WHAT HAPPENS NEXT?

Introduction

Sometimes, articles can be hard to put together because one has too little information. At other times, the challenge is the opposite one, the problem being to condense an abundance of information into something shorter than War and Peace. What follows falls into the latter category.

At an earlier stage in the crisis caused by the coronavirus pandemic, variables and possible permutations far outnumbered clear points of reference. This is no longer the case, and much of the time since the previous article has been spent refining the SEEDS economic model, and casting the multiplicity of its conclusions into a brief and logical sequence.

The first take-away here is that no amount of financial gimmickry can much extend our long-standing denial over the ending of growth in prosperity. The energy dynamic which drives the economy has passed a climacteric. The pandemic crisis may have anticipated this inflexion-point, and to some extent disguised it, but the coronavirus hasn’t changed the fundamentals of energy and the economy.

The second is that the downtrend is going to squeeze the prosperity of the average person in ways that are likely to be exacerbated by governments’ inability to understand the situation, and to adjust taxation and spending accordingly.

Third, this squeeze on household disposable prosperity is going to (a) have severely adverse effects on discretionary (non-essential) consumer spending, and (b) put at risk many of the forward income streams (mortgages, rents, credit, stage payments, subscriptions) that form the basis of far too many corporate plans, and have been capitalized into far too many traded assets.

Barring short-lived exercises in outright monetary recklessness, most discretionary sectors are set to shrink, and asset prices (including equities and properties) are poised for a sharp correction.

It is, after all, hard to sustain a high valuation on the shares of a company whose business has slumped, to buttress the market in homes whose prices far exceed impaired affordability, or to shore up the price of capitalized forward income streams that are in the process of failure.

Finally, economic concerns are set to dominate voters’ priorities, displacing non-economic issues from the top of the agenda. Calls for economic redress – including redistribution, and, in some areas, nationalization – are set to return to the foreground in ways to which a whole generation of political leaders may be unable to adapt.

“Faith in the middle” – all bets lost

Spectator sport has been one of the more prominent victims of the coronavirus crisis, but let’s imagine that we’re listening in to a conversation between rival fans ahead of a hotly-contested fixture. Supporters of the home team are sure their heroes will inflict a massive defeat on their opponents. Followers of the visiting club are equally certain of a stunning victory.

The outcome, as often as not, is a low-scoring draw.

This is a useful analogy for our current economic and broader predicament. One side of an intensively-polarized debate pins its faith in the restoration of normality, or even of a sort of ‘super-normality’. The other is equally certain of catastrophic collapse.

What actually happens is likely to be ‘neither of the above’.

That, certainly, is the view here, and it’s reinforced by economic modelling based on the understanding that the economy is an energy system, and is not – as established conventions so mistakenly insist – a financial one.

The conclusions of the SEEDS model form the subject of this discussion.

Where economic output is concerned, SEEDS warns that there can be no return to the rates of growth reported before the coronavirus crisis, with the proviso that a very large proportion of that pre-2020 “growth” was, in any case, illusory. After a period of ‘normalization’ that will fall a long way short of the mythical “V-shaped recovery”, rates of increase in output will fade (see fig. 1), falling below those at which population numbers are expected to carry on increasing.

Continuing rises in ECoE (the Energy Cost of Energy) will amplify these trends where prosperity itself is concerned.

As remarked earlier, the predicament of the ‘average’ person in this deteriorating economy is likely to be made worse by governments’ failure to understand what’s happening, and to scale back their tax and spending plans accordingly. Meanwhile, we seem likely to be at or near that point of credit exhaustion after which we cannot continue to manipulate reported “growth” – or to shore up consumer discretionary expenditure – by injecting ever more debt into the system.

These trends point unequivocally towards declining discretionary (non-essential) expenditures by consumers, with businesses similarly focused on cost-control. It also implies a decay, and in some cases a failure, of many of the income streams on which so many corporate business plans, and so much capital valuation, now depend.

Reverting to our sporting analogy, an outcome which favours neither of the extremes results in the loss of any bets placed by either side. This applies to the economy, too, where a wide range of financial and non-financial wagers – placed by governments and politicians, investors, businesses and campaigners for various causes – will be lost.

Fig. 1

Dwindling output………..

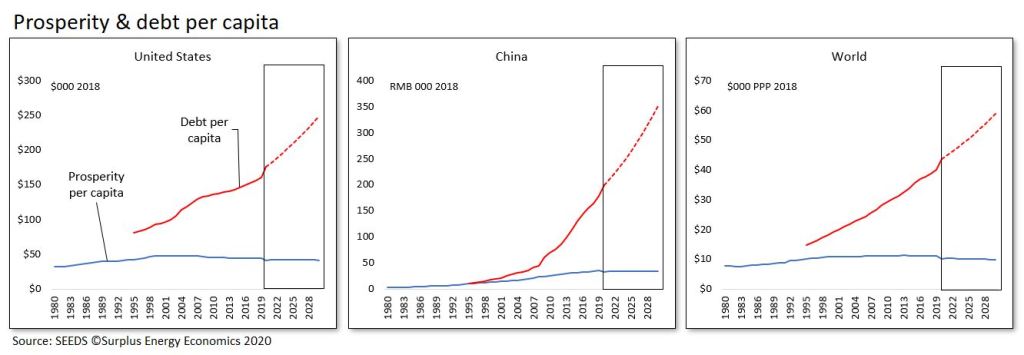

Over the period between 1999 and 2019, World economic output – reported as GDP, and stated here at constant values on the PPP (purchasing power parity) convention – averaged 3.2%, for a total increase of 95%, or $64.5 trillion. During this same period, however, annual borrowing, expressed as a percentage of GDP, averaged 9.6%, with total debt expanding by $193tn, or 177%, between 1999 ($109tn) and 2019 ($302tn).

