SEEDS AND THE CHASM IN ECONOMIC UNDERSTANDING

Regular visitors will know that, since the recent completion of the development programme, SEEDS – the Surplus Energy Economics Data System – forms the basis of almost every subject that we discuss here. For anyone new to this site, though, what is SEEDS? What does it do, and how important might it be?

The aim in this longer-than-usual article is to explain SEEDS, starting with some of what it tells us before examining how it reaches these conclusions. The methodologies of the system are discussed here, with the exception of a small number of technical points of which detailed disclosure would be unwise.

Before we start, new visitors need to know that the divergence between SEEDS and “conventional” economics has now become so wide that it’s almost impossible to place equal faith in both. If SEEDS is right – and that’s for you to decide – then much of the conventional economics approach is simply wrong.

The question thus becomes that of which interpretation best fits what we see happening around us.

“Shocks” that are no surprise

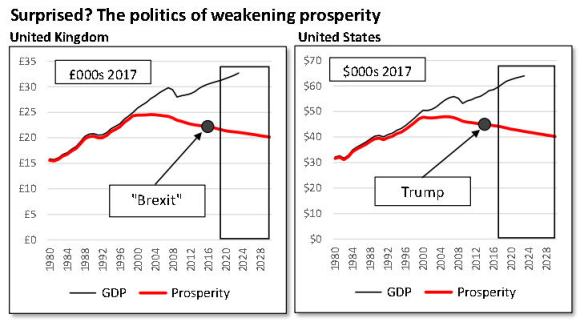

A picture is supposed to be worth a thousand words, and the following charts demonstrate quite how radically SEEDS differs from conventional economic interpretation.

These charts set prosperity (as calculated by SEEDS) against published GDP per capita for the United Kingdom and the United States. With this information, you can see that, for SEEDS, the so-called “shocks” of the “Brexit” vote, and the election of Donald Trump, were no surprise at all.

Rather, popular discontent with the political establishment is to be expected when the prosperity of the average person has been declining relentlessly, and over an extended period. In Britain, the voters’ decision to leave the European Union reflected a deterioration of 9.7% (£2,380 per person) in prosperity since 2003. In the US, the decline in prosperity began later than in the UK, but the average American was still 7.3% ($3,520) poorer in 2016 than he or she had been back in 2005.

Obviously, economic hardship wasn’t the only issue at stake in either case. But it has to be highly likely that it tipped the balance. Similarly, recent events in Italy must in large part reflect a big (12.1%, or €3,300) slump in average prosperity per person since 2001 – which, coincidentally (or not?) was the year before Italy joined the euro.

In short, the SEEDS interpretation is that the rise of so-called “populism” across much of the West reflects a deterioration in prosperity which conventional economics is wholly unable to capture.

This means that policymakers are trying to make decisions in a context quite different from the information that they have to go on.

The main purpose of SEEDS isn’t political prediction, though the system’s track-record in this field is rather impressive. Rather, the aim is to calibrate prosperity – something which conventional economics has become increasingly unable to do – and to draw economic and financial conclusions on this basis.

China – some warning signs

The next pair of charts, which look at China, display SEEDS’ interpretative capability on an issue of current importance. The first chart illustrates that, whilst GDP per capita continues to grow at rates of over 6% per annum, prosperity is increasing at a much more sedate pace, trending higher at rates of around 2% annually.

Meanwhile, and as shown in the second chart, China is paying a huge price for growth in GDP, having added RMB 4.30 of net new debt for each RMB 1.00 of reported growth over the last ten years. Put another way, a large proportion of “growth” in recorded GDP amounts to nothing more than the simple spending of borrowed money.

This is by no means unique to China, of course. Before 2008, pouring credit into the economy, and calling the result “growth”, was a practice largely confined to the West. Since GFC I, this practice has spread to much of the emerging world.

Meanwhile, the West has moved on to new follies. To the “credit adventurism” which preceded the first crash has been added the even more dangerous “monetary adventurism” which is likely to trigger the second.

Watching this progression, you might well conclude that those deciding policy are ‘making it up as they go along’. That, of course, is about all they can do, if the interpretations on which they base their thinking have ceased to be valid.

Risk recalibrated

Where China is concerned, SEEDS puts a wholly different slant on risk exposure. The ratio of debt to prosperity has climbed from 217% back in 2007 to 613% now, and is set to reach 660% by the end of this year. These compare with debt-to-GDP ratios of 162% in 2007, and 309% now.

You don’t need to be unduly pessimistic to appreciate that this trajectory has become wholly unsustainable – and by no means just in China. Yet this scale of risk is something that the preferred conventional measure – the ratio of debt to GDP – simply fails to capture. Much the same applies to the measurement of systemic risk in banking, where comparing financial assets with prosperity shows levels of risk far higher than are indicated by ratios based on GDP.

This is a subject for a future discussion, but we can observe here that countries whose banking systems are disproportionately large are living with exposure whose severity cannot be measured realistically with established techniques.

Debt mis-measured

The explanation for the mismatch in debt ratios, by the way, is pretty simple. Much of any increase in debt finds its way into expenditure, thus pushing up apparent GDP in a way which damps down the measured implications of debt escalation. As we’ll see, where SEEDS differs is that it uses underlying or “clean” output numbers, adjusted to exclude the way in which GDP is boosted by the simple spending of borrowed money.

Given the sheer scale of worldwide borrowing in recent years, understanding how the conventional debt-to-GDP measure is flawed helps us to appreciate why the next financial crisis (“GFC II”), when it comes, will doubtless be regarded as just as much of an ‘unpredictable’ event as the 2008 global financial crisis (GFC). Though there are many ‘popular misconceptions’ in this area (including the ‘safety’ supposedly conferred on the banking system by higher reserve ratios), the debt-to-GDP ratio remains one of the most misleading of the lot.

The reality is that, far from taking us by surprise, many events and trends are eminently predictable. Looking back at the British chart, for instance, you’ll readily appreciate why customer-facing sectors such as retailing, pubs and restaurants are going through a fire-storm of failures and closures. Contrary to ‘expert’ opinion, this melt-down owes very little to “Brexit” (yet, anyway), and almost everything to the erosion of customers’ ability to spend.

Globally, SEEDS reveals levels of risk exposure that are very different from anything you can glean from conventional econometrics. Taking debt as an example, the ratio of debt to world GDP now stands at 215% of GDP, a ratio not dramatically worse than it was in 2007 (179%). For SEEDS, though, the ratio of debt to prosperity is not only much higher (327%) than the conventional measure, but has worsened very markedly since 2007 (229%).

How, then, does SEEDS arrive at these conclusions?

“Something missing”

Put simply, SEEDS fills a gaping hole in how the economy is understood. It’s become increasingly clear, over an extended period, that the ability of conventional economics to provide interpretation and guidance has been breaking down. Policy levers that once worked pretty well seem now to have lost their effectiveness. This means that individuals and businesses, no less than governments, are unable to grasp what is really going on in the economy and finance.

Since the interpretive and predictive abilities of conventional economics are failing, it’s clear that “something is missing” from accepted thinking. Equally clearly, this missing component has now assumed greater importance than it had in the past. So what we’re for looking is a gap in understanding which is more important today than it was, say, twenty years ago.

The view taken here is that the missing ‘something’ is energy. There are at least two reasons why this ought to come as no surprise at all.

First, it’s observable, throughout history, that three data series have progressed in something very close to lock-step. These series are: energy consumption; population numbers; and the economic output that supports that population. From the late 1700s, when first we accessed the huge amounts of energy tied up in fossil fuels, all three series have become exponential. This is illustrated in the next chart, which compares population and energy consumption over two millenia. (For much of the early period, energy wasn’t traded, so we can’t quantify exactly how much was used, but we do know that the numbers were extremely small).

Second, you only have to picture an economy suddenly starved of power to appreciate quite how utterly dependent all economic, financial, social and political systems are on the continuity of energy supply. Cut off this supply in its entirety for as little as 24 hours and chaos would ensue. It’s likely that a relatively short period without energy would be enough to turn chaos into collapse.

