A FINANCIAL CRISIS PRIMER

Amongst the world’s decision-makers, French president Emmanuel Macron has come closer than anyone to spelling out the reality of the current economic situation, saying that “we are in the process of living through a tipping point or great upheaval”, and referencing “the end of abundance” (my emphasis).

If his words are taken seriously – as they should be – a major crisis looms. The global financial system is entirely predicated on perpetual economic growth.

As important as what Mr Macron has said is what he didn’t say. He didn’t say that abundance is over ‘for a year or two’, or that we’ll have to live through this ‘until better times return’. He didn’t make fatuous promises of ‘sunlit uplands’ or ‘a new golden age’.

Some of us have long known that an age of abundance made possible by low-cost energy was coming to an end. Until now, though, decision-makers have fought shy of this conclusion, taking refuge in the tarradiddle of ‘infinite growth on a finite planet’ proffered by a deeply flawed economic orthodoxy.

What should concern us now isn’t when, or whether, other leaders will arrive at this same conclusion. The trend of events is going to impose that emerging reality upon them.

Rather, we need to be prepared for what happens when market participants arrive at the same conclusion as Mr. Macron.

The nature of the crisis

Preparedness requires clarity, and we need to be in no doubt that what we’re witnessing now is an unfolding affordability crisis. This means two things – and both of them point towards a major financial slump.

First, the ability of consumers to make discretionary (non-essential) purchases is in structural decline. This spells relentless contraction, not just in obvious discretionary sectors like leisure, travel and entertainment, but in ‘tech’ and consumer durables as well.

Second, households will find it increasingly difficult to ‘keep up the payments’ on everything from mortgages and credit to subscriptions and staged-payment purchases.

All of this has obvious negative implications for stock and property markets. But the real risk to the financial system resides, not in asset prices, but on the liabilities side of the equation.

The problems here are inter-connectedness, scale and opacity. Globally, private sector debt totalled $144 trillion at the start of the year, of which $85tn was owed to banks. But these numbers are dwarfed by broader private sector exposure. Analysis carried out for this report puts this number at $513tn, but this is no more than an informed estimate, because available data is neither complete nor timely. The probabilities are that $513tn understates the real scale of the problem.

Most disturbingly of all, the majority of this credit exposure isn’t subject to reporting and regulatory rules of the sort that apply to deposit-taking banks.

With hindsight, the causes of the global financial crisis (GFC) – sub-prime lending, securitization, imprudent lending and inadequate regulatory oversight – should have been apparent long before 2008.

Likewise, historians of the future can be expected to marvel at the subsequent further break-neck growth of an enormous network of interconnected commitments based on the false premise of infinite economic expansion.

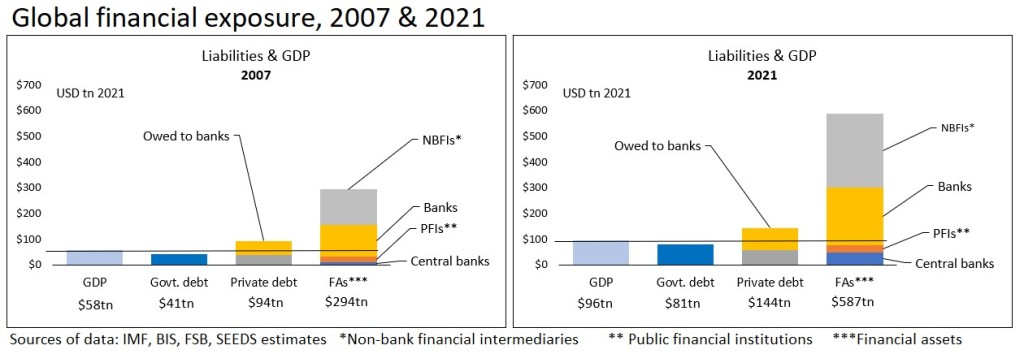

Fig. 1 – whose constituent parts are discussed later – provides an overview of the scale of world financial exposure, comparing, at constant dollar values, the situation today with that of 2007, on the eve of the GFC.

Fig. 1

At the end of abundance

Regular visitors to this site will know why material abundance is ending, and will also know that this turning point hasn’t hit us like a thunderbolt from cloudless skies. In fact, we’re at (or very near) the end of an end-of-growth precursor zone which we can trace right back at least as far as the 1990s.

It is surely self-evident that the economy is an energy system, not a financial one. But material prosperity isn’t a simple function of the quantitative availability of primary energy. Rather, the flow of economic value generated by the use of energy divides into two streams.

One of these is cost, meaning the proportion of accessed energy that, being consumed in the access process, is not available for any other economic purpose. This ‘consumed in access’ component is known here as the Energy Cost of Energy. Material prosperity is a function of the surplus energy that remains after ECoE has been deducted from the aggregate (or ‘gross’) amount of energy available.

Rising ECoEs affect the energy-prosperity dynamic in two ways. First, they reduce prosperity by decreasing the quantity of surplus energy available. Second, they make it ever harder to strike prices which meet the needs of both producer and consumer. In this equation, prices are an interface between producers’ costs and consumers’ prosperity. As costs rise and consumer affordability diminishes, aggregate supply starts to contract.

ECoEs have been rising over a very extended period, driven primarily by the effects of depletion on fossil fuels. Quite naturally, we have used lowest-cost resources first, leaving costlier alternatives for a ‘later’ that has now arrived.

This trend is a global one, and not even energy-rich countries like Russia or Saudi Arabia are exempt from it. Those who blame the current energy crisis on “Putin’s war” are victims of self-deception. The conflict in Ukraine has, at most, brought the end of energy abundance forward by a small number of years. Neither Saudi nor anyone else can ‘rescue’ us from the effects of rising ECoEs.

After the hope that trade with Russia will resume, the second consolation offered to the public – offered, perhaps, in full sincerity – is that transition to renewable energy sources will recreate the economic abundance hitherto bestowed by oil, natural gas and coal.

The reality, though, is that this is most unlikely to happen. The expansion of renewables depends upon the use of enormous quantities of materials including steel, concrete, copper, cobalt and lithium. These material requirements can only be made available by the use of legacy energy from fossil fuels.

The case for ‘seamless’ transition to renewables is based on three sources of self-delusion. One of these is mistaken extrapolation from past decreases in cost. The second is a failure to recognize that the capabilities of technology are bounded by the laws of physics. The third is simple wishful-thinking.

Advocates of transition to renewables are right to emphasise the critical importance of wind and solar power. A “sustainable economy” may indeed be possible, though it’s being made harder to achieve by our insistence on modelling the future on an adaptation of the processes of today (which is why we’re promoting electric vehicles, when trams and trains make a lot more sense).

But “sustainable growth” is a myth – there’s no reason to suppose that an economy powered by renewables will be as large as the fossil fuel economy of today, and every reason to expect that it will be smaller.

Understanding affordability compression

Just as prosperity decreases, the real costs of energy-intensive essentials will continue to rise. This is part of a broader pattern best understood by dividing economic resources into three functional segments.

These are the provision of essentials, capital investment in new and replacement productive capacity, and discretionary (non-essential) consumption.

These patterns are illustrated in fig. 2. These charts are designed to facilitate comparisons with other forecasts, so they accept latest-year (2021) GDP as a start-point, but use SEEDS prosperity calculations to restate prior trends, and to project future outcomes. Each is stated in national currencies at constant 2021 values.

As you can see, whilst aggregate prosperity is deteriorating, the costs of essentials are rising. This means that both capital investment capability and discretionary affordability are falling.

Fig. 2

What this means at the household level is illustrated in fig. 3, where prosperity per capita is compared with trends in the estimated costs of essentials. These charts show average per capita numbers, meaning that the situations of those on below-average incomes are worse than these graphs might suggest.

Fig. 3

Of course, decision-makers have never acted on any assumption other than ‘growth in perpetuity’. When rising ECoEs began to bear down on economic performance in the 1990s, the concept of energy causation was disregarded, and it was assumed that the material deceleration involved in “secular stagnation” could be fixed with financial tools.

