WHAT HAPPENS NEXT?

Introduction

Sometimes, articles can be hard to put together because one has too little information. At other times, the challenge is the opposite one, the problem being to condense an abundance of information into something shorter than War and Peace. What follows falls into the latter category.

At an earlier stage in the crisis caused by the coronavirus pandemic, variables and possible permutations far outnumbered clear points of reference. This is no longer the case, and much of the time since the previous article has been spent refining the SEEDS economic model, and casting the multiplicity of its conclusions into a brief and logical sequence.

The first take-away here is that no amount of financial gimmickry can much extend our long-standing denial over the ending of growth in prosperity. The energy dynamic which drives the economy has passed a climacteric. The pandemic crisis may have anticipated this inflexion-point, and to some extent disguised it, but the coronavirus hasn’t changed the fundamentals of energy and the economy.

The second is that the downtrend is going to squeeze the prosperity of the average person in ways that are likely to be exacerbated by governments’ inability to understand the situation, and to adjust taxation and spending accordingly.

Third, this squeeze on household disposable prosperity is going to (a) have severely adverse effects on discretionary (non-essential) consumer spending, and (b) put at risk many of the forward income streams (mortgages, rents, credit, stage payments, subscriptions) that form the basis of far too many corporate plans, and have been capitalized into far too many traded assets.

Barring short-lived exercises in outright monetary recklessness, most discretionary sectors are set to shrink, and asset prices (including equities and properties) are poised for a sharp correction.

It is, after all, hard to sustain a high valuation on the shares of a company whose business has slumped, to buttress the market in homes whose prices far exceed impaired affordability, or to shore up the price of capitalized forward income streams that are in the process of failure.

Finally, economic concerns are set to dominate voters’ priorities, displacing non-economic issues from the top of the agenda. Calls for economic redress – including redistribution, and, in some areas, nationalization – are set to return to the foreground in ways to which a whole generation of political leaders may be unable to adapt.

“Faith in the middle” – all bets lost

Spectator sport has been one of the more prominent victims of the coronavirus crisis, but let’s imagine that we’re listening in to a conversation between rival fans ahead of a hotly-contested fixture. Supporters of the home team are sure their heroes will inflict a massive defeat on their opponents. Followers of the visiting club are equally certain of a stunning victory.

The outcome, as often as not, is a low-scoring draw.

This is a useful analogy for our current economic and broader predicament. One side of an intensively-polarized debate pins its faith in the restoration of normality, or even of a sort of ‘super-normality’. The other is equally certain of catastrophic collapse.

What actually happens is likely to be ‘neither of the above’.

That, certainly, is the view here, and it’s reinforced by economic modelling based on the understanding that the economy is an energy system, and is not – as established conventions so mistakenly insist – a financial one.

The conclusions of the SEEDS model form the subject of this discussion.

Where economic output is concerned, SEEDS warns that there can be no return to the rates of growth reported before the coronavirus crisis, with the proviso that a very large proportion of that pre-2020 “growth” was, in any case, illusory. After a period of ‘normalization’ that will fall a long way short of the mythical “V-shaped recovery”, rates of increase in output will fade (see fig. 1), falling below those at which population numbers are expected to carry on increasing.

Continuing rises in ECoE (the Energy Cost of Energy) will amplify these trends where prosperity itself is concerned.

As remarked earlier, the predicament of the ‘average’ person in this deteriorating economy is likely to be made worse by governments’ failure to understand what’s happening, and to scale back their tax and spending plans accordingly. Meanwhile, we seem likely to be at or near that point of credit exhaustion after which we cannot continue to manipulate reported “growth” – or to shore up consumer discretionary expenditure – by injecting ever more debt into the system.

These trends point unequivocally towards declining discretionary (non-essential) expenditures by consumers, with businesses similarly focused on cost-control. It also implies a decay, and in some cases a failure, of many of the income streams on which so many corporate business plans, and so much capital valuation, now depend.

Reverting to our sporting analogy, an outcome which favours neither of the extremes results in the loss of any bets placed by either side. This applies to the economy, too, where a wide range of financial and non-financial wagers – placed by governments and politicians, investors, businesses and campaigners for various causes – will be lost.

Fig. 1

Dwindling output………..

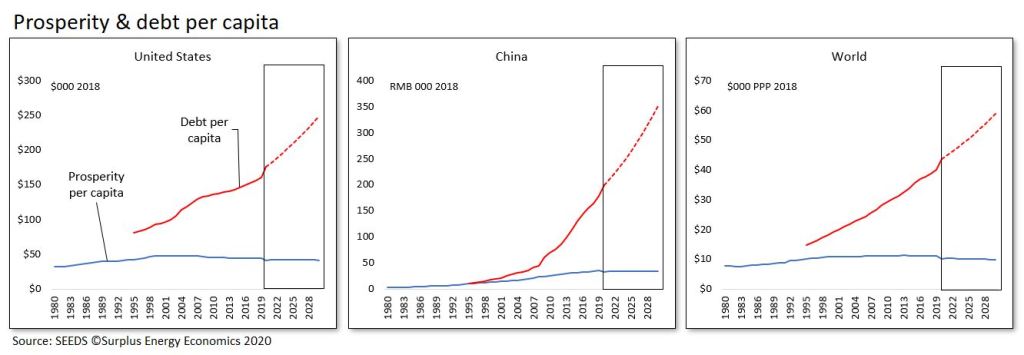

Over the period between 1999 and 2019, World economic output – reported as GDP, and stated here at constant values on the PPP (purchasing power parity) convention – averaged 3.2%, for a total increase of 95%, or $64.5 trillion. During this same period, however, annual borrowing, expressed as a percentage of GDP, averaged 9.6%, with total debt expanding by $193tn, or 177%, between 1999 ($109tn) and 2019 ($302tn).

Another way of putting this is that each dollar of reported “growth” was accompanied by $3 of net new debt. Even this comparison understates the gravity of the situation, in that it does not include huge increases in pension and other commitments over two decades, with the overall situation worsening markedly after the 2008 global financial crisis (GFC).

You wouldn’t be too far off the mark if you concluded that, at the time that the crisis struck, each growth dollar was being ‘bought’ with at least $5 of new ‘hostages to futurity’.

What this in turn means is that most – according to SEEDS, 64% – of all “growth” in the World economy reported over that twenty-year period has been illusory. This is “growth” that would reverse if we ever tried to unwind prior expansions in debt and other financial commitments. More realistically, were we to stop all net new borrowing, growth would fall to no more than 1.5%, and to a lower level still were we also to cease adding to pension and other unfunded promises.

Anyone surprised by this might usefully consider two questions. First, what would happen to rates of reported growth if annual net borrowing (last year, just over $13tn, or 10.3% of GDP) fell to zero?

Second, what would happen to GDP itself, if we tried to pay down the $111tn of net debt taken on over the past decade?

The SEEDS model strips out this ‘credit effect’ to identify rates of change in underlying or ‘clean’ output, known here as C-GDP. This metric grew at annual rates averaging only 1.5% (rather than 3.2%) between 1999 and 2019 (see fig. 2).

Moreover, as you’ll see if you refer back to fig. 1, this rate of growth has been fading, and stood at just 1.2% last year. Current SEEDS projections are that growth in C-GDP will taper off, ceasing by the early 2030s, after which it can be expected to go into reverse.

Needless to say, the immediate crisis is going to create negative growth in economic output, to be followed, according to most projections, by some kind of a recovery when (although some pessimists might say ‘if’) the pandemic is brought under control.

The consensus view, which anticipates a fall of -4.6% in GDP in 2020, and rebound of +5.1% next year, already looks far too optimistic. The SEEDS projection is that clean output (C-GDP) will decline by -7.2% this year, and grow by about +3% in 2021. Again, both of these projections may turn out to have been unduly bullish.

Here’s the big difference, though.

Where the consensus sees World GDP higher by 16% in 2025 than it was in 2019, SEEDS projections show no overall growth at all in C-GDP during that period.