Both observations are so obvious that the absolute primacy of energy in the economy should be clear to everyone. The idea that energy is somehow ‘just another input’ is facile in the extreme. There is literally no service or commodity than can be supplied without it. Clearly, energy is much more important than just one a part of a sub-set of materials, itself one of the five inputs to economic activity (the others being labour, capital, knowledge and management).

What has changed?

We can be confident, then, that energy is the ‘something’ that is missing from the conventional understanding of the economy. Equally, though, if it’s missing now, then it was missing in the past, too – yet its absence has become more important over time.

So it’s not just energy itself that has been left out of the equation, but something dynamic (changing) within energy itself.

A long-standing interpretation of the energy economy has been scarcity. It’s logical that reserves of fossil fuels are finite; that consumption has increased exponentially over time; and that we’ve exploited the most economically attractive resources first, leaving less profitable alternatives for later. This process is known as depletion, and is the logic informing ‘peak oil’ – a thesis that ‘cornucopians’ dispute, but which may yet turn out to have been right all along.

The critical issue – cost

SEEDS, though, isn’t based on resource exhaustion. Where the critical role of energy is concerned, the alternative (though not necessarily conflicting) interpretation is that it’s cost, rather than quantity, which is critical.

Whenever we access energy, some of that energy is always consumed in the access process, and what remains – surplus energy – is the enabler of all economic activity, other than the supply of energy itself.

This relationship is often measured as a ratio known as EROEI (the Energy Return on Energy Invested, sometimes abbreviated EROI). The scientific argument supporting EROEI is compelling, and is stated superbly here.

SEEDS uses an alternative measure, ECoE (the Energy Cost of Energy), which expresses cost as a percentage of the gross energy accessed.

Because the world economy is a closed system, ECoE is not directly analogous to ‘cost’ in the usual financial sense. Rather, it is an economic rent, limiting the choice we exercise over any given quantity of energy. If we have 100 units of energy, and the ECoE is 5%, we exercise choice (or ‘discretion’) over 95 units. If ECoE rises to 10%, we now have discretion over only 90 units, even though the gross amount remains 100.

This is loosely analogous to personal prosperity. If someone’s income remains the same, but the cost of essentials rises, that person is worse off, even though income itself hasn’t changed.

Understanding ECoE

ECoE evolves over time. In the early stages of any given resource, ECoE is driven downwards by geographic reach, and by economies of scale. Once maturity is reached, depletion takes over as the driver, pushing ECoE upwards.

In the pre-maturity phase, technology accelerates the fall in ECoE driven by reach and scale. Post-maturity, technology acts to mitigate the rise caused by depletion. But – and this is often misunderstood – the capabilities of technology are limited to the envelope of the physical characteristics of the resource.

Over time, the trend in ECoE is parabolic (see illustration). Today, renewables remain on the downwards slope, but the ECoEs of fossil fuels are now emphatically on the upwards curve.

The same is true of overall ECoE, because fossil fuels still account for nearly 90% of energy supply, whilst renewables contribute less than 4%.

Even though renewables’ share of total energy supply is rising, it’s unlikely that this will stem, let alone reverse, the upwards trend in overall ECoE. Critically, technologies such as wind and solar power remain substantially dependent on inputs sourced from ‘legacy’ energy. We have yet to demonstrate that we can build solar panels, wind turbines or their associated infrastructure without recourse to energy from oil, gas or coal.

To this extent, the outlook for ECoEs in the renewables sector remains geared to the ECoEs of fossil fuels.

A critical point here is that, once on the upwards slope of the parabola, the rise in ECoE is exponential. According to SEEDS, global ECoE has risen from 3.5% in 1998 to 5.4% in 2008 and 8.0% now, and is projected to reach 10% by 2028.

For obvious reasons, details of the ECoE calculations used by SEEDS are not disclosed. This said, separate trajectories for fossil fuels and renewables are published, as are the global ECoE curve, and its national equivalents. (The aim is to give readers the maximum information consistent with not enabling any organisation to build a SEEDS-type system).

Some pointers, however, can be provided.

First, ECoEs are calculated on a fuel-by-fuel basis over time.

Second, and reflecting the nature of the main drivers, ECoEs evolve gradually, so SEEDS always cites trend ECoEs.

Third, the ECoE for any given country at any given moment, and the way in which this number changes over time, are determined by the mix of energy sources used, and by trade effects, where the country is a net importer or exporter of energy.

Relating ECoE to output – clean GDP

With ECoE established, it might appear that all we need to do now is deduct this number from GDP to arrive at prosperity, which is the corollary of surplus energy, expressed in monetary units.

Unfortunately, things are not this simple.

As we’ve seen, the tendency over an extended period has been to boost apparent GDP though processes known here as credit and monetary adventurism. The adoption of these policies can be seen, in part at least, as a response to a deterioration in rates of growth which began to take effect in or around the late 1990s, as rising ECoEs started to bite.

Comparing 2008 with 2000, reported “growth” of $26 trillion was accompanied by a $58tn increase in debt. The ratio between the two was thus $2.20 of new debt for each $1 of reported growth, though ratios were far higher than this in most Western economies.

Between 2008 and 2017, the ratio of borrowing to growth rose to 3.26:1, with $94tn of debt added alongside growth of $29tn. Furthermore, the latter period also witnessed the emergence of enormous shortfalls in the adequacy of pension provision, which have worsened by close to $100tn since 2008. This destruction of pension value is almost wholly attributable to a policy-induced collapse in returns on investment.

It almost defies credulity that we are asked to accept “growth” of $29tn as genuine whilst ignoring $94tn of net new debt, $28tn of newly-created QE liquidity and the destruction of almost $100tn of pension value.

According to SEEDS, real growth over that period wasn’t $29tn but $9.9tn, and even this calculation might be generous when set against the scale at which the aggregate balance sheet has been trashed over that period.

This calculation also means that GDP, reported at $127tn for 2017, falls to just $90tn on a clean, ex-manipulation basis – and even this, of course, is before we allow for ECoE, whose global cost has increased by 58%, from $4.5tn in 2008 to $6.9tn last year.

The following charts illustrate this situation, expressed in PPP-converted dollars at constant 2017 values. The left-hand chart shows GDP, both as reported and as adjusted by SEEDS to exclude the impact of the simple spending of borrowed money. The second chart shows debt, both as actual numbers and as the trend that would have occurred had debt grown at the same annual rates as reported GDP.

The difference between the red and black debt lines thus corresponds to debt growth in excess of percentage increases in GDP.

When examining these charts, it’s important to note the differences in the vertical axes, meaning that we’re dealing with movements at different orders of magnitude.

Between 2000 and 2017, GDP (as reported) increased by $55tn (76%) in real terms. But debt more than doubled, growing by 126%, or $152tn, from $121tn in 2000 to $273tn in 2017.

Borrowing $152tn to achieve growth of $55tn is not only unsustainable, but surely makes it clear beyond doubt that most of the supposed “growth” in GDP is simply the effect of pouring borrowed liquidity into the economy.

Implications of credit-fuelled GDP

From this, two things follow. The first is that a cessation of debt escalation would reduce growth dramatically – if debt ratios remained at current levels, no longer increasing, then GDP might continue to expand, but probably at rates of barely 1% annually, compared to the 3% and more claimed by reported numbers. Without continued increases in indebtedness, GDP could be expected to fall in most Western economies, whilst rates of growth in the emerging economies would slow markedly.

The second is that, if the excessive borrowing of recent years were to be reversed, GDP would slump, laying bare the extent to which the “growth” recorded since 2000 has been debt-inflated. On this latter point, debt stood at 168% of GDP in 2000, and now stands at 215%. Getting back to the 168% level would require deleveraging of almost $60tn, and the consequences of this for GDP are best left to the imagination.

If you put this $60tn figure alongside the scale of QE (about $28tn) – and add the massive (perhaps $100tn) of pension adequacy impairment, too – you’ll see how far out of reach any definition of financial ‘normality’ really is.

