MANAGING WHAT WE CAN’T FIX

What the media calls the ‘cost of living crisis’ is fast turning into an affordability crisis. The former is where discretionary consumption slumps. The latter means that increasing numbers of people can’t keep up the payment streams on which the financial system depends.

As the situation worsens, politicians and commentators are bombarding us with calls for action, proposing often-contradictory fixes for what can’t be fixed, but can only, at best, be managed.

If there’s a common theme, it is that we need to borrow even more than we already have.

If there’s a common fallacy, it’s that we just need to find the right financial answers to our woes.

None of this can work, because what we are witnessing now is absolute proof that the economy is an energy system, not a financial one.

Western Europe is one of the richest places on the planet, but its financial wealth will be meaningless – and will, in fact, evaporate – unless energy can be sourced in the requisite quantities, and at affordable prices.

Few regions are immune to this same problem. North America has substantial energy resources, but their costs are high, and rising. China has a sizeable energy deficit, as do other economies in the Far East. Even Russia, with her energy wealth, can’t emerge unscathed from a global economic slump caused by generalised energy deficiencies.

The war in Ukraine has reduced the supply of natural gas, but an end to that war, and the restoration of trade with Russia, wouldn’t solve our energy supply problem. This situation – including surges in the price of gas – was developing well before the first Russian tank rolled over the Ukrainian border. The costs of fossil fuels are continuing to rise relentlessly, and this is now pointing towards a decline in the volumes of oil, natural gas and coal available to the economy.

Some believe that renewables offer a complete replacement for the energy value hitherto obtained from low-cost fossil fuels. Some of us think that’s implausible.

But even the optimists have to concede that this can’t happen now, because a transition won’t be effective until the mid-2030s, at the very earliest, even if it can happen at all.

Renewables aren’t going to keep vehicles running, machines humming and households warm in the coming winter.

As a direct result of problems with energy supply – interacting with a system founded on the hubristic assumption of infinite growth – the World is heading for a financial crash which is likely to dwarf the global financial crisis (GFC) of 2008-09.

Reality has arrived

These events should – and, in time, perhaps will – put paid to the notion that the economy is wholly a financial system, unconstrained by resource and environmental limits, and capable of delivering the logical impossibility of ‘infinite growth on a finite planet’.

It should also, if we’re lucky, put paid to political notions based on this same infinity fallacy. Everything that politicians promise or propose assumes that the right financial policies can deliver growth.

This simply isn’t true.

This is a fallacy shared by both ‘Right’ and ‘Left’. Collectivism can’t deliver energy abundance. ‘Leaving everything to the markets’ can’t deliver prosperity – even in theory, let alone in practice – if markets are deprived of the material goods and services for which, ultimately, markets act as financial proxies.

We can’t ‘stimulate’ our way to perpetual growth – and, by the way, Keynes never said that we could, confining the role of stimulus to the management of trade cycles.

This is a time in which we need to shed all delusions based on monetary ‘fixes’. Changes to tax allocation can shift the burden of hardship between groups of people within a country, but borrowing to fund “tax cuts” can’t create “growth” in a contracting economy. Rate changes, and exercises in QE or QT, might act on the margins of inflation, but only within a recessionary-inflation trade-off.

Where monetary and fiscal policy is concerned, there’s something we need to be absolutely clear about – even if we were gifted with utterly brilliant decision-makers in governments and the central banks, there’s nothing they could do to boost the supply of affordable energy.

Lacking that ability, what they’re engaged in is a balancing-act – they can adjust the distribution of hardship between income groups, and they can try to defend exchange rates, but they can’t prevent the deterioration in material prosperity. That also means that there are limits to what they can do to tame inflation.

Inflation is not – thus far – being driven by excessive domestic demand, so raising the cost of existing debt won’t fix anything. Going forward, it’s the scale of lending that central bankers need to keep under control, not least because someone who borrows out of necessity is a far greater default risk than someone who borrows out of choice. Interest rates are a blunt instrument when it comes to restraining runaway borrowing and rising risk.

Principles and consequence

Under these extreme conditions, it’s necessary to remind ourselves of the ‘three principles, one consequence’ of economic reality.

The first principle is that the economy is an energy system, because nothing that has any economic value whatsoever can be produced without it. The second is that, whenever energy is accessed for our use, some of that energy is always consumed in the access process. This ‘consumed in access’ component is known here as the Energy Cost of Energy, or ECoE.