Fig. 2

…… and rising ECoEs squeeze prosperity…..

If you’re familiar with the energy basis of the economy, you’ll know that the generation of economic value from the use of energy is only one half of the equation which determines prosperity. The other side is the Energy Cost of Energy (ECoE). This is the proportion, within any quantity of energy accessed for our use, that is consumed in the access process, and therefore is not available for any other economic purpose.

Though it’s ignored by conventional interpretation, the relentless rise in trend ECoEs is the factor that has undermined, and has increasingly eliminated, the scope for growth in global prosperity.

As ECoEs rise, economies reach an inflexion-point after which prior growth in prosperity goes into reverse. The stage at which this happens varies between countries, affecting highly-complex, high-maintenance economies first. In the United States, for example, prosperity growth went into reverse at a trend ECoE of 4.5%, with the same happening to almost all of the Western advanced economies at ECoEs of between 3.5% and 5.0%.

Less complex emerging market (EM) economies enjoy greater ECoE-resilience, and can continue to grow prosperity per capita up to ECoEs of between 8.0% and 10.0%. The coronavirus crisis is likely to have brought forward the inflexion-point in China, at an ECoE of 8.2%, but this climacteric was due to be reached in the next year or two anyway. This is why reported “growth” in China has become ever more dependent on extraordinarily high levels of net borrowing.

This is illustrated in fig. 3, which compares ECoE trends with prosperity inflexion-points for China and the United States. As you can see, the relentless rise in the ECoEs of fossil fuels have pushed the overall curve sharply upwards, and the development of renewable energy (RE) sources, though essential, is most unlikely to do more than moderate the upwards trend.

Additionally, the economy has now reached the point at which rising ECoEs affect the availability of energy itself, trapping producers between the Scylla of rising costs and the Charybdis of diminishing consumer affordability.

Fig. 3

…..and taxation tightens the screw

As we’ve seen, prosperity per capita has turned down because of a combination of decelerating economic output, rising ECoEs and a continuing increase in the numbers of people between whom surplus energy value is shared. A weakening in energy supply volumes can be expected to add another twist to this deteriorating equation.

Where consumers are concerned, the adverse effects of this process are likely to be exacerbated by a rise in the proportion of prosperity taken in tax. Governments’ failure to understand the energy basis of economic activity lead them to measure the affordability of taxation against GDP.

On this conventional basis, the incidence of taxation worldwide has hardly varied at all over the past twenty years, remaining at or very close to 31% between 1999 and 2019. Unfortunately, and as we ‘ve seen, GDP has become an ever less meaningful measure of the value of economic output over time.

What this in turn means is that the incidence of taxation, when measured against prosperity, has risen relentlessly, from a global average of 32% in 1999 to 49% in 2019. On current projections, this is set to rise to 56% by 2025.

This is illustrated in fig. 4, which compares the per capita averages of prosperity and tax for the United States (where taxation is comparatively low), and of more highly-taxed France, with the global equivalents.

SEEDS analysis indicates that taxation absorbed 67% of French prosperity last year, compared with 53% back in 2004. For the average French citizen, this means that a comparatively modest decline of 6.2% (€1,910) in his or her overall prosperity has been exacerbated by a €3,010 increase in taxation, leaving disposable (“left in your pocket”) prosperity 34% (€4,920) lower in 2019 than it was in 2004.

Fig. 4

Discretionary spending falls, income streams fail

France, of course, is something of an extreme case, but the general tendency has been for rising taxation to magnify prosperity deterioration into a markedly more severe squeeze at the level of disposable prosperity.

For planners in government and business – and, of course, for individuals – this leveraged equation is central to much that is likely to happen in the coming years.

This can best be understood if we look at things from the perspective of the average or ‘ordinary’ person or household. He or she will experience falling prosperity, an observation for which, long before the coronavirus crisis, there has been steadily accumulating corroborative evidence. People in a growing number of countries know that their material circumstances are deteriorating, and are increasingly (and rightly) ignoring official statements and statistics which try to assert the contrary point of view.

As prosperity erodes, and as the proportion taken in tax increases, our ‘ordinary’ person is likely to turn both economically cautious and politically discontented. He or she will become increasingly unwilling to take on yet more credit, almost irrespective of the cost of debt. Essential purchases must carry on, of course, but scope for discretionary (non-essential) expenditure will deteriorate sharply.

Over time, increasing numbers of households are likely to struggle to keep up with the numerous financial demands that the system now makes on them, demands which have long since gone beyond mortgages, rent and utility bills to include subscriptions, staged purchases, the leasing of things which would hitherto have been bought outright, and credit taken on for a multiplicity of purposes including vehicle purchase and education costs.

This enables us to summarise three of the more direct and immediate implications of de-growth.

First, there will be adverse consequences for any business supplying discretionary purchases. We’ve been seeing a foretaste of this since 2018, with downturns in the sales of everything from cars to smartphones. The discretionary category doesn’t just apply to goods, of course, and service sectors particularly exposed include travel, leisure and hospitality. Just as households scale back non-essential spending, businesses are likely to trim discretionary outgoings such as advertising and outsourcing.

Second, the increasing strain on household budgets is going to put income streams at risk. This is extremely important, for two main reasons. One of these is the expanded prevalence of sales techniques which cultivate streams of income in preference to outright purchases, whether by consumers or by business customers. The other is the capitalization of income streams, a process pioneered by the securitization of future mortgage payments. A significant part of the capital markets now consists of capitalized streams of income linked to everything from car purchase and higher education to the supply of gadgets and domestic appliances.

Third, the public is likely to become increasingly focused on economic issues, demanding, not just lower taxation but pro-active measures to bolster household circumstances. We should anticipate growing pressure for nationalization (notably of utilities), combined with calls for greater redistribution from ‘the rich’ to the ‘ordinary’ voter.

For government, business and investors, this poses challenges that have, in many instances, yet to appear on the ‘radar’ of forward planning.

Governments, whilst unwilling to scale back their activities to affordable levels, will nevertheless find that their scope for expenditure falls a long way short of previous expectations.

At the same time, the priorities of the public can be expected to undergo a sea-change, swinging resolutely towards the economic. As a result, many of the cherished ambitions of policymakers will become of diminished importance to the voters, just as they become ever less affordable.

Fig. 5

Well done, again, Dr Tim – what you say here is well underway in the UK, in my experience.

The point about income streams can be reversed – pensioners rely on income streams – and this has fast become the most challenging part of my professional life. DB (“final salary”) pensions are under severe strain, DC (“money purchase”) pensions throw the members onto the vagaries of the bond and equity markets, annuity rates are just off 300-year lows. A 65 year old spending £100,000 of their pension on a fixed lifetime annuity will receive, at best, 4.95% income (Source: “The Exchange” 30/10/20), NS&I (government-backed deposits) rates have been slashed to 0.01%.

A decade of pensioner poverty looms, and that is setting aside those forced to “cash-in” their pension funds to service personal debt liabilities. Insolvencies will rise fast in 2021 and a banking crisis isn’t far away, either (debt payment deferral is crippling them).

Will we end up with “universal basic income” by mistake?

Sets the stage well, Dr. Tim. And Mark’s comment rings true as well. What immediately comes to mind is a ramp up of money printing. Throughout history, many governments desperate to stay in power have resorted to that. Calling it MMT doesn’t change the reality. Printing more than the units destroyed by bankruptcies and defaults can lead to inflation and loss off confidence in the currency particularly by those outside the nation. And a structure of distribution needs to satisfy the vast majority, or exacerbate unrest which will likely already be heightened. A new version of beggar thy neighbor seems likely as well.

You are very correct

Mark, Steven – thanks.

My aim here was to set the scene for issues we can move on to in future discussions.

Analysis is now making things a lot clearer than they used to be, even though the pandemic situation remains anything but clear.

My problem with this one has been ‘too much information’!

Beyond deteriorating prosperity, three conclusions seemed to ‘leap out of’ the model:

– Discretionary sectors are going to get hammered

– This effect, plus failure of income streams, is going to shock capital markets

– Governments don’t understand what’s coming

I might move on to individual countries next.

