ECONOMIC DECELERATION – AND HOW TO MEASURE IT

One of the quirks of economics is that, within GDP (gross domestic product), all output is included, irrespective of what it really adds to prosperity. GDP, like Oscar Wilde’s cynic, knows “the price of everything, but the value of nothing”. If government paid 100,000 people to dig holes, and another 100,000 to fill them in, the cost of this activity would be included in GDP.

Is there a better way of measuring prosperity? Well, consider two people who both earn $30,000. Theoretically, their circumstances match. However, if the first has to spend $20,000 on household essentials, leaving him $10,000 to spend as he chooses – whilst the second spends only $5,000 on essentials, leaving him $25,000 for “discretionary” spending – then clearly the second is much more prosperous.

This is analogous to what has been happening to the economy. The long-run trend towards higher energy costs is feeding through into essentials such as food, water, chemicals, minerals, plastics, construction and virtually every other essential purchase. This is undermining the scope for discretionary spending, leaving the economy poorer even if the headline statistics do not seem to bear this out.

On the ground data bears this out. In the United Kingdom, for example, average wages increased by 25% between 2005 and 2015, but the cost of essentials rose by 48%. This process is happening around the world.

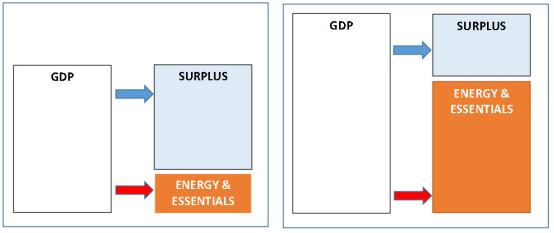

For the economy as a whole, it can be illustrated like this:

Fig. 1: “Growth”? – the impact of higher energy costs

GDP is higher in the second picture, but far more is spent on energy and essentials, leaving a smaller surplus available for everything else. This surplus – and not the recorded total of GDP – determines prosperity.

Where this leaves the economy is with two pictures that do not match – raw growth numbers imply a prosperity that people seem not to experience. As a result, we – whether as individuals or as governments – have been using borrowing to supplement a diminished capability for discretionary expenditures.

This in turn accounts for the escalation in debt. Between 2000 and 2007, world debt (1) escalated from $87 trillion to $142 trillion, triggering the global financial crisis. Slashing interest rates to all-but-zero has enabled us to co-exist with this debt, but the amount outstanding has continued to soar, now exceeding $200 trillion – whilst near-zero rates have been very far from cost-free.

How does the cost of essentials, and the resulting impact on prosperity measured as capability for discretionary spending, help us to explain this?

The energy economy

As most readers will know, the interpretation which guides all of my work is that the “real” economy of goods and services is an energy equation and not, as is so generally supposed, a monetary one.

Everything that we buy or sell, produce or consume is a product of energy. Far back in history, this energy came entirely from human or animal labour. This changed fundamentally with the Industrial Revolution, when we began supplementing this labour with inputs such as coal, oil and gas. This process triggered a dramatic escalation in economic output which has totally transformed our society over more than two centuries.

The modern economy is entirely a function of energy. As well as obvious uses such as transport fuels and plastics, energy is critical in access to minerals – without energy inputs, we could not possibly extract 1 tonne of copper from 500 tonnes of rock (and doing this using manual labour would make copper impossibly costly).

That the earth now supports 7 billion people, compared with just 0.8 billion back in 1800, is entirely due to the use of energy in agriculture, both as indirect inputs as well as directly in planting, harvesting, transport, processing and distribution. Water, too, could be not accessed without energy inputs.

If you doubt any of this, imagine how farming and the food chain would operate without energy inputs. Planting and harvesting would rely on large numbers of labourers and animals, all of whom would have to be fed. Inputs like phosphates would not be available without the energy needed to extract and transport them. Processing and transporting crops would be incredibly costly and difficult, as would storage without refrigeration. In short, without energy inputs, food supply as we know it today would collapse.

Taking this a stage further, it is obvious that the cost of food must reflect the cost of energy at each stage of the process.

Correlation between energy costs (here represented by crude oil) and other essentials is illustrated in the next chart, which shows how the prices of wheat, rice, vegetable oils and copper have all tracked oil prices in recent years. This is far from surprising, since energy is the key input in the supply of these resources. They have tracked not just the increase in oil prices but also the post-2014 decline – but remain about twice as costly as they were in 2000, which compares with broad inflation of about 38%, globally, over the same period (2).

Fig. 2: Commodity prices – the energy connection (3)

Ultimately, the physical economy can be defined like this – it is a process of applying power inputs (rather than human labour) to raw materials which are themselves accessed using energy.

Our homes, roads, schools, factories, railways, ships and hospitals could not possibly have been built by manual labour alone, or by relying on materials accessed without energy inputs.

A key point will have occurred to you from the foregoing, which is this – an increase in GDP can correspond to a decrease in prosperity, if the proportion of GDP which has to be spent on energy (and energy-linked essentials) grows.

We know that energy has a cost, which in fact is an opportunity cost – money spent on oil platforms, refineries, pipelines and solar panels is money that we cannot spend instead on hospitals and schools. The more expensive energy is, the less we have to spend on everything else.

The cost equation

Energy is never free. The human capacity for physical work derives from energy gained from food, and obtaining food requires the use of energy. Likewise, accessing the energy contained in oil, gas, coal or renewables requires the expenditure of energy. Oil platforms, refineries, pipelines, wind turbines and solar panels cannot be built without spending energy. Extracting iron from ore requires energy, as does converting it into steel – and, on top of this, there is the energy expended in building the steel works itself in the first place. This applies to all components used in the energy access process.