Third, money has no intrinsic worth, but commands value only as a ‘claim’ on the output of the material economy.

These three principles lead inexorably to a logical consequence, which is that we need to think conceptually in terms of two economies – an energy-determined ‘real’ economy of goods and services, and a proxy ‘financial economy’, consisting of money and credit, which incorporates claims on material economic prosperity.

The economy can’t be understood effectively unless this conceptual distinction is recognized.

These principles are well-known to regular visitors to this site but, under current conditions, no apology seems necessary for their brief reiteration.

Conventional economic models can’t possibly act as reliable guides to our predicament. Their foundation assumptions are fallacious. The economy isn’t entirely a monetary system; resources are not some kind of substitutable adjunct to the economy; there are material and environmental limits to economic activity; and the promise of infinite growth on a finite planet is a delusion arrived at by reasoning from false premises.

Energy-based economic analysis – like the SEEDS model used here – is the only way in which we can arrive at rational interpretations and forecasts.

The critical issue is the relentless rise in the ECoEs of oil, natural gas and coal. These account for more than four-fifths of global energy use, so this process has driven overall ECoEs to ever-higher levels. This process has killed off the scope for expansion in material prosperity, and has now put prior growth into reverse.

Rising ECoEs affect us, first, by making energy less prosperity-productive, because increasing costs reduce the surplus (ex-ECoE) value of each unit supplied. They are also starting to undermine quantitative supply itself, by making it ever harder to establish prices which both cover producer costs and are affordable for consumers.

Not the turn of a card

This understanding should deal with claims that what we’re going through now is some kind of ‘run of bad luck’. In energy terms, pandemic-related shutdowns bought us a little time, simply because they amounted to a cutback in the consumption of energy, and of energy-dependent products and services.

The restoration of energy trade with Russia might, were it to happen, provide some temporary relief, but wouldn’t halt the rise in global ECoEs. Russia doesn’t have infinite supplies of hydrocarbons, and neither are its oil and gas operations particularly cheap.

Tempting though it is to blame the coronavirus, or Mr Putin, for current economic problems, then, this really won’t wash. The real culprits in the current situation are anyone who has promoted or believed the idea that material consumption can increase indefinitely on a planet with finite energy resources and finite environmental tolerance. This means pretty much all of us so, in that sense at least, the ‘blame-game’ is pointless.

Where blame can be placed is on the way in which prosperity – and, now, hardship – are allocated between different groups of people. Even here, though, arrogance and greed are compounded by ignorance.

Where economic assertions are concerned, our collective hubris knows few bounds. We’ve been congratulating ourselves about “growth” over a long period in which prosperity has been contracting.

We’ve been piling up commitments that we can’t honour in pursuit of growth that can’t happen.

SEEDS analysis indicates that the average American has been getting poorer since 2000, and that the same thing had happened in almost all Western economies before 2008. Latterly, the inflexion-point in prosperity has been reached in an increasing number of EM countries, and global prosperity per capita has now turned down.

These inflexion-points in prosperity can be related directly to ECoEs, as the charts in fig. 1 illustrate.

Fig. 1

The West, in particular, has never accepted the idea that material economic expansion has ended, and has gone into reverse. Instead – and perhaps unknowingly – we have exploited the disconnect between the real and the financial economies to create a delusional simulacrum of “growth”.

Creating incremental monetary ‘claims’ on the economy doesn’t increase material wherewithal, any more than printing a lot more hat-checks can create more hats when checks are presented at the end of a function.

Because all money exists as a ‘claim’, the creation of monetary claims in the present adds to the aggregate of liabilities redeemable in the future.

Stated in dollars converted from other currencies at market rates, global debt at the end of 2021 stood at $236 trillion, or 245% of GDP ($96tn).

But formal debt hugely understates broader financial commitments, which can be estimated at $550tn, or 575% of GDP, and which include about $280tn in the ‘shadow banking system’. The ratios in some countries are far worse, including Britain (1263% as of the end of 2020), the Netherlands (1454%) and Ireland (1809%).

Even these ratios understate the true seriousness of our financial predicament, because the GDP denominator has been inflated artificially.

The basic principle involved here is simplicity itself. We create money which, by definition, is a ‘claim’ on the real economy and, because money itself is a claim, it’s also a forward liability. The spending of this money creates financial transactions, and the adding up of these transactions by statisticians creates the metric that we know as GDP. We then assume – quite mistakenly – that this ‘sum of financial transactions’ is economic ‘output’.

