WHAT HAPPENS NEXT?

Introduction

Right from the outset, it was likely that the multi-article synopsis of The Surplus Energy Economy would extend to a fifth instalment on the subject of ‘what happens next?’

What most of us probably want to know is whether the economy is destined for gradual decline or sudden collapse. The indications on this issue are contradictory. On the one hand, the economy itself is subject to trends which, whilst adverse, are essentially gradual. On the other, the financial system has been managed (meaning mis-managed) in ways which seem to eliminate any possibility of managed decline.

The plan here is to start by examining, in brief, these two, seemingly-contradictory conditions, and then turn to what some of the implications of this asymmetry might be.

1. The material economy

As we know, the economy is a system for the supply of material products and services to the public. The resulting aggregate is calculated by the SEEDS economic model and is known here as prosperity. The deduction of necessities supplies a second SEEDS metric known as PXE (prosperity excluding essentials).

The economy thus described is a product of the use of energy. The vast and complex economy of today can be traced directly to that point in history at which we discovered a means of converting heat into work. The date usually attached to this discovery is 1776, when James Watt completed the first truly efficient steam engine. This discovery enabled us to harness the vast reserves of energy contained in coal, oil and natural gas.

Quite naturally, we have always accessed lowest-cost resources first, leaving costlier alternatives for later. This ‘later’ has now arrived. Over a lengthy period, the fossil fuel energy supplied to the economy has been getting steadily more expensive. The cost referenced here isn’t financial, but energetic – it’s the percentage of accessed energy which, being consumed in the access process, is not available for any other economic purpose.

This ‘consumed in access’ component is known here as the Energy Cost of Energy. All-sources ECoEs are on a long-established and relentless uptrend, having risen from 2% in 1980 to 10% now. You might like to think of this as a five-fold increase in the material cost of energy to the economy. This process is continuing, and ECoEs are likely to reach 13% by 2030, and 17% by 2040.

No economy, as currently conceived, can cope with these levels of ECoE. Complex Western economies have been experiencing (though not admitting to) deteriorating prosperity since the early 2000s, when ECoEs were between 4.2% (in 2000) and 5.7% (in 2008). Less complex EM (emerging market) economies, by virtue of their lower systemic maintenance costs, are better equipped to cope with rising ECoEs, but their prosperity, too, has started to contract now that ECoEs have reached double digits.

It is widely supposed that we can overcome the effects of deteriorating fossil fuel economics – and simultaneously minimise environmental and ecological harm – by switching to renewable energy sources (REs), principally wind and solar power. These, we are told, can not only support current lifestyles, but deliver “sustainable growth” as well.

This favourable outcome is, in fact, extremely implausible, for two main reasons. First, scale expansion of the magnitude required would demand vast quantities of concrete, steel, copper, lithium, cobalt and many other inputs which, even where they do exist in the requisite quantities, could only be accessed and put to use using correspondingly vast amounts of energy. Since this could only come from fossil fuels, there is an ‘umbilical link’ between the ECoEs of renewables and those of fossil fuels.

The second obstacle is even more fundamental. It is that renewable energy is less dense than fossil fuels. The economy operates by using energy to convert raw materials into products, a process whose thermal counterpart is the conversion of energy from dense into diffuse forms, the latter being waste heat. The lesser density of renewables lies at the heart of the practical obstacles to transition – these obstacles include conversion efficiency limitations, intermittency, and the problem of storage.

These considerations mean that, whilst a sustainable economy might be possible, it would be smaller than the economy that we have now. Simply stated, “sustainability” is feasible, but “sustainable growth” is a pipe-dream.

Our problems with adjusting to the practical and psychological challenges of economic contraction are compounded by the problem of material leverage. Essentially, the economic resources made available by the use of energy are deployed in three ways. The first of these is the provision of essentials. The second and third, which are the residuals in this equation, are investment in new and replacement productive capacity, and the provision of discretionary (non-essential) products and services to consumers.

The leverage issue involves the energy-intensive character of essentials. What this means is that, just as prosperity is being driven downwards by rising ECoEs, energy deterioration is driving the real costs of essentials upwards.