So the equation which determines prosperity is the relationship between, on the one hand, the amount of energy accessed and, on the other, the proportion of this energy consumed in the access process.

This equation can be expressed in two ways. EROEI – the Energy Return On Energy Invested – expresses the gross amount as a multiple of the cost. My preferred measure is ECoE – the Energy Cost of Energy – which expresses the cost as a fraction of the gross amount of energy accessed.

These equations change over time, through the interplay of two factors. The first of these, which pushes costs (ECoEs) up, is depletion. Naturally, we have exploited the lowest-cost energy sources first – just as you would always choose to develop a large oil field before a neighbouring small one, you would not extract costly oil from deep water fields, from shales or from bitumen if you could instead tap giant, simple reservoirs of high quality crude. As the most economical sources of energy deplete, we turn to successively costlier resources which push overall costs upwards.

The second determinant, offsetting the depletion effect, is technology, where the advance of knowledge enables us to access energy more efficiently, and thus at lower cost, than in the past.

The critical point about technology is that its limits are set by the physical characteristics of the resource. For example, the advance of technology has made shale oil far cheaper to produce than shale oil was ten years ago. What is has not done – and cannot do – is to transform shale resources into the equivalent of a giant conventional oil field like Al Ghawar in the sands of Saudi Arabia.

Likewise, renewables are cheaper to produce now than the same renewables were ten or even five years ago. This has, in many instances, made renewables cost-competitive with oil, gas and coal. But this is a two-part process – the competitiveness of renewables has benefitted both from cost-lowering technology and from rises in the cost of fossil fuels. Renewables can compete with oil or gas developed today – but they could not compete with giant oil fields like Al Ghawar.

Thus seen, the driver of costs is depletion (determining the physical envelope of energy access), with technology acting as a mitigating factor (improving efficiency within that envelope).

Cost trends

It will be obvious from the above that we are studying comparatively gradual processes. Depletion is something that happens over time. Technology can advance more quickly than this, but the pace at which technology is applied is dictated both by capital investment and by the depreciation of earlier plant.

Because the cost change process is gradual, it should be equally obvious that longer-term trends are critical. The immediate cost of energy to end-users can oscillate very rapidly through market forces, but these are oscillations around a longer term trend.

Fig. 3 illustrates my analyses of where the ECoE costs of various energy sources now are. Obviously, these are broad-brush estimates, but should suffice for at least a general interpretation.

The process of depletion has driven the ECoE of oil sharply higher. If we could go back to the 1950s and 1960s, we would see that oil production costs were extraordinarily low, which helps account for the very rapid annual consumption growth rates (as high as 8%) experienced at that time. But there has been a profound rise in oil costs in recent years. Coal costs, too, have been rising sharply, not least because the energy content per tonne has been falling markedly as the highest-quality resources are depleted. Gas costs, too, have been rising, though it remains markedly cheaper than oil or coal.

Fig. 3: Estimated ECoEs by fuel

The good news, of course, is that the ECoE of renewables has fallen sharply, making them cost-competitive with oil and coal, and no longer markedly more expensive than gas. The factors involved in reducing the ECoEs of renewables are technology and economies of scale. As little as ten years ago, renewables were a lot costlier to produce than oil, but this is no longer the case.

A cautionary note is needed here, however. In 2015, renewables accounted for just 2.9% of primary energy consumption. As a still-small industry, renewables can be assumed to have cherry-picked the best sites first, just as oilmen developed the cheapest oil fields first. Rates of growth which are easily achieved from a low base become progressively harder to sustain as the base enlarges. Renewables can be expected to go on increasing their penetration of electricity supply very markedly, though the nature of solar and renewables suggests that some fossil- or nuclear-powered capacity will still be required.

Other applications will be harder to crack, particularly where the sheer density of oil (measured as energy per unit of weight) remains critical. The gigantic petroleum-powered machines that hack minerals out of rock at concentrations of less than 0.5% might be hard to replace with electric alternatives, and an electric-powered aircraft of anything approaching the size of a 747 remains a pipe-dream.

The overall picture

What we have, then, is a changing mix in which the overall ECoE is rising because of the uptrend in costs in the still-dominant fossil fuels sector. The next chart, comparing the annual cost of energy with the long-term trend, reflects this.

Fig. 4: Trend and current energy costs

The current cost of energy to end-users oscillates dramatically over comparatively short periods and, historically, oil has been the pivotal component. In the 1970s, OPEC drove oil prices sharply higher, where they stayed for a decade until weak demand, and a surge in non-OPEC supply, broke the cartel’s grip. From 2000, oil prices began to move up sharply, largely due to demand growth in China and other emerging market economies (EMEs). High prices invited massive investment in new supply, which has now pushed prices sharply downwards. This is an essentially cyclical process, and the slump in investment since 2014 suggests that supply shortages will in due course push prices back upwards.

These price movements occur on timescales far shorter than the cost trends dictated by the interplay of depletion and technology. Depletion has for decades been driving the trend costs of fossil fuels upwards, in a way that can only be mitigated, not reversed, by technology. Technology is making renewables cheaper, but these account for just 2.9% of current global consumption. So the underlying trend cost of energy is rising relentlessly.

Counting the cost

Where, though, does this show up in our measurement of the economy? If energy costs more, we have less to spend on other things – but money spent on obtaining energy still forms part of GDP. After all, energy expenditures show up in activity measures, and money spent by an energy company provides business for suppliers and wages for those working in the energy and related industries.

So the bottom line is that rising energy costs do not necessarily impair GDP, but do undermine prosperity, by reducing how much we have to spend on everything else. Rising energy costs will eventually impact GDP as we record it, because they will reduce our capacity for investing in other things. This makes GDP a trailing indicator of the economic impact of higher trend energy costs.

