is different, which means that the shape of GFC II will be different as well.

The explanation for this lies in how we responded to GFC I.

Put simply, during GFC I the authorities woke up to the obvious fact that the world had too much debt. Whenever debt becomes excessive – for a household, a business or a whole economy – the primary problem isn’t whether the debt can be repaid. At the macroeconomic level, at least, repayment can usually be deferred.

The big and immediate problem is servicing the debt – and this, by 2008, had become something that the world’s borrowers simply couldn’t afford to do. The logical solution seemed to be to slash interest rates.

This involved two processes, not one. The first, which was to take policy rates down to somewhere near zero, would never have been enough on its own. This was why massive QE programmes were launched, buying bond prices upwards in order to force yields sharply lower.

Defenders of QE argued that this didn’t amount to “printing” or otherwise creating new money, that it wasn’t monetisation of debt, and that it wouldn’t spark a sharp rise in inflation.

None of these assurances was, or is, cast-iron. QE isn’t the creation of money so long as it is reversed in good time. QE may not in principle be debt monetisation, but it certainly has become that in Japan, where QE money has been used by the BoJ to buy up nearly half of all JGBs in issue. It would be no huge surprise if the ECB, too, adopted monetisation as the least-bad way out of the looming debt crisis. And QE need not spark inflation, if by that term is meant rises in retail prices – but QE most assuredly has created huge inflation in the prices of assets.

A new adventurism

Be that as it may, what we have seen since GFC I has been “monetary adventurism”, which is distinct from the “credit adventurism” practised before 2008. The credit variety hasn’t gone away – indeed, it has worsened, with each dollar of “growth” since 2008 coming at a cost of $3.39 in new debt, compared with a ratio of 2.08:1 before GFC I – but monetary adventurism has leveraged its consequences.

The numbers are that, between 2008 and 2017, GDP increased by $28.8tn, but debt expanded by $98tn. Nor is this all. The destruction of returns on capital has created what the WEF has called “a global pension timebomb”, blowing a hole estimated by SEEDS at close to $100tn in worldwide pension provision adequacy. QE has poured something of the order of $28tn into the system. In the background, meanwhile, ECoE has continued to tighten its grip, rising from 5.3% in 2007 to 8.0% now.

To cut to the chase, most of the recorded “growth” in world GDP since 2008 has been cosmetic, amounting to nothing more substantial than the simple spending of borrowed money. As we have seen, this is corroborated by the concentration of “growth” towards the lower end of the value-added spectrum.

Bring the increase in ECoE into the equation as well and what we are looking at is a 10% ($7.6tn) increase in world prosperity trying to support a 54% ($98tn) expansion in total debt. Moreover, the 10% increase in aggregate prosperity has barely matched the rate of growth in population numbers. People have not been getting more prosperous, then, but they have been getting ever further into debt.

What on earth could go wrong with that?

Not like GFC I – the nature of GFC II risk

Thus far, with an episode of risk-aversion in the EM economies compounded by debt worries in Europe, events are following the pattern of GFC I.

But there are at least three reasons why we should not assume that GFC II will continue to look a lot like GFC I.

First, prosperity per person has been declining across almost all of the Western economies. The worst affected countries include France (a fall of 5.4% since 2007), Australia (-6.0%), the United States (-6.3%), Britain (-7.9%) and – of course – Italy, where prosperity has declined by 8.4%.

It is no coincidence at all that major political reverses for the establishment have happened in four of these five countries. Deterioration in prosperity seems certain to have informed the “Brexit” vote, the election of Mr Trump, the defeat of all established parties in the first round of presidential voting in France, and the triumph of Lega and M5S in Italy.

The relevance of this going forward, though, is something termed here “acquiescence risk”. This broadly means that populations undergoing hardship are likely to oppose any kind of rescue plan, especially if it is assumed by voters to involve rescues for an elite, and “austerity” for everyone else.

The second big difference between conditions now and those prevailing in 2008 is that recklessness has no longer been confined almost entirely to the developed economies of the West. This broader compass is hinted at by risk-aversion in the EMs. On the SEEDS risk matrix, China is now rated as riskier than any economy other than Ireland.

Third, and most important of all, a phase of “credit adventurism” which put banks at risk in 2008 has become a wave of “monetary adventurism” which puts fiat currencies themselves at risk.

What we should anticipate, then, is that GFC II will be truly global, not exempting EMs, and that, this time, currencies, and therefore national economies, will share a wave of risk previously (in 2008) borne largely by banks alone.

Precedent can help us anticipate why GFC II will happen – but will prove a poor guide to its shape and extent.

= = = = =

Since brevity was promised here, it is to be hoped that the foregoing provides a succinct summary of why GFC II is likely.

There seem certain to be plenty of opportunities for going into this in greater detail.

= = = = =

Ponziworld’s recent synopsis of the book, “The Loney Crowd,” is a good overview of the modern mindset, and why we will all go right over the cliff. https://ponziworld.blogspot.com/2018/06/the-terminal-idiocracy.html

I am going to test the patience of both readers and Dr. Morgan by attempting to summarize some thoughts from The Physics of Life by Adrian Bejan. These thoughts all pertain to our current predicament.

Bejan makes a distinction between Growth and Evolution, two terms he says are ‘routinely conflated and confused in scientific discourse’. Growth is the spread of a seed as it develops. Evolution is the creation of a new seed…a new way of being in the world. Growth follows an S curve: slow, then fast, then slow, followed by stasis. The S curve which characterizes growth can be derived from first principles of physics.

In terms of Peak Oil, the Hubbert curve describes the S which describes the utilization of what we can label ‘conventional oil’. There are other sources of liquid fuels, which have their own S curves. When Jean Laherrere draws these curves, he draws each one distinctively. For example, he does not try to fit shale oil under the conventional S curve…he draws independent curves and then sums them. The curve for any particular seed (technology) can be moved laterally by incremental improvements to the technology (as Art Berman thinks that the technology for extracting shale oil has moved only a little), but the small incremental movements do not obscure the S curve for the given seed technology. The same could be said, for example, about desktop computers or telephony.

In the rapid growth phase, both scientists and the lay public commonly speak of ‘exponential growth’. This label is always misleading. There is no such thing as perpetual exponential growth on a finite planet.

Now, since I can’t draw it here, I want you to imagine an S curve for conventional oil, and a graph of the global GDP which that oil has facilitated into existence. As late as the 1990s, it sure looked to a lot of people like an exponential. But now, evidence such as that presented by Dr. Morgan indicates that many of us are on the downslope of Hubbert’s curve. But since the public and corporate and political perception is one of ‘exponential growth forever’, we grab the nearest tool to try to at least pretend that things are still as they were. The nearest tool is debt. And so, for a while Wile E. Coyote treads air.

Now I want to shift gears and talk a little about ‘what is flowing?’. With GDP, it is the notion that more economic activity is by definition ‘good’. A proposal such as the ’10 minute walkable community’ is by definition ‘bad’ because it reduces GDP. So the widespread adoption of designing communities so that they are diversified and walkable requires a change in the mental constructs of ‘what is flowing’. I have made the point that our current built environment has been deeply marked by the automobile and airplane and truck. Since there are feedback loops from the built environment to our mental constructs, changing ‘what is flowing’ will not be child’s play. And probably we don’t have the resources to demolish what we have and construct some new vision of Heaven.