This means that we can inflate transactional activity by pushing ever more credit into the economy. This doesn’t add to material prosperity, but it does increase the overhang of forward claims that we won’t be able to honour.

Loaded dice

Beyond a tendency to ‘count the activity and ignore the liabilities’, the snag with this is that, over the past two decades, it has taken more than $3 of extra debt – and an increase of about $7.30 in broader financial liabilities – to produce $1 of additional transactional activity.

We can’t possibly win at these odds. A better option, were it feasible, might be to withdraw from the game, tying the rate of liability expansion to changes in the size of the economy – and, at the same time, desist from making implicit pension promises that a contracting real economy can’t possibly honour.

Instead, we carry on the self-delusion, even though the dynamics of the process are loaded against us. Every now and then, some bright spark tells us that, by borrowing now, we can create “growth” (which is true, but only in a statistical sense), and that this growth will then “pay off the debt” that we’ve taken on to create it (which simply isn’t possible, least of all in economies that rely on continuous credit expansion).

SEEDS modelling identifies the two critical equations that interpret our recent economic past realistically, and give us reasonable visibility on what happens next. With these understood, what we need to address is the matter of process.

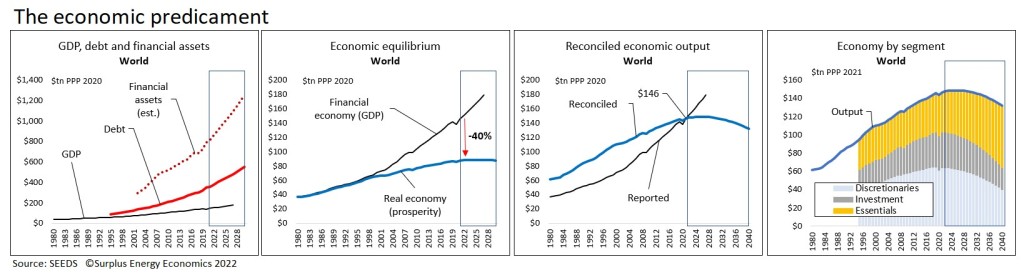

Each equation requires two charts, and these are shown in fig. 2.

The first chart in fig. 2 shows how both debt and broader financial liabilities – known as ‘financial assets’ from the lender side of the equation – have dramatically out-grown GDP. Meanwhile, reported GDP has been inflated, not just by the ‘credit effect’ described above, but also because no allowance is made for ECoE.

Accordingly, we can plot, in the second chart, a widening divergence between the ‘financial’ metric of GDP and underlying prosperity, as calculated by SEEDS.

This divergence is a comparatively recent phenomenon – in past times, ECoEs were low, and we hadn’t embarked on the massive credit-creation binge that has become a seldom-noticed characteristic of the ‘delusional growth era’.

Back in, say, the 1950s, people weren’t using QE, ZIRP or NIRP, because they didn’t have to. ECoEs were low enough for the economy to deliver ‘growth without gimmickry’. The very adoption of these expedients is testimony to adverse underlying trends that we’ve failed to acknowledge.

The downside between the two economies is currently estimated at 40%, which gives us some idea of the scale at which financial ‘claims’ are likely to be eliminated once the inevitable restoration of equilibrium takes place.

Fig. 2

Most forecasters start with GDP and so, to produce projections on a comparable basis, SEEDS segmental analysis accepts the 2021 number (globally, $146tn PPP) as its start-point.

This does not, however, require us to accept the inaccurate statistical narrative of how we arrived at this number. Whilst reported real GDP doubled (+101%) between 2001 and 2021, prosperity increased by only 31% over that same period.

This enables us – as shown in the third chart in fig. 2 – to produce a reconciled trend in economic output, and to see how far this differs from reported numbers, which have been inflated by credit (claims) expansion, and which make no allowance for rising ECoEs.

This in turn enables us to interpret and project – as shown in the right-hand chart – the economy on the basis of the key segments, which are essentials, capital investment (in new and replacement productive capacity) and discretionary (non-essential) consumption.

What happens next

The technicalities of these interpretations and forecasts have been discussed here before, and might be revisited in the future. For now, though, what matters is the outlook itself, and what, if anything, might be done about it.

