FINANCIALIZATION, ANOMALY AND RISK IN AN INFLECTING ECONOMY

It’s been said that, when events turn fast, furious and frightening, and civilians are panicking, the professionals get ever cooler and more calmly calculating.

If this is so, we’ll need to be very professional indeed in 2024.

One of our most serious challenges is that economic and financial forces are pulling in opposite directions. Transactional activity, and the aggregates of assets and liabilities, are continuing to expand, even as the underlying material economy is inflecting from growth into contraction.

Our interest, in this first article of 2024, is in the process of financialization which is driving this divergence. We need to know why parallel forces are driving us to a state of simultaneous affluence and destitution, and why trends increasingly obvious to investors in energy are still invisible to those investing in almost everything else.

Just one consequence of this disconnect is the ludicrous proposition that fossil fuel assets – without which we cannot possibly transition to renewables – are somehow “stranded” and valueless, when the reality is the polar opposite of this exercise in absurdity.

Where wealth is concerned, capital theory tells us that, as the authorities continue to prop up the flow side of the economy by wrecking the stock side of the equation, the resort to ever-looser monetary policies should result in continuing rises in asset prices.

At the same time, though, a point will soon be reached at which the sheer magnitude of our mountainous debt and quasi-debt liabilities induces confidence-snapping vertigo.

Soaring asset prices are, logically, going to make us rich, then, just as escalating liabilities are going to land us in the poor-house. Since logic baulks at the concept of affluent bankruptcy, it’s hard to avoid the conclusion that we’re going to end up owning vast amounts of worthless money.

We’re going to need every analytical skill at our disposal, and every piece of innovative thinking we can lay our hands on, to come out on the right side of this progression.

Meanwhile, in the markets, and indeed in industry, we’re seeing the emergence of a remarkable anomaly.

On the one hand, investors, and energy industry decision-makers too, are reluctantly coming to terms with a material reality, which is that renewables aren’t going to deliver the much-vaunted abundance of low-cost energy after all.

We’re not going to get rich, then, by investing in wind, solar or hydrogen companies, and the development of these energy sources is going to be much costlier, and far less profitable, than had hitherto been assumed. Indeed, it’s hard to escape the conclusion that transition to renewables, if it’s going to happen at all, is going to need subsidy, which can only come from consumers, taxpayers, or both.

On the other hand, though, nobody is yet making the connection from the suppliers to the users of energy. If renewable energy isn’t going to be cheap for those who produce it, neither can it power a tech-and-leisure utopia in which the broader market still believes.

Our need, as I see it, is to deepen our understanding of a series of complex dynamics – the material and the monetary in economics, flow-stock equations in finance, and the energy-prosperity relationship in the material economy.

So let’s get started.

What is financialization?

Technically speaking, the term “financialization” references growth in the absolute and proportionate size of the financial services sector of the economy, a process that carries with it increases in intermediation, and rises in debt-to-equity ratios in business. It’s a term used to describe the rise of ‘financial capitalism’, a variant of, or a successor to, the industrial capitalism of the past.

One can easily see why the term financialization is used pejoratively. Critics allege, for example, that the manufacture and sale of a car needs to be no more than a bilateral transaction between the manufacturer and the purchaser of the vehicle, and that both parties lose out through the unnecessary insertion, for profit, of financial intermediation into such transactions. A riposte to this might be that, without the availability of finance, the car could neither be made nor purchased at all.

The aim here, though, is to be analytical rather than judgemental.

Leaving the politics out of things, financialization has two primary effects. The first is the insertion of more transactional activity into the exchanging of any given quantity of material products and services. The second is that debts and quasi-debts (debt-equivalents) have to increase in order to fund this increased transactional activity or churn.

To emphasise – because this is critical to understanding – the analytical significance of financialization is that it increases transactional activity without adding material economic value. Why this matters will become apparent shortly.

Financialization has been moving on from the established definition of increasing the use of financial services, and hence of credit, within the economy. For example, when a person’s information is garnered for sale to advertisers, his or her data has been financialized. When our otherwise-unvalued time spent waiting to be served at a post office or a delicatessen is used as a marketing opportunity by putting a screen in front of us, that waiting time, too, has been financialized.

This extension of financialization feeds into a new business model. Historically, the aim of businesses has been to sell products or services to customers. Increasingly, this aim has shifted towards the development of streams of income, most commonly as ad-supported or subscription services. There has been a parallel rise in staged payment purchases – in shorthand, BNPL (buy-now, pay-later) – which is a process that comes nearer to the standard definition of financialization.

The streams-of-income model has carried over from the flow side of the financial equation to the stock side, which is what happens when such hypothecated revenue streams are capitalised.

This presents two specific challenges. First, this business model is likely to turn out to be far more fragile than has yet been recognised – ad spending and subscriptions are amongst the easiest savings possible for hard-pressed businesses and households.

Second, its failure could trigger interconnected detonations across the financial system.

Before we get into that, though, let’s remind ourselves about some little-known fundamentals of finance and, first, the economy itself.

Financialization in context

As you may know, there is an essential prerequisite for the effective understanding of finance and the economy.

This is the conceptual necessity of two economies.

One of these two economies is the “real economy” of material products and services, and the other is the parallel “financial economy” of money, transactions and credit.

We can, if we choose, stick to the old Flat Earth notion of a materially unconstrained economy, capable of perpetual expansion, and explicable in terms of money alone. But, in an age of increasingly apparent material and environmental boundaries, the classical immaterial straightjacket to economic thinking, with its assurances of infinite growth on a finite planet, is going the way of the dodo.

The material has arrived, in the sense that physical and environmental limitations are forcing themselves upon our unwilling attention. Environmental deterioration can’t be bought off with money. Central bankers can’t conjure low-cost energy, or high-density mineral resources, out of the ether.

It transpires that most processes – including inflation/deflation, asset price bubbles and liability-driven crises – are ultimately traceable to distortions within the relationship between these “two economies”.

As the fossil fuel impetus fades away, and with no real (as opposed to mistakenly suppositional) complete alternative in sight, the material “real” economy is inflecting from growth into contraction.

At the same time, the parallel financial economy has been expanding at an accelerating pace.

This divergence is dangerous, because it moves the system away from the fundamentally necessary equilibrium between the financial and the material.

This equilibrium is a necessity because, properly understood, money has no intrinsic worth, and its value resides entirely in its role as an exercisable claim on the material economy. If the aggregate of these claims outgrows the wherewithal to honour them, the resulting body of “excess claims” must be diluted or destroyed. We can try to push the restoration of equilibrium out into the future, but we can’t eliminate the dynamic.

Financialization, as we’re looking at it here, is driving this worsening disequilibrium because, as we’ve noted, it involves the attachment of additional financial transactional activity to any given quantity of material economic value in the form of goods or services.

The necessary accompaniments of this form of financialization are (a) the inflating and subsequent bursting of asset price bubbles, (b) the parallel accumulation and destruction of enormous financial liabilities, and (c) the monetary degradation that may attend efforts to prevent these reversions to equilibrium from playing out.

We cannot trace this process through conventional metrics, because, contrary to widespread misunderstanding, GDP is a measure, not of material economic output, but of transactional activity. Accordingly, financialization creates a comforting illusion of growth in ways that serve to disguise the real hazards of super-rapid liability and asset market expansion.

This is why we need to use our own tools and insights, based here on “two economies” and the SEEDS economic model.

A big anomaly

One of the skills we’re going to need going forward is an enhanced ability to spot internal contradictions.

One such anomaly is the divergence between the energy-supplying and the energy-consuming sides of the capital markets.

In energy supply, one myth remains intact, and one is now succumbing to reality.