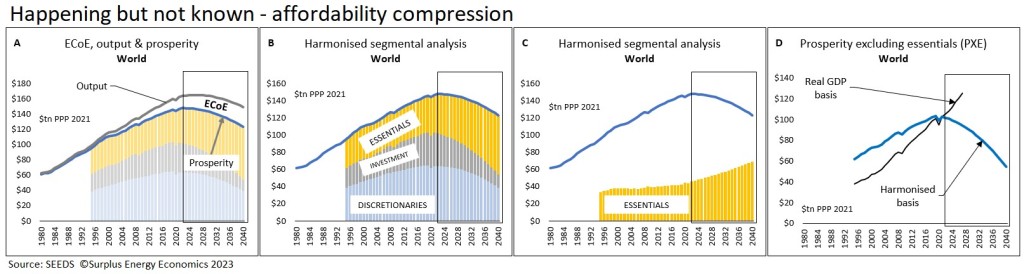

These issues are summarised in the charts in Fig. 16, which are harmonised and, like all charts shown here, can be opened in another tab for improved visibility.

The first chart (Fig. 16A) shows how energy deterioration is being experienced, not just in output (shown in grey), but also in the ECoE effect on prosperity (blue). The second chart shows segmental allocations between estimated essentials, capital investment and discretionary consumption.

The third and fourth charts illustrate the compression effect created by the simultaneous decline in prosperity and rise in the cost of essentials. The purpose of the fourth chart, Fig. 16D, is to compare the SEEDS trajectory for PXE (in blue) with what you might anticipate if you relied on orthodox economics and its promise of infinite growth (black).

Fig. 16

2. The financial impasse

As we have seen, then, the economy has already entered a contractionary process, and it’s important to emphasise that visible trends in the material economy, whilst adverse, and even daunting, are essentially gradual.

ECoEs haven’t jumped from 2% to 10% overnight, but over four decades. Energy supply itself is likely to be driven downwards by deteriorating economics, but – except in certain instances, such as American shales – rates of decline in fossil supply are likely, once again, to be comparatively gradual, and the overall decrease in energy availability can be mitigated, though not reversed, by increases in supply from other sources, including wind, solar, nuclear and hydroelectric power.

There are two problems, though, with any possibility of gradual or managed economic decline. One of these is the financial system, and the other is a collective and absolute refusal to accept and plan for any possibility other than the mythical (and utterly illogical) prospect of ‘infinite growth on a finite planet’. These, of course, are flip-sides of the same coin.

We have discussed, in previous articles here, the illogicality of conventional economics, which, by insisting on an entirely monetary interpretation of the economy, dismisses any possibility that there might be material limits to economic activity. What the orthodoxy is pleased to call the “laws” of economics are, in reality, no more than behavioural observations about the human artefact of money, and are in no way analogous to the laws of science.

Despite abundant evidence of economic deceleration, stagnation and contraction, decision-makers still put their faith in an orthodoxy that is being disproved by events. There has, indeed, been a Thirty Years’ War between orthodoxy and experience, and we are entitled to wonder about the sheer tenacity of mistaken theories about the economy. Why, for example, do decision-makers still pay heed to this outdated orthodoxy?

There are two answers to this question. First, any orthodox convention that has established itself in systemic thinking can be extremely difficult to dislodge. Second, decision-makers like the orthodoxy because they like the results that it produces.

In fairness to political leaders, it has to be said that any authoritative acknowledgement of economic contraction would, at the very least, crash the markets. They have good reasons, then, for not talking about economic decline. But they have no excuses whatsoever for failing to plan for it, or for making the situation worse. The latter is what they have been doing, and it’s important that we trace this process through its grim and depressing history.

This story begins in the 1990s, when the phenomenon of “secular stagnation” – a non-cyclical fall in growth – started to attract attention. We, of course, know that was happening back then was caused by a relentless rise in ECoEs, but no such explanation was countenanced by an orthodoxy which insisted that all economic developments have monetary causes, and can be tackled using monetary tools. By putting together various things that Adam Smith and John Maynard Keynes hadn’t actually said, the chosen ‘fix’ was credit expansion.