But I want to take a specific look at what is a very large part of the US economy: food and healthcare. If you haven’t looked at Viome, please take some time and look at some of the YouTube appearances of Naveen Jain, the billionaire founder and backer. (A google search for Viome may lead you to pages of bullshit about Vimeo, search on Jain instead). Viome began with enormous promises (chronic disease becomes entirely optional; the medical system will collapse) which didn’t immediately come true. My wife and I were early adopters. We now have the first real results. Let me describe them to you.

Gut microbes make butyrate, a substance which is used by many genes in the body to do all sorts of health promoting things. If you don’t have butyrate, you are not healthy. The Viome technology looks at both the existence of particular microbes which CAN make butyrate, but also, and perhaps more importantly, whether they are actually generating the RNA which is necessary for gene activation. The measurements are sorted into 9 boxes: high, medium, and low for both existence and activity. Thus, at one extreme, you may have few of the right kinds of microbes and they may be inactive. At the other, you have plenty of the right kind of microbes and they are busily making butyrate.

If you are in the (1,1) box Viome will advise you to take a certain Probiotic and to eat more resistant starch (which feeds the microbes). If you are in the (3,3) box, Viome will advise you to just keep eating a healthy diet. But it gets interesting in the middle boxes. For example, one can have a relatively poor set of microbes, but a high rate of butyrate production. What this means is that some bad bacteria, which can also make butyrate, are doing so…but also making bad products such as ammonia. The ammonia will lead to inflammation which is associated with virtually all chronic disease. And Viome will generate recommendations for you which deal with your condition.

So the first step down the path that Jain promises looks pretty good to me. What is the potential? I certainly agree that one can envision the collapse of the medical industry built on treating chronic disease, the end of taxpayer subsidies for the treatment of chronic disease, the severe crimping of industries such as supplement manufacturers, a huge cutback in the industry of ‘diet doctors’, probably big restructuring of the agricultural industry and downsizing of supermarkets as people shun processed foods.

Now, today, when people walk down the middle aisles of a supermarket, they are searching for something very specific to flow: clever combinations of fat, salt, and sugar. If the above paragraph is to actually occur, then what needs to flow is the concept of ‘science based health promoting food’. Which will turn out to look a lot more like what our ancestors ate.

So a question for you:

Can scientific measurements plus feedback change what flows?

If the answer is ‘Yes’, then we are into one of Bejan’s evolutionary changes. That is, the structure of a very large proportion of our economy changes because ‘what is flowing’ has changed.

Working against change is the desire of all living things to ‘go with the flow’. The flow is currently the combined volume of the Mississippi, the Amazon, and the Nile. Viome is equivalent to the creek that runs in the back of your property.

One can extend the same sort of thinking to Dr. Morgan’s ideas about the futility of EVs and the necessity for better designed urban areas and the 10 Minute Walkable Neighborhood. All that is left as an exercise for the student.

Are you optimistic, or pessimistic?

Don Stewart

Hello Dr. Tim – I recently has a question about Charles Hall’s EROI approach which I think is relevant to your prosperity calculations as well. Namely: How do sunk capital costs effect prosperity?

As an economy grows, capital allows for faster growth – a positive feedback loop or economy of scale. More railroads made coal easier, more roads and cars made oil more viable, etc. However as a civilization grows the maintenance cost of capital increases as a share of energy use, leaving less marginal energy available for the construction of new capital. This is relative to the rate of increase of resource extraction and is a function of diminishing resource quality.

So prosperity decline seems to contain TWO functions: Energy cost increase, plus increasing capital requirements. Instead of (E-ECoE)/N = P, we would have (E-ECoE-SUNK CAPITAL ENERGY MAINTENANCE)/N=P.

Much of the peak oil thinking focuses on “E”, while current discussion focuses on “ECOE”. Much of the problem with civilization lies with the second component of the denominator – the ongoing sunk metabolic energy demands of capital and institutions. We can’t seem to do anything without sacrificing something else.

So a marginal barrel of oil in 1960 may have 100 units of energy. Perhaps only 1 of those units of energy was required for proximate (“at the well head”) extraction. However – lets say 80 of those units of energy went to existing capital and institutions (repaving roads, kindergarten teachers…) leaving 19 units of energy available to the economy for growth. Over time, I assert that the problem isn’t whether the marginal barrel of oil costs even FIVE TIMES as much energy (5 of 100 units) but the fact that legacy sunk capital requires 90 units of energy (as an example) leaving only 5 units of energy available to invest in growing the economy – new capital and institutional expansion.

The problem is that BOTH of the units of the denominator are growing. One unit is subject to diminishing marginal returns, the other is subject to exponential expansion. This to me is the heart of the matter. Even if infinite quantities of energy were available collapse is still inevitable because at some size of the economy the legacy share of energy demand by capital and institutions represented by the MARGINAL unit of energy will leave no SURPLUS energy available for the creation of new capital and the expansion of existing institutions.

Capital maintenance isn’t exactly “essential” like food and shelter. It’s neither discretionary. You can put it off for a long time before it starts to undercut functional stability.

If you built an infinite road to nowhere your costs of expanding the road would include each incremental meter. The longer the road got, the more expensive each incremental meter would cost since at first you traveled one mile from start to finish, but soon would travel many hundreds of miles. This is EROI, or perhaps related to ECOE. However, if you are also repairing the road as you work things become much worse as some of your time and energy need to be spent filling potholes and patching cracks. As limits are reached, the road builder may abandon some repairs to allow still further growth. If there are any limits to energy then at some point all available energy would be put into road maintenance – or the maintenance of the road would be abandoned to allow growth.

Long story short I think prosperity is worse off than we might estimate without capital considerations.

Japan and I think China built some roads to nowhere and there is also an airport in Spain and housing which will never be used.

Here in the UK we’re about to spend billions of on HS2 which we might not be able to maintain.

The state of the roads in the Uk is appalling with not much money to fix them.

The way I look at this is to divide energy supply into three parts. One, of course, is ECoE. The second is non-discretionaries or essentials, into which category I would put maintenance of infrastructure. The third is discretionaries.

This equation is leveraged against discretionaries. That’s why, in situations where prosperity is in steep decline (as in the UK, for example), we’re seeing retail, pubs and restaurants under pressure. You would also expect to see neglect of maimntenance spending.

An added complication here is utilisation rates. Infrastructure is geared to near-full utilisation. If utilisation rates fall, the share of maintenance cost falling on each remaining user rises. This can exacerbate the downwards trend in utilisation, and become a vicious circle.

SEEDS is showing a pronounced decline in prosperity in almost all Western economies. There may be a case for things being even worse than SEEDS indicates.

But, to the best of my knowledge – and whilst there are many interpretations which recognise weakening prosperity – SEEDS is the only model which captures this. Conventional economic models invariably claim ‘growth’ in output, and assume rising prosperity on this basis.

@Dr. Tim – Thanks for the reply. You helped me connect a few dots between apparent growth (GDP) in the face of declining prosperity. I am convinced it is structurally irreversible. I think the tendency to neglect maintenance might be a small element of things being worse than SEEDS would indicate since the concept of “essentials” has some fuzzy boundaries.