The intact myth is that fossil fuel assets are somehow “stranded”, and of little or no value. As we shall see, this must be one of the daftest conclusions ever reached in investment analysis.

The myth that’s now succumbing to reality is the notion that renewable energy can only get less expensive over time.

This is where an anomaly of perceptions – a failure to link up the fortunes of energy suppliers with those of energy users – is coming to the fore.

Energy users don’t come any bigger, in simple financial terms, than the Big Seven tech stocks. These continue to storm ahead – their aggregate market value increased by about 75% in 2023, and now matches the combined market capitalisations of the Japanese, British, Chinese, French and Canadian exchanges.

But nobody seems to be asking the hard questions about what’s going to power tech activities (or anything else) in an energy-constrained future.

The almost universally-proffered answer is that Big Tech – and pretty much everything else – will be powered by cheap renewable energy. The only fly in this ointment is that renewables aren’t going to be cheap. Their lesser energy-densities, in comparison with fossil fuels, make this impossible.

Some people, though, are asking this question rather than simply assuming a comfortable answer to it. These are the people who manage, and invest in, the renewable energy supply sector of the market.

A little forensic analysis gives us a clue to this big anomaly that’s emerging in the financial markets, albeit as yet seemingly unnoticed by asset allocators.

As the always-insightful Goehring & Rozencwajg have pointed out, the prices of a host of renewable energy stocks – including Orsted, Nextera and Plug Power – have plunged from previously-exuberant highs, whilst the corporate appetite for investment in renewables projects has been decreasing markedly.

The stock price examples cited by G&R are not exceptions to an otherwise positive trend. On the contrary, as of mid-December, the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index had fallen by 21% and 28%, respectively, since the start of 2023. This contrasts very starkly indeed with a rise of about 25% in the S&P 500 itself over that same period.

To be clear about this, renewables development is still happening, but it’s turned into an uphill slog. Power prices have to rise to keep it viable, and subsidy may be the only way to stop the wheels from falling off.

Ultimately, business and domestic consumers will have to pay for that, either as customers or as taxpayers, because there’s nobody else who can. And, by definition, if people have to spend more on one thing, they have less to spend on something else.

The advance of non-cheap renewables

The underlying problem is that ‘cheap’ renewable energy is turning out not to be cheap after all. Some of us have never believed it would be.

For a start, cheap wind and solar power requires cheap fossil fuel energy to deliver all the steel, cement, copper, lithium, cobalt and other raw materials needed to build, operate, maintain and replace the system.

This linkage dictates that, if the material (ECoE) costs of fossil fuels are rising relentlessly, which they are, those of renewables cannot decrease. This linkage also makes the very idea of “stranded” or ‘valueless’ fossil fuel assets an absurdity.

To return to a point made earlier, the rationale informing the impossibility of cheap renewable energy is a straightforward matter of energy density. The densities of renewables are lower than those of fossil fuels, and technology can’t overturn the laws of physics in order to change this material relationship. The lower the density of an energy source is, the larger – the more material-intensive, and the more costly – the delivery infrastructure has to be.

The message clearly being taken on board by energy investors is that, contrary to what had previously been received wisdom, wind and solar power are not going to deliver enormous profits through the supply of ultra-cheap energy for sale at healthy margins to domestic and business customers.

Where investors in energy itself are concerned, then, this penny seems to have dropped. But, if renewables aren’t going to be highly-profitable or low-cost for those who supply them, what about those who use them?

Is it feasible that non-cheap energy can power us to an ultra-profitable tech and leisure nirvana?

Can consumers really become more prosperous when the material cost of the energy embedded in everything they buy carries on rising?

Somebody, somewhere, has got their wires crossed.

With that noted, let’s get back to financialization, and the disequilibrium between the “two economies”.

The credit engine

With financialization, of necessity, goes credit expansion. When seen through the prism of “two economies”, it’s readily apparent that there’s no other way of financing the churn.

Over the past twenty years – and stated in real (ex-inflation) terms in international PPP dollars – global debt has increased by $265 trillion, but this doesn’t include broader financial liabilities, such as those of “shadow banking” (the non-bank financial intermediary or NBFI sector).

Because of glaring gaps in the availability of data, we can only estimate growth in these broader liability aggregates, put here at about $320tn, which is almost certainly a pretty conservative calculation. Beyond this again lie rapid rises in the “gaps” in unfunded pension commitments, and the potential nightmare that is derivatives.

Global broad liabilities, then, have increased by about $585tn in real terms over twenty years. which is roughly 7X the expansion in reported real GDP (+$83tn).

That ratio, in itself, is wholly unsustainable. But the real sting in the tail here is that three-quarters of that supposed “growth” has been the cosmetic effect of financialization itself.

By backing out the growth-inflating “credit effect”, and deducting the first call on output made by the Energy Cost of Energy, SEEDS analysis reveals that world material economic prosperity increased by only $20.6tn (rather than $83tn) between 2002 and 2022. We should never forget that, as mentioned earlier, gross domestic product isn’t a measure of material economic output, but of financial transactions, which is a very different thing, and the creation of non-value-additive transactional activity is a necessary statistical product of financialization.

What the numbers tell us is that, in annual, inflation-adjusted terms, we have become, over twenty years, materially better off by less than $21tn, having ramped up our collective liabilities by getting on for $600tn.

We can see the sleight-of-hand of financialization in numerous instances. If IMF data published in October is confirmed by final outcomes, for example, the American economy, measured as real GDP, will have grown by about 2.1% in 2023. But the same data puts ‘general government net borrowing’ – the fiscal deficit – at 8.2% of GDP.

This means that about US$530bn of growth will have been bought with upwards of US$2.1tn of government borrowing, the latter confirmed by American public debt breaking the US$34tn barrier. This is even before we include increases in household and corporate debt (and, of course, in their NBFI and other quasi-debt exposures).

It’s an often-remarked fact that the American consumer has been extremely resilient in recent times, comfortably out-spending inflation – but it’s hard to see how he or she could have been anything less than resilient, when being handed this much additional liquidity, borrowed on his or her behalf by the government.

Another anomaly – the concept of wealthy bankruptcy

Part of the contradiction in the financialized morass in which we have become entangled is that the same factors that seem ‘good’ for asset prices are simultaneously ‘bad’ for economic stability.

Within capital theory, there’s a valid debate to be had about which – interest rates or liquidity? – is the primary driver of asset prices. A reasonable conclusion might be that asset prices are a function of the supply and the cost of capital, because these are linked – an increase in the quantity of money (a rise in liquidity) is consistent with a decrease in its price (interest rates).

On this basis, expansionary fiscal and monetary policies point towards continuing rises in the prices of stocks and property. To prop up GDP, and pretend to deliver “growth”, the authorities will have to carry on driving public (and, for that matter, private) debt upwards.

Some observers think that the central banks’ real motivation in pushing rates upwards was to create headroom for cutting them again when exigencies require. The logic of ever-rising public debt points towards both lower rates (to keep government debt servicing affordable) and a reversion from QT to QE, to create enough debt-rollover liquidity in the system and, perhaps, to fund public borrowing if other sources fail.

So far, so good. But the same dynamics that seem destined to make us wealthy (by driving asset prices upwards) also seem destined to put us in a Marshalsea debtors’ gaol (by pushing debt and quasi-debt to ever more stratospheric levels).

We are, then, going to be both (a) rich beyond the dreams of avarice, and simultaneously (b) bankrupt, defined as having liabilities that we can’t possibly honour. (We can’t, collectively, pay off the debts by selling the assets, because any amount of asset sales requires a matching quantity of purchases).

A twisting road to reality

Just as surely as nature abhors a vacuum, logic abhors the concept of wealthy bankruptcy.