Accordingly, access to credit was expanded, causing debt to rise rapidly. At least until 2008, this appeared to be working. In fact, though, what we had been doing was creating cosmetic “growth” with liability escalation.

The GFC should have laid bare the fallacy that we can create material supply with financial demand. Instead, decision-makers doubled down on this fallacy by supplementing “credit adventurism” with “monetary adventurism”. Negative real interest rates are a dangerous anomaly, incentivising borrowing whilst discouraging investment. The capitalist economy, after all, relies upon positive returns being earned by the owners of capital. It also depends on allowing markets to price risk without undue interference.

This means that, in 2022, we’re discovering what many have known (or at least suspected) all along – that we’ve been sacrificing the stability of the financial system, and the effective working of a market economy, in pursuit of a chimera of “growth”.

Go figure – the scale of exposure

Let’s start putting some numbers on the magnitude of global financial exposure. This is complicated, and fig. 1 (shown earlier) is intended to set out the broad structure of financial liabilities – at constant values – comparing the current situation with the equivalent position on the eve of the global financial crisis (GFC) in 2007.

Please note that the data set out in fig. 1 is stated in constant (2021) dollars converted from other currencies at market rates, not on the PPP (purchasing power parity) convention generally preferred here.

Conventional debt data is available from the Bank for International Settlements. BIS data shows that, at the end of last year, governments owed $81tn whilst, within private sector debt totalling $144tn, $85tn was owed to commercial banks.

The real issue, though, isn’t debt, but broader financial exposure. These “financial assets” – which are the liabilities of the government, household and private non-financial corporate (PNFC) sectors – are reported by the Financial Stability Board.

Financial assets fall into four broad categories. Three of these – central banks, public financial institutions and commercial banks – are self-explanatory, though it’s noteworthy that the total exposure of commercial banks (estimated here at $224tn) far exceeds the conventional debt owed to them by households and PNFCs ($85tn). The fourth is NBFIs, which means ‘non-bank financial intermediaries’.

We need to be clear that the FSB data is neither timely nor complete. The data covers 29 countries which, between them, account for about 85% of the world economy when measured as GDP. The most recently-available data, published on 16th December 2021, relates to the situation at the end of 2020.

To assess the current global position, then, we need to make informed estimates, brought forward to the present, based on the data that is available.

At this point, it’s vital to note that the FSB is not a regulatory authority. Generally speaking, deposit-taking institutions are regulated, but other credit providers are not. This is a huge gap in the ability of the authorities to maintain, or even to monitor, macroeconomic stability.

This lack of regulation is particularly important when we look at NBFIs. This sector is commonly referred to as the “shadow banking system”. NBFI exposure is enormous, and can be estimated at about $290tn as of the end of 2021. This exceeds the combined total of global government and private debt ($225tn).

The NBFI sector comprises various components, which include pension funds, insurance corporations, financial auxiliaries and OFIs (other financial intermediaries). This latter category includes money market funds, hedge funds and REITs.

In an article published in 2021, Ann Pettifor provided a succinct description of the shadow banking system. She traces the rise of the sector to the privatisation of pension funds, which happened in 30 countries between 1981 and 2014, and which, she says, “generated vast cash pools for institutional investors”.

Shadow banking participants “exchange the savings they hold for collateral”, generally in the form of bonds, usually government bonds. Instead of charging interest, they enter into repurchase (repo) agreements whereby the borrower undertakes to buy back the bonds at a higher price.

She points out that securities “are swapped for cash over alarmingly short periods”, and that “operators in the system have the legal right to re-use a security to leverage additional borrowing. This is akin to raising money by re-mortgaging the same property several times over. Like the banks, they are effectively creating money (or shadow money, if you like), but they are doing so without any obligation to comply with the old rules and regulations that commercial banks have to follow”.

Measuring the shadow

How much risk attaches to this depends, of course, on the scale at which it exists, and this is where we run into difficulties. As remarked earlier, FSB reporting covers only 29 economies, though these do account for about 85% of the global economy.

What we need are informed estimates of global financial exposure. The approach used here is to divide the financial assets universe into three parts.

One of these comprises the 23 (of 29) FSB reporting countries that are also covered by the SEEDS economic model.

The second group comprises specialist financial centres, of which two – Luxembourg and the Cayman Islands – are covered by FSB data.

As of 2020, Luxembourg had financial assets of $19.3tn, and a GDP of $79bn. The equivalent numbers for the Caymans were $8.9tn and $4.9bn. Accordingly, their respective ratios of financial assets to GDP were 23,678% (Luxembourg) and 253,485% (the Caymans).

The third group consists of all countries other than the 23 SEEDS-covered economies and the two specialist financial centres.

Together, these calculations suggest that aggregate financial assets totalled $520tn at the end of 2020, rising to an estimated $589tn last year. The deduction of the central bank and PFI (public financial institution) component puts private sector exposure at an estimated $513tn, most of which is unregulated.

The composition of available data and estimates is illustrated in fig. 4. (Like the other charts used here, fig. 4 can be expanded by opening it in a new tab).

Fig. 4

Assets and liabilities – “the future is almost gone”

There’s no absolute “right” or “wrong” level of financial exposure. What matters is the relationship between monetary commitments and the underlying economy.

Those of us who understand the economy as an energy system are at a unique advantage when it comes to assessing the level and tendency of financial risk. The concept of “two economies” enables us to recognize the true nature of money – in short, we know that money isn’t ‘the economy’, but exists instead as an aggregate of ‘claims on the economy’, which is a wholly different proposition.

As you may know, money has no intrinsic worth, but commands value only as a ‘claim’ on the products and services supplied by the ‘real’ or material economy of products and services.

Three useful distinctions can be made here. First, current monetary activity is a financial representation of the underlying economy of goods and services. Second, liabilities are a claim on the material economy of the future. Third, asset pricing represents a collective perception of what the material economy of the future will be able to deliver.

As we’ve seen, the representation of the economy has become distorted by the use of monetary expansion to create cosmetic “growth”. Liabilities at their current size, meanwhile, could only be honoured “for value” if the underlying economy were to continue to expand indefinitely which, as we’re beginning to discover, cannot happen. Asset prices have been inflated, not just by ultra-low interest rates, but also on the basis of a collective misconception about the future size and shape of the economy.

Let’s clarify this a little by recognizing that both asset prices and liabilities are embodiments of collective futurity. By “futurity”, we mean common expectations for the future.

If forward expectations are positive, investors assume growing corporate profitability, whilst lenders assume an ability to service and honour expanding debt and quasi-debt commitments. If the expectations embodied in collective futurity are downgraded, asset prices become vulnerable to sharp corrections and, more importantly, assumptions about borrower viability are called increasingly into question.

The current economic crisis is causing an increasing resort to credit by struggling households and businesses. These ‘borrowers from need’ are a far greater default risk than ‘borrowers from choice’, but this worsening risk profile hasn’t – yet, anyway – been reflected in the availability and cost of credit.

Lenders’ collective insouciance about providing credit to high-risk borrowers may reflect a general assumption that credit providers will be bailed out ‘if the worst comes to the worst’.

We need to be absolutely clear that systemic-scale rescues aren’t possible, which is surely obvious to anyone who compares over $500tn of non-government liabilities with a $96tn economy.

This isn’t 2008, when “toxic assets” were largely confined to securitized sub-prime mortgages and reckless real estate-related lending. What we face now is the culling of large swathes of the discretionary economy, combined with degradation of the income streams which flow from households to the corporate and financial sectors. If the authorities attempted to backstop all of this with newly-created money, the result would be hyperinflation.

So the real problem now is – in the words of Mickey Newbury – that “the future’s not what it used to be”. We might also reference a newly-released song by Monkey House – “the future is almost gone”.

The essentially-positive collective futurity that has shaped both asset prices and the cost and supply of capital is turning out to have been wrong. This has a direct read-across to the expectations and attitudes, not just of investors, but of lenders as well.

If we’re making a list of critical interpretational phrases to help us understand changing conditions, we can add “a futurity reset” to “affordability compression”. Both are compatible with Mr Macron’s “end of abundance”.