For all practical purposes, we are stuck with negative (sub-inflation) interest rates, ultra-cheap credit and negligible returns on invested capital until this combination of forces reaches its logical conclusion.

Corroboration

The calculation of ‘clean’ – ex-borrowing – output is undertaken using an algorithm which it would be folly to disclose, because to do so would be to hand an important methodology to those who don’t have an equivalent (though, pretty obviously, they need one).

But this doesn’t mean that we’re without at least three forms of corroborative evidence.

The first is to be found in the content of the “growth” reported in recent years. Data for the United States for the period between 2006 and 2016 illustrates this point.

Over that period, the American economy grew by $2.3tn at constant values. Of this growth, increases in the net export of services contributed 7%, or $159bn. The remaining 93% ($1.97tn) came from internally-consumed services (ICS), including finance and real estate (+$628bn) and government activity (+$272bn, excluding transfer payments).

Together, the combined contribution to this growth from globally-marketable output (GMO) – that is, manufacturing, construction, agriculture and the extractive industries, all of which are traded on a worldwide basis – was zero.

In other words, virtually all growth has occurred in activities where Americans pay each other for services that cannot be marketed to foreign customers. This is the classic profile of an economy relying for growth on ramping up its debt.

This has by no means been a phenomenon limited to the United States. Rather, it’s been visible across the West. In the emerging economies, and especially in China, the pattern has been different, with borrowed funds being channelled into the creation of capacity. But this borrowing, too, inflates consumption, because these activities act as conduits which push borrowed money into the pockets of those employed building capacity.

A second way of corroborating the debt-funded nature of reported “growth” is to examine the circumstances of the average person. If GDP growth (and, therefore, its per capita equivalent) was organic and sustainable, prosperity would be rising as well. That this isn’t the case is apparent in various metrics. One of these is real wages, and another is the comparison between incomes and the cost of essentials.

Critically, debt per person has risen by much more than per capita GDP, something which isn’t consistent with the improving prosperity implied by reported GDP. Again using the United States as an example, and stating all numbers at 2017 values, GDP per capita increased by 6.5%, or $3,620, between 2007 and 2017. But debt per capita was $22,400 (18%) higher at the end of 2017 than it had been ten years earlier.

Prosperity

To get from GDP to prosperity, then, two stages are involved. The first is to arrive at a ‘clean’ GDP number by removing the distortions introduced by pouring cheap credit into consumption. The second is to deduct ECoE from this underlying number.

The results show a deterioration in prosperity across all major Western economies other than Germany. Typically, Western citizens are getting poorer at rates of between 0.5% and 1% annually.

Moreover, the share of debt – personal, business and government – that these citizens are required to support on the back of dwindling prosperity has grown markedly. Because servicing this debt at normal (above-inflation) interest rates has become impossible, we are locked into monetary policies which are themselves destructive.

Though the citizens of emerging economies continue to enjoy increasing prosperity, their debt, too, is rising. For example, the average Chinese person is 41% more prosperous than he or she was back in 2007 – but the per capita equivalent of debt has quadrupled over the same period.

Worldwide, continued growth in EM prosperity has matched the deterioration in the developed West, meaning that average prosperity has flat-lined – but the ratio of debt to world prosperity has continued to rise markedly.

So, globally, we’re not getting richer, and we’re not getting poorer – but we are getting ever further into debt, whilst pension provision is falling ever further away from where it ought to be.

In short, SEEDS concludes that a string of observations often taken for granted are simply misleading. Output per capita isn’t growing, and most Westerners are getting poorer, not richer.

Take these observations on board and a lot of things that might have seemed inexplicable – including political outcomes, rising trade conflicts and many other stresses – all of a sudden fit into a logical pattern.

And it’s a pattern that‘s looking ever less sustainable.

= = = =

Tim – we’re simply going to have to redefine the meaning of wealth away from tangible products when non essentials become unaffordable.

Thank you for the clear and concise post.

We could define wealth as ‘useful energy’ in keeping with the idea that energy cannot be created or destroyed but can be changed to and from useful states.

You’re welcome

You’ll see that I’ve added a stats annex, giving some of the numbers for the UK, the US and China referenced in the text.

Thank you for another very interesting post Dr Morgan.

I’m reminded of the old adage quoted by Sir John Rose, then chief executive of Rolls-Royce, in 2006: “There are only three ways of creating wealth – you dig it up, grow it, or convert it to add value. Anything else is merely moving it about.”

https://www.telegraph.co.uk/finance/2939400/Personal-view-Science-is-key-to-how-we-add-value-and-create-wealth.html

If wealth is defined as ‘useful energy’ then SEEDS illustrates this very well. You’ve written much about the extractive industries (“dig it up”); do you have any plans to write about farming (“grow it”)?

Or breed it….

I don’t have any plans to look at agriculture, because it’s not something I know enough about, so I’ll stick to energy, economics and closely related issues such as finance and politics.

Thanks for the latest analysis

You are most welcome. I’ve just added a downloadable stats annex which you might find useful

Great presentation by Steve Keen on the role of private debt in economic crisis:

Steve (what he calls MCT) and the MMT folks have nailed the debt issue – the problem with debt is destruction of (1) demand, and (2) productive capacity. The real issue is that consumers saddled with debt can’t continue to support aggregate demand, and economies which have too much “rentier” credit payments have too many people engaged in non-productive financial services.

The issue is most certainly not about monetary sovereigns being unable to service debt. This results from mistaken moral reasoning by analogy – comparing nations to individuals.

Very interesting analysis,Tim! MMT adds a few inputs as well, which you might like to weigh up.

Depending on your definition of borrowing, it may just be in the non monetary sovereign sector that your figures apply to. In the Monetary Sovereign sector, [central governments], growth from government spending does not use borrowed money. It still uses energy but the measure will differ.

Also we cannot have “unfunded liabilities” a common error in mainstream economics. The government pensions we pay today are not based on savings from yesterday. There can be no saving today to fund future pensions. Private pensions cannot do this so their costs have to be compared with savings, but in the future all private pensions will be taken over and paid by central governments, PAYG. Your $100 trillion figure will not be for private pension schemes. There can be no private business model that will satisfy that issue. General Motors is today not so much an auto manufacturer but a financial management company, it’s pension liabilities are so large.

Like you, Debt/GDP ratios are spurned by MMT economists as useless. You have made a new one, debt/ prosperity which is useful.. Let’s hope the switch comes soon!

Thanks John, as ever.

I’m not optimistic that the consensus will shift to prosperity any time soon…….

I think the “savings” angle is necessary for understanding, to get people out of the debt moralization trap. All those who say “you can’t print energy” need to be reminded that “you also can’t save it” in the form of money.

Prices will rise as we shift to transparently to PAYG – but this is different from inflation. Increasing prices accurately reflect the increasing capital costs of energy as a share of input costs for GDP producing products. Wages will not go up, just prices – not inflation.

I would argue in energy terms inflation should be looked at related to the amount of productive work (use of energy) which backs the created money. This relates to capacity and unemployment, but also technology, capital and productivity.

The need for increased money supply reflects the destruction of the concept of savings. The percent of saved money used to purchase goods and services has to go down when there is declining surplus.

Apologies if you’ve already read this – but the crisis we’re in has also been neatly explained here using air as an analogy for oil.

Come on now – the economists – financiers monitoring the World economy must know this.

I’ve seen this, and I’m not wholly persuaded either way about oil prices.

Back in the early 2000s, when oil prices had moved from $20 to just over $40, a colleague on our European desk told me prices would have to fall back, his argument being “can’t pay, won’t pay”, i.e. $40/b was unaffordable. But the obvious counter is “can’t pay, won’t pay – so go without?”

@Dr. Tim – I think the price will depend on the monetary response. Gail is spot-on about so much, but treats debt and money creation in a reified way. We can prop agregate demand with monetary adventurism, but it is ultimately extend and pretend. This would yield high prices.