This, of course, didn’t work, because it can’t. Whilst GDP increased by 50% between 1997 and 2007, debt expanded by 77% over this same period. Essentially, each dollar of incremental GDP was being bought with $2.40 of net new debt, whilst 54% of reported “growth” was the cosmetic effect of credit expansion. This led directly to the global financial crisis (GFC) of 2008-09, an event caused by a combination of breakneck liability expansion and the proliferation of dangerous financial practices.

A case can be made that, under the shot and shell of the GFC, the authorities were justified in using QE, ZIRP and NIRP to steady the ship. These, though, did not turn out to be the “temporary” expedients claimed at the time of their introduction. Even conventional economics would have counselled that negative real rates, reckless credit expansion and the creation of a gigantic “everything bubble” in asset prices could only end badly.

We may never know why ‘the powers that be’ persisted with these utterly irresponsible practices – perhaps they were enjoying the ride as the financial system careered towards the cliff-edge, and perhaps they believed that people (well, the richest ones) really were getting wealthier as purely paper asset values implied.

The latter, of course, isn’t even true, in any lasting sense, because inflated asset values will crash when the “everything bubble” bursts. It has been reported that the world’s wealthiest 218,000 people lost 10% of their wealth, or $10 trillion, over the past year, and this may be just a foretaste of what will happen when discretionary sectors start to implode, and defaults start to cascade through the world’s ludicrously over-stretched ecosphere of interconnected liabilities.

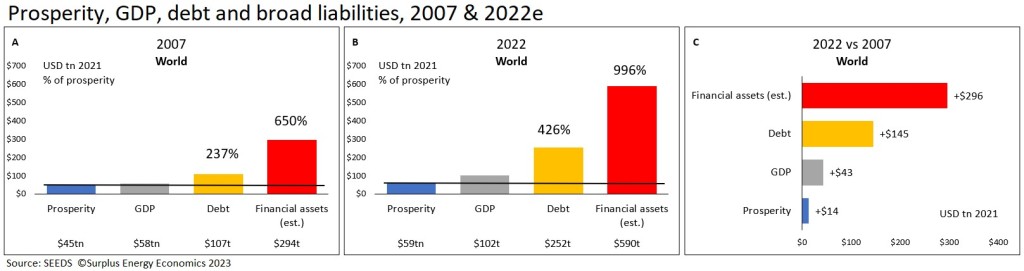

This time around, the leverage effects have been even worse, with each dollar of “growth” between 2007 and 2021 bought with $3.60 of borrowed money, and reported “growth” has been even more cosmetic, with fully 64% of it ascribable to credit expansion. More worryingly still, broad liability expansion averaged an estimated $7 for each dollar of “growth” between 2007 and 2021. Much of this can be ascribed to the non-bank financial intermediary (NBFI) or “shadow banking” sector, which is very largely unregulated.

The final chart in this five-part series, Fig. 17, endeavours to put this into context by comparing output, debt and estimated broad liability data stated at constant dollar values. Estimated broad liabilities now stand at almost 10X prosperity, and even this doesn’t include enormous “gaps” that have emerged in the adequacy of pension provision.

Fig. 17

3. So what next?

On the basis of what we know, we have strong reasons to fear that the realities of economic contraction will continue to be ignored and that, in consequence, any lingering possibility of managed retreat will be rejected.

At present, central banks are showing a commitment to taming the inflation that their own policies have created. They have, thus far, shown no inclination towards the “pivot” that many are urging upon them. The best near-term expectation is that current monetary and fiscal policies will continue until the reality of fracture becomes undeniable.

We can, in the meantime, attach high levels of probability to two processes. One of these is contraction in discretionary sectors, and the other is cascading defaults, commencing at the outer perimeters of the financial system and then travelling inwards towards the regulated banking sector.

A personal view is that the authorities will find themselves forced into trying to counter these trends by a reversion to expansionary monetary policies. Despite the very real downwards pressures created by economic contraction, it’s likelier that we face an inflationary rather than – or rather, as well as – a hard default resolution to over-inflated capital markets and ludicrously unsupportable levels of liabilities.