A process of implosion

As we’ve seen, the long-established positive collective futurity is being undermined by a dawning recognition of the reality that we cannot rely on perpetual economic growth. We can’t know what the sequence of events is likely to be as this reality sinks in, but we do know some of its critical components.

One of these is a slump in capital markets, led by an investor flight from discretionary sectors. This can be expected to occur as soon as investors realize that affordability compression isn’t temporary but is, rather, an intrinsic component of the ending of abundance.

Another is a sharp fall in property prices, reflecting impaired affordability, compounded both by rate rises and by the prospect of distressed sales. People who can no longer afford to service the mortgages they already have are in no position to take on ever larger commitments. We have no systems in place for coping with collapsing property prices, even though such systems would not be difficult to design.

Governments can be expected to act, even before the financial system starts to implode, because of the need to address the hardship now being suffered by the public. But this is where the authorities are brought to a recognition of quite how limited their options really are. If they resort to full-on monetary intervention, the effects would be to drive inflation higher – particularly in the categories of necessities – which would make household hardship worse.

We need to be clear, meanwhile, that there is no single “right answer” to the rate policy conundrum. The Fed seems to think that rate rises, and the reversal of QE into QT, will defend the purchasing power of the dollar.

The Bank of England has been much criticized for raising rates, and is likely to face more flak over future rate hikes. In fact, it’s highly unlikely that the Bank is naïve enough to think that it can counter double-digit inflation with 0.5% increases in rates. Rather, the Bank can be presumed to be endeavouring to demonstrate to the markets that it’s not indifferent to defending the value of the pound. The very worst thing that could happen to the British economy would be a “Sterling crisis”, and the independence of the Bank is the single strongest defence against this happening.

The biggest danger of the lot, though, is an implosion within the credit sector, affecting not just banks but NBFIs as well. Here, market participants may – for some time, at least – hold their nerve, placing their trust in the (actually impossible) assumption that, as in 2008-09, governments and central banks will intervene to backstop the system.

Eventually, though, the network of interconnected liabilities will start to unravel, in a similar (though vastly larger) re-run of the ‘credit crunch’ of 2007. At this point, credit flows dry up, because nobody knows which counter-parties are or are not viable.

“All roads”, it’s said, “lead to Rome”, but all of the discernible trends in the financial system point to financial implosion.

As abundance ends, so, too, must any system that is predicated entirely on its infinite continuance.

Here’s a quick primer on the cause and consequence of Europe’s natural gas crisis:

The worst is yet to come.

Very interesting Joe. I think that you are not correct in saying, (and I am paraphrasing) that the only way to provide adequate gas to Germany is via LNG. The EU and NATO could negotiate a peace settlement with Russia and end the sanctions and turn on NordStream 2.

Please someone refute the facts provided in this article:

https://www.globalresearch.ca/europe-energy-armageddon-from-berlin-brussels-not-moscow/5792005?pdf=5792005

No way the west will cave in to putrid Putin in my opinion. I’m surprised that he’s still alive with all the enemies he’s made in Russia and outside. Their economy is getting gutted, and brain drain huge. No chips kills their tech industry and many others needing smart parts.

Sent from my iPhone

>

Perhaps the most amazing paragraph in this paper is:

“On August 28, German Finance Minister Christian Lindner, the sole cabinet member from the Liberal Party (FDP), revealed that under the opaque terms of the complex EU Electricity Market Reform measures, the producers of electricity from solar or wind automatically receive the same price for their “renewable” electricity they sell to the power companies for the grid as the highest cost, i.e. natural gas!”

The policy is obviously great for reducing CO2 production, but it is also great for killing any European economy. Controlled de-growth?

Even if the West were to do the right thing and negotiate with Russia, things would not go back to the way they were before.

If Nordstream 1 is put back into service and / or Nordstream 2 were to be comissioned, the Russians would demand a much higher price for their gas.

The Euroeans and the UK, have exposed how weak and vulnerable they really are, and they have shown absolutely no brotherly love towards Russsia. ( quite the contrary, the combined West’s open and visceral hatred for all things Russian has profoundly embarrassed me ).

So if I were Russian, I would bleed Europe and the UK dry. ( economically speaking )

You’ll have a very long wait, Johan. Russia is crumbling internally as we speak. Ukraine forces are winning back territory, and might capture thousands of trapped Russian soldiers. Europe will do better than expected this fall and winter in the opinion of some. There are combinations of other fuels (oil, coal, wood) being ramped up, and people have been preparing for several months with personal firewood. Sabine Hossenfelder, physicist and author in Germany, told me that her house uses oil for heat and so do many others. The invaders have most of the world against them, and will be ostracized for years after they lose this break of UN rules.

Johan;

I agree with your evaluation, and your feeling of embarrassment. I have been following the war as closely as an ignorant person can (I dont speak or read Russian, or Ukrainian).

I was just checking the news, and the death toll from the Kherson offensive is now being reported to be at or near 10,000 dead and generally a rule of thumb that I recently learned is that the number of wounded is likely 3 times the number of dead, so 30000. Hospitals up to 150 miles from the front are reportedly overflowing.

The offensive in the north part of the country will be much more deadly, because the Ukrainians have pushed into an area in which they are functionally surrounded with no escape. Hopefully, many will surrender.

The Russians, DPR and LPR are killing these people, but I can only conclude that they are being murdered by US, British and NATO policy.

(So, where is my comment from last night?)

That is a good one. US promo a bit, Zeihan, but OK.

Do we have a nerd on board that saves IP etc from the lackeys?

Crowd funding?

True Johan. There’s no value anymore. Fiat currencies can extract low hanging fruit.

From the third branch and up, there’s nothing but cheap comments and filthy avatars.

Pintada, facts? Based on what, a view from the monetary plane? Or a view from a common divorced lady unable to rent or buy a decent house in her own f*cking country to raise just ONE son or daughter in the country she once believed in?

The £ is a fact. Do you believe?

‘Food Banks All Over The U.S. Are “Overwhelmed” As The Cost Of Living Pushes More People Into Poverty’?

http://theeconomiccollapseblog.com/food-banks-all-over-the-u-s-are-overwhelmed-as-the-cost-of-living-pushes-more-people-into-poverty/

@David in a million years

I hadn’t really thought about the weight of EVs vs the weight of a gasoline engined car. My understanding is that the EVs weigh a lot more. Second, the amount of material that has to be moved in order to produce the batteries and charge them is a lot higher than the amount that has to be moved to produce conventional oil. (tar sands and fracking are something else). So when we get down to the basics of moving weight, the world is choosing to go to much more physical work intensive processes.

There won’t be any free lunch in terms of those choices. More work is, at the end of the day, more work which requires more energy. So the ECoE will rise steadily.

The comparison with bicycles is pretty stark. Vastly less work. Better public health with lower medical costs.

The bicycles do demand a “modern” system of paved roads. Bicycle clubs were established in the 19th century in the US to promote better roads for bicycles. As the example of Edo shows us, friction reducing narrow wheels cause erosion in soft surfaces, and paving roads without using fossil fuels is an unsolved problem.

So walking is the ultimate solution. Back to the Hadza???

Don Stewart

I agree that: “we’re promoting electric vehicles, when trams and trains make a lot more sense”.. However, on a personal basis if one has to have a car, then an electric one is a far more efficient use of energy than petrol, because of regeneration. I can drive about 4 miles in my BEV for one kWh of power, which I can generate from my rooftop solar panels: over the course of a year I generate enough solar to drive my car 10,000 miles. Thats a real game changer for the average motorist, and is already starting to reduce demand for petrol.

A quick check of live Grid status in the UK shows we’re currently exporting 10% of electricity output to Europe, mainly to France. Looking at the generating mix, this isn’t a baseload surplus that’s being exported, because natural gas is being used for 50% of power generation at the moment.

Thankfully we’re still in summer, because during the winter months It’s more typical for the UK to be importing 10% than exporting 10%. This reliance on winter imports doesn’t bode well, because it just might not be available, at any price.