With “Brexit” so topical, UK vs France vs Ireland is a tempting article…………..

Thanks Tim for another excellent summary of our unfolding predicaments. Here in Ireland we seem to have our fingers firmly plugged in our ears to drown out the mounting crescendo of consequences bearing down on us as we bunker down for another lockdown. Looking forward to your insightful analysis of our particular version of the gathering storm.

Tim’s article ‘nails it’ for me. Given the current state of play the mainstream politicians can’t help us, and very few people seem to want to help themselves. In fact many if not most of my friends refuse to entertain the idea that the years of great economic growth have gone. Their ‘solution’ seems to be an unshakable belief in BAU by stopping using plastic carrier bags, moving towards buying an EV and running their laptop from ‘green energy’. I’m not sure that I grasp fully what de-growth means in reality but I’m pretty certain – in fact I’m absolutely convinced – that a great deal of weeping and wailing and gnashing of teeth lays ahead of us.

Reading this now from Richard Heinberg and David Fridley from Post Carbon Institute. $48 trillion? On top of what the banking cartel wants back!

https://ourrenewablefuture.org/chapter-6/

Because oil is economically crucial and hard to replace, and because oil is leading the EROEI decline of fossil fuels, more and more energy investment capital will have to go toward maintaining essential existing oil-based energy usage systems, just as massive new investment is needed for renewable energy capacity, energy storage, and grid upgrades. The ballooning need for new investment just for current systems is confirmed (but probably seriously underestimated) in the 2014 International Energy Agency World Energy Investment Outlook report, which concludes that “meeting the world’s growing need for [mostly fossil] energy will require more than $48 trillion in investment over the period to 2035.”[39]

@KevinC,

I have had the same experience with my friends and family back in Germany. Life over there is quite good, and until Corona hit, nobody could imagine a slowing economy. I have been an open critic of their energy policy, ( infantile ) and have tried in vain to explain to them that BAU is over. Not just for the rest of the world, but for Germany too. Denial was the only response.

I spend a lot of time going over what “De-growth” actually means, simply because it is very relevant to my lifestyle over the coming 20yrs.

As you say, there will be “a great deal of weeping and wailing and gnashing of teeth”, but that will be predominantly from our Snowflake generation.

Others of a more pragmatic, and dare I say brutal nature, will resort to violence to essentially take what they need from others.

Countries like Germany which over the last few years have taken in many immigrants from war-torn regions, primarily able-bodied young men,( and not women and children as reported ) will find that these people will have no problem in reverting back to their survivalist instincts.

So as I see it, we are looking at a future of chaos and of significantly greater violence.

De-growth is not only going to be uncomfortable for the bulk of the population, in many cases it is going to be absolutely deadly.

Thanks Kevin, you are too kind.

Earlier this year, just before Covid really struck, we were discussing the ‘anatomy of de-growth’, and I think we had the processses pretty well defined – ‘decomplexity’, ‘de-layering’, ‘simplification’, ‘utilization losses’, ‘critical mass failures’, and so on.

But all that economic modelling and interpretation can do is to define situations. A ‘situation’ is something with multiple possible outcomes. It’s decision-making that turns situations into outcomes.

This is where the coronavirus crisis is particularly disturbing. Far too many countries have failed the test of handling a serious crisis – and if they fail the ‘covid leadership test’, how are they going to tackle de-growth, especially when most of them don’t understand how the economy actually works, and are in deep denial about current realities?

Dr. Morgan

From above: “The SEEDS model strips out this ‘credit effect’ to identify rates of change in underlying or ‘clean’ output, known here as C-GDP. This metric grew at annual rates averaging only 1.5% (rather than 3.2%) between 1999 and 2019 (see fig. 2).

Moreover, as you’ll see if you refer back to fig. 1, this rate of growth has been fading, and stood at just 1.2% last year. Current SEEDS projections are that growth in C-GDP will taper off, ceasing by the early 2030s, after which it can be expected to go into reverse.”

In the past, GDP/growth has been highly correlated with Oil production. A few informed folks have suggested that November 2018 production of 84.5 million barrels per day may turn out to be the peak in Global Oil Production (All liquids.) IF that turns out to be correct, then perhaps there will be no GDP growth going forward, except attempts to return to a pre-COVID world and to November 2018 oil production levels, through additional financial stimulus and possibly nationalization of oil production. I am assuming here that it is the rising ECoEs that will prevent a return to 2018 oil production levels. (There is some slack in the oil production system and reserve utilization, for example Libya, Iran, I suppose Venezuela, etc., no doubt some other informed folks think that this is where additional volume above the 2018 levels may come from.)

My main point above is that we could actually be at the no global growth/permanent degrowth point now, and not till the early 2030’s?

Regards

Shawn,

There is currently little new upstream investment in oil. Most headlines are how the IOCs reduce their workforce and borrow money to keep that unsustainable dividend a little longer – not “growth and the shale miracle” as it was a few years ago.

Look at this figure from IEAs latest world energy outlook (https://www.iea.org/data-and-statistics/charts/global-oil-demand-by-scenario-between-2010-and-2040-and-declines-in-supply-from-2019), it shows how much new capacity that is needed up to 2040 in a BAU scenario (and their sustainable transition scenario). I guess we are in the purple zone due to current investment levels. Venezuela will not comeback any time soon. Iran and some others (Libya) will probably but that is hardly likely to be sufficient in the medium/long term.

I think I needed to be a bit clearer about the processes and time-scales.

C-GDP measures economic output (stripped of the credit effect), but we then need to go through two more stages:

– Deduct ECoE from economic output

– Divide what remains – aggregate prosperity – between the projected number of people in the population

So:

1. C-GDP, hardly growing at all even now, stops growing by the early 2030s

2. Earlier than that, with ECoE rising, aggregate prosperity turns down, say mid-2020s

3. But prosperity per capita has already turned down

Back to Basics

An article dealing with the virus and the debate between the right wing and the bulk of scientists in the United States will illustrate one point I would like to make:

https://thetyee.ca/Analysis/2020/10/28/Herd-Immunity-Inviting-Idea-Terrible-Policy/?

Now, I agree with the Right that a lot of deaths we are counting as ‘Covid 19′ deaths are actually a cumulative effect of people being generally unhealthy to begin with. I have previously expressed dissatisfaction with our practice of forcing statistics to fit the unrealistic model that a death must necessarily be traced to a single ’cause’.

But what I will point out is that the Snow memorandum is the first time I have seen a large body of scientists step up and point out just how sickly our populations have become and how a sickly population is not reconcilable with a ‘herd immunity’ strategy…unless one becomes a ‘survival of the fittest’ advocate (like Mussolini) or else just realizes that that is what is going to happen regardless. But even those scientists who sign on to the Snow memorandum are reluctant to bite the hands that feed them in the form of the dysfunctional GDP which fosters the disease states and also provides funding for faux scientific research.

Similarly, studies like Dr. Morgan’s, which point out that we cannot borrow our way to prosperity also invite us to look under the hood at the kind of world we really want. Whether our society will be able to step back from the edge of the cliff and actually think through our situation remains to be seen.

Don Stewart

@Red

I made this comment on the previous post, but I am not sure it made it under the wire for timely comments. IF the world decided to follow Steve from Virginia’s advice and simply outlaw private automobiles, then what would we do with the gasoline component of crude oil? And part of the answer may be ‘flexible fuel’ machines. See this, for example:

https://www.motorship.com/news101/ships-and-shipyards/tanker-series-denotes-bold-russian-outlook

The Russians are beginning to use natural gas fueled tankers to transport crude oil. Since the energy density of gasoline is higher than the energy density of natural gas, I would expect that clever engineers could also build ships that could run on gasoline. In the past, the question was: “How can we maximize profits from the various components in abundant crude oil?”. The new question may be “How can we continue to use the valuable energy density in the remaining crude oil to maximize the transportation benefits that energy facilitates?” The answer to the second question is likely not the same as the answer to the first question…which was to sell gasoline for light duty vehicles and diesel for heavy duty vehicles. However, changing to new flexible fuel engines does require capital expenditures and perhaps may need to be coupled with favorable laws. I know a lot of people hate the very idea, but it might require some international agreements.