Letting ourselves walk into depression for lack of demand (and imagination) would result in low prices.

It seems theoretically possible to ride the downward slope of prosperity. It may not, however, be practically (i.e. politically) possible.

An aside to the 500 comments on the last blog:

George Mobus, the Systems Scientist, has just published his latest epistle:

http://questioneverything.typepad.com

George now only writes on the calendar day when seasons change, plus April Fool’s day.

His theory is, more or less, that humans are a cake not fully baked, consequently ill-adapted to the world as it actually exits.

Don Stewart

My take on this is that evolution is of necessity a gradual process, so has been unable to keep pace with the speed of change in our circumstances since we started using fossil fuels. “Space age technology, stone age emotions” is, I think, how Don Henley put it.

Although Tim has gone over many of the points covered it’s still interesting hearing Gail Tverberg. Depressingly she doesn’t see a way out of the coming crisis.

Right I have to finish my Stepmum’s tax return before the World ends because if I go to Hell – that’s where all the tax inspectors will be.

I think the best we can hope for is to smoothly ride the declining prosperity curve in a way that avoids collapse. I think this is theoretically possible, but I do not believe it is practically possible given the limitations of human psychology.

I’m hoping for a smooth ride too – but it’s inevitable that there will be problems.

The next decade is going to define the rest of the century but I can’t see the sensible people who are aware of the current economic dangers we face being listened to.

Thanks for the new article!

Thanks. I appreciate your comment because putting this one together was particularly hard work, but I wanted readers to have ‘the whole thing’ in a single article.

Just FYI

Dmitry Orlov reviews recent predictions of trouble from Krugman, Soros, and Lagarde and asserts that none of them understand the real problem: energy.

It’s behind his Patreon pay wall.

Don Stewart

More of these paywalls are going up on YouTube as Ads can’t be relied upon to pay people who spend their own time and money making informative videos.

I have a somewhat conflicted position on this.

Personally, I greatly dislike ads, not least because, taken collectively, they are a form of propaganda for consumerism. Also, ad spending has, apparently, stopped growing, because of corporates’ increasing adoption of “zero-based budgeting”, which starts from the baseline of ‘we won’t spend more on anything than we did last year, unless there’s a compelling case’.

Logically, therefore, since things do have to be paid for, I ought to favour direct rather than ad-funded payment. For the forseeable future, though, I want the public to have free access to what I do here.

As I’ve said before, what won’t be free here is any request for comprehensive data for commercial or similar purposes.

Perhaps in the future this is what the smartest delivery van will look like. The article makes a good point about water misusage.

https://www.theguardian.com/world/2017/mar/01/indian-traders-boycott-coca-cola-for-straining-water-resources

John Doyle said, “but in the future all private pensions will be taken over and paid by central governments, PAYG.” Blondebeast said, “Prices will rise as we shift to transparently to PAYG ”

I am not so sanguine that these predictions or MMT remedies will actually be implemented. I believe they rely on the assumption (unsupported, unproven) that central governments are system managers (let’s not go so far as to say “prudent system managers”) rather than tools of, by and for oligarchy (the position which all of history thus far supports). Legitimacy is sold and garnered on the systems management theory, but it is not the reality.

Perhaps the argument is that central governments will be driven to do these things in order to avoid absolute social chaos, out of oligarchic self-preservation. Again, apart from a few notable exceptions, like FDR’s New Deal, derided by business interests from Day 1 and still under assault for being too generous, the historical evidence is not too great for the position that oligarchs actually turn away from self-destruction before it is too late or have any idea how to keep their greed from completely destabilizing or destroying the entire system on which their wealth and social status depends. Looking at the years preceding the French Revolution, e.g., one might surmise that their attitude is, “how can we know if we’ve gone too far, how can we know if there’s not more to be had, if the people are not yet actually cutting off our heads? We won’t stop until we know we have hit the absolute limit. Oops, we found it!”

In this respect, I fully concur with blondbeast’s assessment: “I think the best we can hope for is to smoothly ride the declining prosperity curve in a way that avoids collapse. I think this is theoretically possible, but I do not believe it is practically possible given the limitations of human psychology.”

Be that as it may, a simpler way than taking over private pensions would be to let them collapse, reduce all those people to penury and consign them to a quicker death, and then, when the society is on the verge of massive revolt, institute guaranteed minimum incomes for the impoverished at a subsistence level sufficient to fund food, really crap shelter and mind-numbing entertainment via the telly and computer.

Great new article, Tim!

I agree. It’s hard to differentiate between what something “is” vs what we think it “should” be.

In decline, however, the interests of corporations don’t necessarily match the interests of finance. Corporations could become allies in opposing the short term interests of the financial sector. There are class struggle issues here, however, in that owners of stock are attached to their own gains.

I think people are going to consume enough resources to stay alive or die trying. The best response to this seems to me to be to pay them to do something, even if it isn’t particularly productive. Prices will rise and wages won’t because it will become more expensive to produce everything. This is just a corollary of saying prosperity will decline. I.E. it takes more time, energy and capital for the energy sector to support everything we do.

There are theoretical ways to support de-growth. I just think these will not be taken. I don’t think it is psychologically possible for people en-masse to face a pessimistic future without scrabbling for the best of what’s left.

Another way to say this is at the very least we don’t have to pretend that the monetary sovereign governments can’t “afford” something. This is not to say there won’t be consequences, or that some people think the government shouldn’t do certain things out of moral reasons (i.e. the government shouldn’t be a “charity”) – so let’s talk about those, would be my suggestion.

Money is detached from reality. Recouple it and that part is solved. Its going to hurt though.

Interestingly China’s demand for oil is about to soar as their own production has peaked and for the next 12 years they will be importing twice as much oil as they do today – and they intend to get it from Saudi Arabia. Clearly this will have ramifications for the rest of the World

Source:

Your analysis and conclusions seem intriguing, plausible, informative, and most importantly, useful. Prosperity seems exactly the right concept to illuminate the dismal trajectory that we find ourselves on. You gave a two sentence conceptual definition of prosperity, but what are your plans to publish the explicit formula(s) so that results can be replicated and defended? This could be a powerful means to bring the critical concept of surplus energy into the mainstream discussion. Not being an economist I haven’t a clue about which journals would be receptive to this, but I am guessing that they exist.

Thanks, and, as I think this is your first comment here, welcome.

On formulae and so on, where I start from is that official and commercial users of conventional economics are basing their decisions on increasingly faulty analysis. Moreover, I think this serious problem is gradually gaining recognition.

If I’m right, they’re going to need something new, – along SEEDS lines, at least in terms of certain core understandings – to overcome this deficiency. From personal experience, building this type of system is far from straightforward.

This said, I don’t see why I or anyone would make a gift of the central formulae of this to, say, a government or an investment bank. Yes, making these formulae available would facilitate some external verification, but it would also hand the system to official or commercial interests to use for their own ends.

So my position has been to “provide the maximum information to the public, consistent with not disclosing core methods” to these organisations. You’ll notice that in this article I point to “corroborative evidence” by which SEEDS interpretations can be assessed by generally-available benchmarks.

Finally, it helps that I’m not a zealot, determined to ‘convince the world’ about anything. If I, and readers, benefit from this, that’s good enough for me.

Dear Dr. Morgan

There is no doubt that SEEDS is a major advance in terms of putting current events into a useful context. I congratulate you.

However, I believe the energy part of the equation deserves a closer look. I particularly recommend this interview by Derrick Jensen with Alice Friedemann:

I’ll summarize Alice: ‘Our current world is simply unimaginable without diesel powered trucks’.

Now one of the operative phrases is ‘diesel powered’…not natural gas or fracked oil or biodiesel or electricity produced by wind or PV panels.

I will not be presenting data showing that our ability to produce diesel is falling off the cliff (because I’m no expert), but I think there is room for serious concern. The fracked oil in the US is not capable of producing very much diesel…gasoline, but not diesel. And we know that gasoline cars move, in terms of human weight, only a tiny fraction of the weight moved by diesel trucks. In other words, almost all of the work, as defined by physics, is done by the diesel. We can also figure out that we simply can’t grow enough corn to replace the diesel produced from traditional oil fields We can pretty quickly figure out that battery powered trucks are going to be a lot less efficient than diesel trucks.