It is particularly important because much of the cost of extraction of energy has to do with capital requirements rather than labor. Roads, heavy equipment, mining and materials, etc. To say the energy cost of energy is increasing and the price is increasing is to say that the return on capital is decreasing, to some extent, and that what we cannot afford is the capital intensity of growth – in that we need to maintain our current capital with energy and resources just to stay in place, and don’t have enough surplus to add any more without abandoning that which we have.

Those who say “we have plenty of oil if the price can get higher” haven’t thought through the limitations. If the government subsidizes oil prices to $300 a barrel we would use so much steel, concrete, sand and trucking that other sectors would collapse for lack of resources – which would look like price spikes.

Thank you, and I’m glad I’ve helped.

If you look at, say, a bridge, and consider all the steel, other materials and work embedded in it, it has a clear (and large) energy cost. That bridge ages over time, meaning that we have to (a) invest in maintaining it, and/or (b) invest in replacing it when necessary. By ‘invest’, of course, I mean ‘put energy into’.

So infrastructure is ’embedded energy’, and this decays, requiring replenishment, over time. That’s one of the demands – and a significant one – on our surplus (ex-ECoE) availability of energy.

I’m struggling to reconcile increasing EROEI with news coming from the oil industry that technological advancement is driving down decline rates on established wells from around 7% to 3%. In some areas extraction costs have fallen to around $10 per barrel.

As far as Surplus Energy economics goes I’m a believer but I’m sceptical over the accuracy of EROEI measurements. Who is measuring the amount of energy used by the pumps the Saudis use to inject water into their wells ? . Are the reports accurate ?.

In the coal industry we have seen a shift away from deep mine to open cast coal. This must be hugely beneficial in terms of EROEI?.My gut feeling is that any change in EROEI is marginal and will remain of secondary order significance for the foreseeable future. Exponential population increase and alternative energy supplies that might not live up to the hype seems to be the main issue. ?

There’s no doubt that ECoEs are rising, I’m afraid. Reported costs are often only operating expenses, not capital costs. Decline rates on some wells can be reduced by investment, but that cost needs to be taken into account. Annual decline rates on shales are enormous. The amount of oil discovered annually has plunged to an all-time low. Technology is limited to the physical envelope of the resource being accessed, something very widely overlooked. Saudi water injection is huge, itself evidence of the ageing of much of the Saudi resource base.

There is a specific issue with coal, which the is energy content per tonne extracted. This has been falling relentlessly, and open cast coal is likely to be at the low end of the range.

Someone posted a visual of how much anthracite vs lignite coal reserves remain… the anthracite number was in the single digits…

So we are left with burning the low quality brown coal that produces far less heat… meaning we have to dig up, transport and burn more of it … to compensate…

This is another huge headwind….

If open-cast mines are now being opened, (Germany?) it’s poor quality stuff – and undoubtedly a measure of desperation.

EROEI

As I understand it, the observed EROEI can increase when the industry collapses. The reason is that capital expenditures count as a cost. If the industry stops spending capital dollars, the observed EROEI will increase. That happened in the Canadian tar sands a few years ago.

Of course, it also means the industry is going out of business. I guess the moral of the story is that we need to be really careful with measurements, and understand the implications.

Don Stewart

Don

That’s a correct observation, and it reminds me of a certain US oil major which once decided to develop projects with an IRR above a specified level – the result was a shrinking portfolio of assets.

This will not affect SEEDS, however, because ECoE is measured on a multi-year trend basis for each fuel type. Output mix does change overall measured ECoE – if more of a low ECoE fuel is used, say, and less of a higher ECoE alternative – but trends themselves are not influenced the effect you describe. (This was one of the numerous – believe me, very numerous! – issues tackled in creating SEEDS).

Open cast coal is usually ‘younger’, and of lower quality, than deep-mined coal.

Regarding Exponential Pop growth and Limits to Growth here is the other side of that particular Bet

https://en.wikipedia.org/wiki/Julian_Simon

Just to make the point I consider Erlich and Simon to be two extreme polarities although I believe the Needle points to a Cornucopian or free will side of the balance without privileged distortions effecting fair “SocialMarket” outcomes.

This guy has been screaming Apocalypse for over fifty years..His book the Population Bomb even came with letters in the back you could send to Congressman..That book is like the New World Order for Liberals..

Hi Mastermind, your starter for 10, watch the video. It’s quite the job on de-bunking Ehrlich.

Tim, what assumptions are SEEDS prosperity projections based upon? The model projects increasing prosperity per capita for China and India. I find that difficult to reconcile with an increasing ECOE.

I can perhaps help you best by taking China as an example – because there are certainly issues which could depress prosperity in China below current SEEDS projections.

For 2018, GDP is likely to grow by c6.6%. But a very large chunk of reported “growth” is fuelled by ever-expanding debt, with each RMB 1 of incremental GDP now costing well over RMB 4 in net new borrowing. According to SEEDS, growth without this borrowing impetus is about 2.8%.

Against this, ECoE for 2018 is put at 8.5%, which is worrying, because it’s nearly at the point where it strangles growth altogether. Prosperity is now growing at about 2.5% annually, or 2.0% per capita, once adjusted for the rate of change in population numbers. That’s nowhere near the 6% rate of growth in reported GDP per capita, because the latter (a) ignores ECoE and (b) is very largely fuelled by massive borrowing.

Looking at ECoE, China’s 8.5% for 2018 compares with 8.0% globally. By 2025, the global number is projected at 9.6%, and China’s at 9.7% – pretty similar, but very adverse for growth by then.

According to SEEDS, ECoE (and energy supply) is one of three main problems for China. The others are:

– The massive build-up in debt, which looks increasingly unsustainable, but without which headline growth would stumble.

– The trade effects of customers getting poorer.

So yes, trend growth in prosperity per capita could well be lower than the 2% modelled by SEEDS. The clear risks are to the downside.

Please note, though, that SEEDS’ 2.0% is already drastically below the 6% swallowed open-mouthed by the ‘consensus’ world of conventional economics. Forecasting can never be precise, but I’d suggest that SEEDS is giving us a radically different (and much better) line on Chinese prosperity than you can get from any conventional source.

In other words, which is likelier to be right – the consensus at 6%, or SEEDS at 2%?

I’m biased, of course, but……

I find this very well worth watching:

Great Presentation of the Extent of contamination of the legislative process, The Judiciary Sadly is also succumbing to the contagion.

Lobbying in the EU

http://www.wetube.io/video/the-eu-corporate-lobby-tour-the-power-of-lobbies/

As long as politics is the shadow cast on society by big business, the attenuation of the shadow will not change the substance.

Quoted in John Dewey and American Democracy by Robert Westbrook (Ithaca: Cornell University Press, 1991), p. 440; cited in Understanding Power (2002) by Noam Chomsky, ch. 9, footnote 16; originally from “The Need for a New Party” (1931) by John Dewey, Later Works 6, p. 163. (Via Westbrook.)

The video is interesting and well explains the lawful corruption the state is engaged in. It links to a cartoon presentation about banking but this is half full of errors and should not be believed.

Good / shocking video Tim – but obviously no amount of lobbying money can make oil cheaper to extract – only help in hiding the real costs / truth.

Perhaps when the next bill comes in – if the taxpayer won’t meet then they can always claim diplomatic immunity like Boris Becker

Test

‘The weakness (In world GDP growth) is also indicative of the longer-run

trend towards slower energy growth driven

by gains in energy efficiency’.