Don Stewart

@ Don S.

A good start yes? As far as “outlawing” private transport, it is already happening with the removal of the ICE vehicles by laws regarding their manufacture and use in certain areas and countries by x date, https://www.weforum.org/agenda/2017/09/countries-are-announcing-plans-to-phase-out-petrol-and-diesel-cars-is-yours-on-the-list/

The UK moved their date up already from 2040 to 2035. As fuel becomes scarcer the value of these ships will increase and can probably be converted to use a gas and LNG mix. The amount of goods being traded will be contracting as well, so smaller ships will also help with this. After reading the above book which was published in ’16 I’m left wondering how much would change if it were to be written since the “new normal” has been dropped on the human world? Never forget the global MIC as it cannot function without FF’s and it has a use for most all the products of FF’s. Also of note my experience with two stroke engines is they require an injection of lubricant with the fuel in order to keep it from seizing. Their life span is also shorter due to the higher rpm at which they run. I couldn’t find if these issues have been over come. Probably corporate secrets if so. Still all in all a good start!?

Reading through the dire numbers in the higher education sector presented today makes one wonder – who’s going to be eating cat food in retirement?

“The IFS annual report on education spending says there will be funding shortfalls in colleges and universities, where the pension deficit has increased from £3.6bn in March 2018 to an estimated £21.5bn last August.”

….. “Researchers say there will be mounting long-term costs for the government, with a predicted £12bn shortfall in student loan repayments as graduates struggle to find work in a labour market devastated by the pandemic. ”

https://www.theguardian.com/education/2020/nov/03/universities-face-funding-shortfall-caused-by-covid-and-pensions-says-ifs

What a complete mess – that’s only going to get a lot worse.

I can’t comment on this particular case, but gigantic pension gaps have emerged, especially since 2008. The World Economic Forum has called this a “global pension timebomb”.

One factor here is the crushing of returns on invested funds, thanks to ZIRP.

Whoever would have thought that ZIRP would have this effect on pension provision?

Well, not those in charge, that’s for sure. Frankly, I sometimes get angry over the shockingly low calibre of decisions and decision-makers. Since you raise a UK-related question, today’s newspapers show airports, not just still open (surely absurd, in these circumstances), but thronged with queues of people wanting to travel to other destinations.

And it’s not only pensions (whose benefits were based on absurd long term projections of circa 7% regular annual returns) that are getting crushed by ZIRP – but life assurers too.

A gamut of policy types, including whole life and term plans, are destined to fail to provide the ongoing levels of cover that their hapless policyholders have been led to believe they (or their beneficiaries) will benefit from. They too base their ability to provide cover on absurd 7% regular returns on underlying investments.

In fact, when one considers the impending inevitable and enormous commercial property write-downs in major city centers we shall see shocking failures across the entire life assurance industry.

Think of the Equitable Life debacle times 100.

Watch out below!

Tim, I agree with you about airports in the abstract but you can hardly blame people for wanting to escape the Johnsonian Madhouse, where the lives and livelihoods of millions of otherwise healthy people are to be trashed because of a disease with a 0.5% fatality rate, mainly among the over-eighties. The public sector is of course exempted from this scorched earth policy. I have just returned from two weeks in Germany and, despite German restrictions, thought about going straight back, but for various reasons decided not to. It is still possible to enter Germany if you take a Covid test when you arrive and test negative.

Understood, though I’d say that Britain had become a madhouse long, long before Mr Johnson.

Tim, perhaps you will allow me a moment of ‘madness’ to ‘lighten’ the mood for just a brief moment by posting a letter that I am sending to the local newspaper:

Recently a number of national commentators have been expressing concern about the level of the national debt. A solution is to hand – the Big Silver Coin.

Chancellor Sunak instructs Royal Mint to produce a Big Silver Coin with a face denomination of £500tn (Five Hundred Trillion Pounds). They give the coin an extra special polish to make it look nice, and take it to H.M Treasury who say ‘Thank you’.

The staff at the Treasury load the coin into back of a limousine and drive to Threadneedle Street where they hand the coin to the Governor of the Bank of England. The Governor thanks them and then says ‘Hang on a minute, I’ve got something for you’ and he disappears into the vault. A few minutes later he returns carrying bags of money containing £500tn Pound coins (manufactured by Royal Mint). He gives the bags to the staff from the Treasury, who thank him, and they load the bags into the back of their limousine and drive straight to Number 11, Downing Street. They hand-over the bags to Chancellor Sunak who stacks them neatly in the hallway ready for paying the country’s creditors.

The key to making the ‘idea’ work is really simply – everyone has to believe that the Big Silver Coin is worth £500tn, and the Pound coins in the hallway at No11 have real value.

The notion of absurd, collective delusion is nothing new – it was foretold in the story of ‘The King’s New Clothes’, and the film ‘The Wizard of Oz’.

You may think I’m making this up, but money is a social construct that has value only because we all agree that it does! And, if you’re thinking that we’re no longer in Kansas, you may be right.

Money has no instrinsic worth – it commands value only as a ‘claim’ on goods and services. These in turn are products of the use of energy, so money is, in reality, a claim on energy.

Debt, as a ‘claim on future money’, is therefore ‘a claim on future energy‘. Logically, a debt-based monetary system fails if and when energy becomes insufficient to meet those future claims.

The Trillion Dollar coin is an old, albeit recent, proposal!

https://en.wikipedia.org/wiki/Trillion-dollar_coin

Tim – I challenge your definition of debt for the simple reason that there are a myriad of ways to release it.

Default on it, hyperinflate it away, trade it, repackage it, forgive it, refinance it.

Unlike energy, and just like money, debt’s not real. It’s a fabrication, a mental construct.

And its role, like many of our economic constructs, is to convince people to *do things*. To dig minerals out of the earth, to build houses, to invent. It’s a psychology game. When it stops convincing people to doing things, that’s a failure, but “claims on future money” won’t do that, that I can see. Nobody cares.

Greg:

This is a perennial topic of debate! Here, it probably deserves an article to itself.

There’s a widespread view, mistaken in my opinion, that debt somehow ‘doesn’t matter’ all that much. This view was prevalent in the ten years or so before 2008, which didn’t end well, and even more so since, which isn’t likely to end well either.

Ultimately, one person’s debt is another’s asset. We can always renege on debts, in either ‘hard’ (default) or ‘soft’ (inflation) ways. But this destroys value for the lender. To this extent, this process merely transfers value (‘claim’) from one person to another. (Ultimately, though, either course can undermine trust in money).

My main interest is in how debt escalation inflates GDP artificially.

On the people who are not yet already poor being now forced to crash into reality, there is still quite a buffer of waste in most middle-class western societies. My peers in good jobs still go on 2 annual family holidays costing the average annual UK salary, have multiple cars for their households, more clothes than they can recognise, all the toys they want regardless of their own ages or the expense and see hidden costs (exploitative poverty pains of others, cumulative and exponential environmental destruction) as the problems of tomorrow which don’t/wont affect them anyway.

Those now struggling in certain areas of their lives find reassurance in believing it’s surely only temporary and borrow the difference to maintain their former standards of living, while those now reduced to poverty hide it for shame vis-a-vis their former peers. Our culture’s victim-blaming ensures the losers accept it’s their fault they have fallen, so there’s no unity and denial prevails. Those feeling the pain become embittered and the anger resulting fuels the rise of ever-more extreme populists who fast-forward the destruction.