These, of course, are purely economic and financial trends, and I’m sure that readers will have their own views on the broader implications between economic decline and financial chaos.

Before handing this over to readers for comment, it’s worth asking ourselves what is the worst thing that can happen, in economic terms, in this kind of nightmare scenario. The answer would seem to be the destruction of the purchasing power of money. We may, then, find ourselves needing to find a new medium of exchange. That could be one of the most difficult tasks that we have ever been compelled to undertake – and we’re likely to find ourselves tackling it under very chaotic conditions.

It’s recently ocuured to me about house sales in the UK.

If homeowners cash out here they will have a large amount of cash from the inflated prices.

Even if they don’t manage to sell at the top the ones who have owned for a while will still be beneficiaries of high profits.

Obviously if enough do this prices come down hard but due to the appreciation over the years/decades won’t this cause problems for the system?

These sellers will have a large amount of cash in the bank and so a huge claim on real goods and services if they don’t repurchase.

Have policy makers thought about this potential outcome with their interventions in the housing market throughout the years?

My thinking is this could end up with a lot of currency in the system especially if the markets gets propped up again as more sell.

Who else here watches Nate Hagens? He expects to economy to contract by 30% as a result of the financial re-calibration. Discretionary sectors will contract by significantly more than 30%. https://www.youtube.com/watch?v=cKqu3gH1Mz4

Nate Hagens believes that U.S. economy will shrink by ~30%. https://www.youtube.com/watch?v=cKqu3gH1Mz4

Nate Hagens mentioned again, which is positive because it means some are alert to what’s coming down the road. By a strange coincidence, the Canadian ecologist Paul Beckwith just posted a You Tube discussion on Nate’s best known paper – Paul don’t half drone on, but anything that promotes Nate and Tim’s opinions gets a thumbs up from me:

@isiah

“How much and how quickly will this ripple through the economy?”

Methinx, it depends how many other banks/firms are exposed. It may be limited, at least to the US.

I was surprised at how fast the rumour mill travelled – there were just rumours of it being in “trouble”, (see the article below about “SVB shot itself in the foot” ) – which initiated a mass panic “run” on the bank which made the rumour true. The phones, Facetime, Zoom calls etc must have been running so hot, no wonder some websites and comms lines went down with the panicking mass of congestion.

The bulk of its depositors are mostly very large accounts too – some of the clients couldn’t get their company payrolls out on Friday, before the regulators put the brakes on.

https://techcrunch.com/

That is an example of a positive feedback loop. The financial system has quite a few of them.

From Wolf Richter

“The bank then had to sell assets and borrow money to fund those withdrawals. But turns out, the bonds it could sell to raise the cash had fallen in market value due to the rising yields, and when it sold those $21 billion in bonds, disclosed yesterday, it lost $1.8 billion, and it would have to sell more bonds and lose money to raise the cash to fund the run on its banks, and those losses would eat away its capital, and it would become insolvent.”

So the problem is not only that the start-up and crypto businesses are in trouble, but also the bank-style problem that as interest rates are rising, it’s portfolio of investments in bonds is declining. If it has to sell bonds, and they are worth less now than when they were bought, they have a classic bank-style problem.

I’m not sure about British housing. But if people have made home equity loans in order to get money to spend, they could run into the same problem. Rising interest costs cut into the price that purchasers can pay, which causes a loss of the (on paper) home equity. The result could be very (on paper) rich people going broke very quickly.

Don Stewart

There’s an offset here, Don, in that bond prices might be driven upwards by a ‘flight to quality’. The broader picture, though, is that collateral values are falling, so that a mark-to-market of assets other than bonds is likely to undermine banking ratios. There are plenty of reasons for expecting a domino effect.

As in the US, UK fixed-rate mortgages aren’t retained by lenders, but sold to investors, who will be the first to suffer losses. This said, one can see why a UK economy built on over-inflated house prices might be heading for very real trouble. There are limits to how far rising mortgage costs for buy-to-let landlords can be passed on to tenants, and the BTL sector is contracting rapidly. The UK economy depends on incremental credit expansion made possible by rising property prices. I suspect that UK property prices will ‘hang on the roll’ (a surfing term) for a while, then fall rapidly, at least as far and as fast as in the US.