Another way of putting this is that each dollar of reported “growth” was accompanied by $3 of net new debt. Even this comparison understates the gravity of the situation, in that it does not include huge increases in pension and other commitments over two decades, with the overall situation worsening markedly after the 2008 global financial crisis (GFC).

You wouldn’t be too far off the mark if you concluded that, at the time that the crisis struck, each growth dollar was being ‘bought’ with at least $5 of new ‘hostages to futurity’.

What this in turn means is that most – according to SEEDS, 64% – of all “growth” in the World economy reported over that twenty-year period has been illusory. This is “growth” that would reverse if we ever tried to unwind prior expansions in debt and other financial commitments. More realistically, were we to stop all net new borrowing, growth would fall to no more than 1.5%, and to a lower level still were we also to cease adding to pension and other unfunded promises.

Anyone surprised by this might usefully consider two questions. First, what would happen to rates of reported growth if annual net borrowing (last year, just over $13tn, or 10.3% of GDP) fell to zero?

Second, what would happen to GDP itself, if we tried to pay down the $111tn of net debt taken on over the past decade?

The SEEDS model strips out this ‘credit effect’ to identify rates of change in underlying or ‘clean’ output, known here as C-GDP. This metric grew at annual rates averaging only 1.5% (rather than 3.2%) between 1999 and 2019 (see fig. 2).

Moreover, as you’ll see if you refer back to fig. 1, this rate of growth has been fading, and stood at just 1.2% last year. Current SEEDS projections are that growth in C-GDP will taper off, ceasing by the early 2030s, after which it can be expected to go into reverse.

Needless to say, the immediate crisis is going to create negative growth in economic output, to be followed, according to most projections, by some kind of a recovery when (although some pessimists might say ‘if’) the pandemic is brought under control.

The consensus view, which anticipates a fall of -4.6% in GDP in 2020, and rebound of +5.1% next year, already looks far too optimistic. The SEEDS projection is that clean output (C-GDP) will decline by -7.2% this year, and grow by about +3% in 2021. Again, both of these projections may turn out to have been unduly bullish.

Here’s the big difference, though.

Where the consensus sees World GDP higher by 16% in 2025 than it was in 2019, SEEDS projections show no overall growth at all in C-GDP during that period.

Fig. 2

…… and rising ECoEs squeeze prosperity…..

If you’re familiar with the energy basis of the economy, you’ll know that the generation of economic value from the use of energy is only one half of the equation which determines prosperity. The other side is the Energy Cost of Energy (ECoE). This is the proportion, within any quantity of energy accessed for our use, that is consumed in the access process, and therefore is not available for any other economic purpose.

Though it’s ignored by conventional interpretation, the relentless rise in trend ECoEs is the factor that has undermined, and has increasingly eliminated, the scope for growth in global prosperity.

As ECoEs rise, economies reach an inflexion-point after which prior growth in prosperity goes into reverse. The stage at which this happens varies between countries, affecting highly-complex, high-maintenance economies first. In the United States, for example, prosperity growth went into reverse at a trend ECoE of 4.5%, with the same happening to almost all of the Western advanced economies at ECoEs of between 3.5% and 5.0%.

Less complex emerging market (EM) economies enjoy greater ECoE-resilience, and can continue to grow prosperity per capita up to ECoEs of between 8.0% and 10.0%. The coronavirus crisis is likely to have brought forward the inflexion-point in China, at an ECoE of 8.2%, but this climacteric was due to be reached in the next year or two anyway. This is why reported “growth” in China has become ever more dependent on extraordinarily high levels of net borrowing.

This is illustrated in fig. 3, which compares ECoE trends with prosperity inflexion-points for China and the United States. As you can see, the relentless rise in the ECoEs of fossil fuels have pushed the overall curve sharply upwards, and the development of renewable energy (RE) sources, though essential, is most unlikely to do more than moderate the upwards trend.

Additionally, the economy has now reached the point at which rising ECoEs affect the availability of energy itself, trapping producers between the Scylla of rising costs and the Charybdis of diminishing consumer affordability.

Fig. 3

…..and taxation tightens the screw

As we’ve seen, prosperity per capita has turned down because of a combination of decelerating economic output, rising ECoEs and a continuing increase in the numbers of people between whom surplus energy value is shared. A weakening in energy supply volumes can be expected to add another twist to this deteriorating equation.

Where consumers are concerned, the adverse effects of this process are likely to be exacerbated by a rise in the proportion of prosperity taken in tax. Governments’ failure to understand the energy basis of economic activity lead them to measure the affordability of taxation against GDP.

On this conventional basis, the incidence of taxation worldwide has hardly varied at all over the past twenty years, remaining at or very close to 31% between 1999 and 2019. Unfortunately, and as we ‘ve seen, GDP has become an ever less meaningful measure of the value of economic output over time.

What this in turn means is that the incidence of taxation, when measured against prosperity, has risen relentlessly, from a global average of 32% in 1999 to 49% in 2019. On current projections, this is set to rise to 56% by 2025.

This is illustrated in fig. 4, which compares the per capita averages of prosperity and tax for the United States (where taxation is comparatively low), and of more highly-taxed France, with the global equivalents.

SEEDS analysis indicates that taxation absorbed 67% of French prosperity last year, compared with 53% back in 2004. For the average French citizen, this means that a comparatively modest decline of 6.2% (€1,910) in his or her overall prosperity has been exacerbated by a €3,010 increase in taxation, leaving disposable (“left in your pocket”) prosperity 34% (€4,920) lower in 2019 than it was in 2004.