So for the average person still in a middle-class existence, there is a margin of waste they can cut out to break the fall in reaching a sustainable lifestyle. Looking outside my window right now, I see that most people don’t really need more than one car, exotic plants from garden centers, poorer people to wash their windows while they get obese from lack of daily physical activity, a multitude of pets, etc., etc. Similarly, the biggest bills here can be reduced quite a bit without damage to health, like council tax reductions from not having govt. tractors mowing kerbside public strips of grass, vanity projects and unnecessary construction like traffic lights in the middle of nowhere or streetlights on all night. Home power bills are huge, while people wont simply wear another layer, water bills too, while ample rainwater is wasted, people watch tv as long as they sleep in a day, yet order takeaway food rather than cook from scratch.

History shows, in turbulent times violence and chaos escalate and survivors will be in the few areas where wise leadership combined with unity of the general populace exist or arise. They will have a massive advantage over the rest mostly due to the rest self-destructing, rather than using their advantage to subjugate. As wise generals know, why interfere if your enemies are already doing your job for you well enough? Just be grateful and keep your head even whilst others lose theirs.

I just found this Don: https://www.wingd.com/en/engines/engine-types/x-df-dual-fuel/x92df/ shouldn’t take me more than a couple of months to sort through this. Looks very informative to start.

This, yesterday, from Dr. Nate Hagens. A very good short read. It is mostly U.S.A centric, with perspective on our election today in the context of the bigger picture of energy, environment, etc. https://www.energyandourfuture.org/2020/11/02/no-matter-who-wins/

“In aggregate, US production is so far down -2.28 mmbpd from a 2019 high of monthly average of 12.86 mmbpd. Assuming rig counts and prices stay roughly where they are (and with no stimulus they may get worse), this implies a level of about 7 mmbpd by mid 2021 – nearly a 50% drop. Globally, the reduction in travel, leisure and transport due to COVID effectively squeezed upstream investment- we are down to 72.8 mb of crude and condensate from 84.6 in November 2018, -which date is highly likely to be the all time peak in global production.”

“If governments guarantee high prices to oil companies, or there are other incentives, production might be higher than indicated here – but here is a glaring statistic – if we were to stop drilling in USA entirely we would lose around 40% of our entire oil production in 1 year – we have to keep investing/drilling in more difficult and costly spots to avoid such a decline. (the 1 year decline rates are: Texas 40%, ND is 52%, Oklahoma 50%, GOM/deepwater 32% New Mexico 45% – these 5 regions are 80% of US production).”

“No matter who wins the election, US oil production has peaked – again -and this time including the tight oil provinces – from the ‘source rock’. This will have….large long term consequences, whether one is left, right or libertarian.”

The rig count estimates above are from Art Berman. In a question to the comments section of his web site, I asked Art Berman if he thought the U.S.A. could replace the 6-7 mmbpd decline with purchases on world markets. He replied he did not know.

Even assuming the U.S. (oil refineries?) can dramatically increase their oil imports, the implications for the U.S. would seem to be profound. The myth of U.S. energy independence would take a hard hit. Balance of payments would increase, unfavorably. Geopolitical power shifts a bit back to oil exporters. Etc.

Maybe I am overreacting on this one, but for this issue, and other reasons, it feels like we in the U.S. are about to experience some “discontinuities” to our way of life. We will see….

Re: Government Competence

Sobering read from Bloomberg describing the stark difference in Covid 19 outcomes by comparing East Asia with the West (Japan being considered as East Asian). The US, UK, and French death rates are approximately 200 times those in China. While there are also doubtless social factors at work, and while it’s not over till it’s over, the outcomes seem to me a wake-up call on simple competence. Saber-rattling cannot be the answer. Unfortunately, in the US, I don’t see anything except saber-rattlers.

Don Stewart

https://www.bloomberg.com/opinion/articles/2020-10-30/don-t-ignore-the-good-news-on-covid-19-from-asia

Good Essay from Chris Smaje

https://smallfarmfuture.org.uk/2020/10/the-us-election-perspectives-from-an-ear-of-grain/

Smaje, writing from the perspective of a small farmer in Britain, believes that attempting to hold a central government together in a society experiencing Degrowth inevitably requires Fascism. In the US, he sees a full-Fascist Republican Party and a floundering party of Democrats who have no pole star. (From a SEEDS perspective, one can add a lot of thoughts relative to the ultimate disposition of all the debt and obligations…at some point government collapse becomes more attractive than trying to prop it up.)

“The story of non-fascist alternatives is yet to be written”…but he thinks it will, of necessity, revolve around a small farm based economy. Small farms do not support a lot of debt or a large financial sector.

Don Stewart

Manolis Kellis

At 1:50

“If engineers had designed evolution, we would still be perfectly replicating bacteria”…

Because in order to go in a different direction you have to break existing relationships.

“It is by making things worse that you allow evolution to reach a new optimum.”

Some notes on Nate Hagens: “Our plight is biophysical (biology and physics)”

I want to venture a private opinion about genetics and the responses we might give to biological and physics challenges. Our genes and brains frequently encode various scripts. For example, our mitochondria can be in flourish mode or in danger mode. They cannot be in both simultaneously. So we can execute the danger script or we can execute the flourish script, and we can alternate between the two. Please note that the mitochondria, which are an absolutely essential part of the human, are actually the remnants of ancient bacteria. So what I am about to suggest goes back a very long way in evolution.

My suggestion is that the environment, which both human actions and natural laws co-create, determines which script we will run. Just as the mitochondria can sense whether they should be in flourish mode or in danger response, humans can sense whether their best prospects, in the environment they sense, are served by deadly competition or by a tendency toward co-operation. We might also add to that a response of ’subservience to the elites’ (which might be a part of the Fascism response by the lower classes). Slaves in the US quickly learned that ‘house n….s’ were treated a lot better than field hands…who were entirely disposable. The point is that true democracies are hard to maintain. Recent studies have shown that they are not any more stable over the long term than authoritarian regimes. My heart is on the side of Chris Smaje’s ‘Peasants Republic’…Jefferson’s ideas of America versus those of Hamilton. The peasants in the US won the Declaration of Independence, but the authoritarians won the Constitution. The project of the Republicans to sweep aside millions of votes in the current election, backed by decisions from their hand-picked Supreme Court, is evidence for how dysfunctional our ambitions (the Declaration) and our implementation (the Constitution) have become.

If we really do face hard physical facts in the coming decades, then my suggestion is that ‘genetic determinism’ is a blind alley. We need to be thinking about the interplay between the environment we create (using both physics and the social sciences) in determining which scripts will be dominant. Execution will tell the tale.

Don Stewart

Pingback: When the dam breaks | Consciousness of Sheep

Scripts

I should mention that some scripts are doubtless expressed pretty much automatically. But many that you might think are ‘just natural’ are learned. A newborn has to learn how to see. A baby born blind, and then having that condition corrected later in life, will take up to a few years to develop what we think of as ‘sight’.

So we should be wary of things like The Maximum Power Principle or the inherent evilness that lurks in the hearts of men. The one underlying principle is that the brain evaluates the situation and chooses what is ‘best’. But ‘best’ can also be influenced by education. Some children learn to resist eating the marshmallow now. Some save for their old age, despite all the economics lectures about discount rates. And some soldiers do sacrifice themselves for the good of the squad.

But it is also true that the information processing power of the brain is limited. Given about a trillion bits per second striking the body, how does the brain sort out the signal? There is enormous compression and the compression techniques may not be very good. A pretty good rule of thumb is to practice before it becomes critical. Armies routinely train soldiers how to react when things get serious.

Maybe in our current circumstances, more people should go backpacking to be reminded that excess weight is not helpful.

Don Stewart

Dr Tim,

You are quoted here https://consciousnessofsheep.co.uk/2020/11/03/when-the-dam-breaks/

As one would expect!

Two different scripts in play:

First, the Russian script:

Millions of doses of the world’s first Russian-made vaccine against Covid-19 are set to be received by Argentina in the coming months, the country’s president has announced. It comes as the pandemic shows no signs of abating.

Some 10 million doses are expected to arrive in Argentina in December, President Alberto Fernandez told RIA news agency on Monday as his nation was holding talks with Moscow on the Sputnik V vaccine supplies. Another batch of 15 million doses is scheduled for early January. The leader later again confirmed the information in a separate tweet.