‘This is the third consecutive year in which energy

consumption has grown by 1% or less, with

energy intensity – the average amount of energy

needed to produce a unit of GDP – falling at

historically unprecedented rates’.

BP Statistical review of world Energy 2017

Perhaps BP are ignoring the fact that growth (in GDP) is being driven mostly by the spending of borrowed money rather than an increase in the manufacture of useful goods and services ?. I think falling energy needed to produce a unit of GDP is being driven by monetary manipulation ?

Yes, exactly.

..I guess the implications are :-

– Even BP with all their resources don’t understand the limitations of using GDP as a yardstick to measure economic activity?.

– Reported gains in energy efficiency are being exaggerated because they assume that GDP goes hand in hand with energy usage?

This is what SEEDS is designed to address, and what is false about energy intensity is, equally, false about climate change progress.

In fairness, BP are not alone in simply accepting GDP as a measure of economic activity, without enquiring further into where “growth” comes from, and how meaningful it is – the same is true of government, business and finance.

Those who accept GDP as a measure of prosperity then profess complete surprise at events like “Brexit” and Donald Trump.

Looking on the bright side, though, it’s nice to know something of which decision-makers remain in ignorance.

So here is a mystery for SEEDS to answer, Tim. Why did Mario Draghi choose to exit QE at this juncture when economic growth is weak and inflation is relatively contained? What are the real motivations for this step?

Flip answer: Draghi doesn’t have SEEDS…..

Seriously, though, I’m slightly surprised by this, and more than a bit suspicious – I had supposed that QE might play a role in some sort of compromise over Italian debt. Might he bring it back in a form which has greater “flexibility”, using it to buy (meaning support/take over) the EA’s “cheapest” debt?

When the crash comes – globally, I mean – I’m sure we’ll move into outright monetisation of debt, something which – remarkably – Japan has been getting away with for some years now.

I think it’s time for an article here entitled “What is SEEDS?”

This seems important because we’re getting ever more evidence that ‘conventional’ economics’ interpretive abilities are breaking down.

Why SEEDS? More obvious. People who come over here know what SEEDS is.

Why SEEDS could also be “Why energy prices matter” to answer those skeptics who say that “energy is just like any commodity – money spent on energy just goes back into the economy like any purchase.”

Good points both. I have been thinking of explaining a little more about how the system works.

Dr Tim this has just landed in my in box, interested, do you have time or anyone else???? Some how I don’t think they can handle the truth!!!

https://blog.ons.gov.uk/2018/06/15/calling-all-economic-experts-do-you-have-what-it-takes-to-become-an-ons-fellow/?utm_source=govdelivery&utm_medium=email?

I have emailed Daniel Groves a couple of times with links to your website. He showed interest in energy use per capita but not sure how far he got.

Thank you for everything you do and the commentators I have learned so much over the years.

Thanks. I agree that my methods and conclusions would not be accepted.

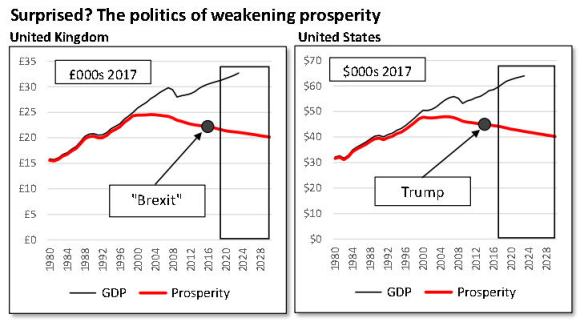

To illustrate this point, I have just added (at the foot of this article, because it’s not possible within a comment) a pair of charts intended for the next article here.

The charts are designed to illustrate how measuring prosperity, as SEEDS does, rather than simply accepting reported GDP per capita, makes both “Brexit” and the election of Mr Trump nothing like the “shocks” that conventional interpretation would have had us believe.

In this context, I cannot imagine anyone in authority in the UK (or, for that matter, in the US either) accepting this interpretation…..

The Collapse of Civilization Manifesto

https://imgur.com/a/pYxKa

Marx and the Unabomber ain’t got nothing on me..

Ok Master Mind, your general knowledge round.

So what do you do for an encore? When the Oil Runs Out, When the Gas runs out Then and only then when the Coal Runs out , When the Tides cease, Gravity fails and The Sun no longer shines then we have a problem.

I prefer James Burkes view of the Future, I think he has it about right and the screed in your Link is so much eschatological bunkum.

There are problems sure but there are solutions, Seeds gives us good information to the time now being right to do More with Less.

http://letthemconfectsweeterlies.blogspot.com/2018/06/abundance-or-scarcity-more-with-less-or.html

Or this,

for those who are curious about the current world political issues, This interview with Pepe Escobar is very explanatory.

At one point he says”It’s all about energy”

I heard Burke on the same theme on the radio at Christmas – I thought it might be very dead-pan satire.

Once entertaining and stimulating, but as the Duke of Wellngton said to Lord Castlereagh before he went off to cut his throat:

‘I regret to have to inform you, Sir, that I have reason to believe you have lost your reason.’

This will be about Natural Gas, but a short preamble may set the stage:

http://cluborlov.blogspot.com/2018/06/keeping-up-with-putin.html

It’s behind a paywall (as little as a dollar a month). So I will quote from memory. Each year Putin puts on a 4 hour TV performance for the citizens of Russia where he answers questions about everything from potholes in streets to the state of the world. This year, citizens submitted well over 2 million questions. These were edited to a manageable number, combined, clarified, etc. What was different this year was that rather than Putin alone being on the hot seat, the Russians used communications technology to involve all sorts of government officials. When Dmitry Orlov’s question was asked (having been combined with other, similar questions), the government official charged with responding and doing something about the problems, was brought into live video conference and asked to commit to doing the right thing.

Besides this novel experiment in bringing government officials into direct responsibility to the citizens, there was an interesting question about electric vehicles which Putin answered himself. The question was:

‘Why isn’t Russia building electric vehicles?’

Putin’s answer was that electric vehicles are a very inefficient way to turn coal into rolling wheels. He said that Russia will move as rapidly as possible to shift from petroleum powered transport to natural gas powered transport.

Shell has bet big on natural gas also. And I believe Total has agreement in principal to partner with Russian companies to exploit new gas fields. Of course, the US is trying to stop the Russian/ European initiatives with sanctions.

Leaving aside the murky political fighting, my question is:

‘What would be the impact on ECOE of a switch to NG?’

I know that we had NG powered automobiles when I was a teenager…65 years ago. So it’s not exactly a new technology. But there had to be a reason that gasoline and diesel never yielded to NG…and my guess is that it was the superior energy density of gasoline and especially diesel. But now that more people are admitting that fracked oil cannot actually produce diesel economically, the search is on for alternatives. I understand the corn lobby supports biodiesel. But we also know that the US grain production is highly dependent on the Ogallala aquifer which stretches from South Dakota to Texas, and is rapidly depleting. And the water in the aquifer lies, each year, farther below the surface, which increases the energy cost of raising the water to the surface to use for irrigation.

If the ECOE is, say, 8 percent today, what would it likely be in 10 or 20 years with a large scale conversion from gasoline and diesel to NG? Dr. Morgan says that his model takes into account the mix of energy sources. Not asking for the revelation of proprietary information, is there anything Dr. Morgan or anyone else can say to enlighten me (us)?