During the winter, typical daytime demand for electricity in the UK is about 30% higher than it is today. Where’s that going to come from, if not gas? There’s only one answer, and that’s wind. We need a very mild and windy winter to keep things going. But, supposing there’s one of those periods when the Jet Stream gets stuck for weeks on end, and we’re becalmed in cold arctic air. Those occurrences’ seem to be happening more frequently, and if it happens this winter then we’re probably in very big trouble. It’s not just the UK that can be affected, but also the North Sea states within the EU. Industrial load shedding might not be enough to keep the lights on, as wholesale gas prices rise to ever more insane levels, or it’s just not available at any price

Import and export of power via interconnectors has become a well-established practice, but I wonder if that might suddenly change if (or more likely when) the “shit hits the fan” this winter? Potentially, it’s a political hot potato if a nation experiences load shedding power cuts, but is known to be exporting through the interconnectors; even if the export occurs during periods of no blackouts. I wonder if international co-operation will break down and Energy Nationalism will emerge? This has the potential to tear Europe apart.

Well said.

I meant to Tim’s comment about the late Queen.

Please see: https://substack.com/redirect/1609a9ab-0bdf-4071-a1a1-2f51f23ee150?r=1m5qgr

Nothing to disagree with in Nate’s take on green growth, degrowth, and growth in general.

This winter in Europe we’ll see how well developed economies respond to a significant economic contraction caused by energy scarcity. If Hagens is right, Europe will burn everything it can to keep warm and keep the lights on.

The tricky part will be spreading the pain equitably. If Europe can pull it off without too much social disorder, it can show the way for the rest of the world, which will be following along shortly. The hard part will come when everyone realizes that the pain will never end.

Speaking of pain: we somehow have to manage a never-ending global economic recession with continuously intensifying hardship, including rising death rates, for many decades to come without stumbling into financial, supply chain or social collapse (and avoid widespread war). It would be nice to think that humanity is clever enough to do all that on an ad hoc basis, but I’m not optimistic.

Yes, Nate is excellent, nothing to disagree with in that video.

My take on things is slightly different, at least in emphasis. In much of the West, material prosperity has already been deteriorating over a lengthy period. We’ve been ‘faking it’ – creating a simulacrum of continuity and growth – using financial gimmickry. That’s already created one financial crisis, and will now bring a second and much larger sequel.

I wish I could be optimistic about the coming winter in Europe, but no amount of fiscal support can change the fundamentals, i.e. energy shortages. We’ve reached a point that should be beyond politics, where countries may need ‘grand coalitions’ or ‘governments of national unity’. This is pretty much what Britain did in the Second World War.

Schizophrenia

https://thesaker.is/asias-future-takes-shape-in-vladivostok-the-russian-pacific/

Summary of developments in Vladivostok. Absolutely 180 degrees from most of our Atlantic basin conversations. Biden’s position is that all that multilateralism will not be allowed to happen. The US must be the orchestrator. Probably a bumpy road.

Don Stewart

Biden and his handlers are in panic / headless chicken mode.

So we can expect some not only stupid but seriously dangerous decisions being made in future.

The Vladivostok conference has been equated to a mini- modern day Bretton Woods. Eurasian countries are de-dollarising. They are trading in bilateral currencies, and if what we hear about Russia setting up a new Gold exchange ( based on Physical metal )is true, then we will most probably see a new currency emerge from this very soon.

Russia with its energy abundance will benefit greatly from this. People who think that Russia is struggling economically, are paying too much attention to biassed, western, main-stream media, ( ie. Propaganda ).

Just look at the Aluminium market now. Europeans are closing down smelters because they can no longer afford to pay the energy costs incurred in the process. Production in Europe is supposedly down 80% !

Russia on the other hand is stepping in to fill that void. Their smelters are still running of cheap, reliable and dependable Russian gas which gives them an enormous competetive advantage.

This will soon cross over to other products too, in fact I can see a future in which Russia dominates all markets for products that are energy intensive in their manufacture.

Fair enough, but what does this mean for China? The PRC has serious energy deficiencies so, by implication, is disadvantaged vis-a-vis Russia in much the same way (though perhaps to a lesser degree) as Europe.

@Dr. Morgan

So far, China has not been stupid enough to shut down the two pipelines from Siberia.

While I doubt that Russia will want to single-handedly finance a pipeline from Russia through Central Asia to India, the talk in Vladivostok about opening up more land routes might lead to more multi-country efforts. Russia was burned once with Nordstream 2, so will likely be twice shy before financing something through Central Asia and down into India. (Afghanistan was, to my surprise, represented at Vladivostok).

While there seems no way to avoid a global crunch in energy, if Europe continues on determined to choose the most expensive way to power their economy, then Europe may see a collapse, which frees up resources for Russia and Asia and Africa. Also, I expect Japan will stick with whatever it is the US does. So I wouldn’t expect pipelines to Japan any time soon (as Russia proposed a few years ago). Gazprom announced plans to build a very large LNG facility, and Putin said in the conference that LNG will play a large role in the future, as it is pretty easily redeployed from one location to another. A good question is whether LNG gas is too inherently expensive to produce nitrogen fertilizer, which would create another essential product with a few bottleneck suppliers.

So the global oil market and the regional gas markets may be in for some pretty radical restructuring…with Europe choosing to do without.

Remember I pointed out Nate Hagen’s dark comment, upon his return from Finland, that Russia may just turn its back on Europe. I have felt from the time when Germany indicated that it would stall on Nordstream 2 forever, that Europe was prepared to roll the dice. So the stakes in Ukraine were very high. If Europe can’t reduce Russia to colonial status, then it will pay a very high price.

Don Stewart

PS. Also note Putin’s criticism of Turkey for sending Ukrainian wheat to the rich people in Europe rather than the starving people in poor countries. The evolving situation carries some connotations of class warfare, which has been a point of conflict in climate discussions.

I find it hard to be optimistic about Sterling. The latest excuse the BOE is using for inertia is the Queen’s Death. They were making dovish noises anyway, even as the national debt is about to spiral even higher. The ECB looks proactive in comparison. Presumably the BOE is being leaned on the Government…..not least to prop up the housing market……

I can’t offer much comfort on the British economy, but I don’t think the BoE will cave in to government pressure. There seems to have been a roll-back on Liz Truss’s plans for changing the BoE mandate, which might have undermined its independence.

I can’t over-emphasise how important this is. The Bank must be seen – by the markets and others (i.e. trading partners) – as committed to the support of Sterling. If that credibility is ever lost, GBP will slump, and the Bank will be forced into rate rises. If that punctures the over-inflated housing bubble, so be it. The single greatest threat to British economic viability would be a “Sterling crisis”.

Liz Truss said, during her campaign, that she was opposed to state “hand outs”. After two days in office, she announced a fiscal intervention bigger than the covid income support operation. If only she would renounce the rest of her party’s daft economic policy platform!

Dr Morgan,

Although the perception might be that the BoE is independent, the Bank of England Act 1998, Section 19 clearly says that the Treasury can force the BoE to do anything: https://www.legislation.gov.uk/ukpga/1998/11/section/19

True, legally. But exercising this right would have consequences!

@Dr Tim & Richard.

The Bank of England is supposed to be “independent” when it comes to setting interest rates. However, it is still a tool of government.

If the Treasury tells the BoE to buy government bonds/debt, the BoE can’t say no.

I believe that the BoE has recently been direct funding Treasury spending rather than by buying bonds from the Primary Dealers. There is a funny name for the mechanism that I can’t remember?? Asset Purchasing Facility or something?? A smoke screen to stop people from realising that the BoE creates currency out of thin air and can give it direct to the Treasury. Which begs the question, “what was austerity all about?”

Remember Theresa May saying “There is no Magic Money Tree”?

Seems there is now a forest!!!🤣

The Bank isn’t powerless. The ‘nuclear option’ would be resignations. It’s not so much about being independent of government, but of being seen to be independent (by the markets).

@Richard appears to be correct, the UK government have been “exercising this right” for more than a decade already, notably the DARLING LETTER TO BOE GOVERNOR MERVYN KING :-

“In my statement to Parliament on 19 January 2009, I announced that the Government had authorised the Bank of England to create a new fund, the Asset Purchase Facility.