Just as a matter of curiosity

Does anyone know if the assets of Silicon Valley Bank have been marked to market in the official statements about it re-opening on Monday? The assets to liabilities didn’t look too bad in the news accounts, but some of the assets may be book values rather than market values?

I know that in the Great Recession, federal regulations in terms of mark to market were loosened substantially.

Don Stewart

this has some interesting background regarding SVB:

https://adamtooze.substack.com/p/chartbook-200-something-broke-the

“Banks can classify their security holdings as “held-to-maturity” (HTM) or “available-for-sale” (AFS). Those that are labelled HTM cannot be sold. But that means any changes in market value will not count in the formulas regulators use for calculating capital requirements. By contrast, any losses in the AFS basket have to be marked to market and deducted from the bank’s capital base.”

@Dr. Morgan

Flight to Quality?

It’s hard for me to figure out where the quality is located. One could speculate that buying a relatively high yielding government bond or note, counting on a sharp decline in interest rates which would drive up the price of the bond, would be a good move. But will the Fed really cut interest rates with inflation still elevated? CHS’ reading of the tea leaves is that the government can’t afford to “bail out the rich” again.

I found it interesting that the European guy interviewed by Wealthion a couple of days ago was recommending investing in stable countries in Latin America??? He said they used to send their money to Miami, but now nobody trusts the US government to not seize it.

Don Stewart

Flight to quality really means believing that the US government is less likely to go bust than any other institution to whom people might entrust their money. You might or might not make a profit or a loss, this thinking runs, but at least your capital won’t get wiped out (unless, of course, there’s hyperinflation).

I’ve not yet read CHS on this, but I’ve said before that the authorities can’t bail out the system again, a point that I’ve illustrated with charts comparing end-2007 with the current position at constant values. The shadow banking system is just too big, and we can’t insulate mainstream banking from it. To rescue the system now, they’d need to create so much QE that the purchasing power of money would crash.

By way of caution, let’s remember that most of what’s slumping now is tech-related. Tech was bound to correct, and has been hugely over-hyped and over-inflated.

the authorities can’t bail out the system again without crushing the purchasing power of money,

thing is, this is within the dollar zone, largely a G7 phenomena where the various fiat currencies are inextricably linked to USD,

in the event of a hyperinflationary bail out, USD linked money would be crushed in purchasing power relative to money increasingly firewalled off from the USD system,

so if the US can’t compel the entire world to do an hyperinflationary bail out, the USD and it’s Western partner currencies effectively devalue in relation to those who’ve firewalled themselves off and are building an alternate, market led system.

we currently have to use a PPP convention to get a realistic comparison of the size of real economies,

using Forex to compare nations is measuring them by the size of their financial economies,

it’s like a C-GDP based comparison instead of an orthodox GDP based comparison,

isn’t this showing that the Western currencies are currently much stronger than their underlying real economies because of the distortion of their financial economies?

For comparing the sizes of economies, PPP is the superior convention. Actually applying FX conversion (PPP or market) over time requires inclusion of comparative rates of inflation.

C-GDP is the SEEDS measure of underlying or ‘clean’ economic output.

Wow, wow, wow! I swear it was just a week or two ago Dr Morgan you mentioned bankruptcy…and inflation.

You have to feel satisfied, if not I will for you :-). Yes I get that this was inevitable, slowly at first and then all at once.

The energy problem has not gone away despite this bankruptcy in which other “things” did.

Mises.org has a nice piece on this including the line that there is no business anywhere that goes bankrupt overnight when some of it’s customers want their stuff back. Assets marked to reality…

I feel like we are going to see shear panic shortly.

Thank you for all your hard work, may you stay safe!

I think what we can conclude is that a lot of things are coming together, and that a fair amount of this has been predictable on the basis of logic, applied through modelling.

A number of these things that are coming together have happened before, but not at the same time. Each of these – a tech (dotcom) bust, a housing bust, a banking crisis, an inflationary crisis, market slumps – have occurred at least once in the past, but not simultaneously.