If we want to anticipate this, and measure the current impact, there are two routes open to us. Both are based on the recognition that prosperity is a function, not of income in the absolute, but of discretionary spending capacity (the income that remains after the cost of essentials, really meaning the cost of energy, has been deducted).

The first way of measuring the current impact of trend energy costs is a bottom-up measure of prosperity which factors in the cost of essentials at the individual level. The second, far more practical approach is to deduct the trend (not the current) cost of energy from reported GDP. Since the cost of all essentials – such as food, water, minerals, plastics and transport – is dictated by energy costs, deduction of the trend energy cost essentially identifies discretionary GDP.

The global situation and outlook is set out in fig. 5. As trend ECoEs have risen, a widening gap has emerged between the financial and the real economies. This shows up within individual experience as an increase in the proportion of incomes absorbed by essentials. For the economy as a whole, the proportion of GDP that has to be spent on energy and its derivatives – including food, water and basic materials – has been rising, crowding out scope for discretionary expenditures even where total GDP is supposedly increasing.

To picture what this means in practice, imagine a government health system whose share of GDP is constant, so that cash resources increase in line with GDP. This ought to make it possible for health provision to be enhanced – but the opposite happens, because the cost of essentials absorbs a growing proportion of its budget.

In due course, this “crowding out” will impact investment in discretionary areas, meaning that headline GDP itself will start to fall. But prosperity – as it is experienced both individually and in the aggregate – will fall before the deterioration in the underlying situation is reflected in GDP.

Fig. 5: World financial and real economies

Finally – and whilst not wishing to intrude on private grief – fig. 6 shows what is happening to the real economy of the United Kingdom, and links it to trends in ECoE.

From 1980 to about 2005, the UK enjoyed a lower ECoE than the global average, mainly because Britain was a major net exporter of oil and gas. But energy production has fallen sharply, from 249 mmtoe (million tonnes of oil-equivalent) in 2002 to 108 mmtoe last year, and the UK now has to import almost half of its energy requirements, despite a decrease in demand.

This is a mathematical calculation delivered by SEEDS, and is reflected in a precipitate decline in real economic output. But what does this mean in practice – and can we see it in action?

What it ought to mean, first, is that the comparative (through-cycle) cost of energy in the UK is rising – which it is because, since 2005, the cost of energy to British consumers has risen by far more (90%) than general inflation (27%). It ought to mean that the cost of essentials is absorbing a growing proportion of incomes – which, again, is the case, the cost of essentials having grown by far more (48%) than average wages (25%). It ought to mean that government budgets buy less services, even where those budgets have at least kept pace with inflation – as is palpably the case with health care. It ought to undermine ability to provide for the future, something which is reflected in huge pension fund deficits.

That these trends are set to continue seems equally evident. Energy costs in Britain are rising, as reflected in the ultra-high contract price for electricity from the new Hinkley C nuclear plant. The cost of essentials will continue to rise (which the slump in the value of Sterling ensures). This will continue to make people feel poorer, as the cost of essentials continues to out-pace incomes. And it will further stretch public services (such as health), even where budgets rise at least in line with inflation.

I rather doubt whether planners and policymakers, in Britain or elsewhere, understand this dynamic. If they don’t, they must be baffled by the phenomenon of more money buying less.

Fig. 6: UK economy and comparative ECoE

The concluding point, generally applicable, is that the rising trend cost of energy – and hence of energy-derivatives such as food and minerals – is squeezing discretionary spending capability even before it exerts major downwards pressure on gross output. The latter is beginning to happen as well, though, through a squeeze on discretionary investment capacity.

What this all means is that we should take headline GDP figures with the proverbial pinch of salt. What really matters is prosperity, meaning scope for discretionary spending after the cost of essentials (really meaning energy) has been deducted from incomes.

By this critical measure, we are at the end of growth – and no amount of borrowing, or of mortgaging the future, can change this, or even long disguise it.

Notes:

- Includes financial sector. Debt excluding the financial sector was $67 trillion in 2000 and $105 trillion in 2007, and is about $155 trillion now.

- Source: SEEDS database

- Source of data: IMF

Hi Dr Morgan

Thank you again for a very interesting post on a vital subject.

What you are saying is that the GDP statistics are not merely wrong in that they do not adequately reflect inflation but that the adjustment from nominal to real is structurally incorrect in that it should be based on the trend cost of energy rather than on a (fixed?) price index which many even now recognise as inadequate. Is this correct?

Interestingly enough I’m sure you’re aware that the Austrian school would adjust the GDP statistics even more fundamentally by excluding government spending. Murray Rothbard gives an example in a recent article of an island which has private production of 1000 apples. 200 apples are “taxed” by the government to fight a war and spent. Conventional GDP would regard their GDP as 1200 apples (100 private and 200 public) but it is quite obviously 1000 only.

If we adopted Austrian principles and yours together our GDP would be minuscule not merely reduced!

However, this period of economic stagnation has caused some head scratching and one does have a sense that folk are becoming more and more critical of the conventional wisdom and realising that there is indeed a disconnect between what they are told and what they perceive.

Hi Bob, and thanks

There are many views on how we measure GDP, with criticisms often aimed at the “production boundary” (what’s included and what isn’t), and “imputations” (such as the “imputed rent” supposedly paid by homeowners – to themselves, presumably? – which is a big component of US GDP, and quite material elsewhere – £125bn in Britain, for example).

My view is more about how we use it. GDP, and per capita GDP, and for that matter wages, do not measure prosperity, but income – we need to deduct essentials before we can measure prosperity, particularly in an era when essentials have soared in cost.