The president said that he would also get the Russian vaccine jab, but only after it becomes available to the Argentinian people, adding that it would be “unfair” to do so when ordinary people still do not have such an opportunity.

Meanwhile, presidential aide Cecilia Nicolini, who traveled to Moscow for the talks on the vaccine purchases, said that the vaccination would be free for all Argentinian citizens, although Buenos Aires would buy it for $19.9 per dose.

The vaccine destined for Argentina would be produced by Russia’s partners in India, China and South Korea and “some other countries,” Kirill Dmitriev, the director general of Russia’s Direct Investment Fund – the body which bankrolled the vaccine – told journalists.

The US script is the familiar close guarding of secrets and maximum extracted value.

Don Stewart

‘Clarity from the drivers’ windscreen’

Tim, many essays ago you mentioned that on your return to the United Kingdom you saw widespread evidence of decaying infrastructure. You posed the question of whether the roads are still in a bad condition? May I provide you with an update? I will not name the city but …

Yesterday we travelled along the entire length of a trunk radial road within the former boundary of a once prosperous Northern city – about 2.5 miles.

Our generation remember fifty years ago the re-development of the road as heralding another sign of the re-energising of the city – a statement of post-war modernity, the modern age. A vista of a six lane, dual-carriageway with roundabouts and underpasses and pedestrian segregation by way of subways.

Here was another instalment of the new world – it was the epitome of the very best of municipal foresight and engineering.

Half a century later the decline and neglect of the road reflects the fall of the industrial North, and the decline of the city.

The highway surface is badly worn-out, the white-lining is faded, road signage is old, bent or missing, the central railings are in a similar condition – a hotch-potch of make-do-and-mend. The grass verges are unkempt. Pedestrian subways are closed, brickwork is missing or collapsing – they are fenced off like some sort of border to an experiment that failed and is now too dangerous to enter.

In some places the subways have been replaced with pelican crossings, and one roundabout has been filled-in and reconfigured as a traffic-light controlled junction.

Recently, the inner running lane in both directions has been ‘converted’ into a segregated cycling lane separated by a mixture of hastily installed barriers of various kinds, but the new lane is full of detritus and bits that have fallen off cars.

The road reeks of decay and neglect – it surely signifies a City that has lost its way, a City shorn of hope, a City that is adrift and floundering.

A journey along the road engenders a number of feelings, but I suspect that I’m the only one to see it as a sign of fading prosperity – declining surplus energy.

Kevin, Colne

Thanks Kevin.

I grew up between two English towns, a small one to the east and a larger one to the west (I won’t name them).

I can remember, at school, when the smaller town got a municipal swimming pool – real quality, and the town was rightly proud of it. Long since, though, it’s fallen into disrepair, and I think has been demolished, as the upkeep could no longer be afforded. Crime rates are pretty high there now – not too long ago crime was negligible.

A couple of years ago, I returned to the other, larger town. I’ve always liked the people there (though I’m not a local). But the town looked pretty sorry-for-itself; no anchor stores in the shopping centre; a lot of people looking weary, struggling and (was it my imagination?) shorn of hope; the once-proud town centre very run down; and I almost expected tumbleweed to blow through the once-thriving industrial estate on the by-pass.

Very sad, in the proper meaning of that word.

Your report highlights a great problem with our civilization, in fact with any civilization: having exhausted the resources of an area – the reason for the growth of the city in the industrial era from perhaps a market town or even village – there is an expectation that such prosperity should continue, and a demand on politicians to bring it.

I found an ancient instance of this in the History of Anna Comnena, the Byzantine princess: the emperor found a decayed city, and decided to rebuild it, ‘as what was once great should be great again.’ Not sure how long that lasted…..

Dr Morgan described one of the major factors affecting availability of net energy and it’s effect on prosperity…”the relentless rise in trend ECoEs is the factor that has undermined, and has increasingly eliminated, the scope for growth in global prosperity”. There is at least one other energy factor that affects prosperity. It was fully appreciated and described by Tainter in his book, “The Collapse of Complex Societies”, and you touch on it with your comment.

Every thing and every structure that is built immediately begins to decay. Roads, houses, machinery, tools and every other creation of humankind require energy to merely keep a fixed level of stuff (and prosperity) from decaying. The more infrastructure we create, the more ongoing maintenance is required. This factor affects every society, regardless of whether its energy comes from renewable sources or from fossil fuels. I shudder to think how much energy China is going to need just to keep the infrastructure they have built in the last two decades from decay.

So, the more grand the structures of civilization, the more difficult it is to keep them intact. Eventually a threshold is reached where the difficulty becomes too great to overcome and a society must let its structures decay and simplify. It must collapse.

Thanks.

An important factor here is complexity. Despite its massive expansion in recent years, China remains a much less complex economy than the US. Reflecting this, SEEDS indicates that US prosperity per capita peaked at an ECoE of 4.5%, back in 2000, whereas Chinese prosperity peaked at an ECoE of 8.2%, in 2019. (Without the events of 2020, China might have peaked slightly later, but SEEDS had long been identifying the Chinese prosperity climacteric as 2020-22).

I’m not wholly persuaded, though, that what follows is necessarily collapse. Economies have survived severe economic hardships, stock market crashes, periods of change in which previously-important sectors fall from grace, the replacement of entire incumbent elites, and even revolutions, without collapsing. Decades after 1789, France remained a world power, and Russia became a superpower in the decades after 1917. The South Sea Bubble and Tulip Mania didn’t destroy England or Holland.

To be sure, the difference now is the surge in ECoEs to levels at which de-growth becomes inescapable.

This from Nate Hagen:

At year end 2019 we were still recovering from the Great Recession in 2008 -the ‘temporary’ measures initiated in 2008 – artificially low interest rates, too big to fail guarantees, Quantitative Easing, explosion of government debt, expansion of central bank balance sheets, etc were still in effect a dozen years later. Even with all this, productivity gains have been tiny – and a fraction of earlier decades.

Now, in addition to all this, governments are adding fiscal stimulus – because they must. The little green man behind the curtain – (currently Jerome Powell) is a very capable and good person but he is not superman. The institution he oversees -the Federal Reserve is using an invisible giant magic wand to move what we might’ve consumed in 2030 or 2040 forward to 2020 (in the process leaving less available in 2030 and 2040). Modern Monetary Theory tells us deficits don’t matter – but they do – when we create money, we do not create the energy and materials needed to pay it back, so adding more and more debt becomes less productive over time – and has limits.

What happens when either government decides to stop stimulus (hard to imagine) or the bond market says ‘no mas’ via higher rates? What is the plan by either the Left or the Right (or anyone) for when QE and stimulus combined cannot plug the economic hole for people and businesses? My opinion is that question will be answered in the next administration – and the answer will be a drop in GDP akin to the 1930s. Yes, more debt and creative stimulus/infrastructure spending will forestall this – for a while but we will soon face a situation when we can no longer kick the can of growing GDP again to the future. Money isn’t reality – it’s a marker for the things that matter: built, social, natural and human capital. No matter who wins the election we have a decades old physical/financial bill that’s coming due.

Thanks.

I’ve heard it said this morning that the BoE’s new QE – said to be £100bn last night, now announced at £150bn – is being done because they’re not sure they can borrow the required sums in the market.

I must stress that this is someone’s opinion. At present, the UK govt can borrow very cheaply. The IMF’s latest data puts the UK 2020 deficit at 16.5% of GDP (c £320bn) for this year, but that’s pretty much the consensus pre-“second wave”. If there’s any substance to this story, though, it means the UK is pretty near the edge.

One has to be a little careful of deficit/GDP ratios. The numbers here are £320bn deficit, GDP £1,960bn. But that GDP number includes the £320bn of fiscal stimulus being put in, i.e. it’s something of a circular equation. On the same basis, the 10% drop in US Q2 GDP was really nearer -40%.