Starting with the economy, global aggregate output, referenced to prosperity, is heading for a downturn, and per capita prosperity is already declining. Meanwhile, the real costs of energy-intensive essentials are rising.

Accordingly, capital investment is poised to turn down, whilst we should anticipate relentless contraction in the affordability of discretionaries.

This will, probably sooner rather than later, undermine the confidence which investors and lenders place in businesses supplying non-essential products and services. Accordingly, these discretionary sectors will lead the decline in the valuation of assets. This will be accompanied by falls in the real prices of property, as these prices are linked to the metric of affordability, which is declining very markedly.

Though rate rises don’t help, the size of a mortgage that anyone can afford to service depends upon how much he or she has left after paying for necessities.

Assets, though, are less important in this context than liabilities. Asset prices are a function of the availability and cost of money – and money, as we know, is an aggregation of claims on the real economy. What happens now is that the vast burden of excess claims, created during a period of hubristic and futile denial of underlying reality, will be eliminated, either through inflation, through default, or a combination of both.

From the perspective of ‘two economies’, it’s clear than inflation is a function of the relationship between the material and the financial. Prices are the point of intersection in this relationship, because a price is the financial number ascribed to a material product or service.

In real terms, we can’t prop up inflated asset prices, and it would be insane to try to carry on doing so. Neither can we ‘make good’ liability excesses, and any attempt to do so would involve the creation of money at a scale which would invite hyperinflation – which, ultimately, is an alternative, informal version of default.

Asset prices will tumble, then, and commitments won’t be honoured. What we’re left with is an economy in which, just as prosperity is declining, the cost of essentials will carry on rising.

Inequalities are inevitable in any economy, but these inequalities can be expected to combine with deteriorating prosperity to drive ever larger numbers of people into absolute poverty. This makes redistribution inevitable, even though the more privileged will fight this every step of the way.

The only way in which governments can seek moderate the rising cost of essentials is by spending less on public services (which count as essentials for our purposes, as the citizen has no ‘discretion’ about paying for them).

Time to call time on delusion

It would be a good idea if, whenever anyone suggests a financial ‘fix’ – rate rises, rate cuts, QT, QE, debt-funded tax cuts, more debt – we were to ask them to explain how these measures are going to deliver cheaper energy.

This situation doesn’t leave us entirely powerless. We should, for instance, have long since embarked on energy efficiency measures, including the provision of public transport as a counter to the diminishing affordability of cars. Nuclear power offers some scope for supply relief, though it isn’t going to rescue us from energy deficiencies.

But no workable amelioration measures can be crafted whilst our appreciation of the situation remains faulty.

The reality is that we need to concentrate on how to allocate and manage deteriorating prosperity. This has become a less-than-zero-sum game. We should not delude ourselves into believing that we can help some without taking from others.

This becomes a political choice and, many might say, a moral one. Social cohesion depends on facing this reality, and there’s no mileage in denying it, or trying to wish it away by proposing financial gimmicks that can’t work.

“The assessment, which involved officials from all key departments and major industries, took place this summer following 12 months of preparation. It was designed to ensure emergency power plans were ‘fit for purpose’.

“Instead it ‘exposed the fact that, where contingency plans against power disruption exist, some of those plans are based on assumption rather than established fact’, according to a report of the exercise, distributed privately last month. ‘Populations are far less resilient now than they once were,’ it concluded. ‘There is likely to be a very rapid descent into public disorder unless Government can maintain [the] perception of security.’

“Any central Government response to the crisis may be too slow, arriving ‘after the local emergency resources and critical utility contingency measures had already been consumed’. Departments needed to revise ‘critical facets’ of their plans, it found.”

https://consciousnessofsheep.co.uk/2022/08/25/in-brief-cost-push-prices-its-not-just-the-price-lets-talk-about-windfalls/

With Some Trepidation

I suggest (relative to Macron) this post by my soul-mate Eliza Daley:

https://by-my-solitary-hearth.net

She’s not a Luddite, but neither does she suffer from the delusion that a lot more of what money can buy will make anyone happy.

Don Stewart

Criticism of Dawn of Everything; Egalitarian vs. Hierarchical

https://energyskeptic.com

See the latest article.

Conclusion: “hierarchies arise whenever a group can monopolize a resource.”

Throughout most of human history, the precondition for hierarchies did not exist. Ironically, destabilization of climate might destroy those preconditions again.