It also has a bearing on perceived inequality. Someone earning $200,000 has 10x the income of someone earning $20,000. But if each spends $10,000 on essentials, the ratio is really 19x ($190,000 vs $10,000). Ther poorer you are – as an individual, but for a country too – essentials take a bigger percentage of your income.

Thanks, Tim for yet another great article. It’s good to see that you include agriculture and its perilous state. Whilst my smallholding could be operated by muscle power, either mine or an animal’s, my neighbour’s farms simply couldn’t. The tied cottages are gone as are the people. The demography is just plain wrong now. Although an electric tractor is just as ridiculous as an electric jumbo, as the system slowly converts to renewables I wonder, will the infrastructure still exist to refuel agricultural diesel tanks? What price food then?

Your first paragraph reminded me of my wife and I plodding through a quarter acre of potato planting, I dug a hole, she was to put the potato in from a bucket and scuff the soil back over it with her foot. We went on like this for a happy half hour or so until it occurred to me we hadn’t had to refill the bucket. ‘turned out, I was digging a hole and she was filling it back in again whilst carrying a nearly full bucket of potatoes!

Sort of summed up married life really…..

Thanks Nigel. I don’t think the critical role of energy inputs in modern farming is sufficiently understood. I don’t think you’ll lose the infrastructure, because an electric tractor is, as you say, pretty improbable at the moment.

This said, I read a lot of serious nonsense about electric vehicles. They do not “reduce” the need for primary enerfy, simply displace it from the fuel tank to the power station – and there are system losses, of course, because putting fuel in a vehicle is a pretty direct and efficient way of using high-density energy.

Love the story about the potatoes – I’m sure we’ve all done similar things. It reminds me of a time as a student, when a friend didn’t have a tyre-lever for his bike, so we told him to use a fork – but he didn’t realise we meant the handle end, and there were lots of little holes in rows of four when he dipped the tube in water……

There were several projects in 1920-1930 to develop electric tractors and other mechanised farm equpment. The tractors were connected through long power cables. Impratical yes, but not impossible. See e.g. http://www.guardianonline.co.nz/heritage/electric-tractors-were-short-lived/

I really appreciate this article. It explains a fundamental issue we don’t easily see. Our industrial two century “dynasty” is now on the wane, like all dynasties. How soon before we can’t miss it? I cannot say, but it’s heading our way now and probably has since plateauing in about 1970.

The social inequality issues will become more of an issue sooner than finance and money issues. We can “print” money indefinitely, but not resources. Money through credit growth is masking the problem and many of us have not seen their living standards decline, although discretionary spending is changing due to what Richard Koo says is a balance sheet recession. Preferentially debts are being paid down first and so consumer spending is limited to say going to cafes and eating out rather than new furniture or renovations. Here in Oz, Sydney house prices continue to rise across the board but I think we are an exception and it will soon change. There is no possibility we will avoid a crash.

Thank you for this. This particular article required a lot of thinking, because I was trying to figure out how we would identify decline – statistically – given that everything (including the cost of energy) is included in GDP.

House prices continue to reflect an environment of ultra-cheap money. Logically, therefore, this is a bubble. What ends it? In my opinion, two things. First, the destruction of pension fund value is going to force homeowners to monetise their properties (by downsizing) in order to provide retirement income – as and when the boomers are forced into this, there will be a lot of simultaneous selling. Second, price stability requires a seamless hand-over to the next generation – but these people are a lot poorer, so affordability is lower for them. When the market spots these two things looming on the horizon, prices should fall sharply. Governments and banks, when they see this, will try to counter it – perhaps by much longer, even multi-generational mortgages.

I agree with your reply. It’s just hard to forecast when.

One thing we cannot do and won’t enjoy when the bubbles burst is downsize.

http://www.endofmore.com/?p=1464

Hello Dr Morgan

I have followed your essays with interest. I found this one especially enlightening. It helps explain that feeling that I think many of us have – that the economy isn’t growing as much as the official statistics tell us it is.

Of course, undiscriminating focus on gdp growth suits governments: most of their taxes are turnover-related, so the greater the turnover the greater the tax, regardless of the real benefit from that turnover. Ditto banks etc insofar as they obtain income from turnover paid for by borrowing.

I wonder if there are other ways in which official and beneficial gdp are tending to part company? For example, the difference between what you might call final and sought-after consumption, whether or not of essentials (I daresay economists have a name for it) and other expenditure, often intermediate or precautionary in nature, that we have little choice but to pay for – eg most government functions, but also advertising and marketing, a lot of “financial services”, and protected professional functions of all sorts. Of course, these have always been an element of gdp. The question is whether they are tending to grow as a proportion of it.

Other trends come to mind. Corporations and governments offloading clerical and manual tasks onto customers in order to cut costs – eg scanning your own purchases at supermarkets, online banking and tax returns, obtaining free market data by encouraging addiction to social media and online shopping, and so on. It enables businesses to hold down prices which presumably gets reflected in gdp price indices while the unpaid labour undertaken by the customer does not.

Or for that matter the increasingly poor quality of consumer goods which I suspect is not picked up by the price indices either. Of course, the frequent replacement purchases do get picked up as gdp growth! I was recently told by an electrician that new washing machines are so unreliable that I should treat them as throw-away items to be replaced every 18 months or so. In many cases it is nothing short of a scam. Some goods are even deliberately designed to be impossible to repair. Meanwhile the makers constantly add new electronic “functionality” that no doubt can be claimed as an improvement for price index purposes, although in practice they are functions that few people use and that only increase the complexity and unreliability of the product.

It would be interesting to know any work has been done by economists on such themes.