“I am writing to set out the terms of the authorisation….”

https://www.reuters.com/article/uk-britain-bank-letters-idUKTRE6132O720100204

@Dr. Morgan

One more thing to keep an eye on re China and India. Russia, China, and India had a joint military operation in Russia recently. It seems to me that the three potential enemies are trying to build a platform of cooperation and trust. During WWI, the military cross fertilization which was common in the early 20th century did them no good (at least, that is my understanding). One of Nate Hagen’s recent interviewees has been studying how Europe unthinkingly descended into the hell of trench warfare…one thing just led to another. David Lloyd George in Britain lamented that the poor diet in Britain had resulted in too many physical rejects for the British army. That is another way of saying “I am so sorry we couldn’t have sent more young men to an early grave”.

But I do congratulate the three potential enemies perhaps realizing the potential for deadly conflict and trying to prevent it.

Don Stewart

@pintada

You’ve been suckered like Johan. Estimated Russian troop losses are 50,000. Have a look on twitter for links like this:

“I can’t believe my eyes.

Izium retaken, Lyman retaken (Svyatohirsk likely too)

The Russian front sector in the northeast is collapsing by hours.”

shows map, Plus more in the thread.

And this is an additional important dimension to be considered: https://thehill.com/opinion/international/3483799-prepare-for-the-disappearance-of-russia/

Thanks for this. Makes sense.

The future will tell who has been “Suckered”.

When the Russians embarked upon their Special Military Operation, it was with clear objectives in mind.

One of these was to De-militarise Ukraine.

That is precisely what the Russians are doing.

They are not there for territorial gains.

They are destroying the Ukranian military, they do that either by advancing or by retreating. If it preserves their soldiers lives by retreating, that is what they will do,

Russia is not throwing its young men away the way Ukraine is. I dread to think how many young Ukrainians have died in this, probably close to 100,000 and counting.

Now I will not hijack Dr. Tims blog again by discussing the Ukrainian military situation further.

What I will and what I would like to discuss is the economic fall-out from all of this.

Due to increased energy prices, Russia is making lots of money.

Russia is energy rich, Western Europe is energy poor.

Now as we all know, the Economy is a function of Energy.

Germany is in the process of De-industrialisation because it can no longer afford energy. Russia may well benefit from that, and take up the slack.

The brain drain from Russia has been enormous. The technological embargo has the same impact. Only out I see for Putin is to use nuclear weapons. I could be wrong of course. But the west continues universal support for UKR : weapons, ammunition, training, intel including satellite photos, and humanitarian aid included. The oligarchy in Russia has lost billions due to this, and I suspect Putin’s head has an increasingly high bounty on it. Yes, time will tell…

And, again, there is an important possibility that needs to be considered: the dissolution of Russia. https://en.wikipedia.org/wiki/Dissolution_of_Russia. Russia is not a stable entity.

Dear Steven;

I am going to spend some time making a case that a negotiated settlement is the only viable solution in the Ukraine. Of course, at the end you will still think as you do, and I will have wasted my efforts. I hope that you will consider what I say, but I understand that is not likely, and that is fine. Be advised, that if you post stuff from western media without showing that it is not propaganda I will not read it or comment on it in a serious way.

1. Russia will not loose the Crimean Peninsula without ending the human race. The President of Russia, and all of his military advisors have said so, and the Duma has promulgated a policy that clearly states that nuclear weapons can and will be used if Russian territory (Crimea) is threatened by an enemy. As soon as the “Zapp Branagon offensive” (more on that later) is over there will be votes in the Kherson and Zaporizhia Oblasts and of course the people there will vote to join the Russian Federation, because all of the western Ukrainians that used to live in those Oblasts have had ample time to leave. (I would bet that the Russian speakers would have voted to join the Russian Federation before the war.). After the referenda, Kherson and Zaporizhia will be part of Russia, and then anyone attacking those Oblasts will risk nuclear war in a very serious way.

2. Recent polling conducted by western pollsters found that about 70% of the Russians approve of the war and how it is being handled. After the murder of that Russian woman in Moscow that percentage is likely higher. Putin has never been more popular in Russia, so there will be no coup.

Why is President Putin popular? It isn’t just because the Russian people have reason to hate westerners almost as much as the average westerner hates Russians. It is partly because in Russia the price of fuel is flat, or down. The price of food is down. Though there has been no tax increases, the amount of tax revenue is up. (The chart in the article is what you should see, the article itself is largely nonsense.)

https://www.thesun.co.uk/news/19698308/russia-uk-prices-sanctions-food/

3. Zapp Branagon is a cartoon character from “Futurama” that is famous for sending wave after wave of his own troops against killbots knowing that they would be slaughtered because the killbots had a fatal flaw – they were programmed with a maximum kills limit. Once the maximum number of his men were killed, Zapp “won” the war. Zelenski is employing a variation of that strategy right now. He is sending wave after wave of poorly trained poorly equipped people against the Russian artillery, tanks, rockets, flame throwing systems, etc. etc. until the Russians get tired and have to pull back.

Это никакая не война, нас просто истребляют… Сколько еще наши матери и жены прольют слез? Сколько детей останутся без отцов? Сколько еще будет братских могил? Братья, кто не пережил эту ночь, вы навсегда в наших сердцах… Где мобилизованные? Всех на фронт! Всех на защиту Украины! У нас батальоны остались только на бумаге, а они гуляют себе!» – сообщают разгромленные морпехи в своем Telegram-канале.

Translation: “This is not a war, we are simply being exterminated … How many more tears will our mothers and wives shed? How many children will be left without fathers? How many more mass graves will there be? Brothers, who did not survive this night, you are forever in our hearts… Where are the mobilized? Everyone to the front! All–to the defense of Ukraine! We have battalions left only on paper, while they (in the rear) are partying!” – the defeated marines report in their Telegram channel.

If you really, really hate Russians, you are no doubt hoping that lots of Russians are being killed by these suicidal attacks – nope. Most of the people on the front line are members of the DPR and LPR militias. The Russians are mostly in the rear doing logistics, and firing missiles and artillery.

4. The idea that Ukraine could hold its own against Russia is completely absurd, and so all those Ukrainians dying are dying because, first the leadership of the west is insane, and corrupt and second to improve the profits of the military contractors in the EU and US. Problem is, manufacturing in the EU is not possible because of the EU sanctions on (incredibly) themselves.

https://sonar21.com/ukraine-and-russia-it-is-a-math-problem/

https://www.mintpressnews.com/ukraine-crisis-dan-cohen-scott-ritter/279819/

Idiots like Truss and Biden will keep rattling their sabers, and thousands of innocents in Ukraine will die, but Russia (Putin, the Duma, and the Russian people) know full well that they are at war – not with Ukraine- but with NATO, the US and the EU. US policy has pushed China, Russia and the global south together and it puts us on the wrong side of history.

https://www.globaltimes.cn/page/202209/1274853.shtml

One more thing:

The west is caving right now.

https://consciousnessofsheep.co.uk/2022/09/09/since-when-did-banks-produce-energy/

Doesnt anyone here remember the guy Sadam had that said that Iraq was winning the second gulf war as US tanks entered Baghdad? Taking the word of western media about alleged progress on the front is just silly. Paying any attention to what the Zelenski government says is even more naive.

Meanwhile thousands are dying so that the US can punish Russia by keeping the slaughter going. If there are 50000 Russian (Ukrainian) casualties, is that a good thing? I dont think so. I am of the old fashioned opinion that killing is wrong. Why would anyone support it?

” I am of the old fashioned opinion that killing is wrong. Why would anyone support it?”

Straw man. Only a factual response to claims that Russia is winning. Read the posted article about the dissolution of Russia by an expert in the field. I’m done. Time will tell. Extreme left or right systems eventually fail as they exclude the well being of the 99%.

Dear Steven;

I am going to spend some time making a case that a negotiated settlement is the only viable solution in the Ukraine. Of course, at the end you will still think as you do, and I will have wasted my efforts. I hope that you will consider what I say, but I understand that is not likely, and that is fine. Be advised, that if you post stuff from western media without showing that it is not propaganda I will not read it or comment on it in a serious way.