There are two ways – though they are not mutually exclusive – in which this contradiction can be resolved. First, the mountain of liabilities could collapse, taking asset values down with it. The second is that runaway money-creation could destroy the purchasing power of currencies.

We might, then, find ourselves the possessors of vast amounts of worthless money. If this is how things turn out, financialization, in all of its various forms, will have been ‘a road to ruin, paved with bad incentives’.

Before it quite gets to this, though, some other processes can be expected to kick in. These are best considered pictorially, using charts sourced from SEEDS.

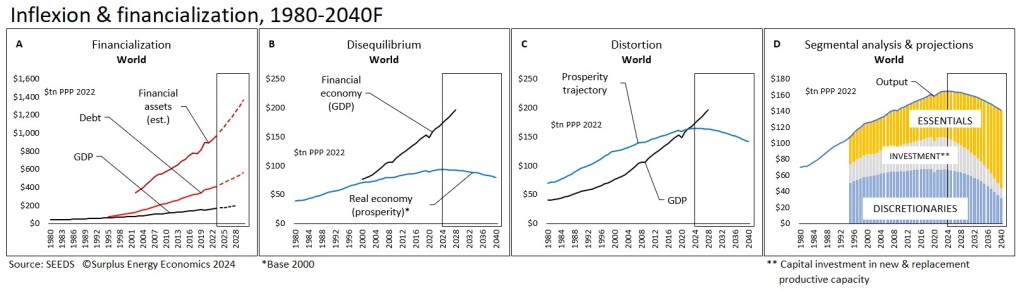

The first chart shows how rapidly debts and broader liabilities have been outstripping even GDP, let alone underlying prosperity.

At the same time, risk itself has been rising as the disequilibrium between the real and the financial economies has become progressively more extreme (Fig. 1B).

In short, the quantum of liabilities has been rising, just as their risk profile has been worsening.

If we retrofit transactional activities to the prosperity curve (Fig. 1C), we can see how much prior “growth” has been inflated artificially.

The further introduction of segmental analysis – dividing output into essentials, capital investment and discretionary consumption – enables us see an emerging dynamic in which consumers’ ability to afford non-essential products and services is coming under relentless pressure.

What Fig. 1D does is to reveal to us those economic processes which are being experienced as the ‘cost of living crisis’. We’re at the start of a steep downwards incline, not just in the affordability of discretionaries, but also in the ability of the household sector to service its ever-growing mountain of financial commitments.

Meanwhile, and just as financial investment is increasing, capital investment – that’s to say, investment in the creation and replacement of productive capacity – is on a declining path.

Fig. 1

The key aspect of money is its use as a medium of exchange. Without the ability to exchange money for real objects and services, its use as a store of value vanishes and its use as a unit of account becomes irrelevant.

In the global economy, virtually all exchange is now effected through the medium of money. The “arrival of materiality” therefore raises three questions: 1) Can some other method of exchange be created that doesn’t require money if money becomes worthless as an exchange medium? 2) Can a new monetary system be created in a timely manner to substitute for one that has failed? 3) If one or more of the major currencies in use becomes worthless, can some other currency take over quickly?

Let me consider these questions in reverse order (from easiest to hardest):

At present, 68% of the global foreign exchange market involves the US dollar. I suspect that this percentage is indicative of how important the dollar is in global transactions. If confidence in the dollar were to collapse quickly, which other currency could take its place? I suspect that no other currency could just step into the dollar’s place, so the answer to 3) is likely “no”.

Could the US or some other entity create a new dollar system after the old one had failed? Perhaps, but I don’t see how. If not, the answer to 2) is also “no”. Perhaps others will have some idea how this could be done and I would be very interested to hear it.

How could a global method of exchange be created that didn’t use money? Could computer systems be used to facilitate direct material exchanges between all parties at every stage of exchange from resource extraction to production to delivery to the end consumer? I have my doubts. Perhaps such a system could be developed within a single country as part of a “command economy” but not as a global system, and without global exchange to keep supply lines functional, most industrial production would simply collapse from lack of parts. I suspect that the answer to 1) is “no”, too.

As I see it, financialization is a very dangerous practice. The global economy is extremely complex. That complexity is dependent on money that is accepted everywhere. If financialization ends up destroying money as a medium of exchange, it ends up destroying the world economy. I doubt that any amount of wisdom could put it back together again.

Thanks Joe. I agree with you on this.

The dollar is ‘the least dirty shirt in the laundry basket’. This being so, I think we need to keep an eye on some of the weaker ones, of which, in the West, the most obviously at-risk is GBP.

I don’t see how we can replace the dollar, which is worrying when we think about spiralling US public debt, out-of-control deficits and the seeming inevitability of lower rates – and an eventual reversion to QE – just to keep the show on the road.

Financialization is indeed dangerous. I’ve toned this down a little in this article, mainly because I didn’t want to get into the motivations driving it.

Dr Tim, thank you for starting the New Year in fine style!

One feature here in the UK that I think is being seen as merely discrete and unconnected events is the increasing levels of Council Tax arrears, the extraordinary levels of debt owed to energy suppliers, and the greater prevalence of shop-lifting – including petrol theft from filling stations.

I view these as dots that are inter-connected, and are revealing hardship arising from declining prosperity, with an added twist.

Ultimately, local authorities recover unpaid Council Tax by adding to the charge in the following year, which means that it falls on those that remain able to pay the Tax. Similarly, energy companies are to be allowed to add around £16 to the bills of existing customers to make good the loss of revenue. The cost burden of shop-lifting is paid for by those customers that do not steal.

I believe that this developing scenario validates an argument that you made some time ago, when you referred to there being a ‘ratchet’ effect of transferring costs that incrementally will erode the financial situation of the better-off.

Thanks Kevin, and a Happy New Year to you.

I’ve sometimes thought about doing a new article here about the UK, and I’m aware of the issues you mention. Relatedly, I’ve read about the disturbing incidence of abuse, both verbal and physical, being experienced by people who work in shops. One could also mention councils’ resort to penalising motorists in efforts to prop up crumbling revenues. Then there’s pollution of seas and rivers, the plight of tenants, crumbling schools and hospitals……..the list goes on and on.

So yes, this is indeed a ratchet effect. A lot of this is rooted, not just in the mechanics of a rapidly deteriorating economy and an inability to see it, but also in attitudes.

So much in the UK seems to be failing, and this, for me, is an intersection of two issues – deteriorating prosperity, which is not unique to Britain, and an extreme inability to deal with it. Whatever one thinks about the dreadful present government, the opposition don’t seem to be offering much that’s constructively different.

I don’t know what’s going to pull Britain out of this spiral.

Hello, Kevin. I go to Wells in Somerset most Saturday mornings and the weekend two weeks before Christmas found the city absolutely heaving with people – more than I had seen in 30-odd years of living nearby. Interestingly, the boutique shops selling fancy scatter cushions and expensive lampshades (£350, anyone?) were virtually deserted, especially in comparison with the ubiquitous charity shops. I spoke to a few retailers – trade has been bad, they said. The weekend before Christmas was unusually quiet. I think Tim Watkins is right in that the UK consumer is ‘tapped out’.

@Mark Meldon

I went to Clarke’s Village just before Christmas and was surprised by the amount of retail units that were boarded up.

The costs of living crisis is hiding in clear view.

The UK is far closer to the cliff-edge than most people realise, even though it’s surely obvious in everything other than headline data.

A Happy New Year to you Dr.Tim.

Thank you for this piece, as excellent as always.

No-one can forecast the future, but I have a hunch that 2024 will be “difficult” for most of us in the UK. Pension problems are my daily bread nowadays, and the palpable sense of disappointment that many I see through my work is profound. Millions are sleepwalking into an impoverished retirement, many saddled with long-term debt, and most are oblivious to this until it’s too late to do much about it.