Thank you, Ian – you raise some very good points.

I think I should stress that there are two questions here – “are GDP, and growth, measured objectively?”, and “even if calculated correctly, how realistic is what GDP tells us?”. My concern in this piece was entirely on the latter.

Of course, there are methodological issues on this. Absolute GDP sums are boosted by “imputations”, such as “owner-equivalent rent”, and attaching prices to things that people do not in fact pay for, such as employment benefits, free bank accounts and so on. About 16% of US GDP falls into this non-cash category. Of course, as these sums don’t exist as transactions, they cannot be taxed – so measures of tax as % of GDP understate how much government really takes as a % of the real, cash economy.

Inflation, critical to measuring growth, is even more contentious. Issues here include “geometric weighting” and “substitution”, plus of course “hedonics”. Shadowstats (John Williams) has great primers on these issues, and publishes inflation numbers on the older, pre-distortion basis, and Chris Martenson is good on this. My own book, Life After Growth, goes into this, and other, official stats distortion in detail.

Pingback: Grossly distorted prosperity | News from the Future

Thank you for a helpful and provocative article which is a huge help and such a contrast to much MSM reporting. The UK ONS publish esimates of household disposable income based I think on survey data. Although calculated differently from what you are trying to estimate, it’s interesting that non-retired households seem to have had static or declining disposable incomes since about 2004/5. Retired households have done better, seemingly as a result of the “triple lock” but it looks as if this is bit of rather optimistic policy is going to be binned as being unfair to working households.

The real issue is going to be politics in a world of shrinking pies – and how this is managed with elites keeping/increasing the size of their slice. A recipe for conflict I fear.

Agree entirely. This is the kind of situation which, historically, has called for self-denying reform from elites, in order to avoid the kind of social unrest in which they are overthrown. The course of resisting reform seldom works out well – but I see no sign of self-denying reform being adopted.

The next turns of the screw are the US election (where I’ve doubted all along the narrative of “Mrs Clinton is sure to win”), and the Italian referendum on 4th December (which I suspect the Renzi government may lose). After those, we may have a very different US, and a very different EU……

Hi Dr Morgan

I don’t know if you’ve come across Pete Comley’s website at http://inflationmatters.com/inflation-tax/, however if not I think it’s worth a look. His first book (Inflation Tax, which I’ve linked to) was written in 2012, and describes how he found raw inflation data from 1750 onwards online, and when charted it looked fairly normal (peaks and troughs) and very similar to Chart 5 on Page 20 at http://researchbriefings.files.parliament.uk/documents/RP02-44/RP02-44.pdf. When however he charted the Raw Price Index (RPI) on which this first chart was created using a logarithmic scale a radically different picture emerged (see Chart 2 on Page 18 of the same publication). Prices have been going up, even if you don’t use a logarithmic scale (see Chart 1 on same page, using a linear scale). He states that prices have risen at an average of 5.4% per annum in the 67-year period 1945-2012, compared to an average of 1.5% per annum in the 1853-1920 period.

He investigated further, but I don’t want to spoil a good read, so his central thesis is that inflation is actually a hidden Government tax, and the ONS deprecating the RPI in favour of the CPI (source data first collected in 1996, measure derived from the Harmonised Measure for Consumer Prices (HCIP), a part of the EU’s toolkit for evaluating prospective new EU members, but much added to since) as a consumer price index (see Chapter 4) has benefits for the Government, in that the latter makes inflation look less than it really is. Over the period 2000-2013 using RPI as base data RPI inflation increased prices by 50%, however with CPI they went up by a third. The ONS formally deprecated RPI and introduced a variant which, like CPI, uses geometric means (RPIJ).

He also notes that in a particular year UKGOV made a decision to cease settling debts, instead looking for ways to erode them by manipulating inflation, and that the fact that the UK has (uniquely compared to other companies) gilts of 15-Year duration is a benefit.

The Chapter which may be of interest in your next post on a Rescue Plan for the UK economy is 14, entitled Future Debt and Inflation Scenarios, which includes Plans A-D which are a response to four future scenarios he saw for the UK in 2012.

Pete produced a new book in 2015 (Inflation Matters – see same site), which builds on and updates the one above

HTH and I’d very much welcome your views on whether he is correct in his conclusions on inflation, the consequences for UK businesses and consumers, and also on his scenario assessments and A-D plans (from 2012)

Jim

Thanks, and welcome. I will certainly check out that site. I look at this sort of thing a lot, and a complete chapter of my book “Life After Growth” goes into it. The conclusions you cite accord with my findings. One useful way of looking at this is to measure the cost of household essentials – which, again, concurs.

Inflation is a theft of value, and is NOT a prerequisite for a vibrant economy. The industrial development of the United States throughout the 19th century happened in a deflationary climate, with the sole exception of the Civil War years. Computers and It have grown massively in modern times, despite prices falling each year. On pure development grounds, deflation isn’t the bogey-man so often assumed.

Where deflation IS a nightmare is where an economy is heavily indebted – inflation helps pay down debt as a sort of covert or “soft” default, but deflation makes debt grow in real terms.

To conclude, for now, if you run your economy on debt, as we are now doing, you need inflation. Borrowing and inflation are linked. We habitually understate inflation for all sorts of reasons – just one is that, if payouts of pensions and benefits were linked to real inflation, both systems would have collapsed long since.

It has occurred to me that we need inflation to really happen and more than just a per cent or two.