1. Russia will not loose the Crimean Peninsula without ending the human race. The President of Russia, and all of his military advisors have said so, and the Duma has promulgated a policy that clearly states that nuclear weapons can and will be used if Russian territory (Crimea) is threatened by an enemy. As soon as the “Zapp Branagon offensive” (more on that later) is over there will be votes in the Kherson and Zaporizhia Oblasts and of course the people there will vote to join the Russian Federation, because all of the western Ukrainians that used to live in those Oblasts have had ample time to leave. (I would bet that the Russian speakers would have voted to join the Russian Federation before the war.). After the referenda, Kherson and Zaporizhia will be part of Russia, and then anyone attacking those Oblasts will risk nuclear war in a very serious way.

I cannot respond Steven, so I guess that you win the debate. LOL. Its odd, I can make short comments like this one, but anything substantive wont “stick”.

OK, so now its better.

2. Recent polling conducted by western pollsters found that about 70% of the Russians approve of the war and how it is being handled. After the murder of that Russian woman in Moscow that percentage is likely higher. Putin has never been more popular in Russia, so there will be no coup.

Why is President Putin popular? It isn’t just because the Russian people have reason to hate westerners almost as much as the average westerner hates Russians. It is partly because in Russia the price of fuel is flat, or down. The price of food is down. Though there has been no tax increases, the amount of tax revenue is up. (The chart in the article is what you should see, the article itself is largely nonsense.)

https://www.thesun.co.uk/news/19698308/russia-uk-prices-sanctions-food/

This, folks, is the fog of war. We don’t really have the facts. If historical experience is anything to go by, even the respective C-in-Cs may not have all of them.

In May 1940, there was a British news movie which showed the allies’ defences, and stressed how strong they were. The voice-over was a classic – “apart from normal military secrets, we have nothing to hide. Our propaganda is true“.

Personally, I take anything I hear from Russia, and the West, with a large pinch of salt. I suspect that this is territorial for Russia, even if only as a buffer zone – NATO has, in Moscow’s view, come too close for comfort to the Russian border.

I find it hard to believe that the West has acted as it has in ignorance of the energy leverage that Russia has. Liz Truss might think that Ukraine is an island in the Baltic, but the West’s political leaders, officials and military chiefs aren’t complete fools.

It seems to me that this war can only be settled by negotiation. Each side aims to strengthen its bargaining position before this happens. Russia may be relying on a winter energy squeeze to weaken Western resolve. After all, it was winter that defeated the German and French invasions of Russia.

Ah, so now its all there. Some of it twice. Sorry.

Steven said, “Straw man.”

There are two possible scenarios:

1. The Russians are winning because … physics. In this case the US and NATO prolonging the war is outrageous and immoral “we” are murdering those men as surely as if I pulled the trigger with my own wrinkly old finger. NATO is fighting the Russians until every drop of Ukrainian blood is spilled. Horrible.

2. The Russians are loosing. Well, in this case the war is still immoral and NATO is at fault because … history.

A. NATO provoked a response from Russia on purpose and as the result of detailed planning that goes back well before the turn of the century.

B. Zelenski was negotiating at first, (in fact, he won his election based on a peace with Russia through negotiations platform). Somehow, NATO (and especially Boris Johnson) convinced him that war was the better option.

So, no. The fact that thousands are dying is not a straw man argument for negotiating with Russia.

You and Johan can cheer each other while the rest of us puzzle at your posts. I’m done. You guys should move to the promised land where WWll tanks are being sent to the war because the newer ones broke and there are no spare parts!

You think Russia is loosing the war?

Please, go to the Military Summary channel and go to his first post for the Ukraine war. Run through them and observe.

Have the Ukrainians actually ever taken back any territory until this week? No.

How does one win a war without taking at least some territory? It doesn’t.

The Russians are actually fighting NATO in general and the US specifically.

Have you noticed any declines in the economy of the US or any NATO members? I have.

The Russians know who they are fighting, so they (up until last week – they may be pissed off now) have been playing Rope-a-Dope to take out as much NATO equipment as possible. It goes like this:

Russia: “Hey, Hello. Look im advancing.” Wink wink

Zelenski: “Charge!!”

Russia: “Hear they come. Fire.”

Lots of Ukrainians die, lots of NATO equipment is blown up with minimal (no) Russian losses.

Some ‘facts’?

“2:09 this report examines russia’s economic

2:11 political and military vulnerabilities

2:14 and anxieties

2:16 then analyzes potential policy options

2:18 to exploit them ideologically

2:21 economically geopolitically and

2:23 militarily including air space maritime

2:26 land and multi-domain options after

2:29 describing each measure this report

2:32 assesses the associated benefits costs

2:35 and risks as well as the likelihood that

2:37 the measure could be successfully

2:38 implemented would actually extend russia

2:42 most of these steps covered in this

2:44 report are in some sense escalatory and

2:47 most likely would prompt some russian

2:50 counter-escalation

2:54 uh so this is an open admission that all

2:56 of this is

2:57 to provoke

2:59 unnecessarily provoke russia

3:03 uh not to defend the united states from

3:06 any sort of perceived threat but to

3:08 deliberately and maliciously antagonize

3:11 another nation russia which is on the

3:13 other side of the atlantic and on the

3:16 other side of europe” ?

Postkey;

Nice.

Thanks

“Gail Tverberg says:

September 10, 2022 at 7:11 pm

This is a video about a 2019 paper by the RAND Corporation, taking about what would happen if the United States deliberately tried to antagonize Russia, such as by instigating the Ukraine war. Russia wants to just wants to mind its own business, Rand corporation recommends ways of antagonizing Russia, all of which have been implemented:

1. Hinder petroleum exports

2. Hinder natural gas exports

3. Hinder pipeline expansion

4. Impose sanctions

5. Enhance Russian brain drain

6. Provide lethal support to Ukraine <—- Video focuses on 7. Increase support to Syrian rebels 8. Promote regime change in Belarus 9, Exploit tensions in the South Caucus 10. Reduce Russian influence in Central Asia 11. Challenge Russian presence in Moldova 12. Meddle in Russian internal political affairs 13. Increase US and NATO Landforces in Europe 14. Increase NATO exercises in Europe 15. Withdraw from the INF Arms Control Treaty 16. Develop new capabilities for the sole purpose of threatening Russia US clearly not the Good Guy, if it is doing these things About 10:00 – Starts talking about lethal support to Ukraine According to 2019 Rand Report, if US escalates the war in Ukraine, it gives Russia a reason to escalate its response to these new higher-powered weapons. This escalation could come out badly. Much loss of Ukraine citizens. Bigger flow of refuges. The escalation could lead Ukraine into a disadvantageous peace. Could escalate out of control. Weapons could go into hands they were not intended to go to. US weapons might be reverse engineered by people getting ahold of them. Perception of corruption could deter donors who might otherwise provide free equipment or supplies. Deduce that Ukraine cannot be trusted with high-tech systems. Might lead to a disadvantageous peace settlement. Now the US is in the middle of a catastrophic US policy failure. Can see that this was not instigated by Russia. The US was looking at this as an option, back in 2019. US cannot end the conflict, because ending it will mean admitting that the Ukraine lost."?

I’ve interacted with G.T. for a decade. I finally realized that she was a very devout Christian, and that influenced much of her thinking. I also realized that most of her output was rehashing of stuff I’d encountered elsewhere. So, I’ve cut back on time devoted to her output.

The Ukrainian counter offensive could be an attempt to push the Russians to a diplomatic solution before winter comes.

An end to hostilities is crucial for Europe, especially Germany. It can’t afford to be without Russian gas over the winter.

Maybe Ukraine has been pushed by the US/Europe to go for it.

When winter comes, the front lines will become fixed until the weather improves. Not good for the European economy.

Well G.T. certainly was ‘rehashing’ the ‘Rand report’ that showed that the US was unnecessarily provoking Russia?

Rope-a-Dope in this context works another way as I have observed (again through the Military Summary channel, and other sources):

Russia: “Hey, look over here, I’m advancing. (Remember, the Ukrainians have very few drones and no air assets so they fall for it every time.)

Zelenski: “Charge!”