Fig. 4

Discretionary spending falls, income streams fail

France, of course, is something of an extreme case, but the general tendency has been for rising taxation to magnify prosperity deterioration into a markedly more severe squeeze at the level of disposable prosperity.

For planners in government and business – and, of course, for individuals – this leveraged equation is central to much that is likely to happen in the coming years.

This can best be understood if we look at things from the perspective of the average or ‘ordinary’ person or household. He or she will experience falling prosperity, an observation for which, long before the coronavirus crisis, there has been steadily accumulating corroborative evidence. People in a growing number of countries know that their material circumstances are deteriorating, and are increasingly (and rightly) ignoring official statements and statistics which try to assert the contrary point of view.

As prosperity erodes, and as the proportion taken in tax increases, our ‘ordinary’ person is likely to turn both economically cautious and politically discontented. He or she will become increasingly unwilling to take on yet more credit, almost irrespective of the cost of debt. Essential purchases must carry on, of course, but scope for discretionary (non-essential) expenditure will deteriorate sharply.

Over time, increasing numbers of households are likely to struggle to keep up with the numerous financial demands that the system now makes on them, demands which have long since gone beyond mortgages, rent and utility bills to include subscriptions, staged purchases, the leasing of things which would hitherto have been bought outright, and credit taken on for a multiplicity of purposes including vehicle purchase and education costs.

This enables us to summarise three of the more direct and immediate implications of de-growth.

First, there will be adverse consequences for any business supplying discretionary purchases. We’ve been seeing a foretaste of this since 2018, with downturns in the sales of everything from cars to smartphones. The discretionary category doesn’t just apply to goods, of course, and service sectors particularly exposed include travel, leisure and hospitality. Just as households scale back non-essential spending, businesses are likely to trim discretionary outgoings such as advertising and outsourcing.

Second, the increasing strain on household budgets is going to put income streams at risk. This is extremely important, for two main reasons. One of these is the expanded prevalence of sales techniques which cultivate streams of income in preference to outright purchases, whether by consumers or by business customers. The other is the capitalization of income streams, a process pioneered by the securitization of future mortgage payments. A significant part of the capital markets now consists of capitalized streams of income linked to everything from car purchase and higher education to the supply of gadgets and domestic appliances.

Third, the public is likely to become increasingly focused on economic issues, demanding, not just lower taxation but pro-active measures to bolster household circumstances. We should anticipate growing pressure for nationalization (notably of utilities), combined with calls for greater redistribution from ‘the rich’ to the ‘ordinary’ voter.

For government, business and investors, this poses challenges that have, in many instances, yet to appear on the ‘radar’ of forward planning.

Governments, whilst unwilling to scale back their activities to affordable levels, will nevertheless find that their scope for expenditure falls a long way short of previous expectations.

At the same time, the priorities of the public can be expected to undergo a sea-change, swinging resolutely towards the economic. As a result, many of the cherished ambitions of policymakers will become of diminished importance to the voters, just as they become ever less affordable.

Fig. 5

I concur. The impending socio-ecological disaster about to strike certainly dwarfs petty issues such as the election of a tweedle-dee or tweedle-dumb.

And this guy can lie like the very best of them:

The fawning adulation currently on display for this wretched warmonger is simply astonishing.

Gore Vidal was right when he called it the ‘United States of Amnesia’.

Keep your eyes on the insane Arctic temps at this moment:

https://climatereanalyzer.org/wx/DailySummary/#t2anom

http://ocean.dmi.dk/arctic/meant80n.uk.php

It may trump everything (excuse the pun!).

Let’s see.

As I understand it, the Dems are committed to increasing the corporate tax rate from 21% to 28%, taking more in taxes from the richest, and doing something to curb the power of ‘big tech’.

Time will tell how much of this gets done.

My guess

The increase in taxes will pass, because the very richest pay a lower tax rate than the middle class. That is such an egregious outlier that I think they stand a reasonable chance on that one. BUT, I imagine the loopholes which permitted Donald Trump to pay a pittance in taxes will be alive and well. All the politicians loves to create loopholes for their favored contributors.

As for curbing Big Tech, I doubt they will do anything which actually works. The Facebook group which sprang up suddenly, and disappeared in less than 24 hours through banning, whose purpose was to keep the myth that the election was stolen from Trump, is an example of unrestrained power exhibited by the social media. But the Democrats are strongly in favor of that. The Republicans are strongly in favor of the banning of anything that might be remotely connected to China. I don’t see how those bans can be written into any constitutionally legal set of laws. So I imagine there will be a lot of posturing with not much happening.

I think that Biden will rejoin the Paris Agreement during his first week in office…to global acclaim. He may spent a lot of deficit money on solar and wind, but I don’t think he will do anything that Louis Arnoux would approve of. I don’t know if you have taken a glance at the two hour marathon, but Louis says that the problem is that fossil fuels have a 12 percent efficiency (5 percent for automobiles). Substituting solar and wind for coal and natural gas does not change the 12 percent, which still leaves 88 percent ‘waste’ (which was the ‘pollution’ in the LTG study all those decades ago). Since nobody has a solution (except possibly in Louis’ head), I expect nothing much will be accomplished…but possibly to great fanfare.

The most effective action Biden could take would be to cancel federal flood insurance. No state and no private insurance company would write beach front insurance unless they have federal backup. That would bring climate change and sea level rise to a prominence that is completely missing at the present time. But since it is the solid foundation of ‘it’s not your fault’ that undergirds both parties, nothing will be done in terms of unambiguous feed back loops.