On Gail’s OFW site is a graph showing how much oil is recoverable according to how much money is invested. At $300 per barrel, oils supplies become plentiful. So, if we want plentiful oil we have to make $300 oil affordable, and inflation is the only way to achieve that. It has lots of downsides but If the government can get its act together It can engineer a solution. First by subsidising the cost of essentials, even giving a UBI to everyone, living costs will remain affordable and so will fuel supplies. Monetary Sovereign governments have no trouble managing such costs. I’ll leave it at that for now. Let’s see how the idea goes.

You mention Hinkley Point C as an example of rising energy costs, but it is worth considering that the ludicrous price agreed is actually a political/policy cost, rather than an energy cost. Had the UK government selected the (proven) KEPCO APR1400 design, then the costs would be around half of those agreed for Areva’s as yet unproven EPR design.

And (as usual) there is no situation government cannot make worse, and in this case their nuclear “strategy” isn’t limited to the financial black hole of the EPR, but involves different unproven designs and technologies from Hitachi (for the Wylfa and Oldbury sites), and from Westinghouse (the 3 reactor Moorside site). Even that’s not bad enough to satisfy government, so it seems likely they’ll agree to the proposal for yet another new unproven design, this time from China General Nuclear for Bradwell. This is total madness, but the current government seem to be obsessed with high cost, low return projects, be they un-needed runways, un-needed high speed rail routes, vast “super-sewers”, pointless multi-billion pound “smart meter” schemes etc.

Returning to energy, what the UK’s misbegotten nuclear policy does for electricity is bake current peak prices into baseload, and that’s doubly unfortunate as policy continues on the pell mell rush to “decarbonise”, and government hope we’ll all be charging our cars and heating our homes with electric power. Having mandated vast volumes of subsidised wind and solar power, wholesale prices will be set throughout the year by the vagaries of wind and sun, but because neither renewables nor nuclear can provide winter peaking power, we’ll need much high “capacity payments” to keep gas plant operational for when needed. And that’s why the apparently falling cost of renewables is a fallacy – at a system level they increase energy costs unless you’re prepared to compromise the productivity of ALL other economic assets by living with their intermittency. Energy storage is being touted as a solution, but in reality it works well as a network management tool, can’t help much because it is extra cost with a net loss of generation (due to the end-to-end losses), and the need for regular cycling – which means that summer sun can never meet the winter energy demands.

You make a series of excellent points here. Two things intrigue me particularly. The first is the programme of “life extensions” to UK reactors. I have heard that Dungeness B is in very bad condition, and that this may now apply to two others (Hinkley B and Hunterston?) as well. Any thoughts?

Second, on electric vehicles, clearly these relocate but do not reduce the need for primary energy, i.e. for power generation – but how big are the system losses when electric vehicles replace petrol/diesel powered ones? I’m finding it hard to get at these numbers

The life extensions on nuclear are not ideal, but are being done solely for reasons of necessity. Having shut down so much coal plant, and allowed part-time renewables to make much thermal plant unprofitable, having dithered on nuclear (or a new dash for gas) for so long, the government have no other option but to extend the operating lives of the ageing AGR fleet. Even with these life extensions, National Grid’s winter forecast shows that in a “derated” scenario the UK will depend on wind power to keep the lights on this and next winter. “Derated” in this context is the situation where for whatever reason your total generating capacity is reduced – which could be several different small problems, or one or two large ones, but on any complex system there will always be something that’s not optimal. Because winter peak demand is associated with cold air and low wind, that reliance on wind is not very comforting.

We’ll probably just about creak through this winter, but it really is touch and go. Looking forward, the problem returns because we won’t have any new nuclear by the time the life extended nuclear plants approach their new end of life (2023 for Hinkley B and Hunterston B, with Heysham 1 and Hartlepool following in 2024, and the remaining AGR plant closing by 2030). I’m nowhere near close enough to know the real state of the nuclear plant, but as Dungeness has been life extended to 2028 on the back of a £150m lick of paint, we’ll have to hope that the paint is quite robust! Either government need to further extend these ageing plant lives (eek!) or they need a mad dash for gas, and the new build of around 5-8 GW of new gas plant (that’s about five large CCGT stations). Technically that’s readily achievable, a number of suitable sites exist (planning, gas, grid connections all tee’d up). The problem is that with rising amounts of renewables on the system, there’s no certainty on the investment case for something in the ballpark of £3bn capex. Whilst the “capacity mechanism” is supposed to address this, the problem is that the cack-handed structures that exist reward anybody and anything, and the contracts are neither long enough, nor prices high enough to persuade anybody to undertake new build (and then maintain in operational status for perhaps fifteen years). The government’s mad thinking about small modular reactors (SMR) further complicate the picture as to what will be built, and what things will cost.

End to end system losses on EVs are a challenge. Generation losses depend on what plant you’re using, and what you regard as a loss, but I suspect you’re up to speed on those? The DECC energy flow chart is very useful for this sort of thinking, but I’m guessing you’re familiar with that. In real embodied energy terms, nuclear plants lose two thirds of the potential energy in the fuel rods, but this is usually glossed over, as is the gap between wind energy potential and actual output, whereas the efficiency of thermal plant is fairly well known and reported, so it depends on what the purpose you use the numbers for. Certainly for EVs we need to budget for 11% transmission, distribution losses as with other grid energy. You then have the rectifier/transformer and battery charging/discharge losses. Figures vary, but I’d suggest budgeting around 15% here. There’s some makers figures that are lower, I’d take those with a pinch of salt. In the EV context, worth noting that ancillary loads are around 1-2% of traction loads in winter (whereas for ICE vehicles, ancillary loads are simply lost in the enormity of thermal inefficiencies). If you were to assume that an EV requires 25% more power generated than it would require for traction purposes you’d be in the right ball park. But I suspect that “behind the meter” losses probably don’t matter to us, though? If you assume that (for the future) the average vehicle is something of the scale of Merc B class, which uses a measured 0.34 kWh per mile including behind the meter losses, then at the system level you’d only need to add the distribution losses, and that suggests an average of around 0.37 kWh/mile of power generated per car mile. Does this help?