Don Stewart

Thanks Don, and you raise a number of interesting questions here, which I’ll do my best to answer as succinctly as possible.

Incidentally, you’ll note that this website is not behind a paywall, and, also, is ad-free. This is a personal choice, and, in my case, I think of it as a pro-bono duty to let the public have as much access (and input) to this debate as possible. Where the line is drawn here is that I don’t disclose methods or data which could help a commercial organisation build a SEEDS-type system. Likewise, anyone who wants comprehensive output cannot expect to get it for free. Just thought I’d explain this policy.

Now, first of all, the reason why oil has predominated in vehicle engines is the superior power-to-weight ratio. In the Second World War, Britain powered vehicles using gas (made from coal), but this was done only because oil had to be imported at great risk. Obviously, superior power-to-weight is something we pay for, making oil a premium fuel. The ECoE of gas is lower than oil, a gap which might prompt a rethink, but the gap would have to be very big before we’d trade the convenience of petroleum for the lower cost of gas.

You know, I’m sure, my views on EV, and how I see EV as an exercise in denial over the fundamental issue – which is changing our patterns of work, habitation and travel in response to the rise in ECoEs.

Acquifers raise an interesting point. Thus far, the problems experienced in parts of the US are dwarfed by what’s been happening in Cape Town, though this is the shape of things to come, in the US and elsewhere. If you’ve not done so, I suggest reading up on the water situation in Cape Town, where extreme measures have been necessary (so you can forget baths, let alone swimming pools or watering the garden).

The obvious solution would be for Cape Town, located right on the coast, to resort to desalination. Ultimately, California could do the same (and must do something, because the water situation in CA looks set to become perilous, and sooner rather than later).

But the problem, as with so much else, is ECoE. Put very simply, to desalinate water you have to boil it, capturing and cooling the pure vapour, and leaving the salt as a residue. That needs a lot of energy. In principle, then, the water problem is an energy problem, which in turn means it’s an ECoE problem.

Interesting regarding costs and type of water used for treatment.

Just a point on Desalination, to de salinate or purify water you have to evaporate it this does not require boiling.

See Waterstillar for details.

My Neighbour invented Waterstillar and has a large scale offshore patent which delivers huge volumes using Solar power to induce evaporation.

https://www.waterstillar.com/products

A matter of pressure, presumably.

Though, if you read about the privations and near-disaster of Cape Town – but, if there is an affordable solution, wouldn’t they have grabbed it with both hands?

https://www.zerohedge.com/news/2018-06-08/if-you-think-water-restrictions-california-are-tough-check-out-cape-town

but, if there is an affordable solution, wouldn’t they have grabbed it with both hands? There are quite a few solutions Tim, there is a huge water lobby and in Mexico where Water Stillar has a subsidiary in the Bottled Water market is very Strongly contested.

https://twitter.com/RogerGLewis/status/1008283920633298945 this is a link to a satirical spoof on Opec which I did when I was Marketing Director for WaterStillar.

On EVś and alternative technologies Hybrids anyone? or Wankel engines. The list is endless where early adoption of viable technologies are frustrated by Established monopoly Lobbying.

Hi good video –

https://www.theguardian.com/uk/2004/mar/19/foodanddrink

‘The recall is the latest headache for Coca-Cola’s marketing men and women, who sought to convince consumers that Dasani was “as pure as bottled water gets” – despite the fact that it was essentially tap water, sourced from the mains supply to Coca-Cola’s factory in Sidcup, Kent.’

https://www.independent.co.uk/life-style/why-bottled-water-is-one-of-the-biggest-scams-of-the-century-a8050841.html

I think that bottled water will slowly disappear from shops anyway as production and transportations costs make it too expensive for many consumers.

Perhaps like anything that becomes scarce it will then become highly desirable and you might then getting moped gangs targeting water bottles.

One thing though – my mum’s tap water is awful and you can’t make a decent cup of tea or coffee out of it (it tastes of disinfectant) so she is forced to but bottled water.

A feasible government response to GFC2 will be to introduce a new central bank issued digital currency, the ‘e-£’, and set a depreciating exchange rate against old £ notes.

Old £ held in bank accounts will be converted at 1:1, as will old £ notes within a set period, say 12-months; however, after said period, the e-£:old note rate will decrease, say 1:0.9.

The effect will be obvious: all holders of currency will pay in their notes within the first 12 months to get the better exchange rate. Once all cash is voluntarily removed from the system, negative interest rates can then be introduced.

The ‘war on cash’ has already started, but banning it will be problematic. This approach will be far more effective and less costly in terms of resources.

Personally I suspect this is what is being planned, because aside from the effectiveness, the biggest beneficiaries will be 1) Government: all financial transactions can be tracked and hence tax dodging and other criminal activity becomes impossible; and 2) banks: will have an influx of liquidity when all the old £ notes are paid in, bank runs will be a thing of the past, and banks can really start screwing account holders because there is no alternative to keeping money in a bank account.

It will be sold to the technology-obsessed public as ‘futuristic and modern’, maybe that its ‘blockchain’ or ‘crypto’ (it looks like there is intentional confusion in the MSM between these terms and digital currency), as well as being able to stop crime and terror attacks.

http://www.themonetaryreset.com/2016/04/e-dollar-concept-is-being-pursued-by.html

This sounds plausible – and frightening.

I also think it is possible, and there are some signs that the NSA and other government organizations are behind the blockchain technology (they are associated with some of the original white papers). So it may seem like a conspiracy theory, but there is enough real evidence and it does make perfect sense. And the people using it now who think they are “avoiding using the system” seem to be test driving the system’s next technology.

In all but name the currency systems of the Washington Consensus and rest of the world come under the Bank of International Settlements Central Banking system. 97% of all circulating Money ( not Cash) is Digital. This currency is created electronically ( Digitally) by Centralised Bank Ledgers. The Only Difference with a Blockchain system is that it can potentially be distributed on a Network, that is all BlockChain is, a distributed network ledger system.

In the UK the Banking act of 1844 barred coining or printing of Cash by private banks reserving, therefore, seniorage benefits to Government.

http://positivemoney.org/how-money-works/how-did-we-end-up-here/

The System in the US and The system for the EURO are all slightly different but all Clearing Banks in the UK and Europe create digital money out of thin air The Basle Rations (Capital Ratios) are honoured more in the breach than the observance but even where there is observance collateral is a very broad brush when it comes to what Central Banks will accept acting as Lender of last resort.)

The NSA has a Patent on the SHA 256 algorithm which is the security encrypting algo’ used by Bitcoin

https://en.bitcoin.it/wiki/SHA-256 , The ethereum Dagger Hashimoto algorithm is open source. https://github.com/ethereum/wiki/wiki/Dagger-Hashimoto

Why Be Memory-Hard?

http://www.hashcash.org/papers/dagger.html

The main reason why memory hardness is important is to make the proof of work function resistant to specialized hardware. With Bitcoin, whose mining algorithm requires only a simple SHA256 computation, companies have already existed for over a year that creates specialized “application-specific integrated circuits” (ASICs) designed and configured in silicon for the sole purpose of computing billions of SHA256 hashes in an attempt to “mine” a valid Bitcoin block. These chips have no legitimate applications outside of Bitcoin mining and password cracking, and the presence of these chips, which are thousands of times more efficient per dollar and kilowatt-hour at computing hashes than generic CPUs, makes it impossible for ordinary users with generic CPU and GPU hardware to compete.