Also, what was it you were saying about “homeowners” only being able to sell their properties to each other?

https://www.theguardian.com/money/2024/jan/02/uk-first-time-buyers2023-interest-rates-house-prices

Only yesterday I was talking to the daughter of an old friend about the property buying process and they hadn’t really thought about the old rule of thumb that you pay back in interest and capital roughly three times what you borrow over the term of a mortgage (setting aside the effect of inflation).

Keep up the good work!

Thanks Mark, and a Happy New Year to you.

My private view is that the UK is in a dreadful mess, far worse than is generally understood or acknowledged. I only hope that 2024 isn’t as bad as I think it’s going to be.

The point I make about property is that aggregate valuations – average price X number of properties – are meaningless, because “we” can’t all sell our properties, because only “we” could be the buyers of the whole lot (apart from a few net buyers or sellers from overseas).

It is ludicrous that most young people can’t afford properties (and are also caught in the rent trap – how do they save for a deposit whilst they’re paying rent?) If couples have children at, say, 25, and life expectancy is say 80, they won’t inherit (their only hope of moving on) until they’re 55, on average – what kind of society is that?

The UK economic model is failing as we watch. It’s tragic. Everything – NHS, water pollution, infrastructure, so much else – seems to be falling apart at the same time. The model is a combination of “everything is potentially for sale (to overseas investors)” and “we can keep going on a tide of credit so long as we can keep property prices inflated”.

The polarization between a prosperous few (prosperous on paper, for the most part) and the struggling majority isn’t healthy. Sometime, this has to be an open goal for radicals/populists, whether of right or left.

HNY Tim – may you continue to provide wisdom in these terrible times.

Just one thing I must take issue – there is no climate emergency or crisis.

What we have is a good old-fashioned government scam to extract money from the masses.

Thankfully the excellent Mark Steyn will demonstrate this in a DC court to refute a $25m claim by Michael Mann of Hockey Stick fame.

https://www.steynonline.com/14002/two-weeks-to-trial

“Climate crisis or climate scam? When scientific debate is shut down you have to ask yourself if scam is the answer. As always, follow the money”

Mr. Tedd;

Here is an excellent book that you might be interested in. It really explains the scam and makes clear where we are going. You can get it for free if you sign up for “Kindle Unlimited”, and then immediately cancel.

Happy reading!

Pintada

The situation is so complex that I, a semi-retired scientist haven’t worked out the (likely) truth yet. I took it for granted in 1992 onwards that ‘climate scientists’ were telling the truth but that seems to have become less and less the case as time’s gone on.

I heard via a professor friend of somebody who’s watched ~1,500 video-hours of climate scientists debating the topic. He still hasn’t come to a conclusion.

What I’ve arrived at after talking to some of these people, is that in the 1970s/80s the scientific papers and debates were pretty honest and uncorrupted. It hadn’t yet become ‘political’ and academic funding didn’t depend on exactly what you wrote in your published papers. It does now.

In 1975 people still didn’t know if the world was heading into a new ice age or not. If it was, seen in hindsight some warming from fossil fuels would presumably have been a very ‘good thing’ indeed. Cooling is much worse than warming for humans, given the effects of a ‘year without a summer’ on food yields. They had several of those in past centuries.

At least with ‘COVID’ there was Prof. John Ioannidis from Stanford Univ. an expert that all sides seemed/seem to trust. He came out with useful data in spring 2020. It helped those who were deeply suspicious of the authorities and were already following the topic by then.

Jonathan do you like a good detective story?I know I do. My top detective as far as global warming goes would be Doug Vogt of the Diehold foundation(youtube) After 20 years of extraordinary hard work he points his finger squarely at magnetosphere collapse. He is a polymath so to follow him you will need to channel your own polymathness! Just put aside a complete week and the you will have a very good handle on what is going on.

The Undesigned Universe – Peter Ward

“ . . . it is these ocean state changes that are

1:02:28 correlated with the great disasters of the past impact can cause extinction but

1:02:35 it did so in our past only wants[once] that we can tell whereas this has happened over

1:02:40 and over and over again we have fifteen evidences times of mass extinction in the past 500 million years

1:02:48 so the implications for the implications the implications of the carbon dioxide is really dangerous if you heat your

1:02:55 planet sufficiently to cause your Arctic to melt if you cause the temperature

1:03:01 gradient between your tropics and your Arctic to be reduced you risk going back

1:03:07 to a state that produces these hydrogen sulfide pulses . . . “

The New York Times, today, January 2, says that “the debt matters again”. Some economists who formerly thought that borrowing and spending was an excellent idea have reversed course.

Don Stewart

Thanks Don. It’s a very strange world in which debt ever ‘doesn’t matter’!

I’m surprised there’s not more discussion (other than in specialist fora) about “shadow banking” and the various interconnectednesses of the credit ecosphere.

This is timely – apps “are part of what’s known as the “attention economy”, in which it’s our attention (and data about what we are likely to pay attention to) – rather than goods or services – that’s being sold” (my emphasis).

Beyond coinciding with part of what we’re discussing here, it’s a very good read, especially about the phone demanding attention that the author should have been giving to her baby –

“There was my baby, gazing up at me. And there was me, looking down at my phone.

“I was horrified”.

This link to that: https://www.theguardian.com/lifeandstyle/2024/jan/02/smartphones-attention-economy-reclaim-free-time

Happy New Year Dr Tim, and thanks for starting the year with a real fizzer of an article.

Questions don’t come much bigger than what replaces the dollar when it fails? For years now, Jim Rickards has been pushing the idea that it will be SDR’s (Special Drawing Rights). I can see how he arrives at that idea, but could it ever happen in practice? It would mean the USA had to cede authority to the IMF. Also, these things are designed for international transactions, so they wouldn’t replace the dollar in your pocket.

Do you have any views on the feasibility of this idea?

For Science Nerds who Sense That The Tide is Going Out

Begin here:

Peter Attia, reputedly the most expensive doctor you can hire to take care of your problems, argues that what we eat doesn’t have an important impact on our health.

Nick Norwitz, a third year medical student at Harvard, responds with evidence from a dietary trial on himself that, for a person eating a high fat ketogenic diet who is thin and has high cholesterol, eating Oreo cooked can reduce the LDL cholesterol by roughly 70 percent. He has now completed, but has not yet published, the second arm of the study which shows that reverting back to his high fat ketogenic diet can cause the cholesterol to increase to its previous level. While he doesn’t reveal the answer here, his smile gives us the answer.

So…an experiment costing a couple of hundred dollars (mostly for the blood tests) upsets the trillion dollar industry defended by Attia and a horde of lipidologists and cardiologists and heart hospitals and drug manufacturers.

The second entry into our nerdy approach is this article from the Scientific American:

https://www.scientificamerican.com/article/a-new-physics-theory-of-life/

I’ll summarize by saying that the chemical and electrical properties inherent in nature tend to create entities which concentrate energy. (I hope I don’t have to convince readers here that concentrated energy is important.)

Third in our nerdy approach is to think about what happens when the concentrated energy which has resulted in what we call Western Civilization begins to decline. My argument is that, over the long term, only those entities which are adept a using the available energy…not the energy which was once upon a time available…will survive. How can society force the reduction and allow success and failure to determine which entities survive?

That is the 64 dollar question (showing my age…now 64 quadrillion dollar question). I suggest that the ideal would be a forced reduction in energy usage. But I have no idea how to bring that about in the real world of politics.

Don Stewart

Dear Tim,

Thank you for your first New year post.

As you well know, net energy is the fuel of our economic system and significant variations in this net energy are likely to have significant impact on the relative stability of our economy.