Don Stewart

I’ve submitted a comment to Alice’s post. She is 3 hours behind EST, so it may be a while for approval to let it appear. Here it is:

As hierarchies exist in social mammals and other species such as some insects, it is semantics to claim that humans can avoid this. Breeding in humans involved/involves hierarchy. Choosing a mate, mainly done by females barring rape events, involved/involves more than starry eyed love. It is widely thought that males perceived as most capable of providing protection and nutrition were highly valued.

Conflating political hierarchy with biological hierarchy is confusing at best.

@Steven Kurtz

As social animals, humans are never without constraints. Whether we label those constraints as hierarchy is another question. Most people, I believe, equate hierarchy with some sort of organizational control…whether the “organization” be based on sex, income, family status, ability to talk with God, ability to cause it to rain, or whatever.

If a boy and a girl are free to mate with their choice, or not to mate at all, then most people will say that there is no hierarchy. If the parents make the decisions for the boy and girl, then most people will say that there is hierarchy. If there is no hierarchy, it doesn’t mean that there aren’t other contributing factors, such as the girl perceiving that the boy will make a good father or a poor father.

Adrian Bejan, with his Constructal Law, points to the most efficient organization which facilitates flow as the organization most likely to survive selection pressures. Sometimes these organization become the “college basketball royalty”, because the best high school players going to play for the “royalty” is most likely to produce the teams which will supply the players who will go on to the professional leagues. But events can upset the “old royalty”, as when upstart colleges with bales of money become basketball powers overnight. So is it a hierarchy or not a hierarchy, only organized free enterprise?

In Europe, national cohesion was long facilitated by monarchs. That sounds to me like hierarchy. In the US, we have Joe Biden…who I don’t perceive as anything like a monarch in terms of inspiration. Donald Trump, on the other hand, is verging on monarchy.

My points are two:

*I think that most people will understand the use of “hierarchy” in the context of the review of The Dawn of Everything

*The term “hierarchy” is a noun, trying to describe relationships which are inherently verbs or at least potential verbs. Confusion is sure to follow.

Don Stewart

The word status is closely aligned with hierarchy. (Semantics as I wrote earlier.) The socio-political-economic hierarchies that humans have created are second order systems based upon biological parameters and traits interacting with the current states of affairs. The first sentence below connects the two terms.

from:

https://www.artofmanliness.com/character/behavior/men-status-the-biological-evolution-of-status/

“Status and Reproduction

So status hierarchies promote survival by giving dominant animals more food and safety while simultaneously reducing conflict. Lower status animals benefit from this arrangement because they get the protection of the pack while not having to fight all the time for food.

But besides survival, status plays an important role in reproduction, and the stakes are particularly high for males. In most animal species, only a few males will have the chance to reproduce, and they’re typically the alpha males. For example, when researchers observed a colony of lion seals for several years, they found that at times, only five alpha males sired more than 50% of the colony’s babies. In some breeding seasons, the top five alpha males were responsible for 90% of the pregnancies.

While elephant seals are the most extreme example of this phenomenon, even in primates, you see similar disparities. In one chimp colony, researchers discovered that the group’s alpha male sired 36% of offspring, while the other dominant males sired another 14%. In other words, the chimps at the top of the totem pole accounted for half of the children born in the colony.

The same sort of imbalance exists among humans. While most cultures today embrace monogamy, in the distant past, polygyny was the norm and only the men at the top of the status heap had a chance to reproduce. In fact, anthropologists and evolutionary biologists estimate that only 33% of our human ancestors were male.

Because not every male will get the opportunity to reproduce, and because the chances of siring children are much greater for those on the top of the hierarchy, males across animal species are far more driven to seek status than females.”

It is highly unlikely early homo sapiens whose cultural flashpoints include flake tools, burying their dead, cave paintings, sewing and spears even had a conception of egalitarianism and the principle that all people are equal and deserve equal rights and opportunities.

https://www.ushistory.org/civ/2.asp

No doubt bands were hierarchical much like apes and were based on a violent succession of leaders, not welfarism, with different individuals competitively proving their worth as leaders, improvisers, hunters, gatherers, reproducers, healers, tool makers, artists, entertainers etc.

Any freeloaders would not be given equal rights and opportunities but violently ousted to fend for themselves.

The Holocene probably brought about a semblance of a peaceful existence as progress from what was probably a very brutal and short existence within a very wild dangerous Nature. No wonder they believed in Gods. They probably couldn’t believe their luck when the climate changed.