Don Stewart

Pingback: The Narrative Problem After Peak Oil - Nemos News Network

Pingback: The Narrative Problem After Peak Oil – iftttwall

Pingback: The Narrative Problem After Peak Oil - Indeki - Real News Network

Pingback: The Narrative Problem After Peak Oil - Open Mind News

Pingback: The Narrative Problem After Peak Oil

Pingback: The Narrative Problem After Peak Oil – American Broadcasting CommUnity

Pingback: The Narrative Problem After Peak Oil | | Dawson County Journal

Pingback: The Narrative Problem After Peak Oil | Zero Hedge

Pingback: The Narrative Problem After Peak Oil | altnews.org

You guys may enjoy this

Tim, I think this is from yesterday re the 130000 votes but I did see a fact check on the same day Trump tweeted it so I don’t think all MSM is ignoring this. https://www.bbc.co.uk/news/election-us-2020-54811410

Pingback: OILIGARCHY: The Narrative Problem After Peak Oil – By Tim Watkins | RIELPOLITIK

Quite right: looking at it cynically, there is a great deal which the Biden administration could do rather quickly, reversing the ‘horror and indecency’ of the Trump years, to the applause of the masses and media, while leaving most vested interests and unexamined assumptions about inherent progress and our imperilled way of life untouched. Who knows, maybe the COVID dead will rise from their graves now the Redeemer has arrived? It will all be an ineffective variation on ‘Hope and Change’ -just so that everything can stay more or less the same.

@ Jeremy Beck,

Sadly I can only agree with you, Trump is only the symptom of a terrible problem not the cause, as such his absence solves nothing really and new outbreaks of extremism are inevitable. He won in 2016 effectively on a coin toss because it was so close and similarly Biden won now on the 50/50 odds going the other way as per probability, the only meaning we get from that is the US is broken and hopelessly divided. Additionally there is nothing on the horizon to give hope, like great leaders of the past, or a compromise resulting in renewing the social compact.

I see this only as half the people wresting the spade out of the hands of the guy still digging the hole the country is in, a pause if you like, as opposed to a ladder to get out. Bidden was Obama’s assistant during 2 terms where they had no answers and the Democrats were like New Labour, they lost the working classes when they just adopted neoliberalism ‘but with a human face’ to get elected. To be fair, I don’t know with the American mindset if Sanders could win with a Scandinavian-system humane balance, like the English the US has become ever-more rightwing.

As to trying to read the runes to survive the immediate future, this article on what history reminds us is thought-provoking: https://consciousnessofsheep.co.uk/2020/11/06/the-narrative-problem-after-peak-oil/

Biden and Response to Covid 19

One of the bigger immediate problems is crafting an effective response to Covid. Biden has assembled an advisory group. (Trump accused him of ‘listening to scientists’.). Here is a brief article from a scientist who seems to have achieved good success in the state of Maine:

https://www.scientificamerican.com/article/how-straight-talk-helped-one-state-control-covid/

“His twice-weekly public radio briefings follow three principles: never shy away from the truth, answer questions directly, and acknowledge the statistics and numbers without overlooking the human element. Our national approach, he says, does not adhere to those principles.”

Whatever sins of omission and commission Mr. Biden may have been guilty of in the past, I suggest that the best way forward is to hold Mr. Biden to account for behaving in accordance with the principles used successfully in Maine. Trump was clearly such a narcissist that trying to hold him to account for anything at all was impossible. There MAY be some potential for better behavior in a Biden administration. I forget who, but one recent President said ‘the American people get the quality of political leadership they deserve’. Let’s try to deserve better than we have gotten over the last few decades.

Don Stewart

A Way Forward in the US?

There are lots of voices asserting that we can’t move forward because our recent history shows us unable to move at all…or else regress. I am very cautiously optimistic about what CAN be done. Whether it WILL be done remains to be seen.

If we read all of Wolf Street’s analyses of how the public has responded to Covid and the trillions of dollars of stimulus, we see a public which CAN AND DOES respond in pretty rational ways to price and their expectations for the future. For example, student loan debt has continued to rise in a straight line (because, student’s tell Wolf, everyone expects that the debt will eventually be written off), while credit card debt (which has ruinous interest rates) is down rather sharply. Property prices in the most bubbelicious cities are down sharply, while prices in humble cities such as St. Louis haven’t moved at all. All in all, Wolf’s reports of the facts tell us that consumers are not crazy. They might misjudge the willingness of the government to collect those college loans at the point of a gun, but they are not behaving irrationally.

We also have the urban/ rural divide and the curse of abstract European philosophies. People who are heavily dependent on fossil fuels do not need lectures on global warming. Nor do they need lectures about eating animals or smoking pot. So the Democrats in Florida run behind Biden because, according to House Democrats, too many people bring up the concept of ‘socialism’. America has a long history of Pragmatism. The voters in Florida approved on the same ballots a significant increase in the minimum wage. Voters have increasingly approved de-criminalization of drug use. (Hard-red Oklahoma approved ‘medical marijuana’ over the opposition of almost everyone in government a couple of years ago.). So while the educated may try to impose a label such as ‘socialism’ or ‘neoliberalism’ on things, I suggest that Pragmatism is the best explanation.

So my suggestion to Biden and McConnell, who have a long history of compromises, is to pursue a Pragmatic course which deals with the grievances of that huge rural half of the country. They also need to deal with the grievances of the urban underclass. What they don’t need to do is keep making the rich even richer, and they don’t need to adopt Trump’s slogan “the stock market is my report card”.