Ukrainian Grunts: “F*&K You. You charge. I’m done watching my friends die, and Im not next.” (Entire battalions have deserted especially west of Donetsk City.)

Russia: “OK, Boys. Time to move up a couple kilometers.”

Steven says, “You guys should move to the promised land where WWll tanks are being sent to the war because the newer ones broke and there are no spare parts.”

No spare parts?!?!?! You must not realize that Putin took nearly all of his senior military staff to war games on the east coast two weeks ago (The Duran thinks that is why mistakes were made at the front.). Nothing says equipment/parts shortages like committing massive forces to war games. When you look these war games up, look at the list of Russian allies participating.

You know that Russia is not at war. Russia has not mobilized its military … yet.

I am not cheering for Russia, I’m just trying to cut through some of the massive/pervasive propaganda to which westerners have been subjected.

“You guys should move to the promised land …”. Im sorry Steven, you seem to have missed the point so far. I am not saying that Russia is the promised land. I am saying:

1. Westerners who do not look for the truth outside of mainstream channels are likely to embarrass themselves if they actually start parroting the nonsense they’ve been fed.

2. Ukraine cannot win a war against the vastly superior (though flawed of course) Russian army.

3. NATO provoked the war, and so arguing that it is a good this is to take an immoral position.

“… where WWll tanks are being sent to the war…”. Oh, please.

https://www.military-today.com/tanks/t90.htm

excellent material, Pintada and Johan.

from an energy angle, I will point out that near the top of this page, he refers to the fact that Europeans are scrambling to find enough “personal firewood”.

there are consequences to becoming outright hostile to one’s main energy provider. This falls into the category of self harm.

these European energy problems have only grown worse since that Great Day of 2/24/2022, when Russia made clear that they have turned most of their economic interests away from the West, and towards the East.

(that day is perhaps the most significant day in the world since the end of WW2. It’s the Great Russian Reset!)

meanwhile, the word from Russia is that they will have plenty of lighting and heating for the entire winter, and there is no reason to doubt that they have the energy resources to maintain this.

it doesn’t look good for a region to be scrambling for firewood in September.

Exactly. To all.

Russia are seen in Europe as an unreliable supplier. It’s not going back to how it was before. Many of these gas wells will be shut off. They will be difficult or impossible to restart and the idea of building pipelines supplying Asia from these fields in any achievable timeframe is a non starter without Western expertise.

It is, of course, a loss to all.

“It is, of course, a loss to all.”

Not a loss to the biosphere. The more energy we use, the faster we denude the planet of ecosystem health. Shrinkage in human economic caloric throughput is what is needed by all other species. Humans are in massive population and impact overshoot. We will shrink. It’s just a matter of how it occurs. p/capita well being is peaking as easy to get resources are the first mined, toxicity from our activities increases steadily in air/water/soil. Humans are wired to pig out as are all life forms. Have a look at Overshoot Loop: dieoff.org

Returning to the energy aspect of the war: I think one of the significant consequences will be a rapid expansion of LNG for all international trade in gas. Receiving gas by pipeline from a supplier in an other country is a lot cheaper than LNG, but the gas cutoff by Russia is showing everyone how dangerous it can be to rely on a fixed source of supply. Looking at what’s happening in Europe, I wonder if China will have second thoughts about building up a critical dependence on pipeline gas from Russia?

When LNG allows the international trade in gas becomes almost completely fungible, like oil is now, trade will take place in a world market at a world price. It will be impossible for one country to punish another by witholding LNG exports and selling them to some other country because that sale will then allow that country’s usual supplier to sell to the country from which the LNG was withheld. An LNG supplier can still take their product off the market, but then they lose income. Fungibility will mean no longer being able to pick and choose customers for political reasons.

The problem with being an unreliable supplier of pipeline gas is that once-trusting customers, like Germany was with Russia, will learn that they can never again depend on that supplier. I suspect that even if Russia offered to resume full flow in Nordstream 1, Germany would rapidly cultivate other supplies and then wean themselves completely from Russian gas. Russia can only use its gas for coercion once. Once bitten, twice shy.

Exactly right, Joe.

@Joe Clarkson

The problem is that Russia will still and always will be a main supplier of LNG. (Until it all runs out)

LNG may well be traded all over the world but it will still originate from Russia. If this was not the case, then Europe will be able to supply its gas needs from someone else. Something it is finding difficult to do.

@John Adams

I expect Russia will indeed become a big supplier of LNG, but once they load a customer’s tanker with a shipment, it can go anywhere on the world, even places they would rather it not go. A tanker load may be sold and diverted several times before it gets to its original destination.

If there is a worldwide shortage of LNG, prices will go up and everyone will be short of gas. Those that can pay the higher price will get supplied. Right now Germany could outbid a lot of other LNG customers, but they lack LNG import capability because they depended on a pipeline.

Here’s an example of LNG fungibility from earlier this year:

https://www.bloomberg.com/news/articles/2022-01-05/gas-tankers-divert-from-china-to-europe-in-price-premium-race?leadSource=uverify%20wall

@Joe Clarkson.

I don’t see how switching to LNG is going to get around Russia being an unreliable supplier when ultimately the gas will be coming from Russia.

Adding lots of middle men will only push up the global pice for gas. Germany won’t be in a position to compete for that gas if it economy collapses due to a lack of gas.

That you don’t see how …isn’t evidence. The future is unknown. Given the past 1/4 century, German ingenuity, work ethic, stable governance, social cohesion, educational and health systems are another best on the planet. I’d not bet against them.

@S.

the stereotypical German that you describe lo longer exists.

Speaking as a German, the ” ingenuity, work ethic, stable governance, social cohesion, educational and health systems ” are not what you think.

Yes, it did work in the past, and I sorely lament the loss of the germany of my childhood, but the country has changed.

Ingenuity now has to be imported, ( eg, Visas for Indian software engineers )

Work Ethic has gone woke.

Stable governance ? ( I give Scholz the Dolt about 3 months in power until chaos breaks out )

Social cohesion ? Since Merkel opened the floodgates to 1.5Mio refugees, Social cohesion has fractured, the AfD are on the rise.

Cohesion is enforced by the Power of the State. But not for much longer.

Education has gone Woke

Health Care has become unaffordable and is now a racket.

You might not bet against Germany, but me as a German

– Yes.

I’m betting against Germany.

typo: dieoff.com

@ pintada and others thinking Russia is winning

This was posted today by a BBC chap who monitors Russian media.

“The change of tone from the Kremlin’s media machine today, as exemplified by this post written by state TV reporter Andrei Medvedev, has been nothing short of extraordinary

I’m intrigued to hear what Dmitry Kiselyov has to say on tomorrow night’s show”

There is a link to the original in Russian, and the translation is posted as an image which I cannot copy and paste here. It is not long.

coming from a BritishBiasedCo chap, it is very possibly that he misunderstands the Russian SMO.

lost ground can be regained, but a dead soldier is gone forever.

I’m absolutely positive that the Russians have this understanding, which many persons in the West surely lack.

The existing situation in the north of Ukraine is a terrible humanitarian crisis. Any civilian that was not able to run, and keep up with the retreating military (whether they were LPR, Russian National Guard, or some other) are in grave danger. The western Ukrainians have a bloody history of killing anyone that they deem to be collaborators as soon as the Russian army is not there to protect them. That is what Medvedev is talking about here.

This situation puts Putin in a critical position. The gloves may come off, and we may see “shock and awe” Russian style. Or, they may go back to playing Rope-a-dope. Either way we will see.

yes the Russians are using perhaps 5% of their military capabilities.

“gloves off” may mean 10%… we’ll see.

I morn for those that have been murdered on the alter of hating Russia and Russians in general just as i morn for the brave Ukrainians that have been wasted in this offensive and those that will be killed when Russia retakes that territory. The war is wrong. It didn’t need to happen. It can be stopped, if only NATO and the US stopped trying to “weaken Putin”.

Western as well as Russia figures on Russian troop numbers deployed in the SMO is 150,000.

That isn’t anywhere near enough to take control of the whole of Ukraine. Not even Kiev.

So maybe we should take Putin at his word. The purpose of the SMO is to.