That last bit might seem overly technical but it is very important. Money Circulates and its velocity is important regarding how much activity a notional fixed sum of money can participate in. Velocity will go up and down with confidence levels but can lead to large swings in economic activity which are undesirable. Currency issuance is a way to iron out these swings in confidence, in a decentralised issuance system swings in sentiment will even out on average and the control mechanism will necessarily have less extreme undershoots and overshoots. A fixed money supply is not though a good idea, the Gold Standard was a big fat failure in most respects.

https://twitter.com/RogerGLewis/status/1008593703533989888

A Joke.

a physicist, an engineer, and a statistician out hunting. The physicist calculates the trajectory using ballistic equations but assumes no air resistance, so his shot falls 5 meters short. The engineer adds a fudge factor for air resistance, and his shot lands 5 meters long. The statistician yells “We got ‘em!”

With the existing Crypto / Blockchain Infrastructure and Hierarchy there is a problem of concentration of Economic Power, This group are known as Whales.

The exchange of Crypto Currencies for FIAT and their price level are maqnipåulated by Fairly small volumes as the distribution is one with a very fat tail that fat tail wags the Market Dog. Mining or distribution through say a universal currency dividend would ensure that first-mover advantage for newly issued currency is not concentrated to a privileged in-group, this happens with FIAT and it is also happening with increased centralisation of Crypto Mining power on all networks, SHA 146, Dagger Hashimoto, Skrypt etc.

Blockchain Transactions are quite traceable and piercing the anonymity veil not so hard, the trip wire is any conversion back to FIAT. There are though DASH and Monero both of which preserve anonymity much better even within the blockchain space, Governments make a big mistake if they think getting rid of Cash will stop people finding an analogue ( Cigarettes ) ( Pokemon Cards ) Red M and M’s

anything will do, Silver Dollars, You get the idea.

https://www.cryptocompare.com/coins/xmr/overview/USD

https://www.cryptocompare.com/coins/dash/overview/USD

Web 3 is properly distributed network computing uncensorable and a space where Tyranny will find itself in some trouble save for the Tyranny of the Geek. The Tyranny of the Geek is quite scary. Google Richard Stallman to see why Open Source is the antidote to Geek Tyranny

https://twitter.com/RogerGLewis/status/1008581916491120640

https://coinmarketcap.com/

At this stage here in Sweden Cash is almost finished with I have a project Forres/Lagom which will fill the huge gap extinguishing cash will leave Crytpo Complimentary currencies are rather more healthy than Cigarettes although that said who smokes currency but then that’s the same problem with using any store of value that becomes a speculative object.

Tim,

As I understand it, there is currently a limit to negative rates – negative 0.3% if I recall – below which the cost of vaulting cash becomes attractive for large organisations such as pension funds and insurance companies.

By removing cash and therefore this lower bound, CBs can take rates to -3% or even -10%, which will set the stage for another enormous credit bubble, thereby allowing TPTB to kick the can further along the road.

What are your thoughts on this?

Hello Jonny, Re your new currency, It’s unnecessary to do such a thing. Only 3% of the currency in circulation is paper/ metal. But the main reason is that the central banks of monetary sovereign nations can issue new currency at will. They just have to conjure up a debt needing payment. Even if all central banks coalesced into one super bank it wouldn’t work. We see already what a mess is the Euro trying to be currency for diverse Eurozone countries. We’ll never run out of money until the whole system breaks down. As to restricting cash, if legal currency is refused then people will choose something else, like cowrie shells or stone discs.

I am aware most money is digital and that fewer and fewer people use cash. But the fact that cash is only 3% of the money supply is irrelevant; the point is the option is (currently) there for account holders to withdraw cash and hold it outside the banking system, thereby preventing the introduction of negative rates. Large withdrawals could lead to bank runs and instability, with refusal of withdrawals would lead to the same outcome. Confidence in the system must be maintained to prevent it collapsing. By removing the option to go to cash, the system cannot be crashed in the same way and we are completely at the whim of banks.

https://www.imf.org/en/Publications/Policy-Papers/Issues/2017/08/03/pp080317-negative-interest-rate-policies-initial-experiences-and-assessments

I think whether or not the gold standard was a failure depends on your perspective. It limited currency issuance and therefore curtailed ‘growth’ – which in a world of finite resources is not bad thing – and provided stability. No doubt private and central banks would argue it was terrible due to these constraints.

Roger: very interesting info on bitcoin and crypto. I shall delve into it more.

John: I have not had a chance to look over your MMT intro yet, but from your comment it seems in your view that confidence cannot be lost in a currency regardless of how much is issued. I fail to see how this can be the case, as numerous real world examples have occurred.

The Euro is a mess because a currency union cannot work without fiscal unity.

Jonny, that’s not quite what I said. money is only produced while so ever resources are there. No one is saying it’s carte blanche. but the main thing is that tax isn’t a source of government revenue.

Resources will go further in support of an economy, but all bets are off if the grid goes down permanently.

To me there are two red lines in the financial system: the implementation of “bail in ” which hits ordinary depositors and negative rates of interest.

As far as negative rates are concerned I agree that there is a latent desire to eliminate cash and this would be a prerequisite of introducing negative rates. But both of these steps are very serious politically and I think would meet with a lot of resistance. I’ve no doubt that there are some who want this but are not so dumb as to be ignorant of the implications.

There definitely won’t be a bail-in. Apart from the public repercussions, it is completely unnecessary. The central bank can underwrite the equivalent funds if it comes down to such an intervention.

Without triggering huge inflation?

It won’t make any difference there, but a bail in will definitely set off a public back lash. Which do you prefer?Huge inflation is a wholly political decision.

Bob

I agree entirely. Implementing bail-ins, banning cash or introducing negative interest rates would be perceived by many as violating an unwritten but powerful ‘contract’ between the state and the public.

Bob J: agreed, which is why it can only be done under the chaos of GFC2!

Well put – it would certainly require emergency powers.

@JohnDoyle

The problem re bail ins John is that that is the current resolution policy of the EU and it looks like we’ll be staying in the EU!

Bail ins sound OK but I think that if one reached down to depositors then we’d have revolution. bail outs hit the taxpayer but can be done “under the table” which is the traditional British way of doing things. Having said this I actually think that if a resolution looks like it will hit depositors then I think they will funk it and do a bail out, against the rules or not.

Thanks, Bob. Touching savings accounts is illegal for banks, but I don’t know how widely that extends. So a bail in should be illegal, unless the Treaty of Lisbon or equivalent sanctions it. My argument is that a bail in is never necessary, but that doesn’t prevent idiots from sowing distress.

@JohnDoyle

I think you’re wrong there John; in fact savings accounts would be bailed in before ordinary depositors.

Two things: one is that we still have deposit protection although whether that would last the course of a large bank insolvency remains to be seen; if the rules were changed there would be ructions but would it be affordable?

There may also be a retrospective clause in the procedure (I’m not sure). This says that liabilities incurred before 1 January 2016 are not subject to the bail in procedure. However, if a bail in was the resolution procedure what would be the status of liabilities outside – that is non insured liabilities incurred before 1 January 2016 ? More muddle!