I suggest that the federal government get out of the business of shielding people from reality. Rising sea levels and refusal to wear masks and eating bad food and failure to exercise are all risk factors which need to be immediately reflected in the price of homeowners and health insurance. The rural do not realize how dependent they are on federal largesse…and they need to learn that lesson. But the urban are similarly unaware of just how dependent they are on the rural, and they need to learn that lesson. The urban underclass needs to learn some hard lessons around cultural norms.

Don Stewart

Don, you said, “We also have . . . the curse of abstract European philosophies.”

Lol, you mean The Enlightenment (TM)?

De-Constructionism? Post-Structuralism? Nietzsche’s nihilism and Will to Power (which many critique on grounds of N’s advocacy thereof, but which nonetheless accurately describes the underpinnings of the actual behavior of the sociopaths that run the the MIC, big business, big education, big foundations and politicians)?

Personally, I would say that that managerialism is far more a curse on our actual daily lives than these philosophies. For a single overarching destructive outlook, though, it’s hard to beat the foundational views of the Western religions that the earth and all that’s in it was given to Man to rule and use to his heart’s desire, and that we are made in God’s image – i.e., we are mini-gods to everything below us.

It would be an interesting debate though, the primary contributory philosophies and worldviews that curse the modern world.

Doesn’t the Christian view amount to custodianship – that our ‘dominion’ over other species carries responsibilities, for the performance of which we are accountable?

That’s how I’ve understood it, anyway.

@Tagio and Dr. Morgan

RE: Christian viewpoint. Traditional Christianity may have emphasized the custodial role, but the Mega-Churches fell under the spell of ‘human exceptionalism’ and ‘if you want it, you can have it’. These mega-churches, typically located on an interstate highway, may not exist in Europe. The do exist in South Korea, and the Korean government is thinking about suing one of them for actions which fostered a ‘super-spreader’ event.

But more to the point of Tagio’s comment on philosophies. As I see it, the cure for philosophy is prompt and accurate feedback. I think that Lisa Feldman Barrett (whose interviews and articles I have linked to previously) has nailed it on how the brain functions: as a prediction machine which only knows what the body senses and comes to its attention in a highly compressed format. The corollary I draw is that it takes some sharp setback to change course. For example, a midwestern US farmer who has been using high-input agriculture to grow soybeans for export to China to feed pigs in Confined Animal Feeding Operations won’t respond to lectures about how stupid that all is. What they do respond to is when China shifts the purchases to Brazil. BUT, the Trump administration has attempted to make-whole, so that the farmer feels only a little pain and doesn’t vote against Trump.

So my conclusion is that lectures, based on philosophies, don’t accomplish very much except to stoke the ego of the one delivering the lectures. It takes experience to break through the habitual patterns in brains. Government can serve best by making sure that feedback is fast and accurate. And…maybe…helping to pick up the pieces and start on a different pathway. But I suggest that a more realistic scenario involves Kropotkin’s Mutual Aid Societies.

Don Stewart

A vote for Pragmatism?

I’ll consider this review another vote for pragmatism:

https://www.resilience.org/stories/2020-11-09/a-small-farm-future-review-2/

Don Stewart

Update

It seems to me that what we need now is as follows, and I’m minded to do this in three parts:

– Basics – the economy as an energy system, and where it goes next, modelled using SEEDS. (Much of this is familiar to long-standing readers, of course, but not to the many who’ve found this site more recently)

– Implications, part I – sectors, activities, changes

– Implications, part II – nations & regions

Some of these might be supplemented with stats downloads from the new ‘premium’ version of SEEDS.

This seems to me to be a turning point, at which the credibility of ‘conventional’ economic interpretation is at a new low – and we do have alternatives…..

Tim, gods are not accountable, that’s kind of the main thing about being a god.

Certainly the current Pope and many other religious figures have taken your viewpoint, but that is not how it has been understood or evidenced by behavior for the last 3,000 years. In any event, even “custodianship” goes too far, implying that we understand the world well enough to do this credibly and responsibly, even with the best intentions. It still implies a superiority, a standpoint above the world, and a competency and objectivity we very likely do not have, and lends itself to the idea, among others, that there’s always some techno fix to the predicament we created -using technology. Like geoengineering the atmosphere in response to climate change. Yeah, that will go well.

The permaculture principles of observe, observe, observe, and to make changes only slowly, and only in small steps, are far better precautionary principles.

James Delingpole’s interview with respiratory expert Dr Mike Yeadon is a revelation. Here he touches on the WEF and the shadowy Klaus Schwab “build back better”..oddly a phrase used by many world leaders -coincidence surely?

Interesting Panel

Chris Martenson assembled a panel consisting of Art Berman, Gail Tverberg, and Richard Heinberg to talk about energy and the economy, with side trips into subjects such as personal resilience and what each of us might be doing…Don Stewart

Is Trump only a joke?

President Trump announced on Monday that he has replaced Defense Secretary Mark Esper with a new acting secretary, Christopher Miller, who had been confirmed by the Senate as the director of the National Counterterrorism Center. Esper gave an interview to Military Times ahead of his firing saying, “Who’s going to come in behind me? It’s going to be a real ‘yes man.’ And then God help us.”

Don Stewart

Trump can still do immense damage.