What we need to do now, I think, is to assemble the moving parts as a cohesive statement of what’s happening.

I’m looking forward to your next posts! I cannot shake the feeling of chaotic destruction. Complexity has inherent weakness’s and vulnerability. Imho we are at that point where this (slowly) becomes self evident resulting in shock to our belief of a technological solution. Business has a minimum operating level required to be viable or gets destroyed by fixed costs. Labor will get tossed overboard in an effort to stay afloat as markets decline, a self reinforcing downward spiral. SVB and it’s assorted customers and counter-parties are taking immediate layoffs. Wow…

Having got this five-part series done, I’m reflecting on what to do next.

But I think the overall situation is pretty clear. Over a very long period, the fossil fuel economic motor has been winding down, but we have tried everything, and told ourselves anything, rather than face this reality.

Credit expansion and deregulation led straight to the GFC. We’ve told ourselves that QE and ZIRP can create growth (they can’t) and aren’t inflationary (they are). We’ve told ourselves that renewables can provide a complete replacement for FFs (they can’t) and that “sustainable growth” is feasible (it isn’t). We’ve chosen to believe that technology can remove any obstacle to growth (it can’t), and that tech can drive unstoppable increases in corporate earnings (it can’t).

We know we have an “everything bubble”, which will burst, but we’ve also got a liabilities black hole. We seem to be heading for a financial omnicrisis, with our collective heads firmly buried in the sand.

oh look, SVB is also in the UK:

https://www.breitbart.com/europe/2023/03/11/svb-international-fallout-uk-and-european-lenders-lose-30-billion-overnight-as-panic-spreads/

but SVB UK contagion will be well handled by the BoE:

“Attempting to quell the panic, the BoE said that “SVB UK has a limited presence in the UK and no critical functions supporting the financial system.”

onward we go to Monday.

On the debate about a replacement for the present fiat currencies.

Ultimately a “means of exchange” is only effective/accepted by all, if it is backed by government. By being “backed by a government”, I mean as accepted by the State as a payment of taxes.

Ultimately, we all accept payment in £,$,¥,€ etc because we know that others will accept it from us. The demand is created by the State, by it’s acceptance as a payment of tax obligations.

In the case of the UK today. The HMRC only accepts settlement of tax obligations in the money

The BoE creates. Pound Sterling Central Bank Reserves.

(The money we have in our bank accounts aren’t CBRs, but are claims on them)

And as the saying goes, “there are only two certainties in life, death and taxes”.

We don’t have a choice to pay taxes or not, so we all have to get our hands on those claims on CBRs.

Gold and Silver will only be an effective means of exchange, if the State accepts it as a tax payment.

The Inca and Aztec empires had lots of gold and silver but it was never used as “money” as it was never used as a means of paying taxes. They chose primarily agricultural produce as the tax payment.

In the case of the Inca, they had the quipu knot system to keep account of who had paid what, when and how much in tax obligations.

Gold and Silver have no real practical uses. It just looks pretty. On the other hand, a sack of grain does. It’s a store of energy.

The “value” of gold and silver would only be controlled by it’s scarcity. So the State would also need to control the quantity of gold and silver in circulation to maintain price stability, inflation etc.

Silver is used in high quality ball bearings. Given silvers lower price I suspect it will be most commonly used for money, but it depends how hungry one is. We are so vulnerable with our current food supply system.

2008 all over again?

I’ve seen a couple of people say that “this is not like 2008”. But here is one parallel worth noting:

While a few prominent people in Silicon Valley reportedly smelled a rat, the ratings agencies said absolutely nothing until it was obvious for all to see….just like 2008….Don Stewart

Tim said: “Having got this five-part series done, I’m reflecting on what to do next.”

I would welcome a very short post, which is added to by Tim in the discussion, as the shrinking of everything develops.

To counter the tales we will be told by the powers that be.

Limited to aspects of surplus energy economics.

Thanks Barry, I’ll see what I can do.