I’m a little fuzzy on the very heavy oils in the tar sands and in Venezuela…but I believe that they are not very thermodynamically efficient in terms of producing diesel. In other words, the ECoE for diesel produced from those sources is a high fraction.

So what we amateurs might suspect is that the ability of the world to produce diesel is about to go into serious decline. A serious decline in diesel will inevitably lead to a serious decline in our ability to do work. With dire consequences for the economy. If one combines a serious decline in diesel with demands to service all that debt, something has to break.

Don Stewart

Don – the link I provided in my post just above yours stated that the fracked oil in the US (quite apart from ever being profitable) is not suitable for many types of product.

Fracking in the US just appears to be one big con.

US shale in a nutshell.

Without coal, no electricity, without electricity, no diesel. And without diesel, no coal.

I think from 2020, high sulphur shipping oil will be outlawed to be replaced by lighter diesel type fuels. This will be a game changer in terms of oil demand for brent type crudes.

Don – You also alluded to this in a comment in #129, and I agree. It is another dimension of “not all crude oil is the same”, and will contribute to the eventual price spike which will pop the present balloon.

Affordable oil is >$110,- for producers and <$60,- for importers.

And counting..

Tim, a very nice concise updated summary of your thesis. Perfect for sharing with people as an overview/introduction to the subject. Thanks again.

A question I would be keen to get your view on – Does the concept of ‘investing in the future’ have validity in a post-growth situation?

Thanks Kevin – that was my aim, which is why I didn’t start with theory, but with the “surprises” of “Brexit” and Trump.

The concept of investing for the future certainly has relevance – we live in a continuum, where each generation benefits from the legacy of its predecessors, and has an obligation to its successors.

But whether investment for the future remains feasible post-growth is trickier – my feeling is we’ll probably maximise immediate consumption within constrained prosperity, and let future generations go hang. Depressingly, that’s what we are doing already to younger generations. I once wrote a piece called The Dick Turpin Generation about this.

Just watched the Shale oil Ponzi scheme video – this is another ENRON .

Tim

Thanks for a very concise summary of the SEEDS system.

As I’ve said before you concentrate on trends rather than the contemporary “snapshot” way of managing the economy and, to me, this is a huge missing element in the current set up. The political structure is all about managing the minutiae of monthly numbers but these really have no significance and the trends – which you highlight via SEEDS – are never addressed. It is therefore not just a question of getting your views across in the conceptual sense it’s a question of changing the political system to cope.

In China you now have the “Belt and Road” initiative, a major move to place China at the epicentre of the World economy. This is the type of initiative we need to adopt in order to overcome our problems. However, China is not a democracy and can, at least for the time being, pursue this sort of strategic vision. Can we do the same with our fractious politics? I have my doubts.

Thanks Bob.

I fully understand why politicians seize on latest snapshots – incumbents like them if they’re good, and oppositions if they’re bad – but how anyone expects to manage anything on any basis other than trends is baffling.

As mentioned in this article, some of the numbers for China are pretty frightening. It’s true that China isn’t a democracy (though a fair number of Western countries are only quasi-democratic), but Beijing really needs to keep a close watch on public opinion, and I’m sure they do.

As I’ve said before, I think there’s a “grand bargain” at the heart of Chinese government – the public surrender certain liberties in exchange for growing prosperity. The government would be in huge trouble if ever it couldn’t deliver on it’s side of that bargain.

For practical purposes, it’s employment that is critical. That’s why China puts the focus on volumes, not – as in the West – on profits.

My supposition is that the use of truly enormous debt has been necessary to the government keeping its volume/employment deal with the public. If I’m right, and if it’s logical that exponential growth in debt can’t go on forever, then big trouble looms.

For these reasons, there might be a lot to commend publishing a SEEDS-based analysis of China. Without a doubt, it’s the one to watch.

Tim – with reference to an earlier post I made – what’s your view / concerns that China is going to double the amount of oil it imports – perhaps mainly from Saudi Arabia.

My worry is the impact on other importers – including us.

Thannks

As I’ve mentioned before, China seems to be planning to shift the emphasis from oil to coal. Also, it’s become easier for China to strike a deal with Iran, perhaps in RMB, than it was before the US tore up the deal with Tehran.

But whether this can be done is a wholly different matter!

Tim – well coal or no coal – deal with Iran or no deal – China doubling their oil imports cannot be good news for the rest of the World.

Donald

I’m not going to try to answer your question. Just point out some subtleties.

China surpassed the US as the world’s largest oil importer in 2017. What’s that??? I thought we were all reading about the booming US oil EXPORTS? Well, it’s more complicated than simple numbers might lead you to believe. The US imports crude oil and exports refined products. Because the US has a readily accessible petroleum industry…think of the Gulf coast.

So one question to ask is whether China intends to export refined products with the additional oil they want to import. I dimly remember something about Chinese refineries, but I can’t remember now what it was.

If one deducts the exports from the imports, the US is still a net importer. (But the arithmetic isn’t simple, because the products are not measured in barrels.) Also, the US refineries need the tar sands heavy stuff to mix with the light stuff being supplied from shale in order to get a mix which can go through the refinery….as I understand it. I know China made some investments in Venezuela, but I don’t know if they envision doing something similar in terms of mixing heavy and light sources.

Don Stewart

China doesn’t have the surplus energy to build it. And their space to increase debt is very limited as we speak.

Donald

Also as a matter of curiosity. I understand that the ‘free trade’ agreement between the US and Canada requires Canada to send certain amounts of heavy oil to the Gulf, and to maintain certain percentage relationships.

Don Stewart

Thanks for your reply Don – so basically it’s not a straightforward doubling of oil in – there are other factors involved as well.

If you go into YouTube there are a lot of postings regarding peak oil – US fracking being a Ponzi scheme yet it always seems to be business as usual in the World’s economies with no panic setting in.

So there are many highly qualified analysts and economist who know that some sort of crunch is coming but very few are taking any real notice . I can only assume that many are in a constant state of denial.

Even some of my former friends who I meet up for a reunion meal didn’t seem bothered – they just said their savings in banks are protected and that there’s unlikely to be a major crash.

I think they were still thinking of the economy in monetary terms and not energy.

As mentioned in a previous post I’m just hoping for a slow deterioration in living standards – although that in itself will be enough to spark social unrest – especially with those struggling to cope day by day at the moment.

Donald

If you are interested in reading about a bubble gone bad, I recommend the book Cattle Kingdom, by Christopher Knowlton. The book traces the history of the cattle industry in the Western US from the end of the Civl War (1865) until ‘the big die-up’ in the winter of 1886-7. Briefly, Texas, where everyone was broke as a result of the Civil War, had a lot of wild, surplus cattle. Some enterprising people figured out that driving the cattle north toward the railroads or toward the open grasslands of Wyoming and Montana might make a lot of money. A cow was worth 10X as much in New York City as it was in Texas. And Delmonico’s, the NYC restaurant for the elite, was making steak famous. Cattle were replacing hogs as the customary meat eaten by Americans, and prices were rising. Meanwhile, the British aristocracy had a lot of money, but their returns were sinking rapidly. The aristocracy needed a way to make money….partly because they had such expensive tastes. The amount of salmon and deer hunting land in Scotland had increased from a few hundred thousand acres to 3.6 million acres by the time of WWI. Driving the peasants off the land so you could use it for fishing and hunting is a lot of fun, but it doesn’t actually generate any returns…except in terms of social connections to other wealthy people.