@Don Stewart

Please supply specifics. Only because i have to, i didn’t vote for trump in 16 or 20. In the past four years all i’ve heard is how awful he is but i don’t see any policy difference. I do see democrats talking about making “lists” of trump supporters and so forth, i do see the media censoring the president of the united states, i did see four years of baseless accusations of russian collusion, i do remember hillary and Jill stein contesting the election in 2016. I do know Joe Biden has been involved in government since before i was born and the standard of living in the united states for the majority has declined during that period. I do know that billionaires who i’ll never meet or ever have any contact with are coming up with “plans” to order around the rest of the population do to the stupidity of the system they’ve been cheerleading as long as they get to remain in control, and i’m sure the plan to remain in control of “the great reset”. So please, tell me how one man in four years against intense opposition has created this hellscape we live in and which will only get worse as time moves on with our leaders still lying to the majority of people? Please give me specifics.

Mr. House

I see Trump as a dangerous narcissist. I see Biden as having a very Washington-centric view of the world which is not congenial to a Degrowth reality. In the election, we had a choice between two poor candidates. To blame Biden, as you do, for the decline in the prosperity of the great majority of people in the US is to give him far more power than he actually has. I see Biden as part of the crowd who sees everything through the lens of GDP….it GDP is going up because government regulations are increasing the cost of doing business or the government is running huge deficits or people are going into debt…then that is wonderful. It’s like a hall of mirrors where money printing is used to enable people to pay for wasteful production. In my own opinion, we will soon enough find out about harsh reality. It involves neither the Wall Street mentality of Biden (and of Trump) nor the Identity Politics (also practiced by both men).

I heard that Biden lost Cuban votes in Florida because somebody at a Democrat rally held aloft a picture of Che Guevara. That was 65 years ago. At the present time, we do, in my opinion, desperately need to look at the Cuban health care system that Che was instrumental in establishing. It is vastly less productive of GDP than the US system (which is actually just the cost of living) but equally productive of health. As we get poorer, we need to look carefully. But we seem to be unable to have any discussion because of all the noise being generated.

Don Stewart

“I see Trump as a dangerous narcissist.”

And Biden isn’t? I found your response to be an evasion. Where are the specifics? I understand the situation we are in, what does that have to do with who is in charge. You mention we had awful choices, and you think thats just by chance?

“As we get poorer, we need to look carefully. But we seem to be unable to have any discussion because of all the noise being generated.”

Again, this is by chance?

“Make it stop! was, however, followed hard upon by I didn’t do it!. Jonathan Allen and Amie Parnes, in Shattered: Inside Hillary Clinton’s Doomed Campaign, describes how Robbie Mook deployed RussiaGate to delegitimize the newly elected President in a meeting with the rest of the defeated Clinton camp the day after Election Day 2016. RussiaGame became the Goebbelsian propaganda operation that it was — if there had been anything to it, Pelosi would have impeached Trump for it, Mueller Report or no[2] — through an unholy alliance of the Democrat Party apparatus, the intelligence community, and the press. All were variously motivated — “There in stately splendor, far removed from the squalid village below, they fight their petty battles over power and money” (Bob and Ray) — but the effect on the PMC was extraordinary: To this very day, any opposing or dissenting force to the liberal Democrat orthodoxy of the day can be dismissed with a one-liner about Putin! I’ve never seen anything like it.[3] Both (1) and (2) combined to drive turnout, voluntering, donations, and everything else. (That the Democrat base is too sliim to rule on its own is another issue entirely.)”

Mr. House

The head of the DOJ department in charge of election fraud just resigned. I think we can guess why. There MUST be some kind of show trial to please Mr. Trump. It is very similar to what the Democrats did with RussiaGate, what John Kennedy did with the Missile Gap, what LBJ did with the Tonkin Gulf, and what Bush the Second did with Weapons of Mass Destruction. And you want me to explain why? Maybe next to a hot fire during the winter with snow blowing outside. But until then, I will let your imagination run free.

My opinion is that we are in the same place Armenia found itself in the war with Azerbaijan…they lost. The mob which attacked the government offices in Armenia could not recognize reality. It’s just that our war is with the cost of energy, economic complexity and waste, and social dysfunction. So far, we are losing.

Don Stewart

“To blame Biden, as you do, for the decline in the prosperity of the great majority of people in the US is to give him far more power than he actually has.”

Really? Replace Biden with Trump and again, what are the specific differences?

@Don Stewart

No i want you to explain why you take part in the political divide that helps to keep the perpetual screw the little people machine going. Is it because it popular to dump on trump and you just want to fit in with your peers?

@Mr. House

I subscribe to Chris Smaje’s list of 10 mortal threats to the way we live: Population; Climate; Energy; Soil; Stuff; Water; Land; Health and Nutrition; Political Economy; Culture

I also note his description of all of these threats as Wicked Problems:

*There is no definitive single formulation of the problem

*There are no ‘right’, ‘wrong’, or precisely enumerable solutions

*Any solution is a one-shot operation, with no possibility of trial-and-error learning

*Problems are symptomatic of other problems

*No single authority is empowered to enact solutions

*The problems are caused by the people who must solve them

*The future consequences of the problem are excessively discounted

*The time window for solutions is running out.

“Some or all of these features plausibly apply to each of the ten crises, suggesting that the search for simple solutions will prove elusive, especially since many of them challenge the capacities or even the future existence of institutions like governments.” Chris goes on to argue for a sort of response which owes a lot to Anarchism. I agree with his assessment. But to get to Anarchism we have to break a lot of eggs. Can that succeed? Will it happen anyway as the status quo implodes? Will we have another Reign of Terror?… The particular way in which the current political economy in the US and around the world implodes, while a very few people (some of them deranged) have their fingers on the nuclear buttons, is obviously a huge risk factor. I’d like to ignore it…but ignoring may be a huge risk factor.