New US policy toward deposits

The deposit insurance has covered amounts up to 250,000 dollars. But a huge percentage of the Silicon Valley unprotected deposits were over 250,000. So:

“New policies adopted Sunday will “wipe out” equity and bondholders in SVB and Signature Bank of New York while protecting all customers’ deposits, a senior U.S. Treasury official said.

The official said the steps were taken to stabilize the financial system and protect depositors, and did not constitute a bailout of either firm. No losses of either bank will be borne by U.S. taxpayers, the official said.”

So if the US taxpayers aren’t footing the bill, who is? Maybe the ghosts who have to deal with wispy issues such as the inflations caused by printing money?

Don Stewart

US gov guarantees 100% of SVB deposits:

https://www.yahoo.com/finance/news/us-government-guarantees-all-silicon-valley-bank-deposits-money-available-monday-223546372.html

“they” put in some weekend OT to figure it out.

“Depositors will have access to all of their money starting Monday, March 13,” the statement added. “No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

AND, “they” DID IT: “they” created a plan to insure ALL depositors:

“The Federal Reserve also said it will offer funding to banks through a new facility to help ensure banks can meet all depositor withdrawals, essentially backstopping all deposits — both those insured and uninsured — across the U.S. financial system.”

no bank runs on Monday, at least in the USA.

now it’s the lull before the next crisis.

Fact Check on Silicon Valley Bank and Signature Bank

*The politicians can deny that the fat cats are being bailed out

*The fat cat depositors are, in fact, being bailed out

*Well-run banks can make money today by doing little to nothing. Silicon Valley was a very poorly run bank…very asymmetrical to the industry.

In short, there is no reason to believe that US banks are at the epicenter of some crisis.

Don Stewart

Let’s step back a little here. What’s happening is that the authorities are back-stopping the assets of depositors at these banks. In the first instance, this will be financed by the Fed. The assets of the banks will be sold and, as I understand it, any shortfall will be made good by a “special assessment” on other US banks. At least in theory, this means that the Fed gets its money back.

The first principle here is the defence of depositors, who are customers of banks, not investors in them. Any jurisdiction which allows customers to lose money in its banking system suffers a massive blow to its credibility, not least because regulation has failed if this happens. The guarantee limit in the US is $250,000 (and far lower in the EA and UK). There are plenty of reasons why customers might have deposits in excess of this limit. They might have just sold a house, and have not yet bought another. Businesses hold cash for upcoming payments, including wages and suppliers. Individuals might just reckon that they’re better off holding cash rather than other investments.

In systemic terms, these interventions are comparatively small. The danger is if this occurs at a far larger scale. If this were to happen, central banks could find themselves forced into creating huge amounts of new money.

Most of the world’s ‘fat cats’ hold their assets as stock, not cash deposits. My understanding is that, in these instances, stockholders are left with nothing.

@Dr. Morgan

In the special case of Silicon Valley Bank, start ups and wine companies raise lots of money and put the cash in the Bank, and, in many cases the cash disappears over a few years. That is the origin of Wolf’s “Imploded Stocks”. As I understand it, the New York bank was something similar. So we can see both banks as part of the “tech bubble” which has resulted in a few winners and lots of losers and, perhaps, the end of the “borrow and burn” financial gimmicks? And maybe financing crypto schemes was not a good idea?

Don Stewart

After looking at a lot of comments in Wolf’s website:

The bottom line for Wolf is:

“Hiking cycle continues, now that the storm has settled down.”

Looking out for Number One, I hope Wolf is correct. As an elderly person entirely dependent on living off our savings, I do want money to have a value once again.

It is annoying that all insurance schemes involve taxing the prudent to fund the careless. But we don’t seem to be able to devise any better system. The way I look at it, the US government is now a gigantic Ponzi scheme which cannot continue to function indefinitely. So smart people, from Left to Right wing, will continue to manipulate congresspeople (who have never been so cheap to buy, I am told). The sad truth is that my best interests are served if the Ponzi wheel keeps turning for another decade or so. But I fear for my children and grandchildren.

Don Stewart

A new article – #251: The Everything Crisis – has been posted here.

Pingback: suddenly – REAL Green Adaptation