Given that fossil fuels still provide about 80% of the primairy energy used by human « high tech » society, have you been able to assess if, despite growing extracted volumes of coal, gaz and oil, the net energy delivered to society by these energy sources to maintain its complex structure is still increasing ?

Best regards,

John

I have always felt the real economy was the host and the financial economy was the parasite. We are reaching the point where the consumption of the parasite is exceeding the production of the host.

Epic.””

Obviously, the mountain of financial liabilities (“claims” on the energy economy) can never be repaid in honest coin. Some mixture of chaotic defaults and currency dilution is inevitable. It is interesting to ponder the possibilities of which claims are going to be honored (receive priority) and which will be repudiated in whole or in part. The article wonders “whether the economy contracts gradually, or a financial collapse” will occur. Perhaps it will be both – like bankruptcy – “gradually and then suddenly”. I will tell a brief story.

For about ten years I lived in a large city in a Third-world country. Life was pleasant enough, although occasionally inconvenient or dangerous. Utility outages were frequent. The electricity would go out, often for hours and sometimes for days. The water might be shut-off for days, sometimes with no advanced notice. During prolonged electrical outages, the Internet would fail of course. But you learn to adapt. You buy a generator. You keep the bathtub filled with water. You avoid elevators. You eat dinner by candlelight. Sometimes at night we would sit out on the balcony and listen to laughter and the clink of dominoes in the darkness. It’s all fun and games until the sewage pumps stop.

The city was supplied with petrol by truck. One day, owing to labor problems or armed gangs or who knows what, the fuel trucks simply stopped arriving. Nothing. At first life went on as usual, with people driving and working and shopping and going about their business. Then the petrol stations began to run out of fuel and close. You had to drive further and further to find fuel. People started to exchange information on their phones about which stations were still open. Long queues formed. As the situation continued, there were fewer and fewer cars on the road. Eventually all the petrol stations were closed, and the streets were nearly empty of traffic. Businesses closed. A few police vehicles and taxis moved about. An eerie calm descended on the city which was fascinating to observe. There was no panic. Activity did not come to an abrupt halt. The entire city just slowly coasted to a stop, like a gigantic flywheel running down.

I suspect we were just days away from complete chaos. The government sent in the military, got the fuel trucks rolling again. People waited patiently. As the first trucks rolled into the city there was a palpable sense of relief. Things came back to life, businesses re-opened, traffic jams returned. Everything was normal again. For most people the experience was quickly forgotten, but the impression that it left on me is that I do not want to find out what happens on the other side of that eerie calm when the fuel trucks are not coming back.

Enjoy!

https://www.goodreads.com/book/show/27136955-when-trucks-stop-running

Limits to Growth has arrived on the schedule of its standard run. Harder to aquire dwindling resources, an 8 billion and growing mouths to feed, and a ruination of the biosphere that gives us everything. “The major shortcoming of Man is his inability to understand the exponential function.” Professor Bartlett.

Indeed, and our urgent task is to prevent exponential escalation of WW-3, now already in progress.

This “problem” needs the distributed processing capacity of all of humanity and nature, I think.

Hi Dr Tim, great article to start the new year, once again..

From your introduction….

“Where wealth is concerned, capital theory tells us that, as the authorities continue to prop up the flow side of the economy by wrecking the stock side of the equation, the resort to ever-looser monetary policies should result in continuing rises in asset prices.

At the same time, though, a point will soon be reached at which the sheer magnitude of our mountainous debt and quasi-debt liabilities induces confidence-snapping vertigo.”

I can remember back into the 80’s how the gargantuan outstanding loans of the Latin American debt crisis were going to bring down the global economy, then the massive losses from the Savings and Loans crisis, yet by printing more money and shuffling the debts to different groups with different arrangements made the effort seem simple to the public in hindsight.

I suspect similar attempts in modern times, even though we can’t increase net energy use to actually pay for it. Booming markets, should make tax receipts go higher and every politician will point to this as problem solved.

Of course reality will catch up much quicker with energy prices likely to spike upwards again, just as real growth tries to happen, likewise for most commodities. The big question to me is can oil supplies be increased once again, to new record highs of production, or will the price spike in oil fail to increase supplies and cause the spike to go beyond $200/bbl and prick the next bubble with the consequent action of central banks to quell inflation caused by high oil prices.

Even though net energy might be decreasing, my suspicion is they can continue hiding this with debt and ‘other’ energy, until a real decline in oil production happens at high prices and everyone knowledgeable in energy realises the jig is up..

Thanks Hideaway, and a Happy New Year to you.

The issue of debt collapse is an interesting aspect of capital theory. Britain (for example) had enormous debts after the Napoleonic Wars (made worse by some extremists who abolished income taxes), but survived and prospered. The US had huge debts after WW2 but survived and progressed. We got through the LatAm and S&L crises, and the near-simultaneous crises in ASEAN and Russia. This has created a tendency to disregard the dangers of debt excess.

But what got us through those crises was growth in the real economy. The Industrial Revolution got Britain out of its 1815 debt mountain. American debt in 1945 was dealt with by growth at the golden nadir of ECoEs (1945-70). When more recent crises occurred, there was still enough impetus in the real economy to see us through.

The GFC was different. We were spared the consequences of “credit adventurism” only by adopting “monetary adventurism”. Well before 2008, economic “growth” had become mostly sleight-of-hand. Carrying on with QE for so many years after its “temporary” and “emergency” use in ’08 has been partly political, but only partly, because there’s been a consensus that we “must have” growth, so we’ve agreed, collectively, to fake it.

Shale hasn’t been profitabe, meaning that it’s been subsidised. Other forms of oil extraction might be feasible, with the proviso that they’ll have to be subsidised. The biggest subsidy-need of the lot is going to be renewables.

Where we, as individuals, need to try to be is amongst the subsidised, not the ones paying for the subsidies.

That sounds like an idea for an article…….

Agreed!

Government spending was much smaller in previous times than today.

The US government deficit spending is enormous evident by the $34 trillion threshold now passed from today onward and rising.

$1 trillion in interest per year from here? We have reached the end of the road where there are only 2 options left

So much GDP in western economies is from government directly or indirectly.

As your timely article indicates those 2 options of which neither are going to be pretty are either inflate away the debt or deflation.

Deflationary depression like nothing we have seen before or hyperinflation or at a minimum extremely high inflation for over a decade or more of double figures.

I am expecting a major spike in interest rates by the market in the next year or two as a natural reaction to the glut of treasuries entering the market from congress irresponsibility.

Then we find out which option the establishment will choose.

At that point they either decrease spending significantly or re-start QE.

There will be fireworks either way.

Pass the popcorn!!

“To prop up GDP, and pretend to deliver “growth”, the authorities will have to carry on driving public (and, for that matter, private) debt upwards.”

What if private debt is actually the central villain here? Rather than being an afterthought, or an ‘also mentioned’, what if the dark truth behind the financialisation of the world is this: if private debt stops growing, the world is guaranteed to collapse into horror and chaos?

What if this dark truth has been the driving force of financial capitalism all along, since the last tenuous links between the material economy and the financial economy were deliberately severed, with the Nixon Shock in the early 1970s?

This would mean that the dark truth is explicitly known and shared at the highest levels of real power around the world. That would mean that all central bankers, all finance ministers and national treasurers, and all senior public servants engaged in finance related matters, would be painfully aware that maximising the growth of private debt was the ultimate imperative.

This private debt imperative would so dominate all other aspects of public policy, that they become essentially irrelevant, except where extreme outcomes would lead to social instability, and a collapse of any part of the system that contributes to debt demand, threatening the ability of an economy to generate perpetual and exponential growth in the demand for private debt.