@Steven B Kurtz

“Choosing a mate, mainly done by females barring rape events, involved/involves more than starry eyed love. It is widely thought that males perceived as most capable of providing protection and nutrition were highly valued.”

Interestingly DNA evidence seem to show that human females select a lifetime ‘provider’ mate but then couple enthusiastically and extramaritally with the ‘bad boys’ they subsequently encounter

Probably true in many cases. Females do play around, but not as much as men from what I’ve read. Evolution and biology seem to require more parenting and nurturing by the female as breastfeeding can take 2 years, and hard to defend and hunt with kids in tow.

@ Kurtz (cont)

. . . leaving the ‘provider’ mate to bring them up under the assumption that they are his children

It happens sometimes…No disagreement. Barring very different genetic traits such as skin color, it goes undetected. Good for the gene pool. You may know about the supposed Inuit tradition of having a stranger (traveler/trader…) have sex with the female of the family to acquire new genes in the family.

@Steve G

“It is highly unlikely’ etc

Um, no.

https://www.ucl.ac.uk/news/2015/may/unique-social-structure-hunter-gatherers-explained

Are you suggesting that ancient world hunter gathering communities that had just evolved from homo sapien ancestors whose cultural flashpoints were flake tools, cave paintings, sewing and spears have the same character as modern world hunter gatherer communities 🤔

I find the debates about the different theories regarding early human societies very interesting.

However, all theories are only ever going to be speculative at best. We are never really going to know.

I tend to go with the Dawn of Everything version, that our distant ancestors were organised in a whole array of different social forms. Rather than the “egalitarian archetype” theory.

I agree with your view, John.

Steve

https://scholar.google.com/scholar_lookup?&title=The%20dynamics%20of%20biological%20order&pages=228-242&publication_year=1988&author=Collier%2CJ#d=gs_qabs&t=1661860513259&u=%23p%3DmRottGFY1h0J

Most things in the world, if left alone, tend to disintegrate rather than organize themselves. Biological order, on the other hand, appears to originate spontaneously. This peculiarity led Schrodinger (1945) to describe life as negentropic. This leads to a paradox: Why should life be negentropic if the physical and chemical processes that underlie it are entropic?

(Negentropy is reverse entropy. It means things becoming more in order. By ‘order’ is meant organisation, structure and function: the opposite of randomness or chaos.)

Brooks, Leblond and Cumming (1987) have invented a Hierarchical Information Theory (HIT), in which entropy is a measure of complexity and negentropy is a measure of order. Their work is based on Landsberg’s (1984) observation that an expanding phase space allows order and entropy to increase simultaneously (the original insight was due, I believe, to Layzer). The innovation of HIT is the recognition that order is hierarchically arranged according to degrees of redundancy, where the degree of a redundancy is the number of elements required to exhibit the redundant pattern.

The same elements can simultaneously participate in order of varying degrees, as, for example, when the same letters make up words, sentences and paragraphs, which involve different degrees of grammatical order. Macrostates and microstates can be defined for a particular level by taking the macrostates to be determined by the order at that level, and the microstates to be all variants at level one which are compatible with that order. HIT comes to nothing, however, unless the orders of various degrees deviate from what would be expected if the total redundancy were evenly distributed, in which case we could more simply describe the system in terms of its total entropy. If there are laws which work on groups of elements of particular sizes, however, we would expect an uneven distribution of order. Then the question of the correlation or lack of correlation of order of different degrees (whether they share the same elements) becomes interesting. Given the operation of laws, a correlation between orders of different degrees requires a correlation of the laws which produce the order.

Redundancy

1. Portion of the total information contained in a message that can be eliminated without loss of essential information. 2. Provision of duplicate, backup equipment or links that immediately take over the function of equipment or transmission lines that fail.

https://www.gartner.com › redundan…

Definition of Redundancy – Gartner Information Technology Glossary

Hierarchical Information Theory and Negentropy seems to imply that as the size of a biological group exceeds essential functions, the surplus (redundancy) is ordered and complexity becomes manifest.

I am assuming the surplus is appropriately ordered under the relevant essential functions and it is the delegation of essential information/experience that creates the hierarchy.