Lastly, it’s being reported that one UK lender is refusing to extend credit to those working in hospitality. Again, a disturbing sign.

Extension to the UK jobs furlough scheme until March just announced:

https://tinyurl.com/y4c3csr2

Print and borrow, print and borrow.

ps. When my US in-laws have made their annual visit to us here in Devon they are aghast at how dirty, tatty and run down the region is. The verges along the A38, the main artery running down through the South West, are filled with trash and are rarely, if ever, cleaned. Exeter bus station – ‘Gateway to the South West’ – could be fairly likened to an open latrine. Stepping out of Bristol Airport after flying in from almost any European airport, leaves one in shock at the filth and rubbish littering surrounding streets and car parks.

The hotels and guest houses of Torquay and Paignton – “The English Riviera” – are dumping grounds for the homeless and drug-addled. Just so sad.

The UK has become a filthy nation.

A kinder, gentler time:

“Vive Torbay: Travelling to the British Seaside (1968)”

It’s very sad. I was once interested in buying a 17th century house in town, once a tavern; although not on the coast it was full of life’s rejects, mostly alcoholics – many of them would have been set on that path by a dreadful childhood and having been placed in state ‘care’.

The owner was making a fortune out of it, had another such property in the same town, and a villa in Spain out of the proceeds (public money!) about which they boasted.

One of the lodgers said to me ‘If you buy, you won’t make us leave will you? It’s lovely here.’ Really upsetting.

Here in America the stock market is celebrating because the election results mean there will be political gridlock, meaning, no one will be able to change the laws to touch their beautiful money. Hooray!

This is mental illness and a complete divorce from the natural world, well-captured in the famous New Yorker cartoon, “sure, we destroyed the planet but for a beautiful moment there we created a lot of value for shareholders.”

Of course, this also means that it will be impossible for the central government to do anything to address any real problems, such as those discussed here. The hour has produced the man, and this IS that man.

Plan accordingly.

I find this take on the US situation interesting (and am a great admirer of Jim Kunstler). Any thoughts?

https://kunstler.com/clusterfuck-nation/the-awful-reckoning/

@Dr. Morgan

Jim Kunstler can see no good in a Democrat and nothing bad in Donald Trump. Jim used to be a Democrat (as was Trump), and there is nobody more bitter than a former member of some organization that they have left behind.

A more balanced view is that both parties, but especially the Republicans, have used ‘voter suppression’ as a means to maintain power. It is routine in the US that a plurality of voters vote for Democrats, but the legislatures and the presidency belong to the Republicans…thanks to districting shenanigans.

If we step back and take a look, I think we see two parties who have no idea what the problems are, and no ideas about what to do.

Don Stewart

I haven’t vetted Jim’s reports of voting fraud by Dems. Seems if there was proof, it would have been all over social and main stream media. Hard to believe that Jim Kunstler voted for Trump. If you can’t stomach Biden, write in a Green if none is on the ballot.

Steve

https://kunstler.com/clusterfuck-nation/the-awful-reckoning/

“Seems if there was proof, it would have been all over social and main stream media.”

Steve, you can’t be unaware of the degree of social media censorship, nor the fact that intel. agencies are heavily embedded in the MSM. Just as one example, The New York Post was blocked on Twitter for two weeks because they dared to reveal the degree to which the Bidens are corrupt and compromised.

If Trump doesn’t prevail, expect a return to your regularly-scheduled war with Syria and Iran, a resumption of mass immigration and outsourcing.. basically the reverse-colonization we have seen happening apace all over the West. The Chinese didn’t hand billions to the Bidens for nothing. They want something on that investment.

Forget not the Newsweek cover with “Madame President”.

She was never supposed to lose.

I never implied that one side was clean. However, hard evidence usually finds its way to some MSM outlets globally. TPTB in the US don’t control them all!

Which “all” are you looking at? And.. yes, they do.

A Small Farm Future???

Chris Smaje’s book. I have begun to read it. A cursory description: A society built around small farms is the most reasonable solution to many of the problems we face. He begins by describing the 10 crises facing us (a crisis is a fork in the road, with each fork implying multiple knock-on effects if taken).

Population; Climate; Energy; Soil; Stuff; Water; Land; Health and Nutrition; Political Economy; Culture

There is an extensive discussion of the problems around money and the necessity for growth.

“My position in this book is in keeping with the degrowth project, but I argue for a strong focus on agriculture as the key point of energetic transformation….It would generate multitudes of people looking for new kinds of localized, low-carbon work. One of the most obvious and necessary forms of such work in a low-energy throughput economy is farming, which can absorb a lot of labour.” And “address in more practical terms how such (historical) toil might be avoided, especially by retooling the energetic economy of the traditional small farm.”

In terms of energy consumption per capita, Smaje makes these points:

*current levels range from 3 to more than 750 GigaJoules (GJ) per capita. South Sudan at the bottom and Iceland and the Persian Gulf states at the top.

*Vaclav Smil estimates that the current economic system requires 84 GJ for a reasonably prosperous life. Less than half of the countries in the world are above 84 GJ

*There are reasons to believe that 84 GJ is not necessary IF we change our economy. Cuba achieves health outcomes equivalent to the US with about 40 GJ amid constant harassment from the powerful US

*20 percent of the Cuban population is engaged in full time food production (lots more are gardeners, as I understand their system)

The big advantages in Smaje’s book:

*It is a thoroughly systems oriented viewpoint. Everything is tied together with everything else. For example, Energy and Culture are tied together in mutually reinforcing relationships.

*It is not authoritative on anything…but it is one of the few works which tackles the Big Picture with any authority.

*The authority comes both from wide reading by Smaje, but also his decades of practical experience

Reasons for pessimism:

*An analysis of the US election results shows that the political deadlock of 2016 is still with us. Practically nothing changed in the last 4 years.

*Trump is actively campaigning to overturn the result if it goes against him

*White males are still the most disaffected group of voters

*The urban/ rural divide is as sharp as ever

*There is no indication that either party is willing to tell voters the truth

Reason for optimism:

Smaje thinks that we will be forced to a small farm solution. How much pain and agony we have to endure depends on how much denial delays everything and results in sub-optimal adaptations.

Don Stewart

Tim, I tend to find Kunstler a bit overwrought, and not a great touchstone for the national mood or for what will happen. However, he is probably correct that it will take a couple of months to sort through the counting mess and resulting “lawfare.” Meanwhile some here will become more unhinged, but I’m not sure where that goes. I would not discount the possibility that Dems will make a deal with Donald to avoid prosecution on all of his personal legal issues in exchange for an agreement to “go quietly,” and that this, more than a desire to remain President, will drive his actions, but this is wild speculation on my part.

However, this spectacle will definitely have a highly detrimental effect on the perception of legitimacy of the government by Americans, and the perception of America by the rest of the world, and will be major contribution to the conclusion that America is a failed state. See Glenn Greenwald’s excellent article today, “The U.S. Inability To Count Votes is a National Disgrace. And Dangerous”:

https://greenwald.substack.com/p/the-us-inability-to-count-votes-is

Dr. Morgan,

Thanks for continuing to throw light on our current predicament. It is much appreciated. Some first thoughts on economic sustainability, resilience, and adaptability follow.

Even if a country/region/locality (= territory) has a relatively low ECoE, to be economically sustainable this ECoE must be sufficiently low enough for a level of energy efficiency that is suitably high enough. The previous sentence not only means that factors which affect a territory’s energy efficiency must be considered when determining economic sustainability, but also there is an important synergism between ECoE and energy efficiency that needs to be taken into account. Sometimes this synergism is expressed as follows: one gets greater economic value out of the “energy buck” through a higher level of energy efficiency. One needs to gauge the long-term economic value of the energy as well as the long-term value of ECoE when determining economic sustainability.