Fascinating stuff, Badger – I am grateful for your expertise.

On the losses question, here is the issue that interests me specifically – if you took 1 tonne of diesel, and put in a vehicle – or took that 1 tonne of diesel, instead used it to generate electricity, and used that to charge a vehicle of similar performance – how would these compare?

Could we say that the diesel-powered vehicle travels x miles more/less than the EV on that same 1 tonne input? Or would we have to use, say, 1.1 tonnes in the EV to equate to 1 tonne in the IC version? This determines how a switch to EVs affects total requirement for primary energy.

On nuclear “life extension”, I have heard that the quality of the core at Dungeness did not meet normal standards of integrity, so these were lowered to allow the life extension. On the other two, it has been reported that the rods can no longer be relied upon, their routes having been occluded by shifting of the bricks – i.e. that we cannot rely on the rods to prevent an over-run. Sounds a bit disturbing to me – any thoughts?

“I have heard that Dungeness B is in very bad condition”

I worked – briefly – on this project. I had just graduated as a civil engineer and got a graduate position with Balfour Beatty Construction – who largely built it.

At that time, 1971, the engineers on the job were very skeptical about the whole thing. It was supposed to take 6 years to build and took over 20 – and never reached its design output.

To give you an idea how bad industrial relations were on the site, I heard stories of workmen dropping big steel bolts from a great height on to engineers walking below. When they looked up, no one was there.

I think it’s important to look at the ‘well to wheel’ type figures for the type of fuel being used. Diesel requires considerable amounts of energy to refine it from crude oil.

Heavy oil used for shipping and power generation requires much less energy to extract from crude.

Similarly delivering open cast coal for power generation is relatively less energy intensive than the distillation/cracking etc. needed for road fuels.

So here electric power generation has an advantage.

Ofcourse the efficiency of a large thermal power plant is much higher than a car engine. Taking power transmission losses of 15% and a large thermal plant efficiency of 60% gives a combined efficiency at the consumer end of around 50%.

Presuming the electric motors and gearbox in the EV’s have an efficiency of 85% then perhaps the efficiency of power generation and car combined is no more than 40%….

A common rail diesel car engine might touch 28% thermal efficiency, it’s transmission loses 15% so combined, at best it can achieve is low 20%’s. But that’s not the whole story – a diesel car will have zero efficiency idling in traffic but an electric vehicle is much closer to maximum efficiency whatever the temperature or road conditions.

Taking into account cold starts, city driving etc. overall thermal efficiency’s of between 5 and 15% are the norm for many passenger cars on Uk roads. I have an SAE technical paper somewhere that has all the figures gathering dust somewhere.

But one of the important things is to reduce urban air pollution which is an urgent problem and electric vehicles certainly will help!

If I look at the system losses, vehicle on vehicle, with the EV using an equivalent fossil fuel, then there’s precious little to choose. Whilst centrally generated power can have much high efficiencies, say 60% for a CCGT, than a car ICE averaging around 25%, the 25% losses for electricity distribution and storage impacts need to be factored. By comparison the losses of distributing chemical fuels are minimal, perhaps 1%, whether that’s mains gas or road fuel tankerage. I would say that EVs will require the import of the same number of BoOE as ICE vehicles, but as a rule we’d be substituting gas for the petrol or diesel. In roundhouse numbers there’s as many cars as homes in the UK, an EV uses about the same as the average home, therefore any longer term 100% electrification of car transport would require a doubling of generation output, but of course with the generation mix changing and the ambitions to decarbonise heat, there’s a right muddle to disentangle all this.

On nuclear, some stations have had three sequential life extensions already. I would not be at all surprised to see that standards have been softened (and there’s been some quiet de-rating of the plant), but of the detail I know nothing. I don’t think the AGR’s were built for a long life, and we are in danger of repeated scares as the whole fleet get taken off line with sequential scares around core integrity, cooling systems, high pressure pipelines, containment vessels, or whatever turns up from the regular inspections.

Personally I wouldn’t have thought the Nuclear Safety Inspectorate would allow a reactor to run if the control rods couldn’t shut it down, so that may be an extension of some tiny grain of truth? I certainly hope so!

Thanks, very helpful.

Here’s the link on the control rods story:

http://www.bbc.com/news/uk-england-somerset-37789654

Badger makes some excellent points although the figure of 25% efficiency for ICE is very high. A direct injection petrol or common rail diesel might touch 25% efficiency (for the engine alone without transmission losses) when road conditions are good. However a line of ICE powered cars idling in traffic have a thermal efficiency of zero.

Similarly stop start town driving has a dismal efficiency in terms of energy used but here electric vehicles have an advantage over ICE.

Great article. GDP numbers are important to measure debt/gdp ratio’s for example. So they will be destorted as time goes by, adding more debt to compensate for the lack of real gdp. Renewables seem to be a net energy loss, and time is running out to keep the current system running while building a whole new system for the Global Industrialized World.

Thank you. I do think that looking at it this way is helpful – and I hope so, as this project was a lot of work!

What is the data source for Figure 4? According to EIA U.S. data estimates, energy expenditures as a share of GDP were 7.7% in 1970 and 10.2% in 1975 and ~6% in 2016. It calls into question the actual trend line.

Click to access sec1_17.pdf

My figures are global, and are costs of primary energy, not end-user prices – so crude oil, not retail gasoline, for example. The page you link to seems to be US only, and end-user costs?