Similarly, maximising the flow of information seems to generate hierarchical like structures as per constructal law.

https://royalsocietypublishing.org/doi/10.1098/rstb.2009.0302

Which itself is underpinned by the maximum entropy principle and other nonequilibrium thermodynamic principles like the maximum power principle.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2871911/

It makes sense that physical systems whether biotic or abiotic are designed and constructed around the path of least resistance including human groups, especially when faced with survival threats. However what seems important is the relationship and the balance between entropy and negentropy.

@Steve Gwynne

I believe it is fair to characterize John Gowdy’s position as:

*Climate change has doomed grain agriculture, which requires stability and a temperature much like that of the last 12,000 years.

*Without fossil fuels and grain agriculture, human super organisms cannot be supported.

*If we were plants instead of humans, we would get a constant dose of energy from the sun in order to construct the biological plant world we can see, plus the low level grazers and symbionts such as ants and termites and microbes. But we are not plants. We are grazers on the plants and especially domesticated grains. In the future, the plants will be predominately wild because the climate will be too unstable to support anything like horticulture or agriculture.

*Therefore, the best prediction for humans in the 23rd century is bands of hunters and gatherers who do not have the surplus to support hierarchies. One person may be a better hunter of deer than another person in the band, but both will be hunters. One woman may weave better baskets than another, but both are likely to know how to weave baskets. Both will know at least a hundred different edible plants to harvest.

Don Stewart

Interesting point about the end of the Holocene Don.

Regarding naturally occurring rewilding.

Amazon’s growth limited by lack of phosphorus.

Growth of the Amazon rainforest in our increasingly carbon-rich atmosphere could be limited by a lack of phosphorus in the soil, new research shows.

https://www.exeter.ac.uk/news/research/title_924389_en.html?utm_medium=email&utm_source=govdelivery

Thus the question arises, to what extent will soil mineral depletion and pollution affect naturally occurring rewinding?

@Steve Gwynne

Rewilding is complex because the basis for living creatures is a bunch of critters we usually ignore.

“In the Amazon rainforest, ants and termites account for 75 percent of the insect weight”

“the ratio of humans and their livestock compared to wild terrestrial mammals is now 23:1 in favor of humans and their livestock”

A British farmer was riding the train to London for a discussion of re-wilding. He noted that diversified farms INCREASED the diversity of animals, in total. The huge herbivores and the carnivores who preyed on domestic animals tended to be exterminated, or nearly so. BUT, the diversified farms opened up a lot of niches which became filled with a wide variety of smaller insects, microbes, worms, birds, and so forth. Rewilding might well result in a DECREASE in total diversity.

What seems pretty sure is that if the human population crashed to very low levels, the domestic livestock will rapidly disappear…either eaten by hungry humans or just starving to death when humans don’t feed them anymore or defend them from predators. Which opens up the world for the rapid repopulation from the wild. (Infant mortality is very high in the wild…presumably it would be less if the big predators…e.g., lions and tigers…aren’t around.). On the other hand, the tremendous variety which can be found on regenerative farms would also disappear as dense forests take over.

The phosphorus in the Amazon is similar to the calcium which moved from the Gulf Coast to the midwest with Passenger Pigeons, which are now extinct but once were way to numerous to count. But there is enough mined phosphorus now in the Midwest that centuries of animals could thrive.

Don Stewart

Don. Do you have a scientifically researched reference for that Midwest assertion?

Clearly useable/surplus mineral depletion (entropy) will reduce the negentropy of useable/surplus plant life and therefore the primary production capacity to supply successive trophic levels in those depleted local areas unless minerals are imported from elsewhere.

In areas where there is useable/surplus minerals, then this will allow the negentropy of plant life and successive trophic levels depending on the level of useable/surplus minerals in those areas.

It is interesting that orthodox models of the trophic cascade don’t include minerals as the abiotic basis of primary production. Material blind, rather than energy blind.

@Steve Gwynne

It’s pretty common knowledge that there is a lot of phosphorus left over from decades of heavy fertilization in the corn/ soy belt. IF the new regime in farming stops soil erosion, then a huge source of loss is stopped. If, in addition, food is mostly consumed locally and there is heavy usage of recycling and composting (as was true before chemicals in places like Asia (Farmers of Forty Centuries)), then the small amount which came back to the Midwest from the passenger Pigeons as they migrated maintained stability.

In addition, IF the new agricultural regime is based on abundant soil microbial life, then plant uptake of the minerals in the soil will multiply.

On the other hand, if globalization collapses and no phosphate rock comes to the US AND we try to continue current farming practices, famine will be the certain outcome.