This imperative for ever growing private debt would demand that each and every sector of society was reshaped to generate demand for private debt. Massive bubbles of asset price inflation in housing markets would be a very powerful way to generate ever higher demand for private debt. Fixing the housing affordability crisis growing around the world would require some very simple changes in public policy, for example by mandating a percentage of modest housing for those on low incomes, but this doesn’t happen to a meaningful extent because the system needs to maximise how much private debt the punters take on.

The message to the punters is that you cannot live modestly, you must consume as much unnecessary goods and services as you can, and you must take on and service as much debt as possible. An ill-fated Australian treasurer used the terms ‘lifters versus leaners’ to distinguish between those who play their part by servicing enormous amounts of debt, and those who live more modestly and so don’t do enough to drive up new demand for private debt – needless to say he did not last long after his first budget which was designed to condemn the punters into ever deeper debt servitude.

There is only one goal motivating public policy around the world, and it is not to make people or societies happy, or secure, or fair, it is to maximise the demand for private debt.

Privatisation of as many sectors of society as feasible would also generate enormous volumes of demand for private debt by businesses. The goal of privatisation would not be to deliver services at lower public cost, or more efficiently, or with better outcomes. No, the real goal of privatisation is simply to generate ever higher volumes of private debt.

An illustrative example here in the Australian context is the privatisation of aged care. What used to be efficiently delivered by public operated institutions is now done very inefficiently by the private sector. Residents in some cases are miserable and systematically abused, for the sake of profiteering, as a Royal Commission recently determined in no uncertain terms. The scheme was designed that way, and governments do not intervene on behalf of humans, to impose goals other than profiteering, because the more profiteering is on offer, the more private debt (aka investment) the private sector will take on. People don’t matter. The growth of private debt is practically all that matters.

We don’t have ineffective governments around the world just because the punters are getting ever more duped and driven by deluded short term self interest. We are misgoverned simply because governments are forced to serve the private debt imperative above all else.

Just to be clear about this, I never treat private debt as an after-thought. For each country covered by SEEDS, the headline metric is total debt, comprising governments, households and PNFCs (private non-financial corporations). Government debt is calculated on a liability basis (the amount owed rather than the market value of government bonds).

Government debt is significant in that it’s a function of the fiscal deficit, so it’s a direct policy issue. Private debt is independent, though central banks and regulators can encourage or discourage private borrowing.

The bit that really worries me is NBFI (“shadow banking”). I try to calculate this, and work out an ‘at immediate risk’ proportion, and who owns it. This is difficult, because the data is neither timely nor complete.

“Private debt is independent, though central banks and regulators can encourage or discourage private borrowing.”

I am not sure that either assertion is true. I guess that private debt is independent in the sense that central bankers and governments do not dictate who takes on private debt, and for what purpose. But I think governments overall are directly accountable for the total volume of demand for private debt their economy generates.

I think there is an epic battle playing out between the global financial-corporate system, which is owned and operated by the global elites, and governments around the world, whether they are token democracies, or authoritarian states, or somewhere in between.

The credit ratings agencies are of course part of the financial-corporate system, not independent mediators between that system and governments, as was evident in the sub-prime debacle that led to the Global Financial Crisis. I think it is more plausible than not that the credit ratings they give to nations are overwhelmingly based on how much their public policy generates new demand for private debt.

Governments can pretend to serve other objectives, for the sake of their levels of public support, but if they do implement public policy that actually serves goals other than the maximisation of private debt, they risk downgrades in credit ratings that make their big businesses less competitive than those of other nations. This power to dictate international competitiveness is a very big stick.

I think it is plausible that the whole point of the World Economic Forum, which is a regular gathering that “brings together government, businesses and civil society to improve the state of the world,” is in fact the means by which the financial-corporate system exerts its leverage over the world’s governments. This is where finance ministers in particular are told, in no uncertain terms, what the leverage is, and what is ultimately the goal of all public policy, to maximise the growth of demand for private debt.

Imagine being a newly appointed finance minister within a newly elected government, perhaps an ambitious idealist who thinks that with proper management of the finance portfolio, great things could be achieved by the new government. Only the first participation at the WEF dashes all those expectations, by making it clear that governments cannot do anything other than obediently serve the private debt imperative, and that any government that believes it can defy the financial-corporate system will be brought to its knees if needed. One anecdote does not prove such provocative conjecture, but an Australian finance minister did indeed suffer a protracted period of depression after returning from his first participation at the World Economic Forum, and of course there are many other factors likely to have been at work.

I think the private debt imperative is why the governments of the world are no longer able to set public policy that actually serves the public interest, let alone solves climate change or any of the other crises conspiring to drive the global system ever closer to catastrophic collapse.

This is provocative conjecture, for sure, but it may serve as food for thought that can ultimately dispel the notion that private debt is somehow independent, and somehow a minor consideration when governments develop and implement new public policy, and something that governments are free to ignore at will. I suggest that is no longer the case, and that public debt is only of importance when it threatens in any way to impede the maximisation of the growth of private debt.

One thing is certain to me, if the imperative for exponential growth of private debt is not in fact the ultimate goal of public policy, then practically every public policy change I have seen in say the last 20 years is beyond rational explanation. You could argue that it is all driven by neoliberalism, but I think that so called ideology is a contrived facade, a fake rationale, while the dark truth is the world is being held to ransom by a financial-corporate system that is betting everything on the perpetual growth of private debt.

Given the catastrophic nature of the collapse when it comes, meek compliance with the current model of finance by the governments of the world is a case of mutually assured destruction.

I remember seeing a Steve Keen video a few years ago when he used his Minsky software model to show that a leveling off of total private debt, not even a debt contraction, was enough to precipitate a severe recession. If that is true, we can only speculate on what a significant contraction of private debt would do, but it would probably have a large negative effect on economic activity.

Indeed. I think it would depend, at least in part, on how the private debt was reduced – defaults, or borrowing at levels below paying debt down (if that’s even possible).

But the financial economy has definitely been yoked to a debt engine, which mustn’t be allowed to fail, until the day when it does.

Brandon …. “what if the dark truth behind the financialisation of the world is this: if private debt stops growing, the world is guaranteed to collapse into horror and chaos?

What if this dark truth has been the driving force of financial capitalism all along,”

We could check by going back in history. In the ’50’s, 60’s to early ’70’s debt didn’t appear to be a problem, it was created and extinguished within a few years as developed countries grew in leaps and bounds.

In this period we had exponential growth in energy availability especially oil. The energy was cheap allowing all other type of development without large debt being accumulated. There was always more cheap oil available, and we didn’t need to use much coal or gas because of the ever increasing rivers of oil. Oil was in fact replacing coal in uses like heating of homes.

The whole debt issue really started growing in earnest after the first oil embargoes of the early ’70’s and has increased ever since.

I suspect you are correct in that once the cheap growing oil supply stopped being exponential, debt had to take over as a proxy for energy availability as all forms of energy became relatively more expensive and stopped growing to the same extent.

We only managed to get 10-15% of humanity to a modern western style of civilization before we ran into energy constraints stopping the rapid spread of civilized modernity, accompanied with debt taking off.

The part about only getting 10-15% of humanity to a modern standard of western civilization is one aspect that I think is incredibly important in the whole energy debate. If there had been 10 times the easy to get quantity of oil, (say 30-40Trillion bbls) there is no reason the rest of humanity couldn’t have caught up to ‘the west’. With virtually unlimited, cheap abundant oil, every other resource could have been easily mined, no matter how low the grade, with huge infrastructure projects everywhere around the planet, making transport of goods easy and cheap.

Of course I’m ignoring the detrimental effects on the environment, it’s purely on an economic basis.

The debt being a proxy for energy allows future energy use to be dragged into the present. Once overall energy starts declining rapidly, especially oil, then it becomes obvious the debt can’t be repaid, and there is less new debt available for all purposes, meaning less development of everything, and an acceleration of the decline.