By the early 1880s, Cheyenne, Wyoming, had the highest per capita income of any city in the world. It was crawling with, among others, British upper class people who thought that cattle could provide them with 25 percent per year returns. You get such high returns because bulls and cows do their thing and there is an unlimited amount of grass and ‘the weather is not a problem’ according to the brochures and newspaper and magazine articles you read in your club in London or Edinburgh. The book explores lots of topics, but one of them is how the British investors got so thoroughly skinned. The grass was not unlimited, the cow populations did not grow at the rate expected, and the grass turned out to be all too limited. The final disaster was the winter of 1886-7. Theodore Roosevelt had prophesized that the cattle empire would be brought down by ‘one bad winter’. During the winter in question, the temperature in the Dakotas hit 60 below zero. Worse, the newly invented barbed wire prevented the cattle from moving with the prevailing winds, and they ended up in suffocating piles, frozen to death.

Even before the deadly winter, the British came to the US not to actually deal with cows, but to entertain royalty with hunting trips. The sight of British royalty in private railroad cars drinking champagne ignited bad feelings (the war of 1812, when the British burned Washington DC, was still in everyone’s rear view mirror). Finally, a bill was passed restricting foreign ownership. But by that time, the British had turned sour on anything that combined the notion of American West and Cattle.

A lot of joint stock companies and other forms of ownership were essentially total losses.

The best thing that came out of it was the notion of the Cowboy. The seminal novel was written in 1901, long after the open range had disappeared and the cowboy had been reduced to a cog in the wheels of an industrial enterprise. But Hollywood got an enduring legend to make movies about.

History doesn’t repeat itself, but it is easy to see a lot of rhymes.

Don Stewart

One more thing Don – Chris kristofferson is 82 today. I mention this because he starred in ‘Heaven’s Gate’ The 1980 film about cattle barons vs immigrant farmers (The Johnson county war).

The war was actually in the 1890’s – after the period featured in the book you recommended – but it would still be of economic interest.

Donald

The book does cover the Johnson County war. But by then the bubble had burst. It turned into a fight between factions. A woman accused one of the Cattle Barons of ‘murdering 30 people’. He said ‘Yes, I did it all by myself’. Which was not literally true, but he took credit for what he ordered or inspired.

An early governor of Wyoming wore some boots which featured the skin of a lynch mob victim. (or so the story goes.)

Another interesting fact is that, in the Kansas rail-head towns (such as Abilene and Dodge City), there were no apparent fatalities until the towns started hiring marshals. The 19 or 20 year old cowboys were rowdy after months on the dusty trail, and the saloons and brothels did a booming business, but few of the cowboys wore guns and fist-fights were the usual way to settle disputes. When the towns aspired to ‘respectability’ and hired a marshal to ‘clean things up’, it sometimes turned deadly.

Don Stewart

Again thanks – very interesting. My current problem is that I’m six books behind on my reading but when I catch up (‘sadly’ no rainey days due where I live) it’s one I will buy.

Donald

Gail Tverberg analyzes the BP data for 2017, including a look at China and India:

When Gail shows a line for ‘consumption’, I do not know if she is counting consumption as ‘everything which was turned into products’ or ‘everything which was turned into products consumed domestically’. At least in the case of the US, those are not the same number.

In Europe, there (at least used to be) a lot of refining capacity in the Dutch ports. So the Netherlands would show a whole lot of oil imported, with a whole lot of products exported. In such a situation, it is easy to get a distorted picture.

Don Stewart

Thank you for the link. I agree that there are probably many distortions.

This conundrum about wages not being high enough to afford oil at the a price high enough for new investment is interesting. Without massive increases in energy efficiency / productivity I’m not sure how it can be solved.

If say bus drivers get a big pay rise then people might not be able to afford to travel on them. Same with low paid delivery drivers – in fact any industry I can think of. Wages basically cannot go up without the improvements in energy efficiency and productivity I mentioned.

However I think I’ve watched too many doomladen videos. I would like some optimistic thoughts about the future.

Perhaps a new Einstein will come along and we’ll get Nuclear Fusion working

Donald

I’ve suggested this basis for optimism to many people. Can’t say I have convinced anyone…yet.

I go back to the fundamental question that Adrian Bejan poses in The Physics of Life: What is Flowing? (I don’t think Bejan appreciates the way I twist his theory.)

When a person gets in his Hummer and drives down the street, what is flowing? At a superficial level (engineering) it is embodied energy (the Hummer) plus the fuel (gasoline) plus the embodied cost of the gasoline (the energy cost of energy) plus the infrastructure required to permit the flow (e.g., the streets, the cops, the society which makes stuff available if one drives someplace in their Hummer). At a deeper level, it is the feeling of satisfaction that one is on top of the world with one’s magnificent Hummer. Perhaps the notion that one is going to be irresistible to the ladies. At a deeper level is the neurotransmitters and hormones.

So…at the deepest level, we are talking about the flow of microscopic amounts of neurotransmitters and hormones flowing across microscopic synapses and the consumption of perhaps a few hundred calories per day in the brain. I haven’t calculated it, but perhaps we are spending a hundred thousand times more fossil fuel calories than what is required to actually move the brain chemicals.

If you are an optimist, you begin to think about either psychoactive drugs or practices such as meditation or sex. Would you rather work for years to earn enough to buy a Hummer which you drive down to the Strip and fail to impress the ladies? Or would you rather give your honey a screaming orgasm? All of Civilization depends on your choosing the Hummer.

Don Stewart

Hi very profound 🙂 Perhaps man should invest in an (energy efficient) orgasmatron for every home. (See Woody Allen’s film – Sleeper 1973)

Sorry I’m going to pop out now because my neighbours (a youngish married couple with children) are having a massive row – screaming – shouting – threats – and I’ve had enough.

Donald

Quote about the Johnson County War (perhaps relevant to Silicon Valley???)

‘The tough times in Cheyenne in the late 1880s had dire consequences. In the aftermath of the Big Die-Up, a group of lucky, high-living Cheyenne cattlemen who had briefly stood atop the business world in the West were left so drastically reduced in circumstances that many became deeply embittered. They we no longer young men. They had lost much, or all, of their personal fortunes. Their decades of effort had amounted to nothing. Furthermore, their popularity as community leaders was in steep decline, particularly among the smaller cattle ranchers, the cowboys (disgruntled over reduced wages), and the newly arrived settlers. Though they still wielded significant political power–cattle remained Wyoming’s only real industry–nonetheless they felt under siege.

In a desperate attempt to reverse their fortunes, a band of these Cheyenne cattlemen made a series of rash decisions. They began to look for scapegoats and for ways to take revenge. They plotted to evict cowboys and homesteaders from the open range, launching what came to be known as the Johnson County War, the most famous of the range wars.’

It all starts when the rich cattlemen lynch a husband and wife settler, who they perceived to be endangering a water supply. 2 of the Cheyenne newspapers promptly endorsed the lynching, while the third had problems with it. Then the owner called the editor and the editor wrote a scathing follow up making all sorts of scurrilous remarks about the lynched couple. All of which just proved which group controlled the newspapers. Having gotten away with one lynching, the cattlemen were emboldened, and thought they could get away with anything. The truth would be hidden until about 20 years ago, when two amateur historians put together detailed documentation revealing the awful truth.

Fake News is not New.

I don’t know whether you saw Ugo Bardi’s current post about Italy, but the government is blaming the gypsies!!! Some things don’t change.

Don Stewart

Hi – again very interesting – and yes some things never change – perhaps like Trump blaming the Democrats for his child separation policy – and – as per you post – the Italian government blaming the Gypsies.

By the way the husband of the my next door arguing couple jumped into his mercedes and drove away at high speed. I’m worried about their children.

As economic pressures start to grow more families will start to suffer financially putting strain on relationships.

Having read another of Gail Tverberg’s posts – she does imagine a steady state economy where we all accept and make do with less.

My fear is the technological innovation could be affected but perhaps a flat economy will act as a spur for original thought to get things moving again. It might also make people think twice about having children limiting population growth.

I’m going to be optimistic and forecast that by 2088 Europe will be energy rich having cracked Nuclear fusion. That’s another 20 years to get it working and 50 years to build all the reactors. A very long lead time as you can see – but I’m trying to be realistic.