I should add that, globally, a lot depends which GDP series you use. For instance, 2015 world GDP at market rates was $73 trn, but the PPP equivalent was $113 trn.

It is end-user prices. Those prices are used to compute GDP not intermediate prices at the well head, mine mouth, etc. End-user prices capture the worldwide declining energy intensity of GDP.

http://www.eia.gov/todayinenergy/detail.php?id=27032

The energy cost share of energy production is rising but the energy expenditure share of GDP is not.

Primary energy is included in the computation of GDP, with refining, distribution, wholesale and retail all included as separate categories. If you drill down into the data, this is within the SIC categories used for GVA. Excise duties are separate as well. So one can break out petroleum, say, into stages, all the way from “extraction” to “retail”. Even these can be broken out further, if required – gasoline retailing alone has 5 sub-levels.

As remarked earlier, global GDP is difficult, not least because of the PPP vs market rates conversion issue. PPP gives you realistic relationships (say, comparing China with the US), but totals that don’t fit. To overcome this, I have devised something which I call “standard constant GDP”.

U.S. consumer spending ex-energy (direct, not embodied in other goods and services) at ~96% is the highest in 90 years.

Gross Domestic Prosperity, indeed. If you want to you could include food. The prosperity result is even more pronounced.

https://fred.stlouisfed.org/release/tables?rid=54&eid=3220

Understood (and I use a lot of FRED data).

I’d point out that the energy share of much of the world is higher than in the US, as most other countries are poorer, so spend more of their incomes on energy and other (energy-linked) essentials such as food.

Second, I would point out how much is added to US GDP through imputations – these now contribute c16% of GDP (BEA has a table on this). There is much debate on how valid this inclusion is – and there is a lot of ongoing debate around Boskin – when ex-ed out, as by John Williams, this has a major effect as well.

I try to track costs, which are not the same as prices – e.g. if there was a revolution in Saudia tomorrow, prices would soar, but with no relationship to costs.

So this takes me into reversion to mean, taking out cyclical effects where possible. Way back I did some work on cyclicals, the results being published by OPEC.

The cost component, then, is not the same as the price, today or tomorrow. Costs are included in GDP, but what we’re looking to isolate is the pressure (or driver) of costs – this is the economic rent effect, which is the real issue – is depletion/scarcity pushing this driver, and how far can technology offset it.

Finally, we need to factor depletion/decline rates into this – depletion in the non-OPEC world averages c7%, but for shales it is multiples of that.

Thx for the interesting post Mr. Morgan. This point was made in the slicer cheese model by Charles Hall (the one who is working on EROI). If you just google it it shows in a nice graph what you are basically saying.

I’d like to make an extra point though and that is the increased energy costs associated with environmental issues often ignored. It came to my head after the Dakota Pipeline crisis. Are the costs of beimging in police to stop the protests adding to prosperity? Shpuld we consider prosperity the gdp associated with cleaning up messes like the one in the gulf of mexico? What about the costs of destroying ecosystems which provide free services to humam beings (and that cannot be substituted as many economists believez).)? The solution to me is to go back to tje classical economists’ distinction betwrrn use value and exchange value since the relationship between the two is breakimg down due to the limits of our global civilization on the input side (emergy constraints) AND output side (environmemtal constraints). Therefore the costs associated with dealing with climate change, erosion, cleanup, ha dlimg radioactive crap… Should also, in my view, deducted from GDP. Otherwise the picture is incomplete

Cheers from Barcelona

Roger

Thank you, Roger

The Gulf of Mexico Maconda disaster clearly forms part of the cost of producing energy. That project also demonstrates how the scale of projects has diminished just as risk, technical challenge and cost have increased. Recoverable reserves from Al Ghawar in Saudi equate to global oil needs for over three years – Maconda’s recoverable reserves equated to global oil needs for thirteen hours.

Evidence, if any were needed, that costs (as well as risks) are soaring.

I hope you enjoy Barcelona – my favourite city!

I totally agree with your article. Have you seen any work on energy by Gail Tverberg ? Her website is https://ourfiniteworld.com. She has a chart showing that world GDP tracks energy consumption perfectly. It will not increase until consumption goes up.

Thank you, Tom, and welcome. I have seen both the site and the chart.

For those of us who have to go into it deeply, GDP is complex – how do we ensure that we are measuring added value, not simply futile activity? For example, financial services. Some argue that this is a valuable activity. Others contend that, as it simply moves money around, it does not add value, so should be excluded from GDP. Still others – like Dmitri Orlov – say that it is a cost to the rest of the economy, so should be deducted from GDP, not added to it.

Every time money is moved around it triggers a corresponding energy consumption. Futile activity – if it is paid for – also triggers energy consumption. Remember – money in all its forms is the tokenization of energy.

Hi Tim, you may want to write a piece for the BoE’s blog…

Amazing article! I am amazed the BoE has it so wrong!

I left a comment to explain what government debt really is. which is not what the article implies.

Slightly off topic, but reading Der Spiegel’s account of the unraveling of Deutsche Bank (http://www.spiegel.de/international/business/the-story-of-the-self-destruction-of-deutsche-bank-a-1118157-druck.html) was truly depressing. It’s amazing what a change of values can be enacted within a couple of generations. From a trusted national institution to an international systemic problem.

Tim, the attached article on Exxon illustrates your fundamental point on the increasing ECoE. It appears the Exxon has been reducing its capes and writing down reserves which should show up in gdp sooner or later.

https://srsroccoreport.com/end-of-the-u-s-major-oil-industry-era-big-trouble-at-exxonmobil/

Pingback: Reblog: Grossly Distorted Prosperity — Surplus Energy Economics | the world is