Remaining known energy projects get too expensive to develop, because we are dragging the better ones into production now with debt, just as the population is losing the ability to pay for new projects. Because spending is going literally totally towards day to day essentials and virtually nothing towards the discretionary economy, the mass of population which is employed in discretionary sectors loses the ability to spend.

“In the ’50’s, 60’s to early ’70’s debt didn’t appear to be a problem”

I suggest, in addition to your comments, the big difference was in the process of writing off bad debt.

Before the Nixon Shock, when there was still a plausible connection between the volume of debt and the amount of activity in the material economy, and the world had what could be roughly summarised as a ‘fractional reserve’ banking system, banks had to write off the least performing debt, in order to redeploy their reserves and gain profitability by taking on better performing debt.

Since the real world was removed from the financial equation, even non-performing debt could be left as assets on the balance sheets of the banks, and so became no obstacle to taking on ever more debt, and letting central banks essentially perform the role of janitor, tidying up the reserves via overnight processes, so that the system at least appeared rational.

Then came the enormous debt markets and things like mortgage backed securities, where poorly performing debt could be packaged up with better performing debt, and sold into gullible markets and off the balance sheets of the banks. All limits on the volumes of debt the banks could loan into existence simply disappeared.

The world was set upon the path to self destruction the moment the constraints on the excesses of the banking system were removed.

@Brandon Young

“This would mean that the dark truth is explicitly known and shared at the highest levels of real power around the world.”

It’s a bit too conspiratorial for me Brandon.

Maybe there’s an alternative explanation.

It could be any combination of these, and probably all of them.

-Most governments are incompetent

-Most governments are corrupt

-Most politicians are Greedy

-Most of the business elite are more competent but even greedier

-Many politicians aspire to cross over and join the business

elite so they play the game

-Consumers (yes us!) are also greedy, and we are compulsive accumulators.

-The rising cost of energy has driven price inflation well beyond

the reported levels

Finally, and linked to human greed, someone in the know would by now have blown the whistle for a big pay-off.

Can’t argue with any of that!

The only thing I’d add is that I have my own measure of systemic inflation, RRCI (Realised Rate of Comprehensive Inflation), and I have found it very useful.

Nothing wrong with a bit of conspiracy. All of history is a combination of competition, conspiracy, and contingency, both between and within systems of power.

When the same forces apply in the same way, to even very different systems of power, there are natural patterns that constitute a conspiracy of self interest, even if agents from competing systems of power never communicate at all.

I think your fifth assertion may have some merit, but not the others. Not sure how anyone would get a big payout by exposing the absurdity of the current model of the financial system, and plenty of people have been doing just that for decades now.

Brandon, during the 50’s and 60’s the growth in the USA was often 6-8% per annum, all based on cheap oil. Even during the ’70’s to early ’80’s growth was often high. The real debt was all created after 1980 as interest rates started to decline. In the late ’70’s to early ’80’s they had Alaskan oil growing greatly.

Money and lots of debt did not return the US to the high growth rates from earlier when there was cheap abundant oil.

It is clearly the cheap abundant energy that enhanced growth greatly not the debt. The debt is hiding the declining net energy, enabling lots of substitutions and efficiency gains instead of more growth.

The debt ponzi we now have can never be paid off with real dollars as we no longer have the net energy to do so.

I was describing what led to ballooning debt. You seem to be arguing against suggestions that I never made. I never said that debt powered economic growth, and I would never even think such a thing, because as mentioned on the previous blog, economic growth is a meaningless and misleading concept when it fails to distinguish between good growth and bad growth.

But I do see that your argument about declining net energy is about the US, not the global situation. The US is of course a very special case, because it doesn’t have to worry about inflation as much as other countries do, because of the exorbitant privilege of having the world’s reserve currency, so it is free to act in ways that most nations simply can’t.

It might be controversial to say so here, but declining net energy is surely a future scenario for the global economy generally, not a current or historical driver of outcomes. I suggest we don’t even really know for sure what reserves the BRICS plus OPEC bloc really have at their disposal, and how long they can maintain supply to the rest of the world at or about current global levels of fossil fuel consumption.

We certainly don’t know how those energy reserves may be distributed as global geopolitics play out, and it is possible that the US dominated part of the world will face severe shortages of fossil fuels much sooner than those aligned with the major oil exporters.

I certainly acknowledge the close correspondence between oil consumption and growth in the material economy, and that higher levels of debt and other financial shenanigans serve to mask the actual level of so called economic growth. These are pretty much given truths now.

“it is possible that the US dominated part of the world will face severe shortages of fossil fuels much sooner than those aligned with the major oil exporters.”

That said, there are some who think Australia should be considered a petrostate, which I think is a bit of stretch, except:

“Australia’s substantial role in the global fossil fuel trade not only rivals, but indeed surpasses, traditional heavyweights. Australia is the third-largest exporter of fossil fuels globally. Our annual coal exports are around 400 million metric tons per annum. In comparison, the UAE, exports around 114 million metric tons of oil per annum. Our gas industry is equally noteworthy. In 2021, we were the world’s largest gas exporter, surpassing Qatar and the United States.”

https://johnmenadue.com/time-for-australia-to-admit-its-a-petrostate/

There is often a heated debate here about whether Australia should count the carbon emissions from its fossil fuel exports as our own emissions, and therefore voluntarily choose to discontinue those exports. I think that would be economic foolishness in a world without a global agreement to either control the volume of consumption of fossil fuels, or the net emissions of the global economy, which is a far superior solution, because it not only counts the carbon sinking side of the equation, but also fully funds it on the global scale, at exactly the level needed to reverse climate change.

Dr Tim, picking-up on Mark’s point above, I’d like to offer two anecdotal stories from ‘Up Norf’ that are, I think, really quite significant; and which I consider are hinting towards some very serious discretionary compression.

The first is the closure of one of the finest farm food shops on the outskirts of Skipton, which is a town that relatively is a quite wealthy and prosperous place on the outer fringe of the Leeds commuter belt – at the end of the Airedale electrified railway line.

The second is the closure of a long-standing – 33 years – vegetarian restaurant in Didsbury, South Manchester – again, a relatively prosperous suburb of a universities city – hinting at the declining prosperity now in train in such places, as outlined by Tim Watkins.

Of course, businesses fail and close all the time, but when you see these sort of enterprises calling it a day in relatively affluent locales, it kinda of suggests that beneath the surface all is not well economically.

There’s a whole lot of statistical and anecdotal evidence suggesting that the British economy is now in very, very big trouble.

Fortunately, international markets don’t see the UK economy in the same way I do.

@ Dr Tim.

“There’s a whole lot of statistical and anecdotal evidence suggesting that the British economy is now in very, very big trouble.”

Not to worry, there seems to be a new master plan. Tax Cuts.

What an inspirational plan. Give away a few boondoggles instead of starting to pay down the national debt.

One could be forgiven for thinking there’s an election looming.

Meaning yet more borrowing, or further cuts to public services? There’s a John Martyn song that suits this situation – “Some people are crazy”.

HNY Tim. Always glad to gain your insights with each new post.

I and, I imagine, many people aware of the energy problem feel some anxiety about how these two economies are going to reach an equilibrium and suspect we will see the dark side of human nature in the process. It needn’t be an ugly descent to lower prosperity, as you contend that the real economy might not collapse, but there are plenty of other things that needn’t be a certain way if only we behaved more gratiously and yet are…

Although the public is not aware of this, it is being made well aware of the climate crisis and we are taking action. That should destroy demand somewhat and make for a softer landing. For instance, we have the push for electric cars. I’m not sure, but I don’t believe they are more climate friendly (lots of mining, powered by electricity from coal plants and so on) but we make believe that they are solving the issue and they actually are, indirectly, as many more people cannot afford them or don’t find them practical (long charging time, less range). In other words, electric cars alleviate the problem, not by virtue of being “green”, but by resulting in fewer cars.