Natural Gas Powered Vehicles

https://en.wikipedia.org/wiki/Natural_gas_vehicle

Some countries, such as Pakistan, are predominately natural gas powered vehicles. I guess I knew this, but had forgotten it. So it is entirely possible to switch a country’s fleet to natural gas. It may be more costly, but then having fuel may be better than having a declining source of fuel. Art Berman pointed out a few days ago that Canada has a very large reserve of frackable natural gas. I believe the fields the Russians and Total are considering are in the Arctic, but do not require fracking.

If Putin thinks that global supplies of petroleum are about to decline, and/or that he would like to reduce emissions, then natural gas may be a good choice. The vehicles also cost more, which may be compatible with a switch to the kinds of community design Dr. Morgan would like to see.

Don Stewart

I think Putin’s strategy is to use NG domestically and basically export as much petroleum as possible with that substitution, since petroleum is far more valuable on the market and since Russia’s NG reserves would keep them supplied for quite a while yet.

And by selling the more profitable petroleum he can effectively subsidize the costs of changing over to a NG infrastructure and vehicles to a large degree, while giving Russia a longer term energy security than basically any other country on Earth.

I see BAU as a whole … none of the parts (economies of countries) can exist … unless the whole stays intact…

When the financial system goes down .. JIT goes down … and the spare parts to operate the gas and oil wells will not be available… also the grid will go to pieces very quickly (a single part busts and that’s it… and the grid is composed of many thousands of parts… + you need to factor in the vehicles including helicopters that are required to repair this massive system)

They might be able to cobble the local system together for a few weeks using whatever stockpiles they may have … but that is a best case scenario…

A quick check of total employees of a large hydro outfit – Quebec Hydro – indicates nearly 20,000 staff…I would imagine thousands of these people are engaged in day to day repairs of the network…. I would imagine that on a daily basis they would constantly be replacing parts and making repairs…. https://www.statista.com/statistics/472007/total-number-of-employees-at-hydro-quebec/

“They might be able to cobble the local system together for a few weeks using whatever stockpiles they may have … but that is a best case scenario…”

That isn’t the case for developed nations anyway. I have performed risk analysis on critical national infrastructure as part of government resilience assessments. These system can operate for years at slowly degrading performance. The continual maintenance you see maintains them in a ‘high state of operation’. There are ‘lower states that can be eeked out for years, sufficient for alternative/new payments systems to emerge. Utility companies and goverment regulators work on this together in case of war, pandemics, disrupting supply of components. A GFC is a similar situation which is why that isn’t planned for specifically. It is covered by other plans.

There are a few concerns that have been raised about the resilience of utilities in developed nations in specific scenarios, but not financial crisis or supply disruption. These full reports require an FOI request to access though.

I believe similar things are done with large logistics companies identified as critical infrastructure. But I haven’t been part of that work.

I suspect a gradual deterioration in the ability to maintain utilities over many decades. But it isn’t going to fall apart in a matter of weeks.

What is ‘Just In Time – JIT’

The just in time (JIT) inventory system is a management strategy that aligns raw material orders from suppliers directly with production schedules. Companies employ this inventory strategy to increase efficiency and decrease waste by receiving goods only as they are needed in the production process, thereby reducing inventory costs. This method requires that producers are able to accurately forecast demand.

The just in time inventory supply system is a shift away from other “just-in-case (JIC)” strategies, in which producers hold large inventories to have enough product to absorb maximum market demand.

What does global supply chain mean?

In commerce, global supply-chain management (GSCM) is defined as the distribution of goods and services throughout a trans-national companies’ global network to maximize profit and minimize waste.

This new study by David Korowicz explores the implications of a major financial crisis for the supply-chains that feed us, keep production running and maintain our critical infrastructure. He uses a scenario involving the collapse of the Eurozone to show that increasing socio-economic complexity could rapidly spread irretrievable supply-chain failure across the world.

http://www.feasta.org/2012/06/17/trade-off-financial-system-supply-chain-cross-contagion-a-study-in-global-systemic-collapse/

Thank you, Kevin.

I’d welcome your thoughts on something related to this that I’m working on for the next article. What happens if energy supplies are cut off? The coming article asks this as a matter of logic – that the economy is utterly energy-dependent – but it’s not a wholly implausible possibility.

For instance, if the electricity grid went down, which would stop everything from payment systems and ATMs to refrigeration units, hospital and government power and light to petrol pumps, how long could we hold out then?

Or, if a country found itself unable to import oil, gas or coal, again, what happens? This could happen – absent the IMF bailout, nobody would now accept Argentine pesos in payment for anything. This event would, I think, be compounded by panic buying

We will get a test case soon … Venezuela….

Yemen is also worth watching … the main port is meant to be blockaded… potentially resulting it the starvation of millions…. well… unfortunately there won’t be much to watch there because we are the one’s starving the millions and the MSM will be instructed to impose a media black out

I do not know the current numbers – I don’t spend time compiling and updating them anymore.

Q: “What happens if energy supplies are cut off?”

Q: “Or, if a country found itself unable to import oil, gas or coal, again, what happens?

I have answered these questions together – since they can be viewed as the same thing.

If external supplies are cut off with no foreseeable end in sight, the UK uses its reserves over a few months to allow a gradual transition to a ‘home sourced’ situation. We maintain the ability to extract gas, oil, and even coal. at home – but importantly the ability to refine them in to the energy products we require.

Q. “For instance, if the electricity grid went down, which would stop everything from payment systems and ATMs to refrigeration units, hospital and government power and light to petrol pumps, how long could we hold out then?”

Essential services that rely on electricity supply can’t really “go down” nationally in the UK. They have back-up systems and there are processes in place to ensure their continued maintenance is prioritised over other non-essentials.

As mentioned above, the ability to refined energy products can always ensure that essential services are kept up and running. Even if this requires running on generators for years.

Reduction in demand and prioritisation mean that failure of essential services basically can’t happen, because components from non-essentials are used to maintain the essentials (i.e. generators, vehicles, communications).

I have emphasized the importance of being able to refine energy products in our own country. This is critical to maintain the ability to ‘keep going’.

My study focus was on essential services. This is a prioritised rationing situation and will no doubt severely damage the economy and our prosperity going forward – but we could run on this subsistence situation, in theory, for decades.

The worst to expect is something akin to wartime rationing for extended periods.

This is delusional thinking.

Sorry. Very UK focused answer. I don’t imagine it would be the same elsewhere.

Basically, we can power our basic needs, but not BAU and the growth and financial ROIs that come with it.

Increasing ECoE will bite over time, but that will happen regardless of a crisis. A crisis maybe just gives us a taste of Life After Growth 😜

I’ve never taken part in contingency planning, but my own view is that loss of electricity supply would inflict huge damage, and very quickly.

Let’s take hospitals as an example. Generators are – one hopes! – adequate as back-up for a hospital itself, but what about outside suppliers, employees and other inputs?

Even a second-day scenario looks fraught. During the first day, generators kick-in, and have reasonable stocks of fuel, whilst the staff then on duty can stay over, albeit in over-stretched accommodation. On day two, though, a relief surgeon, say, needs to get to work. Having no power, he needs to get dressed in the dark, can’t see to shave, and has to go without breakfast – seems trivial, I know – and hope his car isn’t behind a garage door operated electrically.