As the global financial system deteriorates due to the necessity of global degrowth and loses its ability to command resources for the self-aggrandizement of a relatively few, local resources such as food, energy, and water (FEW) technological infrastructures should remain available for some time despite reduced trade. A question of fundamental importance is then which territories are best positioned to maintain their FEW technological infrastructures over a longer timeframe at a much lower level of trade. These territories would appear to have better prospects for a gentler transition to more localized and sustainable economies. If such is indeed the case, it may be helpful to form two tentative definitions inspired by the SEEDS framework:

A territory has “economic resilience” if it has the ability to at least maintain its FEW technological infrastructures by means of a sufficiently low ECoE and suitably high energy efficiency in spite of a much lower level of trade than previously.

A territory has “economic adaptability” if it has the ability to transition to different FEW technological infrastructures that are more localized and sustainable with both sufficiently low ECoE and suitably high energy efficiency.

As an example of how these definitions might work in practice, a future comment will attempt to gauge (in broad brush strokes) the economic resilience and adaptability of Ecuador’s food economy.

Dr. Morgan

Consider these statistics from the current assessment of the vote watchers:

Biden

264 electoral votes

Popular votes

50.4%

72,586,882

214 electoral votes

Popular vote

47.9%

69,000,670

But Trump could easily end up winning the election because it is not the popular vote that counts…it is the electoral college which is determined by different rules. And Trump is barely behind or leading in all of those states not yet declared. The electoral college was instituted by the writers of the Constitution because they did not trust the (relatively small percentage) of people who were allowed to vote. The idea was that the wealthy who were allowed to vote would have their wishes filtered through a layer of elites who would actually elect the President. If Trump wins in 2020, it will be the third Republican in recent times in which the electoral college has not gone with the popular majority (Bush in 2000, and both of Trump’s terms.). We see the same effect, but with much greater skew, in the House of Representatives because Republicans made a point of winning the Governorships of the various states, and the states have been able to manipulate the district boundaries to control elections. If you are a Republican, you would like to put all the Democrats together into a single district so that they get to elect one Representative. Beyond that, you would scatter the remaining Democrats so that they are a minority in all of the other districts. Such gerrymandering can greatly shift the composition of the House of Representatives.

Don Stewart

The US election is like the olympic opening ceremony, a meaningless circus, but quite entertaining, even if you are one of the miniscule few who know the only difference it will make to the future now is whether you prefer your meltdown slow or fast. It could be called the orange herring show. But I think it’s damaging US and by association ‘anglo-european’ civilization and systems (like capitalism – which sadly most people alive today only recognise as the neoliberal perversion form) by looking corrupt, chaotic and shallow, so nothing you’d admire. Neutrals, in what used to be called the non-aligned nations will look at alternatives like the Chinese, Russians and others and wonder if they’re any worse. Soft power, where other peoples emulate you because they think you’re getting things right, is always under-appreciated when compared to the threat of violence, like wars or financial destruction by sanctions and it is ebbing away fast.

Power is surely always power, and has a sharp gleaming edge? Soft power and moral authority always strike me as a delusion, but then I’m a cynic.

American popular culture has largely been imitated, globally, because it represents the lowest common denominator: any fool can wear a baseball cap and jeans, or even what Kunstler calls the ‘clown suit’.

English fashions were much imitated in the 18th and 19th centuries, due to the immense power and wealth of the British Empire, and, often, admiration for the constitutional monarchy.

Although, ironically, die-hard Royalists in France and Spain, and even Italy, would also dress in the English fashion,and still do.

What is certain is that the US republic is in grave crisis, and offers only lessons in how not to do things.

Any moral authority the US once enjoyed, particularly in the immediate aftermath of WW2, evaporated during the Vietnam era: the last vestiges crushed by the Iraq/Afghanistan debacle just as British residual authority was destroyed by the Suez lie.

An extremely good article from CHS:

http://charleshughsmith.blogspot.com/2020/11/heres-our-historical-analogy-menu-rome.html

CHS has been excellent for many years. We’ve communicated on and off since I first found him. My one (ignored) comment to him was about the tripling of global population in my 75 years, quadrupling in my mother’s 96, and his avoidance of the issue.

CHS is very good, but I dislike all the articles he churns out that basically say, this is what’s going to happen and how it’s going to go down. Like “Alice doesn’t work here anymore.” 1) These are unbacked assertions; 2) no one knows. Really annoying. Historical parallels are intriguing suggestions, but not actually predictive, and certainly not dispositive.

I abandoned the Archdruid many years ago for the same thing – he’s always selling a vision of the future, soothing to his unnerved readers. It’s a religious approach, even if backed by lots of historical “parallels” – tell me about the brighter tomorrow, because today is unbearable.

OTOH, the guy has to make a living, and I guess this stuff sells.

Agree about the Archruid. And he is verbose beyond the pale. CHS does what most involved in discussing financial markets do: gives an opinion about probabilities going forward. I dropped Mac10 (Zen guy) because he was Johnny One Note on a market crash. At least CHS compares three historical eras. And he has admitted many times when he was wrong.

Jay Hanson was good, imho.

https://dieoff.com

@tagio – Good observation about the hubris of these guys’ repeated, specific predictions. I put Richard Heinberg in that basket too. Most of these guys have been totally wrong for, what, 15 years now? “Who knows” is the only sensible conclusion, especially regarding timing.

I can, of course, speak only for myself, but the evidence, hitherto, has not supported prophecies of collapse, only of stagnation, tending towards de-growth.

My approach is to view the economy as an energy system, and to model it accordingly. We can then do our best to follow where the evidence leads.

The conclusions – prior to the events of 2020, and not necessarily changed by them – seem to be as follows.

First, historic economic growth has been powered by very cheap fossil fuel energy. This impetus has been fading, as ECoEs have risen. This is observable back at least as far as the 1990s. The first countries to feel the effects have been the very complex, high-maintenance Advanced Economies of the West, though something very similar has, more recently, started to affect EM economies.

Second, we have tried to combat this deceleration using financial gimmickry. This might be put down to ignorance, denial, hubris or a mixture of all three. It has created the conditions for a financial ‘crash’, but that’s not the same thing as an economic ‘collapse’.

The big question for me is whether we can adapt to the ending of growth hitherto driven by cheap energy.

The pandemic crisis doesn’t, of itself, change the energy dynamics of the economy, so ‘stagnation, tending towards de-growth’ remains the most tenable thesis. But what the crisis does seem to tell us is that we’re not very good at handling the unexpected. Even this is hardly new, as we’ve never recognised the energy dynamic, but have insisted on trying to maintain ‘growth in perpetuity’ despite accumulating evidence that this assumption isn’t valid.

I think it’s important, at this point, to draw a clear distinction between the financial system, which looks dangerously over-extended, and the economy itself, in which de-growth ought to be manageable.

The Age of the Ridiculous

Is an absentee ballot marked with a sharpie legal? Well…it depends on whether you think the absentee ballots favor you or your opponent.

Don Stewart

A few notes from the US, with some reflections on what it means in a Degrowth world.

*”Trump, speaking at the White House last night, again lied about the results of the election and repeated several debunked internet rumors, as BuzzFeed News reported. “A presidency born in a lie about Barack Obama’s birthplace appeared on the edge of ending in a lie about his own faltering bid for re-election,” Peter Baker and Maggie Haberman write in The Times.

Many Republican officials declined to echo Trump’s claims, suggesting they may see his cause as hopeless. Will Hurd, a Texas congressman who is retiring after this term, wrote on Twitter that Trump’s comments were “not only dangerous & wrong, it undermines the very foundation this nation was built upon.” Others, though, repeated the falsehoods, including Representative Kevin McCarthy, the House minority leader, and Senator Lindsey Graham of South Carolina.”

Comment: The best we can hope for is not some clear-eyed and broadly based consensus on what we ought to be doing, but simply getting rid of one of the most successful con-men ever spawned by reality TV.

*”House Democrats yelled, swore and traded blame in a three-hour caucus phone call after their predicted gains in the election yielded to losses that weakened their majority. “We need to not ever use the word ‘socialist’ or ‘socialism’ ever again,” said Representative Abigail Spanberger, who narrowly won re-election in Virginia. “We lost good members because of that.”