The remaining drops of oil will have been left in the ground and all new clean electrically powered industries and clever home 3D printers will produce most things that people need.

The definition of work will have changed with more time being available for family life and study.

Quantum computing will have revolutionised maths – physics and chemistry leading to all sorts of new inventions and materials.

Now the pessimists will insist that this will never happen but we have to have something to look forward to.

What are your thoughts on the chances of this happening?

Donald

I make a point of associating with babies and dogs. They keep me hopeful.

Don Stewart

Thank you – the book looks very interesting and definitely worth a read.

I watched a YouTube video where the accounts of one major fracking company were looked at – and all they’re doing is issuing dety well into the 2020’s to stop themselves going bust. But how will they meet these debt payments? They’re obviously hoping for a bailout similar to the ones the banks received or simply won’t care about any of the investors.

Trump handed out some unbelievable tax breaks to fracking companies which have been greedly gobbled up by ‘not a care in the World’ CEO’s .

Now the debt bubble must burst and when it does it could be worse than 2008

Well as Tim and anyone else who have read my posts know that I have written to my MP who has then forwarded my letter on to the Treasury – but only one reply asking what the acronym EROIE stood for.

https://www.desmogblog.com/2018/04/26/gop-tax-law-bails-out-fracking-companies-debt-eog-hamm

Well apparently we’re not scraping the bottom of the barrel just yet. Looking at the smiling faces it’s BAU.

https://www.theguardian.com/business/2018/jun/22/oil-output-set-to-rise-by-1m-barrels-a-day-in-opec-deal-saudi-energy-minister

My rather extended post dissapeared.

I hope it has appeared now?

Thanks doc, but no. One was waiting for moderation, that one i can see now. The second is lost. I try again later and save it first before posting.

Thanks doc, but no. One was waiting for moderation, that one i can see now. The second is lost. I try again later and save it first before posting.

Moderation

I don’t control all the settings which decide whether a comment appears straight away, or is held for moderation.

It seems, though, that any comment containing one or more links is put into the moderation queue automatically, whereas comments without links usually appear immediately.

Also, any comment by anyone who hasn’t had a comment appear before is held for moderation.

I mention this now because I’m going to be away for a few days. This means that any comments containing links are unlikely to appear until I return. Apologies in advance….

‘I’m going to be away for a few days.’ Tim are you sure you haven’t found a self sufficient community in a remote part of the planet where you’re going to live permanently.

We all know that there’s a huge correction on the way.

I have found such a place, strangely enough, but I’m not off there – yet, anyway! It is self-sufficient not just in energy and water but in cigars and wine – food is abundant, but one would soon become fed up with bananas……

Well sounds like paradise – sadly I don’t think there’s anywhere in the UK where I could go – I’ve often wondered about a remote place in Scotland – but they’ve been afflicted by a plague of midges of Biblical proportions.

A former boss once described the UK to me as “a banana republic without bananas”- it lodged in my memory somehow.

I’ve often wondered if there are midges in the outer Hebrides, or Shetland.

There were in Inveraray, Argyll in early June – perhaps they’ve moved on – but I do know that there are a lot of ticks on some of the Islands. Not ideal for pets – or humans

Chris Martenson from the Peak prosperity website has pointed out another problem we face – concrete reinforced with steel.

Basically the steel rusts and ruins the durability of the concrete which leads to costly repairs. Now it’s not just buildings that use it but one of our hopes for the future – at least some wind turbines are supported on a base made up of reinforced concrete.

So where is the energy going to come from to repair not only buildings but wind turbines?

One of the best-known buildiings constructed with steel rods through concrete is Lloyds – the irony being that, when this centre of world insurance was first completed, nobody would insure it…..

‘Irony’ I’m not sure of that pun was intended. Not seen it go rusty yet – perhaps only its financial foundations.

Pun not intended – shows how much I need some time off.

The big risk problem was lightning strike – all the metal rods would turn into globules, proving no support. So a lightning conductor was the answer. Still, a good anecdote all the same.

Sadly I can’t see any type of lightning conductor saving our economy. The pumping of money into the system has just been deflecting the real problems for a while.

Coda to Johnson County War

The wealthy Cheyenne cattlemen conceived the plan to drive the homesteaders and small ranchers out of the Powder River valley in Wyoming. Among other crimes, they recruited two dozen hired guns in Texas and brought them to Wyoming by train. In all, 50 gunmen set off from Cheyenne toward the town of Buffalo, carrying a list of people to be killed as ‘rustlers’. The list included the newly elected sheriff, who had defeated the long-serving sheriff who was in the pocket of the big ranchers. There was a Cavalry base not far away. The Governor of Wyoming sent word to the Cavalry that there was going to be some action against ‘rustlers’, and not to react to anything they heard.

Things went badly for the 50 gunmen for a variety of reasons. They stopped to kill one of the men on their list, but this single man held off 50 hired guns all night. Two local men came upon the scene, figured out what was going on, and went to Buffalo to raise the alarm about the invasion from the south. The sheriff raised a very large number of men to go and fight the invaders. Meanwhile, the Governor and the two Senators (who were in the pockets of the wealthy ranchers) were alerted that things were not going well. They frantically tried to get the Cavalry to intervene, but messages were slow. The Governor sent word to the President of the US that an insurrection had broken out in Wyoming. But, the President was literally asleep. Finally, the two Senators went to the White House, woke the President up, and he hastily signed the document they had drawn up. Which caused the cavalry to ride up, as in a movie, just at the moment when the 50 gunmen were about to be utterly destroyed. Sadly, the heroic defender who held the gunmen at bay was killed.

And so it became a legal issue. The cattlemen hired a sharp attorney in Cheyenne, who conceived the idea of forcing the small county of Johnson to pay for keeping the prisoners in jail. A little arithmetic showed that the county would soon run out of money and could not prosecute a legal case of this size. With delays and interminable legal maneuvering, the Cheyenne cattlemen got away with pre-meditated murder. One of the Texas gunmen was later hanged for killing his wife, who had nagged him about the killings in Wyoming. On the gallows, he confessed to the premeditated nature of the killings in Wyoming.

The lawyer was placed on the federal Court of Appeals by Theodore Roosevelt, and promoted to the supreme court by President Taft. The lawyer NEVER in his career sided with anyone other than the rich. He was still on the court when Franklin Roosevelt tried to implement the New Deal, and was one of the reasons Roosevelt felt it necessary to ‘pack the court’ with new appointees.

I am not a biographer of Theodore Roosevelt. But it seems to me that he saw two enemies. One was the lower class people who were small farmers and ranchers, and the other was the Trusts, such as the Meatpackers in Chicago and the Railroads and the Standard Oil Company. He saw the big ranchers as the self-made men, or the entrepreneurs from old, respectable families, who had gone out and created something valuable where nothing had existed before. The particular class that Roosevelt favored were, indeed, caught between the immigration of the ‘lower classes’ whose settlement patterns were dooming the open range, and the predatory practices of the Trusts. Roosevelt was not asked to participate in the premeditated murders and the lynchings, but he obviously wasn’t above rewarding the lawyers who made it possible.

One other observation in the book. The actions of the Cheyenne cattlemen are not what our American mythology holds up as ‘good behavior’. But many of these ranchers had deep connections to Scotland and England and Ireland. And ‘clearing out the peasants’ had been a common practice in those countries for a long time. One can see some Scottish investors sitting in a club room in Edinburgh and nonchalantly drafting orders for the ranchers in Cheyenne to ‘clear out the riff-raff’. Especially since their earning had collapsed, by this point.

Don Stewart

Fascinating story especially the snippets about Theodore Roosevelt.

Donald

I just finished reading the book. I recommend it to anyone looking for clues about how the world, and particularly the US and Britain, have got themselves into the situation that Dr. Morgan paints with his dark colors.

*The willingness of Harvard men to engage in lynchings when their wealth is at stake.

*The forging of a certain class consciousness which owed a lot to the clubs of the British Empire

*Economics trumps personality, character, class, etc.