A: demilitarise the Ukrainian army ie, destroy it on the battlefield and

B: De-nazification. Kill all the Azov battalion and others.

Gaining territory isn’t the priority. Engaging with the Ukrainian army and slowly grinding it down is the plan.

Losing ground to the Ukrainian army in theiercounter offensive isn’t great for the Russians as getting Russians captured is a setback, but the objective isn’t land, it’s bodies (Ukrainian)

It’s funny how the western press both portrays Russia as an incompetent army full of deserters and in the next breath, a threat to Europe and the wider world through its military power.

Well, the image made it, so you needn’t go to the link unless you can read Russian.

@John Adams

Re: “So maybe we should take Putin at his word.”

This is a thread by an expert researcher, PhD. Go to the link.

@MarkGaleotti

·

43m

Rossiiskaya Gazeta, the Kremlin’s ‘newspaper of record,’ is as stodgy as you might expect, but in light of the extraordinary Ukrainian successes in the past few days, it’s instructive to see what it’s telling Russians today (and what it’s not). A short thread 1/

@Steven B Kurtz

I wasn’t suggesting that we should believe ever word Putin says but Russia’s claimed objectives seem to match actions on the ground.

It’s about engaging/destroying the Ukrainian fighting capacity.

Territorial gains may come later.

The Ukrainian counter offensive is a major setback for Russia. Losing troops is never a good move.

But Russia hasn’t even gone in hard yet. The tougher the fight the Ukrainians put up, the more resources Russia will bring to the fight.

Why do blogs like these always attract Tankies and people from the left and right who hate the west.

Their beloved Putin and Russia is losing the war they started, not the West, not NATO etc….

On your general question about blogs, I don’t know. But commenters are allowed to express their opinions so long as they are courteous to others, relevant (to energy, economics and finance) and are not party political.

What does it matter who’s winning the war? It’s a sideshow.

@Vlad

I’m not picking a side. I can just see the propaganda being peddled by the media here in the UK.

I expect the same is happening in Russia, but I don’t live there so I don’t know.

A prime example is the reporting of the shelling of the Zaporizhia Nuclear Power plant.

The BBC won’t say who’s responsible but probability says that it’s the Ukrainians that are doing it.

Why would the Russians be shelling a facility that it is occupying????

Russia is trying to disconnect the plant from the Ukrainian grid and redirect the electricity to Crimea. Ukrainian are shelling the plant to hamper the Russians efforts. But the western media won’t report on this because it’s an incredibly recless act and the media doesn’t want to call Ukraine out on it.

@Pintada

Listen to a Russian military leader, and smell the coffee:

https://www.theguardian.com/world/2022/sep/08/we-have-already-lost-far-right-russian-bloggers-slam-kremlin-over-army-response

“The war in Ukraine will continue until the complete defeat of Russia,” Igor Girkin, a far-right nationalist, grumbled in a video address to his 430,000 followers on Telegram on Monday. “We have already lost, the rest is just a matter of time.”

Girkin, a former Russian intelligence colonel who became a commander of the pro-Russian separatist forces in 2014, is arguably the most prominent voice within an increasingly loud and angry group of ultra-nationalist and pro-war bloggers

No one knows whether Russia or Ukraine will ‘win’ this war. Personally, I very much doubt that Ukraine can win and I don’t think either side will win decisively. But, in a sense, does it matter?

The war should never have started. Nato has encroached further and further towards Russian borders and pursued inflammatory policies. Russia has started a brutal war. This has led to mass scale destruction and a huge death toll, including civilians. This is very sad. It has exacerbated long standing energy related shortages and price problems, exacerbating inflation and causing increased hardship for many. There are few people who gain from wars, a handful of political leaders, defence companies, a few companies with vested interests.

The leaders, led by the US, need to sit down and negotiate. It is unfortunate that the new UK PM seems unlikely to do this and has instead created bad feeling when she was the Foreign Secretary.

Even if negotiation takes please, both Russia and the EU will still be worse off compared to before the war. Russia are aware of their energy power and will continue to use this as a negotiating tool, Western leaders are wary and keen to find a scapegoat for current problems. Perhaps we need to go through serious hardship, the shut down of industries, power cuts, recession and its consequences before negotiation is possible.

Not all that long ago, I heard a senior American politician – a Dem, and a supporter of the president – say that foreign affairs were always Mr Biden’s weak-spot. (This was probably during coverage of the Afghanistan withdrawal). As for Liz Truss, as Foreign Secretary she thought that Ukraine was an island in the Baltic – and, when asked by Mr Lavrov, objected to Russian sovereignty over Voronezh and Rostov, which happen to be in Russia.

This is like a chapter in Evelyn Waugh’s Scoop, where the foreign editor of a major newspaper, and all his correspondents, between them, can’t find Reykjavik on a map of the world.

That’s bad!

She’s still getting lots of cheers from her MPs and Tory Party members though.The current batch of politicians seem more concerned with playing politics than any thought for their country or longer term strategy.

I actually dread to think how much is likely to go wrong in the UK within a short period of time.

@John Adams

Consider this:

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 1.3 percent on September 9, down from 1.4 percent on September 7. After this morning’s wholesale trade report from the US Census Bureau, the nowcast of third-quarter real gross private domestic investment growth decreased from -5.8 percent to -6.1 percent.”

Now let me characterize that as the demand side is growing but the supply side is shrinking. Is that a problem? Not to “final demand” economists in their fairy tale world…but it can be deadly for someone who has taken on debt. It is easy to go into debt and participate in the demand side fun and games. But one makes the implicit promise to participate in the grim business on the supply side in the future. And if that supply side will be under pressure to decline over the coming decades, then one is promising to win at the game of musical chairs when the number of chairs is shrinking steadily under pressure from declining energy and natural resources.

Don Stewart

In the UK, the government is intervening – at huge expense – to cap household energy bills.

The effects in “headline” metrics are as follows:

CPI – forward inflation will be 4-5% lower than it would otherwise have been.

GDP – will be higher than it would otherwise have been.

Inference? The more a government borrows and spends, the better the economy performs!

Which, of course, is total nonsense.

If you missed…

https://www.msn.com/en-us/money/markets/european-gas-prices-hit-lowest-in-a-month-on-hopes-putin-energy-war-faltering/ar-AA11J7CT

European benchmark natural gas prices fell to their lowest in a month amid hopes Vladimir Putin was losing leverage in his attempts to cause economic pain to the continent by restricting supplies.

The ICE Dutch TTF Gas Future for October retreated 8% to 190.5 euros per megawatt hour on Monday, compared to around 350 euros per MWh just a few weeks ago.

The ICE U.K. Natural Gas Futures for the same month lost 4% to 363 pence per therm, 48% lower than the high touched on August 26th.

The contracts had spiked to record levels last month on fears, subsequently realized, that Moscow would completely stop the flow of gas through the Nord Stream 1 pipeline to punish European economies for their support of Ukraine following Russia’s invasion.

However, prices have dropped back following news that European Union gas storage levels have already reached 83% of their capacity, notably ahead of the 80% target set for the end of October, raising hopes that the continent will have enough supplies for the winter.

Strategists at Deutsche Bank noted that the U.K.’s decision to spend government money to protect households from surging power prices, and similar actions across Europe, had damped the impact of the Putin energy crisis and helped force prices lower.

“[it] was probably from the tough talk from energy and fiscal ministers, but there was probably also an element of taking out risk premium,” said Deutsche.

Additional downside price pressure came after the EU said at the end of last week that it would seek to apply a price cap on all gas imports, though they have yet to deliver details.

“While the announcement didn’t specify the levels of caps we estimate that imposing a power price cap of €75/MWh…and a gas price cap of €180/MWh,” said Alberto Gandolfi, utilities equity analyst at Goldman Sachs.

Finally, news over the weekend that Ukrainian forces had routed Russian troops in some areas of the embattled country raised hopes among some observers that an end to the ground, and thus energy war, may be more likely.

However Deutsche warned: “Although this will be greeted well by markets, the surprise success does increase the chances of a more aggressive response from Russia.”

Dr Morgan said,

“Inference? The more a government borrows and spends, the better the economy performs!