Don Stewart

Earth for All: A Survival Guide for Humanity

https://www.earth4all.life/book

9 deep dives

https://www.earth4all.life/visuals-and-briefs

Planetary turnaround: an investment banker’s perspective on climate change action.

The five turnarounds involve phasing out fossil fuels, transitioning to regenerative agricultural practices, and employing new development models to support the development of low- and middle-income nations. They also include some redistribution of income (of only the richest people and nations in the world) and ensuring that everyone has access to good-quality education, affordable healthcare and effective contraception.

Basically Net Zero coupled with global welfarism facilitated by extensive government financial support, international aid and targeted global private finance.

I presume the strategy is hoping to piggyback on the COP framework with a global campaign strategy but I need to deep dive a bit more.

Steve G,

Around 24 years ago I was made the first Yank member of The Canadian Association of The Club of Rome. I was 53. I’d been organic gardening for 8 years (6 month season), and P/T studying and researching environmental ethics and sustainable futures. I was an energy hog due to a 1784 house in central New England. I cut standing dead trees for wood stoves to reduce our heating oil usage, but used a small tractor, used grid power to pump water/operate thermostats/furnace/lighting and had to drive everywhere for shopping and cultural activities. I was a spoiled city slicker.

Since then, 2 billion plague species have been added to our numbers. That is the upper limit that many scientists think should be our total population for multi century sustainability.

When I read that this guide book suggests education, health care, contraception, income redistribution, reduction of pollution…during this era of system breakdown, multi-trillion dollar debts, resource constraints, biodiversity decline, non-stop wars hot and cold, I roll my eyes. The wealthiest countries can’t deliver those prescriptions to their middle classes. A few small countries with mostly homogenous populations are managing best, but for how long?

It seems a major global economic failure is coming, and the ecosphere is being pushed to a back burner. The optimism I read about is misplaced given these realities. It is a distraction, and disappointment as it avoids the severe hardships that are likely ahead.

I’d agree Steve.

I’ve now had a look at the deep dives and they haven’t dedicated a single sentence to the biological drivers of human overshoot.

In other words, this book relies on the concept of a tabula rasa human being with a belief that the alternative realities of their imagination can be realised if only we collectively applied our free will.

Quite remarkable ignorance really. You’d think they would have questioned why LtG wasn’t acted on earlier, at which point they blame the usual suspects of multinational corporations, neocolonialism and capitalist elites for human overshoot.

The most disturbing was the sell out by Nafeez Ahmed who now claims there is enough materials to drive a ZERO CARBON renewable transition at a global scale along with assertions that the EROI of wind/solar can reach 40:1 including storage. This he claims is achieved by building 3x the wind/solar capacity as part of a transnational grid in order to reduce curtailment and remove the need for curtailment storage.

https://www.clubofrome.org/publication/earth4all-ahmed/

@, Steven B Kurtz

Just to add to that.

I also think that, as theories regarding human origins are only speculative, then assigning a true “human nature” or “politics” to us humans, is also just speculative.

It probably reflects the ideas/politics of the authors of such theories, rather than any “universal truth” about the “human condition”.

“Criticism of Dawn Of Everything”:

https://energyskeptic.com/2022/criticism-of-dawn-of-everything/

@Postkey

I’ve left a comment on the post you gave the link to. Can’t seem to read any other comments on the blog though. Does it link when you click on them?

‘Damn The Matrix’ discusses Britain’s ERoEI and energy crisis, which of course is interwoven with it’s economic crisis.

https://damnthematrix.wordpress.com/

BBC radio today was discussing the “cost of living crisis “, in more detail than I’ve heard before, today.

People are joining up the dots and seeing how high energy costs are going to cascade through the economy.

It was focused on the hospitality industry. Pubs and breweries in particular. (Us Brits know what the priorities are!!!!🤣)

Guy from a brewery was saying how the cost of glass and aluminium were shooting up. He can pass on the costs to his customers as they would not be able to afford the prices as everyone will be feeling the squeeze.

The one think they all believe though, was that the energy price hikes were only going to be temporary!!!!!!!!!!!!!!!

Maybe that reality is too much for people to take in at this point in time.

(I give Liz Truss six months max!!!!)

Can’t not can pass on costs…….

New report – a primer on the looming financial crisis – has been published here.

Clicking on the title doesn’t seem to take you to the article. But clicking on the comments ‘bubble’ will do so.