Food supply looks critical. Shops require power for refrigeration, light and heat, the tills, inventory systems; suppliers need power to their warehouses and their own refrigeration; distributors need power for their diesel or petrol pumps; and all of them need payment systems working seamlessly. Meanwhile, water supply relies on pumping systems powered by electricity.

In theory, one can park a ship powered by gas turbines in the Pool of London and hook it up to keep Whitehall running.

But I don’t see what water companies, supermarkets and their suppliers can do in this situation. During a power cut that last just a few hours, my village shop couldn’t trade (no light, no payments system), and it wouldn’t take much longer for food in fridges and freezers to go off.

The current population of the United Kingdom is 66,558,434 as of Monday, June 18, 2018, based on the latest United Nations estimates.

The United Kingdom population is equivalent to 0.87% of the total world population.

The U.K. ranks number 21 in the list of countries (and dependencies) by population.

The population density in the United Kingdom is 275 per Km2 (713 people per mi2).

The total land area is 241,930 Km2 (93,410 sq. miles)

81.2 % of the population is urban (54,072,374 people in 2018)

The median age in the United Kingdom is 40.3 years.

I don’t think that in a crisis we could become hunter gatherers again.

Donald

There is an important element usually missing in Doomsday scenarios: Darwinian selection.

Remember the old joke about the two guys running from the lion. Guy 1 says to Guy 2: ‘I don’t think we can outrun him’. Guy 2 responds: ‘I don’t have to outrun him, I just have to outrun you.’

I suspect we are about to go through Darwinian selection of the ‘running from the lion’ kind due to any number of causes. The most nightmarish involve the disappearance of the daily necessities and the rapid starvation or death from violence of a huge number of people. In which case, those few people in the UK who have maintained a simple lifestyle far from civilization will likely be the survivors.

But there are far less draconian scenarios to think about. Jaron Lanier has just published Ten Arguments for Deleting Your Social Media Accounts RIGHT NOW. Just to take a random example of Lanier’s arguments: Social Media is Destroying Your Capacity for Empathy. Now I would only disagree to the extent that SOME people may actually become MORE empathic. One can find apps which encourage all sorts of pro-social behavior, and calm minds, and getting your ten thousand steps every day, and eating healthy, whole food and not eating junk food. The fact that most people are going in the opposite direction sets up the dynamics for a Darwinian selection event. Particularly since the Social Safety Net is likely to be shredded as a result of the bad effects of Social Media, as described in Lanier’s book. Consequently, and in the absence of total social and economic breakdown, more people are likely to die young. We can already see, in the US, increasing rates of suicide and chronic disease in the young. Life span and health span in the US are declining. But some people will leverage technology in favorable ways and live long, healthy lives.

Don Stewart

The end of civilization comes when the power goes off – permanently.

The power went out in New York — for a single night — here is what happened

Now imagine what happens if the power went out across the entire country .. and did not come back on – ever

Scary stuff

It All Depends

My soon to be wife and I were part of the 1965 New York City blackout:

‘On Nov. 9, 1965, at 5:27 p.m., a blackout occurred as several Northeastern states and parts of Canada were hit by a series of power failures lasting as long as 13 hours. The blackout covered 80,000 miles and affected more than 30 million people.

In contrast to the wave of looting and other incidents that took place during the 1977 New York City blackout, only five reports of looting were made in New York City after the 1965 blackout. It was said to be the lowest amount of crime on any night in the city’s history since records were first kept.’

We both worked in the Wall Street area of Manhattan. We were invited to her parents house for dinner, across the Hudson in Jersey City. So we walked down to the old Hudson Terminal (which was replaced by the World Trade Center, which was eventually destroyed on 9/11) and caught the Port Authority train to Jersey City. We were in the tunnel under the river when the lights went out and the train lost power. Not an uncommon occurrence. But the power always came back in a few minutes. The emergency lights came on, but the train did not move. After quite a long time, the rumor began to circulate that ‘there is a problem at Niagara Falls’. Everybody just laughed at the rumor. Then, about 6:30, a bunch of Port Authority employees showed up and told us that the power was out in Manhattan, and we were going to have to walk the tracks back to Hudson Terminal. They set up a ladder so we could climb down out of the cars onto the tracks, and they had flashlights and lanterns to light the way.

As we came up above ground in Hudson Terminal, a Port Authority employee handed us our refund tokens.

We could see that almost all of the big buildings were dark. A few had emergency generators. We began to walk downtown toward the Battery, where we could catch the Jersey Central Railroad ferry to Jersey City. The bars were hopping. Everybody was celebrating with alcohol. Many children were conceived, apparently because people couldn’t watch television.

My wife and I caught the ferry to Jersey City about 7:30. We arrived at her parents house about 8:30, after catching the bus in Jersey City. They were annoyed that we were so late. Why didn’t we call? We told them the lights were out in Manhattan. They didn’t believe us. We took them outside to the street and looked over toward where Manhattan should be lighting up the night. It was almost all dark. So they turned on their television and got the story. It turned out that a low-paid employee of the New Jersey grid management system saw some fluctuations he didn’t understand and disconnected New Jersey from the Northeastern grid. That saved New Jersey and points south.

12 years later everything had changed. Context is everything.

Don Stewart

So you believe that if the power were to go off permanently people would join hands and … and … ???

Context! Context! Context!

If people are in an Amish community, they will keep doing what they have always done, with a few course corrections. If people are in a Prepper community, they will say ‘at last, we get to practice for real!’. If they are clueless, they may kill themselves. If they are Wall Street traders, and there is an open bar, they will likely drink a lot. If they are a couple who fall asleep in front of the TV, they may remember how much fun f…cking used to be. If they are desperate, they may loot.

If you conjure up a scene where electricity very suddenly goes off, and does not come back on at all, then many are going to die. And it won’t take very long to greatly reduce the population. The survivors will learn to get up with the sun and go to sleep when it gets dark…as nature intended.

An advantage in 1965 was that most systems were still mechanical rather than electronic. The Jersey Central ferry did not need electricity to take us across the Hudson. Another advantage was that the city was not suffering from the heat that plagued it in 1977. People think better when their brains are cool.

Don Stewart

So all those tens of thousands of people… near these prepper communities… are going to lie down and die….

They won’t think —- hmmm — I am running out of food — there’s those Amish weirdos down the road… let me load up the pick up with some guns and ammo — drop by my cousins Zeke and Arnold and Clement… then head over there and get me some chickens and pumpkins….

Do these communities live in bubbles where the hungry can see them … but are unable to enter?

Oh and btw — these Amish communities are NOT sustainable … I have spoken to the Amish in St Jacobs Ontario — they use water pumps — they use chemical fertilizers…they use tractors…. they are completely plugged into BAU… and they will grow next to nothing when Walmart closes and the electricity goes down…

Have a look at the map of nuclear installations in North America — there are massive numbers of spent fuel ponds… do you think the Amish bubble will keep radiation out?

Thomas Malthus

I have learned, in dealing with your many aliases, that you have a story and are sticking to it. That’s fine with me. I don’t care what you think, and am not willing to invest very much in trying to change your mind.

Don Stewart

My ‘story’ is based on facts and reality … vs delusional thinking