I did, by the way, invest 10 years of my life working with people 50 years my junior on a small farm. During those 10 years I got a glimpse at how all 10 of Chris’ Ten Mortal Threats create both problems and opportunities. Now that I am 80, I can’t be an actual equal-partner participant in farm work. I can still ‘hoe my own row’, which I do in my personal garden.

Don Stewart

Après Trump, le déluge.

I hope you have some high ground, Lydia!

It’s shaping up to be everything that Hillary Clinton would have brought the US, and worse globally – renewed confrontation with Russia already announced I see.

The sycophantic articles emit a nauseating stench discernible even here on the other side of the Atlantic.

Yes, the vulgarian, who so upset refined sensibilities, is – probably- gone, but what oh what has been inserted by the MIC and corporations in his place?

It seems to me that the test is whether Mr Biden delivers on his commitments, starting with raising the corporate tax rate from 21% to 28%, taking more in tax from the richest, and doing something about the concentration of power in parts of the tech sector.

If he does these things, fears will look misplaced. If he doesn’t, then fears will start to look well-founded.

In fairness, he can’t do any of this early on, but might be judged after one or two years.

Dr. Morgan, he won’t be able to do that without the legislature, which is still in play. Entire states may be in play as the Dominion software (company connected to interested politicians like Pelosi, Feinstein, and to the Clinton Foundation) seems to have “glitches” flipping votes to Biden, and only to Biden.

There is absolutely no way that Biden will encroach upon the Tech Sector, since their censorship is the only thing keeping his campaign afloat. The banning of conservative sites is ongoing, and every day a new one is sent down the Memory Hole.

The plan (should Biden be installed) seems to be go back to the pre-Trump status quo ante: bring back foreign wars, esp. Syria; bring back the TPP; get rid of tariffs that the Chinese don’t like (they will want some return on their $1.5billion+ investment in the Biden family). Dick Cheney is going to advise Biden on foreign policy. Mitt Romney and other putative Republicans are on Biden’s side and joined in the DNC campaign (never seen such a thing in all my life!)

I have doubts that Biden will be alive in one or two years. He certainly won’t be on the scene functioning even at his currently erratic level. Harris (much more of a Hindu than a black.. and not an American black at all) is the real Manchurian Candidate here and I think that is largely being ignored. After garnering a whopping 1-2% in the runup to the Dem. primaries, in the case she rules she will have the “mandate” of 0.5%-1% of the US electorate. However, Harris/Biden is the globalists’ (Great Reset) choice.

===

Perhaps this is something you could address (maybe you have, but I have overlooked it).. do people “at the top” in any way perceive the energy and thus financial issues you outline? You must have feelers and might be able to say to what degree TPTB are knowing but putting up a smoke-screen or whether they are, or want to remain, completely clueless and will be blindsided by what is in store. I look at the WEF site, see Soros’ machinations.. and I can’t help wonder what they think is really going to happen.

CHS illustrates how the super-rich rig the system so they are always in a win-win situation whichever way fate turns: https://www.oftwominds.com/blog.html

So even if universal basic income/MMT for the people, gets here (to stop the masses rioting when they have nothing left to lose but their fear) they will still get ever better off. It’s simple and genius.

At all points in history, I suspect, the richest have always rigged the system in their favour.

One great thinker said that politics was (I quote from memory) “a struggle between those who have (to keep what they have got), and those who have not (to get it)”.

Eventually, the wheel turns, in ways that are reasonably well understood.

SocGen on QE and stock and bond markets

Stock markets owe roughly half of their current value to QE and similar monetary manipulations.

Don Stewart

“Trump is a narcissist”

>Manually types his handle out underneath every post

@Mr. House

Further thought. I previously explained that I thought Biden was in less of an echo chamber than Trump in terms of listening to facts and reason. (Maybe you missed that one.) Therefore, there is a better chance of influencing Biden than there is of influencing Trump…who thinks his massive brain has everything figured out already.

In 2016, I judged that Trump was more likely to behave rationally than Hillary, and voted accordingly. I could be wrong again, but I now judge Biden as more flexible than Trump.

Don Stewart

You are quite possibly correct in that assessment: Biden will be a perfectly biddable, elderly, figurehead (the polite term for puppet) ; which is why such efforts were made for 4 years to unseat and harrass Trump, who is an unpalatable outsider in terms of the US Establishment. At long last he has been regurgitated, and rejoicing must be great in the halls of power.

For your consideration:

Is it possible for a blog’s comment section to not become infected by partisan BS? Apparently not. If you think Trump was THE problem, you’re wrong. If you think Biden will be THE problem, you’re wrong. The kleptocratic systems are THE problem. Overshoot is THE problem. It’s a sad comment on human affairs that a minority of misguided commenters always seem to pounce when they sense a moment at which they feel they can divert attention from THE problems to partisan grandstanding (which is surely infinite).

Thanks David.

The way I look at it is that Trump vs Biden dominates a huge proportion of ‘the global debate’ right now. Whilst that’s understandable, there are other – and much bigger – issues at stake. From my perspective, of course, rising ECoEs, deteriorating prosperity, the environment, and our apparent inability to adapt to these issues are the big ones.

What I suggest is this. The next article here (#184) will be ready soon. Let’s try to discuss it without mentioning either Trump or Biden.

Tim, David Pursel, I vehemently agree!

@Mr. House

Addendum:

There may be no better way to understand the adage that ‘the economy is an energy system’ than by working on a small farm.

The adage is the literal truth that one wrestles with every moment of every day.

Don Stewart

Just read through this and I don’t see any reason to be impressed by it. Gail Tverberg doesn’t appear to have the ECOE view what so ever. More $ per barrel will give all the oil necessary for quite some time to come. In this “peer reviewed” paper it seems that $= energy period! Hmmm… maybe I’m missing something?