Whither the US?

For reasons I don’t claim to be able to fully explain, the US is close to electing a Mussolini, who will be prepared to quickly install an Italian style 1920s fascism. Trump came close to declaring an insurrection because of “voter fraud” when it became clear that he did not win the 2020 election. General Milley told him that an insurrection is people in gray uniforms firing artillery shells at Fort Sumpter, not street rioters. Trump now thinks Milley should be executed. The CEO of a company paid millions of dollars to find the election fraud wrote an Op-Ed in USA Today stating that his company found no evidence of enough voter fraud to change the election…scattered double voting and the like was equally distributed between Republicans and Democrats.

Today, more Republicans are convinced by the voter fraud claims and support the January 6 insurrection than there were back in 2020. So, just like the evidence for the decline in usable energy or the steady increase in global warming or the depletion of soil health, the political public is resistant to facts.

The numerous trials now hinge on Trump’s defense that, as a President or former President, he has absolute immunity from prosecution. Alternatively, his lawyers argue to “let the public decide”. If they vote for him, it means they approve of whatever he did and the Constitution is irrelevant. The founding Fathers, of course, distrusted “mob rule” and erected a careful superstructure which tried to be responsive to the wishes of the ruled, but not allow mob rule.

If he is elected, there is a task force putting together a program to immediately gain control of the federal government, essentially wiping out the Separation of Powers framework created by the founding fathers.

All this is happening while the aggregate spending numbers in the US are booming….debt is also booming but gets little notice. It’s hard to argue that economic suffering is causing the dysfunction. As I walk around and look at the people working, a huge percentage are from Latin America. Trump, of course, has promised to “build the wall”. Perhaps the working class perceives that the Latinos are out-competing them for traditional blue collar jobs? That’s a pretty lame supposition, I admit. But the conclusion is that this is not the country it used to be.

Don Stewart

You really can’t help yourself can you?

@Mr. House

You can believe anything you want to. But here are a couple of facts:

25 percent of people think the FBI instigated the January 6 insurrection.

Around 35 percent believe that Biden somehow stole the election.

I would guess that a similar percentage think that Trump can’t get a fair trial.

Michael Cohen, a former Trump lawyer who spent 3 years in prison, is now on Trump’s enemies list. When he first got airtime, he loudly proclaimed that he was a victim of an unjust judicial system. I found it informative that he was featured on programs which were extolling the slow grinding of the judicial system exploring what Trump and Guiliani etc. had done.

In short, the legitimacy of the way democracy is working is doubted by a significant percentage of the public.

I could do a survey of comments on this site to figure out what percentage of the commenters think that our economic system is working for the well-being of the citizens. My guess is that 70 or 80 percent would give a very low rating.

So…we have democracy, judicial system, and economic system in peril. Couple that with rising ECoE and I suggest we have a very volatile pattern with more than a few parallels with the early 20th century in Europe and Japan.

Don Stewart

Here are the facts Don:

Both political parties are made up of criminals. By supporting either one that makes you an accessory to a crime 😉

You keep calling Trump a Nazi. What did he do that makes you think he is one? If you want to argue he shutdown the economy (sort of) i’ll agree with you. Otherwise you have no argument as far as i’m concerned. He says mean things? Is that why you hate him so much? Why do you focus on one side of the coin, but ignore the other? In the next ten to twenty years i think mean things being said is going to be the least of our worries.

“25 percent of people think the FBI instigated the January 6 insurrection.

Around 35 percent believe that Biden somehow stole the election.”

And how do you know it isn’t true? All you have is faith. Do you think someone like Trump, or Hitler, or Mussolini just show up because everything is great? And everybody is just a racist? I think people like that show up because people like yourself do nothing your entire lives until the house is on fire and then you’re easily led sheep to slaughter. Did the Democrats not have an investigation for around two or three years claiming Trump stole the election with the help of Russia? No they didn’t do that because they couldn’t practice “fascism” right? You think because they harp about social justice issues that maybe effect at the most 5% of the population, they’re the party of the people? If you want to do something productive, don’t vote. The only thing you’re doing is giving legitimacy to fraud. What if we had an election and nobody showed up to vote? Wouldn’t that make both criminal parties look stupid, but like i said, you can’t help yourself. Lucy pulls the football away and you always say to yourself, next time!

“In short, the legitimacy of the way democracy is working is doubted by a significant percentage of the public.”

It was gone in 08, you just didn’t notice. Heck it was probably gone long before that, haven’t you ever wondered why the 2000 election wasn’t contested like the 2016 election? Could it be that the Bushes and the Clintons are on the same side? I’m sure you thought in the early 2000’s that the FBI and the CIA were thugs, but now that democrats support them you think they’re the bee’s knees? If you’re worried about legitimacy, wouldn’t you want an investigation then on the 2020 election? Especially after one side made claims for the previous four, that the election was stolen? How can you claim one side is good, they get an investigation, but the other side is bad and they don’t get one and still consider yourself objective? I’ve been on this earth for 40 years and i’ve been following politics since the 90’s because of my dad. Never in my lifetime and probably yours, has the counting of votes stopped in the middle of the night. You see irregularities, but only for “your” side. If both sides our corrupt, supporting the “lesser” evil is still supporting evil. I haven’t voted since 08, and until a candidate who actually supports the people (mainly the lower and middle classes) i will continue not to vote. Evil is evil, lesser or greater.

“No doubt it is more comfortable to deliberately wear blinkers that prevent one from seeing the evil done in the discharge of their responsibility— to be unwilling to see that one is defending murder and robbery. All my life I have been fighting against the spirit of narrowness and violence, arrogance, intolerance in its absolute, merciless consistency. I have also worked to overcome this spirit with its evil consequences, such as nationalism in excess, racial persecution, and materialism. In regards to this, the National Socialists are correct in killing me.”

Helmuth James Graf von Moltke, Executed in Plötzensee Prison, Berlin, 23 January 1945

“They defended him, verbally and physically, every time he committed one of his criminal acts. They went blithely on past the suffering of all the bombing victims, the prisoners in the concentration camps, and the religious persecutors, because a different regime would have meant the end of their power. You forget our hatred is a deadly poison. In our hatred, we are like bees who must pay with their lives for the use of their stingers.”

Friedrich Reck-Malleczewen, Diary of a Man in Despair, 1947

And to this you’ll say: Yes that is TRUMP! And i’ll reply, no it is both parties.

“And of course many of these same points can be made of that Dark (or rather Orange) Lord of current American politics, Donald Trump. It’s astonishing to watch the political establishment scurrying around like a mob of drunken hobbits, flinging every available scrap of magic jewelry into every volcano in sight, under the frantic delusion that if only they can make Trump go away, the populist movement that adopted him for its leader will vanish in a puff of smoke. Not so; once again, the Shadow will take another shape and grow again, because what drives that movement is the embarrassing failure of the current managerial class to address the problems that matter to most Americans, coupled with the shrill hatred that this same class directs toward every American who doesn’t instantly kowtow to the latest twist of the party line.”

https://www.ecosophia.net/the-three-stigmata-of-j-r-r-tolkien/

One last thing Don, you know who would have beat Trump in 2016? Bernie Sanders, honest to god, i might have even voted for him. I think he’s a fraud now, but i would have voted for him before Trump. What did the Democrats do to Bernie Sanders in 2016? His response to it showed his true colors.

Without going into party or personality politics, one of the mysteries of our age is why an angry public has swung to right- rather than left-leaning populism.