*The role that Theodore Roosevelt played in turning the myth of the cowboy from a dissolute teenager who squandered everything he had in the saloons and brothels of the cowtowns, into a staunch upholder of ‘truth, justice, and the American Way’

*The notion of ‘manifest destiny’ (although the book never uses that term)…which has justified America’s endless wars.

*The role of Roosevelt’s friend the novelist Wister in laying the groundwork for vigilantes and fascism…the stern resolve of the ‘true’ Americans against the ineffectual legal process. I was shocked when I actually watched The Lion King, when my grandchildren were small. How did we get from Thomas Paine to the worship of kings?

*The message that ‘timing is everything’. A few savvy people managed to escape and flourish. And a few cowboys came to their senses, married, and started farming. One wonders whether the ‘spying on people as a way to make a fortune’ theories of Silicon Valley are about to go the way of the Cattle Barons of Cheyenne.

And, on the positive note you desire, the Hollywood ending which currently seems to be supporting Alan Savory’s notions of holistic grazing, against the ‘nattering nabobs of negativity’ in academia. Put David Johnson of New Mexico State together with Savory and maybe we actually can solve the carbon dioxide problem.

Don Stewart

Donald

One more note on myth. Several years ago a local theater group put on a play by Thornton Wilder, written while WWII was in progress. I was shocked that men from the nearby military base were portrayed as threats to everything that civilization stood for…stealing, drinking, fighting, impregnating the local girls, etc.

Immediately after the war, of course, there was a huge change. Our culture disavowed noir cinema (whose message was that ‘we are all complicit in evil’) and the communists who made High Noon were driven out of the industry and out of the United States. High Noon, by the way, displays some of the dynamics referenced in the book. The opening shot is Lee Van Cleef (in real life an accountant, but looking for all the world like a truly bad man) watching as one of the assembling gang comes riding over a hill at a breakneck speed. Now the engineer in you may ask:

Are we supposed to believe that a knowledgable horseman would ride a horse for any distance at such a speed? Especially when there is no time pressure?

And the answer, of course, is both in the book and also in cinematic signaling. In the book, the galloping cowboy symbolizes the utter freedom of the open grasslands. In movie language, the galloping bad man symbolizes to ‘fasten your seatbelts, danger is afoot…and we are about to see a morality tale in which the Good will, certainly, emerge triumphant’.

Another message to ponder about High Noon is the contrast between Gary Cooper in his buggy with his new bride, the virginally white Grace Kelley, who I don’t believe ever rides a horse during the movie. The bad guys are the ones on horseback. Cooper has promised his new bride he will open a retail store in another town. But we also learn that the local Mexican woman has been sexually involved with not only Cooper but also the head Bad Man and also the feckless deputy.

She is an expert business woman, who has loaned money intelligently and is now calling in her chips so she can get out of town before the shootout at high noon.

And the hotel clerk who astonishes Grace Kelley by hoping that Cooper will be killed by the Bad Guy. Why? Because when the Bad Guy was in charge (the Cheyenne Cattlemen?), the town was jumping and people could make money.

Don Stewart

Hi two enjoyable posts. I liked your analysis of High Noon and its relevance to the present day.

I need to read more about Roosevelt and his manipulation of reality regarding cowboys.

Concerning modern day media – its manipulation of reality and selling off of personal data for nefarious uses should have meant that Zuckerberg was sent to prison.

I’ve never really understood why super rich individuals who can’t even spend all the money they have would want more at the expense of individuals. Power ego and control don’t seem enough to me.

Trump will not get reelected because the financial bubble will have burst before 2022 and he and his team will be held responsible. However he will still try and blame Clinton.

Adding complexity solves nothing in this case.

Lies and damned lies. I wonder how much longer the fracking con can go on – the Wolf of Wall Street must be selling the debt to stupid investors –

http://resourceinsights.blogspot.com/2018/06/opec-production-increase-shows-its.html

https://www.theguardian.com/us-news/2018/jun/26/democrats-primaries-upset-joe-crowley-alexandria-osacio-cortez

Interesting – a socialist winning a seat in NY – Trump no doubt will start a propaganda offensive.

Constructal Law view of these issues

https://constructal.org/2018/06/16/social-organization-emerges-by-physics/#comments

The full article is behind a paywall. However, you can get the gist of the argument from the graphic. The argument is that, over time, a society will evolve to use more power to move an increasing amount of mass. The organization of the society likewise reflects the increasing use of power and the increase in mass moved.

Adrian Bejan, the Duke University professor who invented the notion of the Constructal Law, argues that humanity never takes permanent steps backward. There are short-term setbacks, but the long term is always upward. My guess is that Dr. Morgan thinks humanity may be about to experience a setback equivalent to what happened when the Bronze Age gave way to the Iron Age. If we follow the graphic backward, we find devolution from the global to the national….which is consistent with Brexit and Italy and Trump’s trade wars. If one thinks that graphene and fusion are going to open new vistas with ever more power, then I suppose something beyond the communications revolution will reveal itself.

The Constructal Law, in Bejan’s hands, is able to make some intricate predictions, such as the evolution of cooling designs for electronic circuits, the number of tributaries in a river basin, and the design of urban streets as transportation changes from walking through horse drawn vehicles to automobiles.

Don Stewart

‘If one thinks that graphene and fusion are going to open new vistas with ever more power, then I suppose something beyond the communications revolution will reveal itself’

In other words Don you don’t think this is going to happen.

Donald

I honestly don’t know about them.

7 years ago Tim Lenton and Andrew Watson published Revolutions That Made the Earth. Their story is one of biology doing essentially the same thing as the picture portrayed in the Bejan diagram…from fermentation to photosynthesis and on through symbiotic relationships. When they wrote the book, Lenton and Watson thought that there is such an unimaginable amount of energy floating around that surely the innovations would continue and there would be no shortage of energy. Whether they still think that, and whether they think the process would be smooth or jagged, I don’t know.

What I see happening in the 21st century is more consistent with Dr. Morgan’s ‘rising energy cost of energy’ scenario. Whether some deus ex machina is about to be revealed is beyond my pay grade to predict.

Don Stewart

Thanks – I understand now.

Reblogged this on MUSO MUSINGS ON FATHERHOOD THEORY AND STUFF and commented:

https://www.bloomberg.com/news/articles/2018-06-27/from-goldman-to-deutsche-bank-what-to-watch-for-in-stress-tests One to Watch

Can large U.S. banks hand $170 billion to their shareholders in the next 12 months? Will a top European investment bank botch the first public stress test of its entire U.S. business?

The Federal Reserve will answer those questions and more when it posts results from the second and final stage of its 2018 stress test Thursday at 4:30 p.m. While investors got hints during the first stage last week, the central bank has repeatedly found ways to surprise in past reviews of banks’ risk management and proposed cash payouts. #ConquestofDough

https://www.bloomberg.com/news/articles/2018-06-27/from-goldman-to-deutsche-bank-what-to-watch-for-in-stress-tests One to Watch

Can large U.S. banks hand $170 billion to their shareholders in the next 12 months? Will a top European investment bank botch the first public stress test of its entire U.S. business?

The Federal Reserve will answer those questions and more when it posts results from the second and final stage of its 2018 stress test Thursday at 4:30 p.m. While investors got hints during the first stage last week, the central bank has repeatedly found ways to surprise in past reviews of banks’ risk management and proposed cash payouts.

Great Article, I particularly liked the explanation of ECOE

“Because the world economy is a closed system, ECoE is not directly analogous to ‘cost’ in the usual financial sense. Rather, it is an economic rent, limiting the choice we exercise over any given quantity of energy. If we have 100 units of energy, and the ECoE is 5%, we exercise choice (or ‘discretion’) over 95 units. If ECoE rises to 10%, we now have discretion over only 90 units, even though the gross amount remains 100.”

One great question ( Big, Inponerable) not I am asking a great question, Is, To what extent are different energy solutions Mutually exclusive? That is, If you choose one then, you can not have the other.