Click to access ke-wang-an-oil-production-forecast-for-china-considering-economic-limits.pdf

P.S. I’m with Tim, David and Micheal, election shenanigans within any country have no effect on the ECOE. It’s just distraction, bread and circus’ if you will.

Elections are mostly interesting (usually alarming) because of what the illustrate in terms of underlying social and political dysfunction. They may illustrate the problems that a society is encountering as it tries to deal with rising ECoE and all of Chris Smaje’s 10 mortal threats to our way of life…e.g., the Yellow Vests in France and the urban/ rural divide in the US. They are data.

In terms of the Chinese study, Gail Tverberg, etc. Let’s first assume that Louis Arnoux is correct that fossil fuels are used with systems which are 12 percent efficient overall, and 5 percent efficient using internal combustion engines for transportation. I suggest that such efficiencies are conducive to Seneca Cliff thinking…not the extrapolation of historical trends. To the extent that our huge infrastructure builds in the low efficiency, then small increases in ECoE can result in catastrophic consequences.

It is to Gail’s credit that she tries to marshall what she knows to extrapolate to some picture of the overall impact. Chris Smaje tries to do the same thing. There is something to be said for limiting one’s scope of attention…but also something to be said for taking the broad view that Tverberg and Smaje attempt.

Don Stewart

The social gains of the fossil fuel era are being rolled back. “Across the developing world, two decades of gains against child labor are eroding. . . . Instead of going to school, children in Kenya are grinding rocks in quarries. Tens of thousands of children in India have poured into farm fields and factories. Across Latin America, kids are making bricks, building furniture and clearing brush, once after-school jobs that are now full-time work.”

https://apnews.com/article/virus-outbreak-pandemics-mexico-india-united-nations-ab80ad40160b0b255e3dc68d11360b44

It’s back to the past! Dust off your Dickens, and Les Miserables!

It is getting harder and harder to avoid the conclusion that Covid is the opening salvo in implementing a degrowth, neofedual economy.

@Don Stewart

I did not intend to cause offense, i just think that staying within the Democrat/Republican narrative is counter productive. I understand you viewpoints on working on a farm and such. My family owned an autoparts distributor that i worked at from the age of 12 until i was around 23. I view the economy and business as an ecosystem. I think my non “PC” economic thinking was what helped me reach the conclusion Tim is talking about in 2008. What i’m worried about, is if we don’t break out of the red/blue narrative both of those parties are going to drive their “constituents” into harming each other. And those of us who tell them differently then whatever they believe are going to be harmed in the process. Trust me for the past 12 years i’ve been trying to spread the same message Tim is and most of the time its a classic case of shoot the messenger. Anyways i apologize again if i offended you, somedays the despair is stronger then other. I’m tired of feeling powerless and watching people spout things i know to be wrong and ignored when offering a different narrative. I hope everyone has a great day and here is another great chat i enjoyed.

I’m with Don here. I first wrote an op-ed about the impossibility of a dematerialized economy in 2000 for a Canadian techno-optimist journal. In 2001 I wrote “Growth: Salvation, Addiction, Cessation” which is still on-line:

http://www.contratheheard.com/cth/comment/01oct.html

The first few paragraphs are theirs, then I am introduced. I was writing for Joe and Mary Investor, so forgive the elemental style and content. This was 19 years ago.

The blame game between Reeds and Blues will only intensify as material conditions worsen. Wagons are circled, and “outsiders” blamed for everything. Tainter has been calling for this for many years as well. IMHO, Stephen Pinker will look the fool later this decade.

Suppose Louis Arnoux, Dr. Morgan, and Joseph Tainter are Correct

We all know how Dr. Morgan finds ECoE rising, and I have mentioned Arnoux’s finding that the thermodynamic efficiency of transport using internal combustion engines (on land) is 5 percent. Now Tainter in a recent panel discussion:

In “The Collapse of Complex Societies,” Tainter [writes] “The world today is full.” Complex societies occupy every inhabitable region of the planet. There is no escaping. This also means, he writes, that collapse, “if and when it comes again, will this time be global.” Our fates are interlinked. “No longer can any individual nation collapse. World civilization will disintegrate as a whole.”

When I ask him about this, the usually sober-sounding Tainter sounds very sober indeed. If it happens, he says, it would be “the worst catastrophe in history.” The quest for efficiency, he wrote recently, has brought on unprecedented levels of complexity: “an elaborate global system of production, shipping, manufacturing and retailing” in which goods are manufactured in one part of the world to meet immediate demands in another, and delivered only when they’re needed. The system’s speed is dizzying, but so are its vulnerabilities. A more comprehensive failure of fragile supply chains could mean that fuel, food and other essentials would no longer flow to cities. “There would be billions of deaths within a very short period,” Tainter says. Even a short-term failure of the financial system, Tainter worries, might be enough to trip supply chains to a halt.

Back to me. I previously noted that low efficiency in a high energy world can very plausibly lead to collapse if ECoE rises even a little. Since the Economy is now built on transport via ICE’s, I would classify our situation as ‘perilous’…if Arnoux and Tainter are also correct.

Don Stewart

The Tool-Box of the delusional “great Reset” also contains the last Jenga-Brick.

I’m surprised we haven’t been regaled with the epigenetic antecedents of Trumpian behavior yet. This election too will pass.

I would urge you all to listen to this interview:

“Professor Bhakdi is a Thai-German specialist in microbiology and co-author of Corona, False Alarm?: Facts and Figures.”

Pingback: #185. The objective economy, part two | Surplus Energy Economics